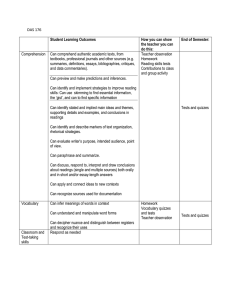

San José State University Department of Economics —Money and Banking Econ 135

advertisement

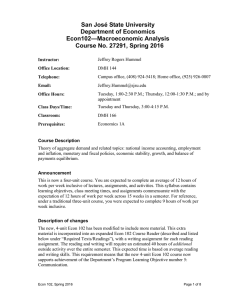

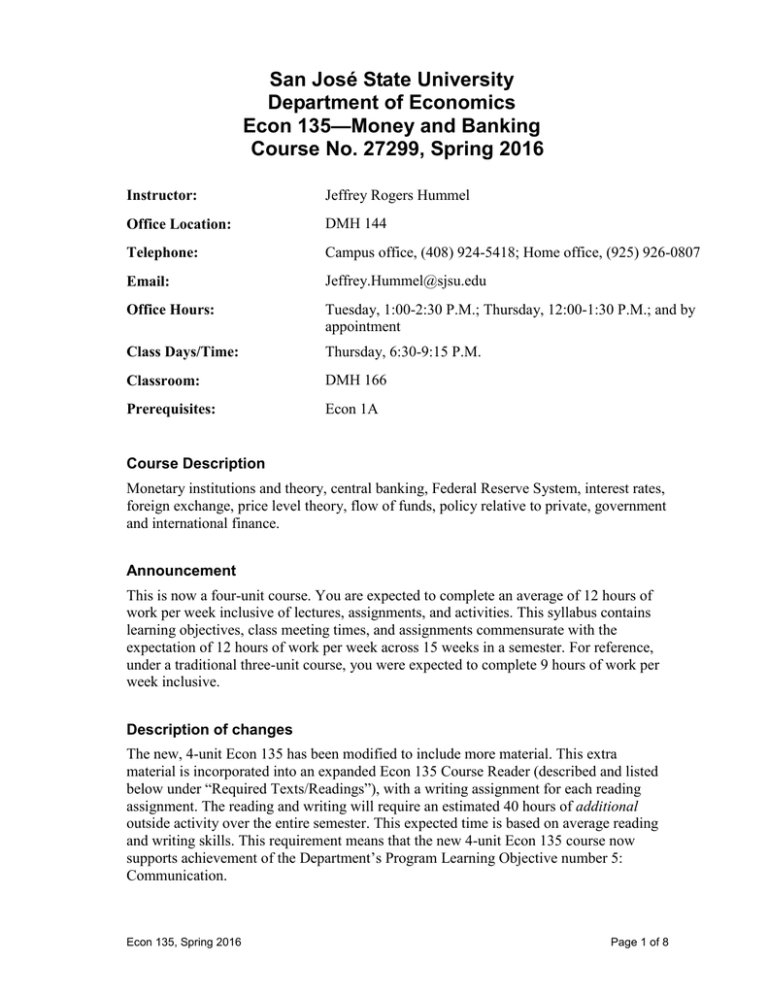

San José State University Department of Economics Econ 135—Money and Banking Course No. 27299, Spring 2016 Instructor: Jeffrey Rogers Hummel Office Location: DMH 144 Telephone: Campus office, (408) 924-5418; Home office, (925) 926-0807 Email: Jeffrey.Hummel@sjsu.edu Office Hours: Tuesday, 1:00-2:30 P.M.; Thursday, 12:00-1:30 P.M.; and by appointment Class Days/Time: Thursday, 6:30-9:15 P.M. Classroom: DMH 166 Prerequisites: Econ 1A Course Description Monetary institutions and theory, central banking, Federal Reserve System, interest rates, foreign exchange, price level theory, flow of funds, policy relative to private, government and international finance. Announcement This is now a four-unit course. You are expected to complete an average of 12 hours of work per week inclusive of lectures, assignments, and activities. This syllabus contains learning objectives, class meeting times, and assignments commensurate with the expectation of 12 hours of work per week across 15 weeks in a semester. For reference, under a traditional three-unit course, you were expected to complete 9 hours of work per week inclusive. Description of changes The new, 4-unit Econ 135 has been modified to include more material. This extra material is incorporated into an expanded Econ 135 Course Reader (described and listed below under “Required Texts/Readings”), with a writing assignment for each reading assignment. The reading and writing will require an estimated 40 hours of additional outside activity over the entire semester. This expected time is based on average reading and writing skills. This requirement means that the new 4-unit Econ 135 course now supports achievement of the Department’s Program Learning Objective number 5: Communication. Econ 135, Spring 2016 Page 1 of 8 Course Learning Outcomes and Program Learning Objectives This is course about money, banking, and the financial system. It applies the insights of both economic theory and history to modern financial institutions. By the end of the course, the student should demonstrate critical and independent thinking about such controversial issues as inflation, the causes of the Great Depression, monetary policy, banking deregulation, the S & L crisis, international exchange rates, and the recent financial crisis. Although this course touches on the full range of Economics PLOs, it emphasizes PLO2 and PLO4. PLO2: Macroeconomics. PLO4: Specialist Areas: Finance. PLO 5: Communication: Demonstrate efficient communication skills. Upon successful completion of this course, students should be able to demonstrate the follow: CLO 1.Explain money's vital function and how it interacts with banking and the financial system. CLO 2. Explain how the interaction of the demand and stock of money determine the price level. CLO 3. Explain seigniorage and the role it has played in the history and evolution of government involvement in the monetary and financial system. CLO 4. Explain the complicated relationships between money, interest rates, and fiscal policy. CLO 5. Discuss the various factors that play a role in financial crises. Required Texts/Readings Textbooks 1. R. Glenn Hubbard and Anthony Patrick O’Brien, Money, Banking, and the Financial System, 1st edn. (Boston: Prentice Hall, 2012): ISBN-13: 978-0132553452). 2. Murray N. Rothbard, What Has Government Done to Our Money? rev. edn. (Auburn, AL: Ludwig von Mises Institute, 1990); ISBN-13: 978-1933550343 (available online at http://mises.org/library/what-has-government-done-our-money). Other Readings Econ 135 Course Reader, available at Maple Press, 330 South 10th Street. Dropping and Adding Students are responsible for understanding the policies and procedures about add/drop, grade forgiveness, etc. Refer to the current semester’s Catalog Policies section at http://info.sjsu.edu/static/catalog/policies.html. Add/drop deadlines can be found on the current academic year calendars document on the Academic Calendars webpage at http://www.sjsu.edu/provost/services/academic_calendars/. The Late Drop Policy is available at http://www.sjsu.edu/aars/policies/latedrops/policy/. Students should be