Document 18020651

advertisement

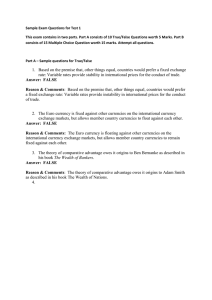

This chapter covers: 5 •Historical and present uses of gold Understanding the International Monetary System •Developments shaping the world monetary system •Balance of payments •Purchasing power parity theory •Major foreign currency markets •Currency conflict and SDR •The euro International Business by Ball, McCulloch, Frantz, Geringer, and Minor McGraw-Hill/Irwin Copyright © 2006 The McGraw-Hill Companies, Inc. All rights reserved. Chapter Objectives Understand the historical and present uses and attractiveness of gold Explain the developments shaping the world monetary system Explain activities of the International Monetary Fund Explain the purposes of the World Bank and its IFC Understand balance of payments Compare relative strengths and weaknesses of currencies Identify the major foreign exchange markets of the world Understand changes being caused in the FX markets Understand the central reserve asset/national conflict of the U.S. dollar Discuss the euro and its present state of acceptance by EU countries 5-2 Convertible Currencies Currencies readily convertible in the market Also called “hard” currencies Most developing countries are not convertible 5-3 Gold Standard History From about 120 to present price of gold generally up Rise in value interrupted around 1980 Early 2002 gold regained safe haven status Most trading and industrial countries adopted the gold standard Each country set a certain number of units of its currency per ounce of gold Comparison of the numbers of units from country to country known as exchange rate Gold standard ended during World War I 5-4 Bretton Woods and the Gold Exchange Standard In 1944, representative of the major Allied powers met at Bretton Woods, New Hampshire to plan for the future. General consensus Stable exchange rates were desirable. Floating or fluctuating exchange rates had proved unsatisfactory. The government controls of trade, exchange, and production, that had developed through WWII were wasteful and discriminatory. 5-5 Bretton Woods and the Gold Exchange Standard To achieve its goals, the Bretton Woods Conference established The International Monetary Fund (IMF) 5-6 The IMF Articles of Agreement entered into force in December 1945. From 1945-1971, IMF agreement was the basis of the international monetary system. The US$ was agreed to be the only central reserve asset. An ounce of gold was agreed to be worth US$35 International Monetary Fund Abandoned objective of fixed exchange rate 1970s Exercises “firm surveillance” over exchange rate policies of members Board of governors regularly examine policies and performance Board reviews economic outlook and exchange rate developments Coordinates with the World Bank to correct economic problems 5-7 World Bank International Bank for Reconstruction and Development (IBRD) Consists of International Finance Corporation (IFC) International Development Association (IDA) Multilateral Investment Guarantee Agency (MIGA) International Center for Settlement of Investment Disputes (ICSID) Other Multilateral Development Banks 5-8 African, Asian, European, Inter-American Bank for International Settlements Located in Basel, Switzerland Functions Forum for international monetary cooperation Center for research Banker for central banks Agent with regard to various international financial arrangements Chair of U.S. Federal Reserve represents U.S. 5-9 Balance of Payments A country’s BOP is a very important indicator of what may happen to the country’s economy. If country’s BOP is in deficit Inflation is often the cause. A company doing business there must adjust its pricing, inventory, accounting, and other practices to inflationary conditions. The government may take measures to deal with inflation and the deficit. 5-10 Balance of Payments Actions the government may take to deal with inflation and the BOP deficit include Market measures Deflating the economy Devaluing the currency Nonmarket measures Currency controls Tariffs Quotas 5-11 International Transactions Debits involve payments by domestic residents to foreign residents 5-12 Dividend, interest and debt repayment services Merchandise imports Transportation services Foreign investments Gifts to foreign residents Imports of gold Credits involve payments by foreign residents to domestic residents The BOP is presented as double-entry accounting statement Total credits and debits are always equal. BOP Accounts Current Account Goods or merchandise Services Unilateral transfers Capital Account Direct investments Portfolio investments Short-term capital flows 5-13 Official Reserves Account Gold imports and exports Increases or decreases in foreign exchange held by government Decreases or increases in liabilities to foreign central banks Balance of Payment Deficit Temporary BOP deficit Can be corrected by the country’s monetary policies or fiscal policies. May be corrected by short-term IMF loans and advice. Fundamental BOP deficit too severe to be repaired by monetary or fiscal policies 5-14 IMF permits countries’ currencies to be devalued Gold Exchange Standard Gold and dollars go abroad From 1958 through 1971, United States cumulative deficit was $56 billion. Deficit was financed partly by use of the U.S. gold reserves. Deficit partly financed by incurring liabilities to foreign central banks. The gold standard ends By 1971, many more dollars were in the hands of foreign central banks than the gold held by the U.S. Treasury could cover. 