Decarbonization: The Coming Natural Gas Economy COGA August, 2003

advertisement

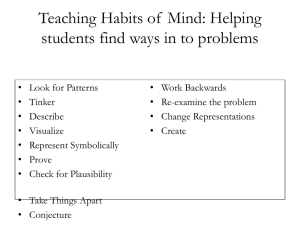

COGA August, 2003 Decarbonization: The Coming Natural Gas Economy Scott W. Tinker Bureau of Economic Geology John A. and Katherine G. Jackson School of Geosciences The University of Texas at Austin Scott Tinker, Director Bureau of Economic Geology August 4, 2003 The four EEEEs — Energy, Environment, Economy, and Education — are inextricably linked. We have a unique opportunity to positively impact the global 4-E balance in the 21st century. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Humanity’s Top Ten Problems for next 50 years 1. ENERGY 2. WATER 3. FOOD 4. ENVIRONMENT 5. POVERTY 6. TERRORISM & WAR 7. DISEASE 8. EDUCATION 9. DEMOCRACY 10. POPULATION Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Nobel Laureate Dr. Richard Smalley, 2003 Outline • Global Decarbonization • Why the Trend Towards Gas • Creating a Global Gas Economy • Challenge of Meeting Demand • Opportunities Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 World Energy Consumption Solids Oil Embargo 80 Solids (Wood, Coal) 40 Liquids (Oil) U.S. Consumption Gases (Natural Gas, Hydrogen, Nuclear, Renewables) 20 WW II 60 WW I Percentage of total market 100 Liquids Gases 0 1850 1900 1950 2000 QAc9841c Year Scott Tinker, Director Bureau of Economic Geology August 4, 2003 U.S. Data: Annual Energy Review 1999 (EIA, 2000) World Data: International Energy Annual 1999 (EIA, 2000) after Hefner, 1993 Energy consumption (percent) Energy Demand 50 World oil 40 World gas, nuclear, hydro, renewables 30 World coal 20 1980 1985 1990 1995 Year Scott Tinker, Director Bureau of Economic Geology August 4, 2003 U.S. Data: Annual Energy Review 1999 (EIA, 2000) World Data: International Energy Annual 1999 (EIA, 2000) Historical U.S. Energy Consumption U.S. Energy Consumption U.S. Energy Energy Consumption Forecast U.S. Consumption Forecast U.S. Energy Consumption 100% 1973 120 1 160.00 0.9 140.00 100 80.00 0.5 10 60.00 0.4 40 90 0.3 20 40.00 20 20% 0.2 Solids 20.00Liquids 30 0.1 0 Gases + Renewables 0.00 0% 0 l 20 10 l l l l l l ll 100 Coal Wood and Waste Tinker Forecast 2040 2025 2010 1995 1980 1965 1950 1935 1920 1905 1890 1 Quad Btu Instability ~ 1 Tcf Gas Supply l l Solids Solids Oil Produced l 1910 40 l 1920 1915 1845 1850 1855 1860 1865 1870 1875 1880 1885 1890 1895 1900 1905 1910 1915 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 l 1920 Data: EIA l 1925 50 l 1930 Data: EIA l 1935 l 1940 60 ll l l l 1945 l 1975 l l l 1950 l 1980 ll ll ll lll l 1955 l 1985 70 ll l 1960 l 1990 l ll l 1965 l 1995 l 1970 l 2000 80 50 30 Nuclear Energy Liquids Liquids Oil Imported 40% 60 40 Hydroelectric Natural Gas 60 1845 70 Renewable Energy Gases and Renewables Renewables Gases and 100 1875 80 0.8 0.7 80 60% Liquids (Oil) 100.00 0.6 120.00 1860 Total Market % ofQuad BTU BTU Share Quad Percentage of Market 80% ll Price Volatility Governmental Policy Technology l 90 l l 100 90 80 Scott Tinker, Director Solids (Wood, Coal) Bureau of Economic Geology August 4, 2003 70 60 50 40 30 20 10 Gases (Natural Gas, Hydrogen, Nuclear, Renewables) QAd1023 Why the Long-Term Trend Towards Natural Gas? • Efficiency • Economy • Environment • Availability Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Why Natural Gas? Efficiency Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Why Natural Gas? Economy/Efficiency $30,000 World Energy Consum ption per GDP Share World Energy Consum ption per Capita United $25,000 Canada Per capita income 4.5 400 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 France Germany United Kingdom 350 4.0 $20,000 300 Japan Italy 250$15,000 3.5 200 World excluding U.S. Saudi Arabia U.S. Mexico Brazil Russia 15 20 25 Per-capita oil consumption (bbl/yr) 30 20 00 10 19 90 5 19 88 0 119 9884 4 119 9882 2 0 19 86 China India 2.00 19 98 Note: 15 largest World excluding U.S. economies U.S. shown in red. 19 96 100 2.5 50 $5,000 19 94 Indonesia 19 92 3.0 150$10,000 119 9880 0 EnergyConumption consumption(Quad sharebtu)/Population of the world Energy (Quad btu)/GDP (billions) States Source: JPT, May 2001 QAd1023 QAd1023 Why Natural Gas? Economy 10.00% $35.00 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Crude Oil Domestic Wellhead Price 8.00% $30.00 6.00% $25.00 4.00% $20.00 2.00% $15.00 0.00% $10.00 -2.00% $5.00 -4.00% $0.00 Crude Oil Domestic Wellhead Price ($/bbl) GDP Growth (% change from previous year) GDP Growth QAd1023 Why Natural Gas? Environmental Quality U.S. Electricity Generation by Fuel Source U.S. Carbon Dioxide Emissions from Energy Consumption by End-Use Sector Carbon Dioxide Emissions from Electricity Generation Non-Electricity Generation in Residential, Commercial and Industrial Transportation Electricity Generation 1,600 3,000,000,000 3,500,000,000 3,000,000,000 2,500,000,000 Other Renewables 1,200 MM Metric Tons of Coal Tons Short Mkwh 2,500,000,000 Hydro 2,000,000,000 Other Units 2,000,000,000 Nuclear Gas-Fired Units 800 1,500,000,000 Natural Gas 1,500,000,000 Petroleum-Fired Units Petroleum Coal-Fired Units 1,000,000,000 1,000,000,000 400 Coal 500,000,000 500,000,000 0 0 019491950 1989 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 1954 1990 1960 1959 1991 1964 1970 1992 1993 1969 19801974 1994 1995 1990 1979 1996 19842000 1989 1997 1998 1999 1994 1999 Data, EIA, 2000 Data, EIA, Data: EIA, 20022000 QAd1023 Why Natural Gas? Resource Availability 1999 NPC Study (NPC, 1999b) Recoverable Portion of In-Place Gas Resource (Tcf) Known Resources Cumulative Production (811) Reserves (157) Reserve Growth (305) Increasing development Undiscovered, Unconventional Reserves (1,004) technology needs, Historical U.S. Composition of Total Natural Gas Discoveriescosts, (1977-2001) U.S. Dry Gas Total Discoveries (Bcf) Unassessed Unconventional25,000 Reserves (400) Reserve Growth New Fields 20,000 Geopressured Brine (Up to 24,000) Data: EIA (2002) uncertainty, and decreasing concentration 15,000 10,000 Gas Hydrate (Up to 300,000) Not Assessed by NPC 5,000 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 0 1977 1980 1983 1986 1989 1992 1995 1998 2001 QAd1023 Creating a Global Gas Economy • Enhance Reserves • Create Resources • Transport • Sequester Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Enhance U.S. Consumption Forecast 160.00 Natural Gas Decline for the Past Decade 140.00 Source: EOG, Baker Hughes Quad BTU 120.00 100.00 80.00 