October 24, 2005 PROPOSAL TO SERVE AS FISCAL AGENT EFFICIENCY UTILITY FUND

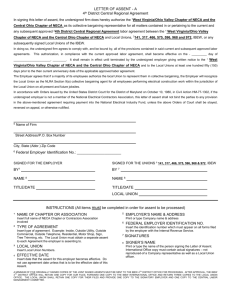

advertisement

PROPOSAL TO SERVE AS FISCAL AGENT FOR THE VERMONT ENERGY EFFICIENCY UTILITY FUND October 24, 2005 Proposal to Serve as Fiscal Agent for the Vermont Energy Efficiency Utility Fund Submitted to: Cynthia Muir, Business Manager Vermont Public Service Board 112 State Street, Drawer 20 Montpelier, VT 05620-2701 From: NECA Services, Inc. President & CEO: John C. Parry Contact For Clarifying Proposal Content Jeff Schnur Director – Business Development NECA Services 80 S. Jefferson Rd. Whippany, NJ 07981 Phone: (973) 884-8383 Fax: (973) 599-6534 Email: jschnur@necaservices.com Contact For Approving Agreement/Amendment Carol C. Kenner Chief Financial Officer NECA Services 80 S. Jefferson Rd. Whippany, NJ 07981 Phone: (973) 884-8502 Fax: (973) 599-6524 Email: ckenner@necaservices.com Proposed Contract Duration: January 1, 2006, through December 31, 2008, with the Board reserving the option to renew for an additional three years. Date Submitted: October 24, 2005 Table of Contents Section Page No. A. Introduction ................................................................. 1 B. Project Approach ........................................................... 3 B.1 Collect Funds From Vermont Electric Utilities .................... 3 B.2 Manage Funds .............................................................. 4 B.3 Disburse Funds ............................................................. 5 B.4 Track Annual Fund Receipts and Disbursements................ 6 B.5 Reporting Requirements ................................................ 7 B.6 Independent Audit ........................................................ 7 B.7 Manage Customer-Specific and Competitively Sensitive Information .................................................................. 8 B.8 Coordination With Contract Administrator ........................ 9 B.9 Additional Responsibilities .............................................. 9 B.10 Meeting in Montpelier, Vermont ..................................... 10 B.11 Disaster Recover/Business Continuity ............................. 10 C. Related Experience ...................................................... 11 D. Staff Qualifications ...................................................... 15 E. References ................................................................. 18 F. Business Organization .................................................. 19 G. Cost Proposal ............................................................. 21 Appendices Page 1 of 21 Proposal to Serve as Fiscal Agent for the Vermont Energy Efficiency Utility Fund A. INTRODUCTION NECA Services, Inc. (NECA Services) is pleased to submit this proposal to serve as the Fiscal Agent of the Vermont Energy Efficiency Utility Fund ("VEEUF" or "Fund"). NECA Services fully understands the requirements of the Request for Proposals issued by the Vermont Public Service Board ("PSB" or "Board"). As demonstrated by our success in carrying out our responsibilities as the current VEEUF fiscal agent and in administering many other state programs, NECA Services adeptly translates statutes, rules, and requirements into functioning systems and operational procedures that achieve fund objectives while satisfying time and budgetary constraints. Our in-depth understanding of procedures and processes, along with our customer-focused interaction with fund participants, uniquely position NECA Services as a capable and experienced business partner for the PSB. Our experience as the current administrator of 15 state fund programs, in addition to managing multi-billion dollar federal programs, including the Schools & Libraries and Rural Health Care programs, has taught NECA Services that successful government program administration requires a multi-disciplinary approach, with demonstrated expertise in the following areas: Forecasting Cash and investment management Fund performance monitoring and reporting Billing and collection Procedures and systems design Funds distribution Fund sizing Accounting Regulatory support Customer communications Auditing Financial planning Page 2 of 21 The background and abilities of our personnel encompass a broad range of demonstrated skill sets, and include financial, regulatory, and information systems professionals, and specialists with years of experience in handling the intricacies and challenges of daily operational processing. The PSB will benefit from the selection of NECA Services to continue to serve as VEEUF Fiscal Agent because: We are highly a highly experienced, impartial, and efficient state program administrator. We have knowledgeable and skilled professionals who can be counted upon to professionally operate state fund programs in accordance with an agreed-upon work plan, as evidenced by our history of doing so for Vermont and many other states. We only associate with sound, reputable, and experienced financial institutions, such as Mellon Bank. We have proven systems and procedures to administer various types of state funds. Independent auditor reviews of our operations have verified the quality of our procedures, processes, and performance. NECA Services does not advocate positions on behalf of clients before the PSB or any other state commission, nor is it affiliated with any law or consulting firm that represents clients who may be participants in the VEEUF. NECA Services is financially sound, properly insured, and bondable. We adhere to our bid