SOME NOTE ABOUT THE EXISTENCE OF CYCLES AND CHAOTIC SOLUTIONS IN ECONOMIC MODELS

advertisement

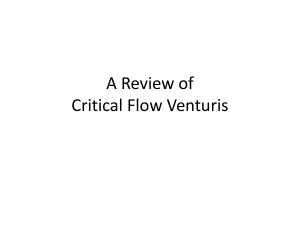

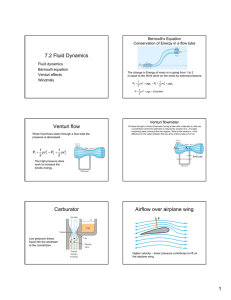

SOME NOTE ABOUT THE EXISTENCE OF CYCLES AND CHAOTIC SOLUTIONS IN ECONOMIC MODELS by Beatrice Venturi Department of Economics University of Cagliari Italy MDEF 2008 BEATRICE VENTURI 1 EXISTENCE OF CYCLE AND CAOTIC SOLUTIONS IN ECONOMIC-FINANCIAL MODELS We analyze the global structure of a tree-dimensional abstract continuous time stationary economic model that includes some determinates parameters. MDEF 2008 BEATRICE VENTURI 2 THE MODEL We shall consider a generic non-linear first order system with some structural parameters: x f , , x , x , x , , , i 1,2...n 1 i 1 2 3 i 2 g , i , x1, x2 , x3 x 3 h , i , x1, x2 , x3 x MDEF 2008 BEATRICE VENTURI 3 Where f, g and h are complicate non-linear functions of class C2 (twice continuously differentiable) in all their arguments. The parameters: ,i 0 i , i 1,2...n are real and positive. MDEF 2008 BEATRICE VENTURI 4 A stationary (equilibrium) point of our system is any solution of : x x 0 x 1 2 3 Assuming the existence of such a solution at some point P* x*, x*, x* 2 3 1 MDEF 2008 BEATRICE VENTURI 5 THE JACOBIAN MATRIX The local dynamical properties of system from (2.1) to (2.3), at a hyperbolic equilibrium point P*, can be described in terms of the Jacobian matrix , for brevity. * J P * J In fact, the nature of the eigenvalues of J*, plays a key role. MDEF 2008 BEATRICE VENTURI 6 We consider the system as a one-parameter family of differential equations dependent of the parameter . We fixe the other parameters . We assume that in our model exists a parameters set where the Jacobian * J P * J has two eigenvalues complex conjugate : ( ), MDEF 2008 BEATRICE VENTURI 7 EMERGENCE OF STABLE CYCLES First we use rigorous arguments to show as an equilibrium of the model could be destabilized into a stable cycle in the dynamic of R3 under the following two alternative assumptions: a) A steady state has three stable roots. b) A closed orbit has a two dimensional manifolds in which it is asymptotically stable . MDEF 2008 BEATRICE VENTURI 8 APPLICATIONS Next we apply these results to a general non-linear fixed-price disequilibrium IS-LM model as formulated by Neri U. and Venturi B. (2007). MDEF 2008 BEATRICE VENTURI 9 APPLICATIONS Neri U. and Venturi B. (2007) discuss the effect of a change of the adjustment parameter in the money market, via the Hopf bifurcation’s approach in a three dimensional fixed-price disequilibrium IS-LM model. MDEF 2008 BEATRICE VENTURI 10 THE ECONOMIC MODEL S = savings, T= tax collections, G=government expenditure, B = interests payment on perpetuities, L = liquidity preference function m = is the real money supply. I = investment, r =interest rate, y = output (income) w =wealth α >0 and µ>0 are the adjustment parameters in their respective markets . y I r, y S y D , w G T y B . r Lr, y, w m . m G B T ( y) (2) (3) (1) Specifically, our “generalized model” is a non-linear system in the independent state variables r, y and m. MDEF 2008 BEATRICE VENTURI 11 THE ECONOMIC MODEL (1) describes the traditional disequilibrium of dynamic adjustment in the product market; (2) describes the corresponding disequilibrium in the money market; (3) represents the governmental budget constraint. MDEF 2008 BEATRICE VENTURI 12 THE ECONOMIC MODEL Next, we define the disposable income y and the wealth w as follows: y y B T y B D B wm r MDEF 2008 BEATRICE VENTURI 13 THE ECONOMIC MODEL We assume that the functions: I, S, T are of class C2 Recall that a stationary (equilibrium) point of our system is any solution of. y r m 0 Assuming the existence of such a solution at some point P*(y*,r*,m*), we want to analyze its local properties (e.g. stability, etc.) around P*. MDEF 2008 BEATRICE VENTURI 14 THE ECONOMIC MODEL We shall