aware of the current deadlines and penalties for dropping classes. Information about the latest changes and news is available at the Advising Hub at http://www.sjsu.edu/advising/. Econ 135, Spring 2016 Page 2 of 8 Assignments and Grading Policy The final examination, which will be comprehensive, is worth 40 points out of the total of 100 for the course. Each of two other examinations is worth 20 points toward the total. In addition, there will be twelve short, objective quizzes based exclusively on assigned weekly readings worth another 20 points. Each quiz individually is worth 2.5 points, allowing students to drop or miss four out of the twelve quizzes. There will be no makeups for any quizzes. Although I shouldn’t have to mention this, cheating on any quiz or exam will result in an automatic F for the entire course. In order to qualify for taking any quiz, students must write a brief summary of the readings assigned for that quiz. These written summaries must be a hard copy, at least 400 words long, neatly typed, and written in standard English. They also must be turned in at the beginning of the class for which the readings are assigned. Failure to turn in the writing assignment automatically disqualifies a student from taking that quiz, earning zero points on it. Hand-written, unintelligible, or late summaries are not acceptable. The written summaries will not be scored but will be checked for acceptability. Written summaries are unacceptable if (a) if they do not apply to the readings assigned: (b) if they do not cover all the readings assigned for that day; (c) if they are less than 400 words; or (d) if they are plagiarized from any source, whether from the readings themselves, from some other written source, or from another student. An unacceptable written summary will disqualify a student’s grade for that particular quiz, earning the student zero points, irrespective of how many questions he or she may have answered correctly. If two or more students turn in identical written summaries for the same assigned readings, the quizzes of each of them will be disqualified. There will be absolutely no exceptions. In addition, the written summaries should include an accurate and typed word count. If they fail to do so, one-half point will be deducted from grade for the associated quiz. Converting Number Grades to Letter Grades 97-100 93-96 90-92 87-89 A+ A AB+ 83-86 80-82 77-79 73-76 below 60 B BC+ C F 70-72 67-69 63-66 60-62 CD+ D D- (continued) Econ 135, Spring 2016 Page 3 of 8 Converting Number Grades to Letter Grades (continued) Also affecting final grades are the total number of quizzes students take. Although allowed to drop four out of the twelve quizzes without penalty, students who do not turn in written summaries and get a positive score (of at least one-half point) on a minimum of four quizzes automatically fail the course, no matter how well they have done on their exams. Below is listed the highest final grade that students can achieve depending on how many written summaries with positive quiz scores they have completed. only 3 written summaries and quizzes only 4 written summaries and quizzes only 5 written summaries and quizzes only 6 written summaries and quizzes 7 or more written summaries and quizzes highest possible grade: F highest possible grade: D+ highest possible grade: C+ highest possible grade: B+ highest possible grade: A+ Classroom Protocol This is a traditional, lecture-based course. I therefore encourage students to record the lectures if they believe doing so will help their studying. But any use of laptops, tablets, or other electronic device for typing notes is prohibited in class. Studies have proven that students who take notes on these devices significantly impair their comprehension of the material. So students need to come prepared to take hand-written notes. Those who violate this prohibition will have a half point deducted from their final grade for the course (out of 100 points) for each and every infraction. Because class participation helps enliven the course, it is greatly appreciated and can earn students up to one extra point toward their final grade. Class attendance is not mandatory and will not directly affect a student’s grade. My experience, however, is that students who miss several classes, in addition to dropping quizzes, consign