price; we have never asked for an interim increase in fees unless it was justified by a substantial change in our duties. NECA Services takes great pride in its work and in its reputation as the preeminent firm in the state fund management/administration business. We believe that NECA Services is in an exceptional position to meet the requirements of this Request For Proposals (“RFP”), and we look forward to continuing our close partnership with the PSB. Page 3 of 21 B. PROJECT APPROACH This section contains a description of the major tasks that NECA Services will continue to perform as VEEUF Fiscal Agent. The section also demonstrates NECA Services’ understanding of the requirements set forth in the RFP, as well as the legislation, rules, and regulations governing the Fund.1 NECA Services will use highly experienced state fund personnel to perform daily Fund operations, thereby minimizing the need for training. Our proposed project approach is based upon our proven method of fund administration, specifically tailored to the particular requirements of, and augmented by our experience with, the VEEUF, as well as by our successful administration of numerous other state funds. NECA Services will continue to use Oracle PeopleSoft for accounts receivable, accounts payable, general ledger, and billing functions. We will be using the same VEEUF database system, which we developed using Microsoft Access running on a Windows 2003 operating system, with Server Cluster technology for high availability. The machine types are dual Intel Pentium III CPU 2.80GHz with 4 gigabytes RAM and dual network interface cards. NECA Services will continue to use Microsoft Excel to generate VEEUF reports. B.1 Collect Funds From Vermont Electric Utilities NECA Services will continue to provide all 21 Vermont electric distribution utilities with an electronic or paper version of the remittance worksheets to allow them to self-report, calculate, and certify kilowatt-hours, and to remit the energy efficiency charge payments to us. NECA Services will continue to work with the distribution utilities to ensure that we receive completed worksheets and payments in a timely manner. The capabilities of our collection processing system allow payments to be made electronically or by check. VEEUF participants will continue to remit their payments and worksheets (see Appendix 1), based on of the reporting schedule (see Appendix 2) included in their information package, to a secure lockbox already established specifically for the Fund at Mellon Bank. 1 Docket 5980 Memorandum of Understanding; Public Service Board Rule 5.300 – Energy Efficiency Charge Methodology; 30 V.S.A § 209(d)(3); Act 61, enacted July 2005. Page 4 of 21 NECA Services will continue to identify any delinquent distribution utilities, and we work with them to bring their accounts into compliance. In the event that a distribution utility remains delinquent in submitting payments or remittance worksheets for more than 60 days, or in the event of an appeal to the Board, NECA Services will provide a written summary of our findings and conclusion to the PSB, the Contract Administrator, and the distribution utility. B.2 Manage Funds NECA Services’ employs a comprehensive program to invest and preserve undistributed VEEUF monies with the objective of maximizing security, liquidity, and yield, in that order. (See Investment Policy in Appendix 3.) We have established relationships with several high-profile institutional investment management firms who, under our direction and guidance, invest funds in a variety of instruments, including institutional money market accounts, overnight repurchase agreements, and short-term government and corporate commercial paper. We have provided a brief synopsis of the firms currently included on our approved list in Appendix 4. NECA Services will continue to maintain only minimal cash resources in the bank account established for the VEEUF to cover outstanding disbursements or while balances await transfer to short-term investment instruments. During 2004, NECA Services' average daily investments under management was $203 million. NECA Services' prudent and secure investment program for undistributed Fund monies has customarily achieved investment returns equal to or exceeding those of standard money market measures, such as the Federal Funds Rate. Our Investment Committee meets at least quarterly to review the performance of all managed funds, and evaluates the performance of the managers as well as the appropriateness of existing investment guidelines. Interest earned on undistributed fund balances, net of investment and banking fees, may be used to offset fund obligations, reduce future funding requirements, or as otherwise directed by the PSB. NECA Services understands that only the PSB shall determine the disposition of undistributed bank balances. Accordingly, we will continue to report monthly Fund balances and Fund activity to the PSB so that the Board can make timely decisions regarding the use of these monies. Generally, our investment strategy focuses on using Page 5 of 21 investment managers who will oversee a portfolio specifically designed for and by our Investment Committee. In accordance with our guidelines and with the types of investments permitted by the PSB, these portfolios consist primarily of highly secure liquid investments with durations of less than twelve months. Our investment managers are required to continually monitor and analyze market conditions, perform extensive credit research on potential