rewrite our system in the equivalent form: r Lr, y, w m f r, y, m y I r, y S y D ( y),w G T y B g r, y, m G B T ( y) h y m with h: R R MDEF 2008 BEATRICE VENTURI 15 THE ECONOMIC MODEL Remark1: Unlike Schinasi G.J. ,1982 , we allow the functions L and S (liquidity and savings) to depend on wealth w. Since G and B are fixed a choice of the policies, implies: 'h y T y because all deficit must be financed either by creation of money or by creation of new debt. MDEF 2008 BEATRICE VENTURI 16 THE ECONOMIC MODEL The monotonicity, of the restrictions: , r I r ,.,. r Lr ,.,. w L(.,., w) y S ., y,. w S .,., w , , is assumed and these assumptions imply the (economic) conditions: . Ir 0 Lr 0 Lw 0 Sy 0 Sw 0 MDEF 2008 BEATRICE VENTURI 17 Dynamical analysis Theorem 1. A hyperbolic stationary point of the system (1), (2), (3) is locally asymptotically stable if the following assumptions hold at: f r g y N 1 with N given by (*) at P* : N = the first integer such that N a2> a3 , at P*, MDEF 2008 BEATRICE VENTURI 18 Dynamical analysis i) the marginal propensity to invest out of income is greater than unity 0 Ty 1 I S y 1 T T g y 0 y y y ii) S w f r (1 Lw ) g r 0 Lw 1 iii) g 0 r f g g L 1S T r y r y w y MDEF 2008 BEATRICE VENTURI 19 Dynamical analysis Corollary 1. Let the hypotheses of Theorem 1 hold at a hyperbolic stationary point of the our system. Then the steady state for each α >0 and all f 1g P* N P* 0 r y is locally asymptotically stable. MDEF 2008 BEATRICE VENTURI 20 Dynamical analysis Corollary 2. Assume Corollary 1 and let J*=J(P*) as before. Then, there exists a value µ>0 for which J* has a pair of purely imaginary eigenvalues. MDEF 2008 BEATRICE VENTURI 21 Theorem 2. Assume the hypotheses of Theorem1 1 except that fr g y N is now replaced by : g P* y 0 2 * f P r Then, there exists a continuous function µ(δ) with µ(0)=μ’ and for all δ small enough , there exists a continuous family of non-constant positive periodic solutions [r*(t ,), y*(t,), m*(t,)] for the dynamical system (1), (2), (3) which collapse to the stationary point P * . MDEF 2008 BEATRICE VENTURI 22 THE ECONOMIC MODEL REMARK For a three-dimensional non linear dynamical model the general version of the Hopf bifurcation theorem, ensures the existence of a small amplitude periodic solutions bifurcating from the steady state only in the center manifold (a two-dimensional subspace of 3). MDEF 2008 BEATRICE VENTURI 23 Dynamical analysis From an economic point of view, sub-critical or super-critical orbits are both reasonable. Since the third real root of the Jacobian matrix is negative the existence of a super-critical Hopf bifurcations becomes very interesting in the analysis of macroeconomic fluctuations for a ISLM model A stable economy, by the increase or decrease of its control parameters, could be destabilized into a stable cycle in the dynamic of R3 MDEF 2008 BEATRICE VENTURI 24 CONCLUSIONS The sub-critical Hopf bifurcations may correspond to the Keynesian corridor (Leijonhufvud, 1973): the economy has stability inside the corridor while it will loose the stability outside the corridor. In such a case the dynamics are either converging to an equilibrium point or the trajectories go somewhere else, and it is also possible that another attracting set exists, but often the alternative is diverging trajectories. MDEF 2008 BEATRICE VENTURI 25 CONCLUSIONS We have seen that fluctuations derive from the mechanisms through which money markets reflect and respond to the developments in the real economy. Our analysis provides an example of the classical thesis concerning endogenous explanations to the existence of fluctuations in some real world economic variables MDEF 2008 BEATRICE VENTURI 26 The general version of the Hopf bifurcation theorem For a three-dimensional non linear dynamical model the general version of the Hopf bifurcation theorem, ensures the existence of a small amplitude