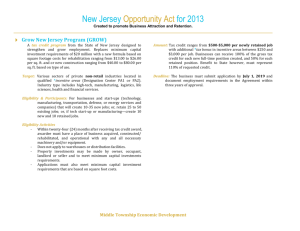

ERG Program Statute - New Jersey Economic Development Authority

advertisement