corporate investments, and canvass the market to determine the nature and duration of the most appropriate investments to be included in the portfolio. As stated in our investment guidelines, the overall goal for any government fund that we administer is to provide maximum yield without compromising the safety and liquidity of investment principal. NECA Services will continue to examine and analyze distributions utilities' monthly remittance worksheets for completeness and accuracy, and we will request an explanation from any distribution utility whose account contains unusual variances in the data being reported. We will assist the utilities in reconciling any data entry errors in financial reporting records. NECA Services will continue to provide a monthly statement to all providers with a non-zero balance. B.3 Disburse Funds NECA Services has developed proven disbursement systems that support the timely and accurate processing of more than 25,000 programmatic disbursements each year, exceeding $875 million in annual payments. In order to ensure the integrity of our disbursement processes, as well as to provide proper control over the billions of dollars in cash flow managed, NECA Services' disbursements systems are subject to periodic reviews by both internal and external auditors. The reviews of our systems and processes have confirmed that we provide substantial levels of internal control, including appropriate segregation of duties, thereby providing the PSB assurance as to the accuracy and timeliness of disbursements to all eligible recipients. Furthermore, only authorized personnel with appropriate executive oversight and approval have access to our systems. NECA Services will obtain signed disbursement request worksheets (see Appendix 5) from the Contract Administrator prior to making disbursements to the City of Burlington Electric Department, the Vermont Energy Efficiency Utility ("EEU"), other distribution utilities, the Department of Public Service ("DPS"), newspapers, and the Page 6 of 21 independent auditor of the Fund. To facilitate the process of funding requests, NECA Services will continue to improve and update disbursement request worksheets. NECA Services will obtain written approval of the PSB chairman (or Board designee) prior to making disbursements to the Contract Administrator. NECA Services will make disbursements for the Home Weatherization Assistance Trust Fund and Gross Receipts Tax Fund in accordance with 33 V.S.A. § 2503 and 30 V.S.A. §22, respectively. NECA Services will notify the PSB and the Contract Administrator when Fund levels are insufficient to satisfy disbursement requests. In such an event, NECA Services will issue pro-rata payments or proportionate payments to recipients. Our Accounts Payable group generates disbursements made by check, handing them off to our Treasury Group for verification, sealing, and mailing. For Electronic Funds Transfers, we require two authorized individuals with separate passwords to release the funds. B.4 Track Annual Fund Receipts and Disbursements NECA Services will continue to track the annual receipts and disbursement of the VEEUF using standard fund accounting practices in accordance with GAAP. NECA Services has installed a state-of-the-art, integrated financial system that performs general ledger, accounts receivable, accounts payable, and billing functions. This system handles full accounting and reporting functions for 15 distinct business units. Our state-of-the-art financial system will continue to serve as the backbone for electronically recording all VEEUF data and each customer’s financial transactions. Our Finance Department personnel have role-based access to the system allowing them to process transactions and produce a variety of financial reports, including VEEUF income statements, balance sheets, statements of cash flows, customer aging reports, and cash analyses. The system allocates disbursements among several categories, including core efficiency services, administrative costs, weatherization taxes, and gross receipt taxes. NECA Services will monitor receipts and disbursements compared to monthly and annual projected amounts by tracking accounts receivable and payable as well as the funds spent in each category. Page 7 of 21 B.5 Reporting Requirements NECA Services will continue to provide the PSB and EEU with monthly and annual status reports. Monthly reports will show receipts and disbursements for the previous month and a breakdown of disbursements by the categories described in Section B.4. Monthly reports will also show cumulative receipts by distribution utility for the fiscal year, cumulative receipts in the fiscal year compared to budget, cumulative disbursements in the fiscal year compared to budget, current fund balance, budgeted receipts for the current fiscal year, budgeted disbursements for the current fiscal year, and a schedule of net assets that shows the Fund's liabilities, including funding set-asides. Annual reports will show receipts and disbursements for the previous calendar year, compare actuals with budgeted amounts, and include any additional information that will assist the Board in its oversight of NECA Services' management functions. Each September, NECA Services will also provide the PSB, the Contract Administrator, and the DPS with a report showing distribution utility contributions by contribution rate class for the preceding Energy Efficiency Charge year, and current Energy Efficiency Charge receipts to date. A sample annual report and a sample September