periodic solutions bifurcating from the steady state only in the center manifold (a two-dimensional subspace of 3). MDEF 2008 BEATRICE VENTURI 27 Shil’nikov Theorem Shil’nikov showed that if the real eigenvalues has large magnitude than the real part of the complex eigenvalues of the Jacobian of system, then there are horseshoes present in return maps near the homoclinic orbit of the model. MDEF 2008 BEATRICE VENTURI 28 The orbits, in the dynamics of the center manifold, can generally be either attracting or repelling. In the case of an attracting orbit (the so- called sub-critical case) trajectory on the center manifold are locally attracted by this orbit, which becomes a limit set. . MDEF 2008 BEATRICE VENTURI 29 In this situation the stationary point is an unstable solution meanness from an economic point of view (unless the initial conditions happen to coincide with the stationary value). Conversely, if the cycle is unstable (the so- called super-critical case) the steady state is attracting. MDEF 2008 BEATRICE VENTURI 30 This case is particularly relevant from an economic point of view only if the initial conditions imply that the economy fluctuates right from the beginning. The study of stability of emerging orbits on the centre manifold can be performed by calculating the sign up of-up-third order derivative of the nonlinear part of the system, when written in normal form. MDEF 2008 BEATRICE VENTURI 31 In fact, the Hopf bifurcation theorem proves the existence of closed orbits but it gives no information on their number and their stability. Using the non linear parts of an equation system, a stability coefficient (as formulate for example by Guckenheimer J.- Holmes P.,1983) may be calculated in order to determine the stability properties of the closed orbits (see Foley , 1989, Feichtinger ,1992, Mattana - Venturi,1999, Anedda C. -Venturi B. ,2003). MDEF 2008 BEATRICE VENTURI 32 Mattana P.- Venturi B. , 1999, analyzed a simplified three-dimensional version of Lucas’s model, a two sector endogenous growth model with externality. Considering the externality as a bifurcation parameter, they proved, the existence of small amplitude periodic solutions, Hopf bifurcating from the steady state in the center manifold. Venturi B., 2002, have elaborated a numerical simulation of this model. . MDEF 2008 BEATRICE VENTURI 33 In Fig.1 is plotted the dynamics of one orbit Hopf bifurcating from the steady state of the reduced version of the Lucas model (see Venturi B., 2002) The orbits is super-critical MDEF 2008 BEATRICE VENTURI 34 Figure 1 MDEF 2008 BEATRICE VENTURI 35 THE ECONOMIC MODELS We review a generalized two sector models of endogenous growth, with externalities, as formulated by Mulligan B.- Sala-I-Martin X.,1993. We show that in this class of economic models, considering the externality as bifurcation parameter, the conditions of existence of periodic orbits and chaotic solutions come true. MDEF 2008 BEATRICE VENTURI 36 The Mulligan B. - Sala-I-Martin X. model deal with the maximization of a standard utility function: c1 1 t max e dt 0 1 where c = is per-capita consumption = is a positive discount factor = is the inverse of the intertemporal elasticity of substitution. MDEF 2008 BEATRICE VENTURI 37 The constraints to the growth process are represented by the following equations k A(u (t ) u h(t ) h )(v(t ) v k (t ) k )hˆ(t ) hˆ kˆ(t ) k (t ) c(t ) k kˆ h B((1 u (t )) u h(t ) h )((1 v(t )) u k (t ) k )hˆ(t ) kˆ(t ) hˆ kˆ h(t ) h k (0) k 0, 0 h ( 0) h 0 0 k =is the physical capital, h =is the human capital MDEF 2008 BEATRICE VENTURI 38 k h 1 k h 1 h u , k v k, , h are the private share of physical and the human capital in the output sector h u , k v k , h are the private share of human capital in the education sector MDEF 2008 BEATRICE VENTURI 39 u and v = are the fraction of aggregate human and physical capital used in the