60.00 Gases and Renewables Enhance Liquids Solids 40.00 20.00 0.00 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Enhance Key Technologies of the 90’s Deepwater, Sub-sea, FPSO 3D Seismic, Computer Assisted Exploration Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Horizontal Drilling, Geosteering, & Rotary Steering Systems Source: Bates, 2002, GCAGS Baker Hughes Enhance Enhanced Gas Recovery Excellent Insignificant Portfolio of EGR Field Studies Overall EGR technologies in these seven fields yielded incremental production response of 231 Bcf. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Create New Resources Create U.S. Consumption 160.00 140.00 Quad BTU 120.00 100.00 80.00 60.00 Gases and Renewables Enhance Liquids Solids 40.00 20.00 0.00 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Create U.S. Natural Gas Production “Conventional” Unconventionals Shale 25,000 Deepwater+Subsalt Offshore L48 Unconventional Onshore Shallow Offshore L48 Conventional Onshore Tight Gas, Shale Gas, CBM Coalbed Methane $3 20,000 >50% 15,000 $2 10,000 “Unconventional” Unconventionals $1 Deep (>15,000 ft) Associated and High-Perm Gas Subsalt 5,000 0 1949 Wellhead Price ($/mcf) Annual Natural Gas Production (Bcf) Tight30,000 (Low Permeability) 1953 1957 1961 1965 1969 1973 1977 1981 1985 1989 1993 1997 2001 Ultra-Deep Water 2005 2009 2013 Year EIA (1949-1990) and NPC (1991-2015) Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Methane Hydrates QAd1023 Create Tight Gas *Advanced Stimulation Technology *Greater Green River Basin Shale Gas *Piceance Basin Federal Alternative State of Texas Fuels Production Credit Incentives GRI Tight GasGas for Unconventional 3,500.0 3,000.0 $3 Bcf 2,500.0 $2 DOE 2,000.0 1,500.0 11 Tcf Incremental Gas 1,000.0 Wellhead Price ($/Mcf) 4,000.0 $1 500.0 Private Sector 0.0 1970 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 1975 GRI, 1999, GRI’s Gas Resource Database. 1980 1985 DOE personal communication. 1990 1995 QAd1023 MAJOR PRODUCTIVE TIGHT GAS BASINS (Technically Recoverable Resources) Rocky Mountain Foreland (13.7 Tcf) San Juan (5.6 Tcf)* Permian Basin (19.5 Tcf) 0 400 m i 0 600 km Midcontinent (16.9 Tcf) Appalachian (18.3 Tcf) Arkla-Tex (29.8 Tcf) N 78 Tcf Texas Gulf Onshore (9.1 Tcf) Bu rea u of Ec on o mi c G eo lo g y Data: NPC (2000), * Based on estimates of NPC (1993), QAc9715c San Juan Basin tight gas resource included with oil field reserve appreciation and new fields in NPC (2000) Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Create Shale Gas Antrim Shale Research Appalachian Basin Shales 350.0 GRI Bcf 250.0 $2 200.0 150.0 100.0 50.0 0.0 1980 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 2.2 Tcf Incremental Gas DOE (1976-1992) Private Sector 1985 GRI, 1999, GRI’s Gas Resource Database. 1990 DOE personal communication. Wellhead Price ($/Mcf) 300.0 $1 1995 QAd1023 MAJOR PRODUCTIVE DEVONIAN SHALE BASINS Technically Recoverable Resources Michigan Antrim (16.9 Tcf) Appalachian (23.4 Tcf) Illinois New Albany (2.9 Tcf) Ft. Worth Barnett Shale (7.2 Tcf) Bu rea u of Ec on o mi c G eo lo g y Scott Tinker, Director Bureau of Economic Geology August 4, 2003 0 400 m i 0 600 km Data: NPC (2000) Cincinnati Arch (2.2 Tcf) N 40 Tcf QAc9712c QAd1023 Create Coalbed Methane 1,200.0 Private Sector 1,000.0 Bcf 800.0 DOE 600.0 Federal Alternative Fuels Production Credit for Unconventional Gas $2 400.0 4.5 Tcf Incremental Gas 200.0 $1 0.0 1980 Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Wellhead Price ($/Mcf) GRI 1985 GRI, 1999, GRI’s Gas Resource Database. 