report are included in Appendix 6. NECA Services will quickly respond to all PSB requests for additional periodic reports and ad-hoc analyses. We will also alert the PSB immediately to any significant financial problems. B.6 Independent Audit Complete and accurate maintenance of financial reports and records, as well as adherence to Generally Accepted Accounting Principles, make audits a welcome reflection of quality fund management. Each of our annual external VEEUF financial audits has resulted in an unqualified opinion, and annual internal audits of our controls and procedures were issued with no significant findings. NECA Services will continue to retain an independent accountant to audit our financial reports for each year of operations. We will provide the audits to the PSB, the DPS, the Vermont Auditor of Accounts, and we will make audits available to the EEU and the distribution utilities upon request. Our Cost Proposal (see Section G) includes the Page 8 of 21 time and materials required for NECA Services to support one external audit per contract year. As always, NECA Services will fully cooperate with the PSB’s approved auditor, providing the data and other information reasonably required to support such audit activities. The fees and other charges billed by external auditors are not included in our contract price and will be billed to the VEEUF following the Contract Administrators' review and approval. On our own initiative, NECA Services will continue to periodically perform internal reviews of state fund processes and procedures to ensure the integrity and adequacy of our internal controls. To the extent that the PSB may require additional audits of our operations, we will cooperate fully, and we reserve the right to request compensation at our daily rates (See Section G – Cost Proposal) plus expenses should the level of NECA Services’ involvement exceed a reasonable level. As requested and authorized by the PSB, NECA Services will perform reviews of VEEUF participants to further validate compliance with rules and regulations by testing the accuracy and completeness of information reported by Fund participants. At the Commission's discretion, NECA Services could annually review a random sample of Fund participants on a rotating basis. Reviews of VEEUF participants, if requested by the PSB, will be billed at the rates shown in Section G – Cost Proposal. B.7 Manage Customer-Specific and Competitively Sensitive Information NECA Services understands the vital importance of protecting the confidentiality of non-public data entrusted to it for the purpose of managing our responsibilities. We will continue to provide VEEUF related confidential data only to the PSB, the Contract Administrator, and to other parties as directed by the PSB. Only authorized NECA Services staff have access to Fund data. As evidenced by our previous performance in administering the VEEUF, we will not permit data to be used in any form, by any other party or unauthorized staff person, for any purpose. Further, the PSB will have exclusive ownership of any and all data acquired and maintained by NECA Services for the purpose of administering the VEEUF. NECA Services is committed to ensuring the confidentiality of all data collected, used, and maintained in the course of our administrative duties. NECA Services has developed and will continue to maintain a process with clearly defined standards and safeguards to govern sharing of information with distribution utilities to ensure that Page 9 of 21 customer confidentiality is maintained and entities are not provided an unfair competitive advantage. We utilize several mechanisms to safeguard confidential information, including physical and data access controls, signed non-disclosure agreements, and employee education, to ensure that data accumulated from individual companies is protected from unauthorized disclosure.2 We foster employee awareness of confidentiality issues, and each individual who works on the VEEUF is required to sign a non-disclosure agreement related to the protection of confidential information. B.8 Coordination with Contract Administrator NECA Services will continue to work with the Contract Administrator to ensure that data requested is received in a timely and accurate manner. We will continue to provide the Contract Administrator, upon request, with information collected from the distribution utilities. We will also continue to coordinate with the Contract Administrator regarding the development of new annual distribution utility contribution worksheets, monthly cash disbursement dates, and possible interim Energy Efficiency Charge rate changes. We will communicate with the Contract Administrator regarding the selection of the Independent External Auditor, annual independent audit data requests, and necessary coordination with the Vermont Auditors of Accounts. If necessary, NECA Services will request that the Contract Administrator assist us in resolving disputes. B.9 Additional Responsibilities NECA Services understand that is expected to perform several other accounting duties including but not limited to providing current financial statements and account reports at the request of the PSB or the Contract Administrator, maintaining full historical fund reports, keeping general ledger and up-to date spreadsheets on projected and actual collections and disbursements, performing bank reconciliations for the VEEUF accounts, and providing procedures to handle adjustments, voids, and full and partial credits for all accounts. 