final output sector at instant t (1- u) and (1- v) are the fractions used in the education sector, A and B are the level of the technology in each sector, MDEF 2008 BEATRICE VENTURI 40 k̂ is a positive externality, parameter in the production of physical capital ĥ is a positive externality parameter in the production of human capital All the parameters: MDEF 2008 BEATRICE VENTURI 41 live inside the following set: = (0, 1)(0, 1) (0, 1) (0, 1) (0, 1) (0,1) (01) (0 1) (0 1) 4. MDEF 2008 BEATRICE VENTURI 42 The representative agent’s problem is solved by defining the current value Hamiltonian: c1 1 H 1 ˆ ˆ A(u (t ) u h(t ) h )(v(t ) v k (t ) k )hˆ(t ) h kˆ(t ) k k (t ) c(t ) 1 k ˆ ˆ B((1 u (t )) u h(t ) h )((1 v(t )) u k (t ) k )hˆ(t ) h kˆ(t ) k h(t ) 2 h i, i = 1, 2 =Lagrange multipliers (co-state variables). = is a depreciation factor MDEF 2008 BEATRICE VENTURI 43 and obtaining the first-order necessary conditions for an interior solutions. Plus the usual two transversality conditions: t lim e 1(t ) k (t ) 0 t t lim e 2 (t )h(t ) 0 t MDEF 2008 BEATRICE VENTURI 44 The general model just presented collapses to Uzawa-Lucas’ when depreciation is neglected and the following restrictions are imposed: v 0 k ˆ ˆ v k 0 k h u h 1 k u h 1 A B 1 MDEF 2008 BEATRICE VENTURI 45 According to the strategy used by Mulligan B.C. - Sala-I-Martin X.,1993, we express the two multipliers 1 and 2 in terms of their corresponding control variables c and u and obtain an autonomous system of four differential equations in the four variables k, h, c, u. A solution of this autonomous system is called a Balanced Growth Path (BGP) if it entails a set of functions of time solving the optimal control problem presented such that k, h and c grow at a constant rate and u is a constant. MDEF 2008 BEATRICE VENTURI 46 We choose a standard combination of the original variables that is stationary on BGP. 1 / 1 x1 h k x u 2 c x3 k We get a first order autonomous system of three differential equations MDEF 2008 BEATRICE VENTURI 47 B.G.P that does not include positive externalities admits only the saddle-path stable solutions (see Mulligan B.C. - Sala-I-Martin X.,1993). We get a first order autonomous system of three differential equations 1 1 x1 x1 x2 (1 x 2 ) x1 x1 x3 1 2 x 2 x2 x2 x2 x 3 1 1 x 3 x x1 x 2 x3 x3 2 3 MDEF 2008 BEATRICE VENTURI 48 Where: ; 1 . 1 MDEF 2008 BEATRICE VENTURI 49 We put our model into normal form (see Guckenheim - Holmes 1983, pp. 573). The system becomes: w 1 TrJ * w1 F w1 , w2 , w3 , 1 w 2 w2 BJ *w3 F w1 , w2 , w3 , 2 w 3 BJ *w2 w3 F w1 , w2 , w3 , 3 MDEF 2008 BEATRICE VENTURI 50 In the equilibrium point is translated the origin P*(0,0,0) of the model and the eigenvalues are linearized in P*. The real eigenvalue is TrJ R * and the complex conjugate eigenvalues are j i B j 1,2 MDEF 2008 BEATRICE VENTURI 51 We consider the dynamic of the system when the parameter values are evaluated in a parameters set where emerges a super-critical Hopf bifurcation. We choose the value (the exponent of the externality factor ) very close to the bifurcation value *. Setting: = 0.75; = 0.055; = 0.054; = 0.1 and = 0.05, We found that the system has a homoclinic orbit. (See Fig. 3.) MDEF 2008 BEATRICE VENTURI 52 Figure 2 -15 -20 -25 -30 -35 20 0.25 0 0.2 0.15 -20 0.1 -40 0.05 0 MDEF 2008 BEATRICE VENTURI 53 The loss of stability and the presence of periodic solutions Hopf bifurcating from the steady state can lead to the occurrence of an homoclinic orbit, Fig. 2, and, under Shil’nikov assumption, of chaotic solutions MDEF 2008 BEATRICE VENTURI 54 The aim of this work is to point out some basic ideas that may be useful to prove the transition to bounded and complex behavior, and to explain how the presence of Hopf bifurcations in a general class of economic-financial models can be interesting from an economic and dynamic point of view. MDEF 2008 BEATRICE VENTURI 55