DEPARTMENT OF ECONOMICS MAY 2, 2014 SAN JOSE STATE UNIVERSITY

advertisement

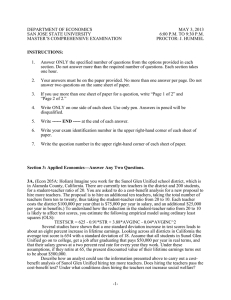

DEPARTMENT OF ECONOMICS SAN JOSE STATE UNIVERSITY MASTER’S COMPREHENSIVE EXAMINATION MAY 2, 2014 6:00 P.M. TO 9:30 P.M. PROCTOR: J. HUMMEL INSTRUCTIONS: 1. Answer ONLY the specified number of questions from the options provided in each section. Do not answer more than the required number of questions. Each section takes one hour. 2. Your answers must be on the paper provided. No more than one answer per page. Do not answer two questions on the same sheet of paper. 3. If you use more than one sheet of paper for a question, write “Page 1 of 2” and “Page 2 of 2.” 4. Write ONLY on one side of each sheet. Use only pen. Answers in pencil will be disqualified. 5. Write ------ END ----- at the end of each answer. 6. Write your exam identification number in the upper right-hand corner of each sheet of paper. 7. Write the question number in the upper right-hand corner of each sheet of paper. Section 3: Applied Economics—Answer Any Two Questions. [But you cannot answer both 3F and 3G.] 3A. (Econ 212: Haight) Much is made in the press of growing income inequality in the United States. Many promote higher taxes on the wealthy in order to redistribute wealth to the poor. a. What effect does income inequality have on the accumulation of human capital and why? b. How does income inequality shape capital investment? c. Is income inequality something we should worry about? Why or why not? d. Empirically speaking, has growing income inequality in the U.S. led to more redistribution? Why or why not? 3B. (Econ 200: Foldvary) Answer the following regarding regulations: a. How can one meaningfully measure the economic effects of regulations? b. What are the constitutional and political causes of regulations whose costs exceed their benefits? c. What reforms of the constitution and of the structure of governance would reduce the incentives to generate excessive regulations? -1- DEPARTMENT OF ECONOMICS SAN JOSE STATE UNIVERSITY MASTER’S COMPREHENSIVE EXAMINATION MAY 2, 2014 6:00 P.M. TO 9:30 P.M. PROCTOR: J. HUMMEL 3C. (Econ 205A: Holian) Describe the steps involved in carrying out a cost-benefit analysis (CBA). Discuss how theoretical, empirical and numerical techniques are used in CBA. You may illustrate these techniques with reference to a specific example, or discuss them in general terms. 3D. (Econ 221: Holian) The inverse market demand for mineral water is P = 12 – Q, where Q is total market output and P is the market price. Two firms, Firm X and Firm Z, have complete control of the supply of mineral water and both have constant marginal costs equal to zero. a. Find the Cournot solution. b. Find the Bertrand solution. c. Assume the two firms play the following game. Each firm simultaneously decides whether to produce and sell 3, 4 or 5 units. Assume for technological reasons they cannot produce any other quantity. After the total quantity is brought to the market, the price is determined based on marginal willingness to pay (i.e. from the demand curve). Please characterize the pure strategy Nash equilibrium(s). 3E. (Econ 166: Pogodzinski) In the simple urban model presented by Brueckner, as illustrated in the figure below, if two groups—rich and poor—reside in a city, then the rich reside further from the Central Business District (CBD). Explain why this is so. -2- DEPARTMENT OF ECONOMICS SAN JOSE STATE UNIVERSITY MASTER’S COMPREHENSIVE EXAMINATION MAY 2, 2014 6:00 P.M. TO 9:30 P.M. PROCTOR: J. HUMMEL 3F. (Econ 232: Foldvary) Answer both parts a and b: a. Analyze the economic impact on the economy (including economic growth) of a large continuous government deficit, including the effects of various categories of spending financed by debt. b. What is the optimal policy for government deficits? [Remember, if you answer this question, you cannot answer 3G below.] 3G. (Econ 232: Ragan) Analyze how one would determine the optimal amount of military defense spending for a country. Provide a policy prescription that includes military spending as a proportion of GDP, the sources of revenue (which taxes and how much borrowing), and whether there would be a military draft. Include both efficiency and equity, and discuss whether in your optimal policy prescription there would be a trade-off between these criteria. Assumptions: 1) There are external enemies with the capability to invade the country and inflict significant damage or possibly conquer the country. 2) The marginal costs (as percentages of GDP) of providing additional military defenses against external threats is known, and the probability of successful defense for a given total cost is known. 3) Providing a defense with the certainty that an attack would be successfully defended has a lower cost than the GDP but would reduce domestic consumption to a subsistence level. 4) Your policy prescription has to be sustainable in the long run. 5) Use USA data regarding input factors, demographics, and income distributions, if these are used. 6) Assume that public choice and social choice uses today’s voting and legislative structures, although you may add additional methods of collective choice. [Remember, if you answer this question, you cannot answer 3F above.] -3-