2 In the twenty-two-year history of NECA/NECA Services, we are not aware of any failures in our controls for protection of proprietary information. Page 10 of 21 B.10 Meeting in Montpelier, Vermont NECA Services understands that, as VEEUF Fiscal Agent, we will be meeting with representatives of the PSB and the Contract Administrator in Montpelier, Vermont, once during the three-year term of the contract. B.11 Disaster Recovery/Business Continuity NECA Services Corporate Disaster Recovery/Business Continuity Plan (see Appendix 7) ensures that programmatic support services can be quickly recovered and become operational in the event that a disaster disables any component of our operations. The plan identifies critical business functions that need to be performed, staff required to perform those functions, operating procedures to be followed, a communication plan, and restoration procedures. Our disaster recovery site is located in Alpharetta, Georgia, and in the event of a disaster, critical staff will telecommute by accessing this site. All VEEUF data stored on our servers is backed up nightly and transmitted to the back-up site in Alpharetta. In addition, all data is synchronized nightly in order to expedite any disaster recovery process. Periodic tests of disaster recovery and business continuity procedures are conducted to ensure that systems and procedures function as intended. Page 11 of 21 C. RELATED EXPERIENCE Below are descriptions of NECA Services' programs that provide relevant experience directly related to the duties of the VEEUF Fiscal Agent. For each program, NECA uses GAAP and GASB 34 rules to account for state funds. Arizona Universal Service Program NECA began managing the Arizona Universal Service Fund at its inception in 1997. Arizona subsequently executed a new USF contract with NECA Services. The Arizona USF is funded by more than 300 intrastate telecommunications providers to provide approximately $1 million per year in High Cost support. Connecticut Telecommunications Relay Service Fund In August 2002, Sprint/United Management Co. contracted NECA Services to implement a new funding mechanism and to perform the ongoing Billing & Collection services to fund Telecommunications Relay Service in Connecticut. The Connecticut TRS provides more than $2.5 million annually to support the provision of relay service. NECA Services collects contributions from over 370 intrastate telecommunications providers and disburses authorized payments as designated by the Connecticut Department of Public Utility Control. District of Columbia Universal Service Trust Fund and Telecommunications Relay Service The District of Columbia Public Service Commission selected NECA Services to implement and manage the District’s Universal Service Trust Fund (USTF) and to administer the telecommunications relay service (TRS) in October 2003. The USTF provides a mechanism to recover from LECs the cost of supporting lifeline service, a telephone service subsidy for low-income customers; and TRS, a telephone transmission service that provides the hearing impaired or speech impaired individuals the ability to engage in telephone communications with non-impaired individuals through a third party who converts speech to text and vice-versa. Through the USTF, NECA Services collects and distributes approximately $1.2 million annually for the DC-PSC. The DC Commission also charged NECA Services with developing performance requirements and criteria for the provision of TRS in the District, to formulate an RFP for a TRS provider, to evaluate proposals from respondents, and then to monitor corresponding service levels. The DC Commission recently renewed NECA Services' UTSF contract. Hawaii Telecommunications Relay Service Fund In July 2003, Sprint/United Management Co. contracted NECA Services to implement a new funding mechanism and to perform the ongoing Billing & Collection services to fund Telecommunications Relay Service in Hawaii. The Page 12 of 21 Hawaii TRS provides more than $2.0 million annually to support the provision of relay service. NECA Services collects contributions from over 175 intrastate telecommunications providers and disburses authorized payments as designated by the Hawaii Public Utilities Commission. Kansas Universal Service Fund The Kansas Corporation Commission (KCC) selected NECA to implement and manage the Kansas Universal Service Fund in 1997. NECA Services now administers the KUSF on behalf of NECA. The Kansas USF receives contributions from over 500 intrastate telecommunications providers. It provides $65 million in annual support to four universal service programs including High Cost funding, Lifeline Service to qualified low income consumers, Dual Party Relay Service (KRSI), Kan-Ed and specialized telecommunications equipment for persons with physical impediments. There are approximately 45 monthly disbursements related to these programs. Maine Universal Service Fund The Maine Public Utility Commission selected NECA Services to be the administrator of the Maine Universal Service Fund (MUSF) effective July 2005. The MUSF provides over $10M in funding to local telephone companies that have a high cost of delivering service. This assistance allows these companies to keep their rates affordable. Under its administration of the fund NSI will collect from approximately 80 telecommunications service providers and disburse funds to approximately 16 authorized recipients each quarter. Maine Telecommunications Education Access Fund The Maine Public Utility Commission selected