themselves to doing extremely poorly on their exams (unless they are truly exceptional). I therefore strongly encourage students to attend fully every class. Finally, if you experience any difficulty in this course, please do not hesitate to come to me for help. I am available not only during office hours but also by phone, and I am always happy to clarify hard concepts, resolve any lingering confusion, or otherwise assist you in making this course enjoyable and rewarding. Econ 135, Spring 2016 Page 4 of 8 University Policies Academic integrity Your commitment as a student to learning is evidenced by your enrollment at San Jose State University. The University’s Academic Integrity policy, located at http://www.sjsu.edu/senate/S07-2.htm, requires you to be honest in all your academic course work. Faculty members are required to report all infractions to the office of Student Conduct and Ethical Development. The Student Conduct and Ethical Development website is available at http://www.sa.sjsu.edu/judicial_affairs/index.html. Instances of academic dishonesty will not be tolerated. Cheating on exams or plagiarism (presenting the work of another as your own, or the use of another person’s ideas without giving proper credit) will result in a failing grade and sanctions by the University. For this class, all assignments are to be completed by the individual student unless otherwise specified. If you would like to include your assignment or any material you have submitted, or plan to submit for another class, please note that SJSU’s Academic Policy S07-2 requires approval of instructors. Campus Policy in Compliance with the American Disabilities Act If you need course adaptations or accommodations because of a disability, or if you need to make special arrangements in case the building must be evacuated, please make an appointment with me as soon as possible, or see me during office hours. Presidential Directive 97-03 at http://www.sjsu.edu/president/docs/directives/PD_1997-03.pdf requires that students with disabilities requesting accommodations must register with the Accessible Education Center (AEC) at http://www.sjsu.edu/aec to establish a record of their disability. In 2013, the Disability Resource Center changed its name to be known as the Accessible Education Center, to incorporate a philosophy of accessible education for students with disabilities. The new name change reflects the broad scope of attention and support to SJSU students with disabilities and the University's continued advocacy and commitment to increasing accessibility and inclusivity on campus. Workload Expectations Academic Policy S12-3 at http://www.sjsu.edu/senate/S12-3.htm has defined expected student workload as follows: “Success in this course is based on the expectation that students will spend, for each unit of credit, a minimum of forty-five hours over the length of the course (normally 3 hours per unit per week with 1 of the hours used for lecture) for instruction or preparation/ studying or course related activities including but not limited to internships, labs, clinical practica. Other course structures will have equivalent workload expectations as described in the syllabus.” Econ 135, Spring 2016 Page 5 of 8 Econ 135—Money and Banking Spring 2015: Course Schedule Week Date Topics, Readings, Assignments, Deadlines 1 Jan 28 2 Feb 4 Rothbard, chs. I, II. 3 Feb 11 Hubbard & O’Brien, ch. 2; Rothbard, ch. III. 4 Feb 18 Hubbard & O’Brien. chs. 1, 4. 5 Feb 25 Hubbard & O’Brien, chs. 3, 7. 6 Mar 3 Hubbard & O’Brien, chs. 5, 6. 7 Mar 10 first examination. 8 Mar 17 Hubbard & O’Brien, chs. 9, 10. 9 Mar 24 Hubbard & O’Brien, ch. 11. Mar 31 Spring break. 10 Apr 7 Hubbard & O’Brien, ch. 12. 11 Apr 14 Hubbard & O’Brien ch. 14. 12 Apr 21 second examination. 13 Apr 28 Hubbard & O’Brien, chs. 13, 15. 14 May 5 Rothbard, ch. IV; Selection in the Course Reader from Mishkin, 2nd edn., ch. 19. 