5-15 Currency Exchange Rates Two attempts made to set fixed currency exchange rates December 1971 and February 1973 Speculators felt banks had pegged rates incorrectly March 1973 floating currency exchange rates developed Clean float depends on competition with no government intervention Dirty float governments intervene and manage currency market to smooth irregularities 5-16 Group of Seven (G7) Plaza Accord Result of concern over U.S. trade deficit Group of Five included Britain, France, Germany, Japan, U.S. Met in 1985 to set the US$ at the “right” exchange rate Canada and Italy added to become G7 Meet yearly to coordinate economic policy 5-17 Currency Areas Most currencies of developing countries are pegged (fixed) In value to one of the major currencies. To a currency basket such as the special drawing rights. To some specially chosen currency mix or basket. In Europe during the mid-1970 a currency grouping called the “snake” was created led by German deutsche mark The snake was so called because of how it appeared on a graph showing the member currencies floating against nonmember currencies. System’s inflexibility led to ultimate demise. 5-18 Experience with Floating Fears that banking and money systems would not be able to handle amounts and directions of currency flows were unfounded January 1999 new major currency, the euro, joined the world market Floating exchange rates create big uncertainties for international business managers Asian financial crisis in 1997 reduced Asian reliance on U.S. economy Forecasting float direction includes measuring inflation with purchasing power parity (PPP) 5-19 Big MacCurrencies 5-20 Money Markets, Foreign Exchange 5-21 London is the world’s largest foreign exchange market. It has 30 percent share of foreign exchange turnover. New York is the second largest foreign exchange market. Asia, Tokyo, Hong Kong, and Singapore are fighting for foreign exchange supremacy Money Markets, Foreign Exchange Asian currencies are no longer thought of as exotic since their markets have emerged. The more liquid currencies include the Singapore dollar Thai baht Indonesian rupiah Malaysian ringgit Hong Kong dollar Singapore fourth largest currency trading center 5-22 Most traded currency US$ Busiest currency trades US$ - euro first, then US$ - yen US$ - British sterling US$ - Swiss franc Euro – yen Virtually all Asian trade is through the US$ Rates not quoted in US$ are called cross rates Special Drawing Rights (SDRs) SDRs in the future May be a step toward a truly international currency. The US$ has been the closest thing to such a currency since gold in the pre-WWI gold standard system. The objective was to make the SDR the principal reserve asset in the international monetary system. Value based on a basked of four currencies 5-23 US dollar, euro, Japanese yen, British pound Percentage of each changes periodically Calculated daily by the IMF Uses of SDR The SDR’s value remains more stable than that of any single currency. Holders of SDRs include The International Monetary Fund (IMF) Most of the 181 members of the IMF 16 official institutions These institutions typically regional development or banking institutions prescribed by the IMF. Not likely to become principal reserve asset 5-24 European Monetary System European countries prefer fixed exchange rates EMS created in 1979 Replaced the snake with a more flexible system European Currency Unit (ECU) established as bookkeeping currency more popular than the SDR Euro has replaced ECU and 12 national currencies Euro is supervised by the European Central Bank 5-25 Transition to the Euro Figure 5.6 5-26 Began on January 1, 1999 Coins and notes of 12 countries replaced Circulated side by side until January 1, 2002 Exchanged old for new at commercial banks Twelve countries now called the “eurozone” All under European Central Bank Fast Facts on the IMF Current Membership: 184 countries Staff: approximately 2,690 from 141 countries Total Quotas: $316 billion (as of 12/31/03) Loans Outstanding: $107 billion to 87 countries, of which $10 billion to 60 on concessional terms (as of 12/31/03) Technical Assistance provided: 356 person years during FY2003 Surveillance Consultations concluded: 136 countries during FY2003, of which 96 voluntarily published their staff reports IMF Loans Canada’s BOP Data Country GDP - per capita Afghanistan purchasing power parity - $700 (2003 est.) Albania purchasing power parity - $4,500 (2003 est.) Algeria purchasing power parity - $5,900 (2003 est.) American Samoa purchasing power parity - $8,000 (2000 est.) Andorra purchasing power parity - $19,000 (2000 est.) Angola purchasing power parity - $1,900 (2003 est.) Anguilla purchasing power parity - $8,600 (2001 est.) Antigua and Barbuda purchasing power parity - $11,000 (2002 est.) Argentina purchasing power parity - $11,200 (2003 est.) Armenia purchasing power parity - $3,900 (2003 est.) Aruba purchasing power parity - $28,000 (2002 est.) Australia purchasing power parity - $28,900 (2003 est.) Austria purchasing power parity - $30,000 (2003 est.) Warning Signs of Foreign Currency Exchange Fraud Stay Away From Opportunities That Sound Too Good to Be True Avoid Any Company that Predicts or Guarantees Large Profits Stay Away From Companies That Promise Little or No Financial Risk Don't Trade on Margin Unless You Understand What It Means Source: www.cftc.gov Question Firms That Claim To Trade in the "Interbank Market" Be Wary of Sending or Transferring Cash on the Internet, By Mail or Otherwise Currency Scams Often Target Members of Ethnic Minorities Be Sure You Get the Company's Performance Track Record Don't Deal With Anyone Who Won't Give You Their Background Two Types of SDRs General allocations of SDRs Have to be based on a long-term global need to supplement existing reserve assets. General allocations are considered every five years, although decisions to allocate SDRs have been made only twice. Source: www.imf.org Special one-time allocation of SDRs Approved by the IMF's Board of Governors in September 1997. Its intent is to enable all members of the IMF to participate in the SDR system on an equitable basis and correct for the fact that countries that joined the Fund subsequent to 1981 have never received an SDR allocation. Euro Coins Euro coins have one common side and one national side. They can be used anywhere within the euro area, regardless of the country of issue. There are coins in denominations of €2, €1, 50 cent, 20 cent, 10 cent, 5 cent, 2 cent and 1 cent. There are 100 cent to €1. Euro coins are also available for Monaco, San Marino and Vatican City (example). Source: www.euro.gov.uk