NECA Services to be the administrator of the Maine Telecommunications Education Access Fund (MTEAF) effective July 2005. The MTEAF provides affordable access to information services for schools and libraries across the state without regard to geographic location. Under this fund NSI will collect from approximately 80 contributors and make approximately 100 disbursements totaling $4.5M annually. Nevada Universal Service Fund The Public Utilities Commission of Nevada selected NECA to implement and administer the Nevada Universal Service Fund in 1999. NECA Services now administers the Fund on behalf of NECA. More than 420 intrastate telecommunications service providers contribute to the NUSF, which provides funding for the High Cost program. As Fund Administrator, NECA Services is responsible for collecting and disbursing approximately $0.5 million per year on a quarterly basis. We are also charged with the review and approval of petitions for support. Oklahoma Universal Service Fund The Oklahoma Corporation Commission (OCC) selected NECA to implement and administer the Oklahoma Universal Service Fund in 1998. Upon renewal, Oklahoma entered into a OUSF contract with NECA Services. The Oklahoma USF is funded by Page 13 of 21 more than 500 intrastate telecommunications providers to provide approximately $15 million per year in universal service support. The Oklahoma USF provides funding for Universal Service goals, Lifeline, and discounts for Schools and Libraries, Rural Health Care providers and county governments. Oregon Universal Service Fund Oregon contracted with NECA Services to serve as the Oregon Universal Service Fund Administrator in 2005. The OUSF provides $48 million in annual support from 500 intrastate telecommunications providers to 30 High Cost providers. Pennsylvania Universal Service Fund The Pennsylvania Public Utility Commission contracted with NECA to serve as the Pennsylvania Universal Service Fund Administrator, following a period during which we served as the Interim Pennsylvania USF Administrator. Pennsylvania has recently renewed the Fund contract, this time with NECA Services. The Pennsylvania USF provides $34 million in annual support to 32 small telephone companies. The fund is supported by contributions from more than 230 intrastate telecommunications service providers. Puerto Rico Universal Service Fund The Puerto Rico Telecommunications Regulatory Board contracted NECA to implement and administer the newly established Puerto Rico Universal Service Fund in May 2000, subsequently renewing the contract with NECA Services. The Puerto Rico USF was established to guarantee all citizens of Puerto Rico telecommunications service at a fair, reasonable and affordable price. The PUSF provides $5 million in annual funding for Telecommunications Relay Services, Isolated Communities, Lifeline and other future programs. The fund became effective in July 2001 and currently involves nearly 100 intra-island telecommunications providers. Texas Universal Service Fund NECA was selected to administer the Texas Universal Service Fund in 1998 by the Public Utility Commission of Texas. In August 2002, after a competitive bidding process, the Commission selected NECA Services to continue administering the fund through 2006. The Texas USF is funded by monthly contributions from approximately 2,200 intrastate telecommunications service providers, including hotels and motels. The total annual size of the Texas USF is approximately $585 million. NECA Services’ responsibilities include management of several universal service programs including: High Cost support, small and rural Incumbent Local Exchange Carrier support, Lifeline, Linkup, Telecommunications Relay Services, Intralata Support and a Specialized Equipment Distribution voucher program. Vermont Universal Service Fund The Vermont Public Service Board originally selected NECA in 1994 to implement and serve as administrator of the Vermont Universal Service Fund. In July 2003 the Vermont PSB completed its fourth competitive bidding process and selected NECA Page 14 of 21 Services as fiscal agent for an additional three years. The Vermont USF provides funding of approximately $6 million per year to support the intrastate TRS, Outreach, Equipment Distribution, Lifeline and E-911 programs. Approximately 350 telecommunications carriers currently contribute to the VUSF with support received by 15 authorized recipients. Vermont Energy Efficiency Utility Fund The Vermont PSB selected NECA to act as the fiscal agent of its first statewide energy efficiency fund, which became operational in March 2000. The contract was subsequently renewed with NECA Services. The Vermont Energy Efficiency Utility Fund is designed to collect and disburse approximately $8 million annually to fund energy efficiency programs and products. Page 15 of 21 D. STAFF QUALIFICATIONS NECA Services' organizational structure is designed to be flexible and totally responsive to our clients, while achieving all objectives on time and within cost parameters. This structure fosters first-class performance, schedule adherence, and cost-effective use of resources through clearly defined duties and responsibilities, short and direct reporting lines to senior management, and proper management span of control. NECA Services proposes the following persons, all located in Whippany, New Jersey, to carry out our responsibilities as VTEEUF Fiscal Agent. NECA Services will not substitute any personnel assigned to the VEEUF without the prior approve of the PSB. Staff resumes are