15 May 12 Hubbard & O’Brien, chs. 8, 16. Final Exam May 19 DMH 166: 6:30 to 8:45 P.M. NOTE: In addition to the above, the Course Reader contains copies of or links to supplementary readings assigned for various weeks. Econ 135, Spring 2016 Page 6 of 8 Course Units: I. The Nature and Origin of Money. II. The Nature and Origin of Credit. III. An Overview of Today’s Financial System. IV. Commercial Banking: History and Practice. V. VI. VII. Nonbank Intermediaries, Deregulation, and Financial Crisis. Modern Central Banking. Money and the World Economy. For each unit, I will hand out an outline of my lecture and a list of important terms. Optional Recommended Readings: Introductory Todd G. Buchholz, New Ideas from Dead Economists: An Introduction to Modern Economic Thought, rev. edn. (New York: Plume, 2007). David Friedman, Hidden Order: The Economics of Everyday Life (New York: HarperBusiness, 1996). Milton and Rose Friedman, Free to Choose: A Personal Statement (New York: Harcourt Brace Jovanovich, 1980). Henry Hazlitt, Economics in One Lesson: Fiftieth Anniversary Edition (San Francisco: Laissez Faire, 1996). David Henderson, ed., The Fortune Encyclopedia of Economics (New York: Warner Books, 1993). Paul Heyne, Peter J. Boettke, and David L. Prychitko, The Economic Way of Thinking, 10th edn. (Upper Saddle River, NJ: Prentice Hall, 2003). [Note: If you can find it, the 5th edn. written exclusively by Heyne was the best, although more recent editions are still useful.] Israel M. Kirzner, Competition and Entrepreneurship (Chicago: University of Chicago Press, 1973). Steven E. Landsburg, The Armchair Economist: Economics and Everyday Life (New York: Free Press, 1995). Money and Banking Texts George G. Kaufman, The U.S. Financial System: Money, Markets and Institutions, 6th edn. (Englewood Cliffs, NJ: Prentice Hall, 1995). Roger LeRoy Miller and David D. VanHoose, Money, Banking, and Financial Markets, 3rd edn. (New York: McGraw-Hill, 1993). Peter S. Rose and Milton H. Marquis, Money and Capital Markets: Financial Institutions and Instruments in a Global Market Place, 10th edn. (Boston: McGraw-Hill Irwin, 2008). Lawrence H. White, The Theory of Monetary Institutions (Oxford: Blackwell, 1999). (continued) Econ 135, Spring 2016 Page 7 of 8 Optional Recommended Readings (continued): Monetary Theory H. Geoffrey Brennan and James M. Buchanan, Monopoly in Money and Inflation: The Case for a Constitution to Discipline Government (London: Institute of Economic Affairs, 1981). Friedrich A. von Hayek, The Denationalization of Money--The Argument Refined: An Analysis of the Theory and Practice of Concurrent Currencies, 2nd edn. (London : Institute of Economic Affairs, 1978). J. Huston McCulloch, Money and Inflation: A Monetarist Approach, 2nd edn. (New York: Academic Press, 1982). Ludwig von Mises, The Theory of Money and Credit, rev. edn. (London: Jonathan Cape, 1934). Murray N. Rothbard, The Mystery of Banking (New York: Richardson & Snyder, 1983). George A. Selgin, A Theory of Free Banking: Money Supply Under Competitive Note Issue (Totowa, NJ: Rowman & Littlefield, 1988). Monetary History Kevin Dowd, ed., The Experience of Free Banking (London: Routledge, 1992). Milton Friedman, Money Mischief: Episodes in Monetary History (New York: Harcourt Brace Jovanovich, 1992). Milton Friedman and Anna Jacobson Schwartz, A Monetary History of the United States, 1867-1960 (Princeton, NJ: Princeton University Press, 1965). Charles A. E. Goodhart, The Evolution of Central Banks (Cambridge, MA: MIT Press, 1988). Alan Greenspan, The Age of Turbulence: Adventures in a New World (New York: Penguin Press, 2007). Edward J. Kane, The S & L Insurance Mess: How Did It Happen? (Washington: Urban Institute Press, 1989). Angela Redish, Bimetallism: An Economic and Historical Analysis (Cambridge: Cambridge University Press, 2000) Murray Rothbard, America's Great Depression (Princeton, NJ: Van Nostrand, 1963). Richard H. Timberlake, Jr., Monetary Policy in the United States: An Intellectual and Institutional History (Chicago: University of Chicago Press, 1978). Andrew Dickson White, Fiat Money Inflation in France: How It Came, What It Brought, and How It Ended (New York: D. Appleton-Century, 1933). Lawrence H. White, Free Banking in Britain: Theory, Experience, and Debate, 1800-45 (Cambridge: Cambridge University Press, 1984). Monetary and Financial Reform Tyler Cowen and Randall Kroszner, Explorations in the New Monetary Economics (Oxford: Blackwell, 1994). Milton Friedman, A Program for Monetary Stability (New York: Fordham University, 1960). David Glasner, Free Banking and Monetary Reform (Cambridge: Cambridge University Press, 1989). Martin Wolf, Fixing Global Finance (Baltimore: Johns Hopkins University Press, 2008). Econ 135, Spring 2016 Page 8 of 8