*** *** *** ORISSA ELECTRICITY REGULATORY COMMISSION BIDYUT NIYAMAK BHAWAN,

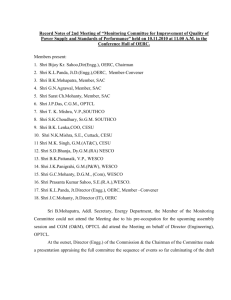

advertisement