contained in Appendix 8. Overall managerial direction and supervision of VEEUF operations will be the responsibility of John H. Donovan III, Director of State Program and Product Operations. Mr. Donovan, who has worked at NECA Services since 2001, is responsible for overall direction and coordination of all state program operations. His career spans more than 30 years in the telecommunications industry, most of which was spent in key regulatory and marketing positions with AT&T and NYNEX. Mr. Donovan holds a B.S. in Economics from Boston College and an M.S. in Finance from Fairfield University. Lori Tasca, who has worked for NECA Services since 1998, will serve as VEEUF Program Manager. Ms. Tasca, who reports directly to Mr. Donovan, will act as the primary point of contact with the PSB, Contract Administrator, and Vermont electric distribution utilities. Ms. Tasca has experience administering various state programs, including the Vermont Energy Efficiency Utility Fund, Vermont USF, Arkansas USF, Arkansas Extension of Telecommunications Facilities Fund, Arizona USF, District of Columbia USF, Kansas USF, Oklahoma USF, Oregon USF, Texas USF, and Texas Specialized Equipment Program. Ms. Tasca develops and implements procedures to ensure the accurate and timely collection of revenue and disbursement of program funds. Her responsibilities also include general accounting, budgeting, financial reporting, daily operational processing, and financial management activities. Ms. Tasca holds an A.S. in Applied Science-Business Management from County College of Morris, and a B.A. from Montclair State University. Frank Garofalo, a highly experienced Associate Manager reporting to Page 16 of 21 Ms. Tasca, will perform VEEUF desk operations, including interacting with utilities to explain and ensure the satisfaction of Fund requirements, processing utility assessments, and preparing monthly reports and analyses. Mr. Garofalo, who has worked for NECA Services since 1998, has responsibilities for database management, data analysis, customer service, and billing and collection procedures. He has experience administering several state programs, including the Arkansas USF and Arkansas Extension of Telecommunications Facilities Fund, Arizona USF, District of Columbia USF, Kansas USF, Oklahoma USF, Oregon USF, and Texas USF. A NECA Services Data Analyst reporting to Frank Garofalo will be assigned to the VEEUF team. NECA Services' Chief Financial Officer is Carol Kenner, CPA. Prior to joining NECA Services in 1998, Ms. Kenner worked for Alive Hospice, Inc., for three years as Director of Finance. Ms. Kenner has overseen accounting activities for all state fund programs, including the VEEUF, since 1998. Ms. Kenner, a Certified Public Accountant, holds a B.A. in Economics from Tufts University and an M.S. in Accounting from New York University. Under the direction of Ms. Kenner, Monique Robinson, CPA, Director of General Accounting and Revenue Operations, will oversee the daily treasury, cash management, accounts receivable, risk management, all general accounting and financial reporting functions for the VEEUF. Ms. Robinson has worked at NECA Services since 1999 and is responsible for daily treasury operations, including financial institution reconciliation functions, cash forecasting, and fund disbursement processing, and she actively monitors fund cash flows and ensures that undistributed funds are invested in accordance with our Investment Guidelines. Ms. Robinson has extensive experience in cash management operations, such as cash forecasting, money transfer, financial institution balance reporting, and general accounting. Ms. Robinson also has oversight of accounts receivable, risk management, all general accounting and financial reporting functions, general ledger activity, the generation of financial statements, all tax and accounting research, and the operation of our integrated financial system. Ms. Robinson is a Certified Public Accountant, and holds a B.S. in Accounting from Rutgers University and an M.A. in Mathematics Education from Kean University. Page 17 of 21 Under the direction of Ms. Kenner, Donna Casey, Director of Expense Operations, will oversee the accounts payable and disaster recovery operations for the VEEUF. Ms. Casey has more than 25 years of experience in these areas, 20 of them with NECA Services. Ms. Casey has managed the activity for state fund program management, which includes VEEUF general accounting and financial reporting functions, since 2001. From January 2000 to 2005, Ms. Casey managed various state USFs and other state programs, including the Arkansas USF, Arkansas Extension of Telecommunications Facilities Fund, Arizona USF, District of Columbia USF, Puerto Rico USF, Oklahoma USF, Oregon USF, Texas USF, Vermont USF, and the Vermont Energy Efficiency Utility Fund. Ms. Casey holds an AS in Business Administration from County College of Morris, and is currently pursuing a BA in Business Administration – Accounting at the College of St. Elizabeth. Overall managerial direction and supervision of VEEUF informational technology operations will be the responsibility of Bradley R. Scott, Director of Information Technologies and Chief Information Officer. Mr. Scott is responsible for company-wide IT strategic and tactical planning. His career spans more than 13 years of experience in the IT and telecommunications industry. Mr. Scott has worked at NECA Services since 1995, and holds a B.S. in Public Accounting from Mesa State College and an M.S. in Information Systems from University of Colorado. Christopher Didden, Business Systems Analyst, will manage staff who will continue to oversee the VEEUF database. Mr. Didden has been with NECA Services since 2004 and has worked as a systems development professional since 1997. Mr. Didden holds a B.S. in Management from Virginia Technical University and a Degree Certificate in Information Systems from Virginia Commonwealth University. Page 18 of 21 E. REFERENCES Oklahoma Corporation Commission Contact Person: Eric Seguin Phone: (405) 522-3765 Fax: (405) 522-1157 Address: Jim Thorpe Building, Suite 580 City: Oklahoma City State: OK Zip: 73105 Service provided: Administration of Oklahoma USF Oregon Public Utility Commission Contact Person: Cynthia Van Landuyt Phone: (503) 378-6638 Fax: (503) 373-7752 Address: 550 Capitol Street NE, Suite 215 City: Salem State: OR Zip: 97301-2551 Service provided: Administration of Oregon USF Public Utility Commission of Texas Contact Person: Bob Saathoff Phone: (512) 936-7065 Address: P.O. Box 13326 City: Austin State: TX Zip: 78711 Service provided: Administration of Texas USF Fax: (512) 936-8058 Page 19 of 21 F. BUSINESS ORGANIZATION NECA Services, Inc., an independent stock corporation, was founded in the year 2000 to pursue program management opportunities on a for-profit basis. The company grew out of NECA (National Exchange Carrier Association), a not-for-profit organization created in 1983 at the direction of the Federal Communications Commission (FCC) to support the restructuring of the telecommunications industry. NECA Services initially operated with few employees of its own, securing most of the resources and skilled personnel necessary to fulfill its contractual obligations through a services agreement with NECA. On July 4, 2004, 220 of NECA's employees were transferred to NECA Services, including most of the employees who administer state fund programs. NECA Services has its own officers and board of directors. NECA Services’ primary strengths are the experience and expertise of its personnel, including professionals skilled in project management, accounting, auditing, information systems design and development, fraud detection and control, government regulation, as well as banking and investment management. These individuals have consistently demonstrated their competencies by successfully implementing and administering numerous support programs at both the state and federal levels during periods of rapid growth and change, and by professionally managing day-to-day operational responsibilities with an attention to detail and quality and without cost overruns. Moreover, our staff is frequently able to offer constructive suggestions for process improvements learned from our experience administering many other programs. Possibly the strongest evidence of clients’ satisfaction with our performance is demonstrated by the renewal of their contractual agreements. Arizona, the District of Columbia, Kansas3, Nevada4, Oklahoma, Puerto Rico, Texas, and Vermont have each renewed, on one or more occasions, their initial agreements with us to act as administrator for their USF program. The Public Utility Commission of Texas (PUCT) gave NECA Services a strong vote of confidence by retaining us to assist the PUCT in administering one of the largest and most complex state USFs in the nation. Likewise, the Nevada PUC agreed to a two-year contract extension, and the Kansas Corporation 3 4 NECA Services administers the Kansas USF on behalf of NECA. NECA Services administers the Nevada USF on behalf of NECA. Page 20 of 21 Commission approved a five-year extension. Particularly noteworthy is the fact that the Oklahoma Corporation Commission (OCC) originally planned to retain NECA for only an 18-month period and then transition the fund administration responsibilities to its own staff. As a result of the Commission's high level of satisfaction with our performance, the OCC instead renewed its contract with us for another two-year period, and, subsequently, for an additional three years. Page 21 of 21 G. COST PROPOSAL NECA Services is pleased to provide this Cost Proposal for its services as VEEUF Fiscal Agent for a three-year period beginning January 1, 2006. Costs Start-Up Cost: –$0– Ongoing Operational Cost: 1/1/2006 through 12/31/2006: Fixed cost of $42,000. 1/1/2007 through 12/31/2007: Fixed cost of $43,300. 1/1/2008 through 12/31/2008: Fixed cost of $44,600. Other Costs: A) Hourly rate to support external audits in excess of one audit per year: 1/1/2006 through 12/31/2006: $144 1/1/2008 through 12/31/2008: $150 1/1/2007 through 12/31/2007: $156 B) Daily rate to conduct reviews of VEEUF participants (at the option of the PSB): 1/1/2006 through 12/31/2006: $1545 1/1/2008 through 12/31/2008: $1625 1/1/2007 through 12/31/2007: $1700 Cost Assumptions The costs presented in this Cost Proposal are based on the assumptions described below. If there are material variations to these cost assumptions, NECA Services reserves the right to renegotiate its cost quotation. Our Cost Proposal includes a one-day meeting in Montpelier between the Fiscal Agent and representatives of the Board and Contract Administrator. The amount to be paid to independent auditors is not included in our Cost Proposal. Our Cost Proposal includes support for one external audit per contract year. Our Cost Proposal includes one mid-year assessment factor change per contract year. Our Cost Proposal does not include any additional costs that may result from decisions made by the Board when it implements Act 61.