1990 DOE personal communication. 1995 QAd1023 MAJOR PRODUCTIVE COALBED METHANE BASINS (Total Most Likely Resources) Powder River (24.0 Tcf) Uinta & Piceance (5.5 Tcf) San Juan (10.2 Tcf) Bu rea u of Ec on o mi c G eo lo g y Scott Tinker, Director Bureau of Economic Geology August 4, 2003 0 400 m i 0 600 km Hanna-Carbon (4.4 Tcf) Raton-Mesa (3.7 Tcf) SW Coal Region (5.8 Tcf) Black Warrior (4.4 Tcf) Data: PGC (2001) Northern Appalachian and PA Anthracite (10.6 Tcf) N 81 Tcf Alaska (Bering River, North Slope, Chignik and Herendeen Bay) (57.0 Tcf) QAc9714c QAd1023 MAJOR PRODUCTIVE DEEP (>15,000 FT) GAS BASINS (Total Most Likely Resources) Montana Folded Belt (5.2 Tcf) Greater Green River (8.4 Tcf) Wind River (5.0 Tcf) San Joaquin (9.0 Tcf) Permian (12.9 Tcf) Bu rea u of Ec on o mi c G eo lo g y Scott Tinker, Director Bureau of Economic Geology August 4, 2003 0 400 m i 0 600 km Appalachian (5.0 Tcf) Anadarko, Palo Duro (17.7 Tcf) LA, MS, AL Salt (15.8 Tcf) Texas Gulf Coast (14.3 Tcf) 62 Tcf N Louisiana Gulf Coast (14.5 Tcf) Data: PGC (2001) QAc9713c QAd1023 MAJOR PRODUCTIVE DEEP-WATER GAS BASINS (Total Most Likely Resources) Pacific Slope (8.9 Tcf) 71 Tcf Louisiana Slope (12.4 Tcf) Texas Slope (4.3 Tcf) 0 400 m i 0 600 km Gulf of Mexico OCS (47.7 Tcf) Bu rea u of Ec on o mi c G eo lo g y Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Data: PGC (2001) N Eastern Gulf Slope (7.6 Tcf) QAc9716c QAd1023 Technology Investment = Resource Creation Annual Natural Gas Production (Bcf) Unc. Gas Major Basins 30,000 (Technically Recoverable) Deepwater+Subsalt Offshore L48 Unconventional Onshore Tight Gas 25,000 20,000 Shale Gas 78 Tcf 40 Tcf 15,000 CBM 170 Tcf 81 Tcf 10,000 Deep Gas 62 Tcf 5,000 Deep Water 0 1949 1953 1957 1961 71 Tcf 1965 1969 1973 1977 1981 1985 1989 1993 1997 2001 2005 2009 2013 Year Scott Tinker, Director Bureau of Economic Geology August 4, 2003 332 Tcf EIA (1949-1990) and NPC (1991-2015) QAd1023 Transport North America Natural Gas 25 Quadrillion Btu 20 17% 15 Transports 10 5 (Bcf) U.S. Natural Gas Natural Gas Consumption Natural Gas Production 1 Tcf Gas = 1 Quadrillion Btu 0 Source: A. Anderson/ Cambridge Energy Research Assoc. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Data: EIA Sequester The sustainability of a hydrocarbon-fueled economy requires that we support an environment and energy win-win. Capture carbon dioxide and return it to the subsurface for the economic benefit of enhanced hydrocarbon recovery and the environmental benefit of reduced atmospheric carbon dioxide. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 Monitor Injector “A” “B” BEG Texas Frio Pilot Project 100 ft Scott Tinker, Director Bureau of Economic Geology August 4, 2003 “C” 440 ft Challenge of Meeting Natural Gas Demand Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Meeting Demand Oil and Gas R&D Funding Note Scale Difference 120 1998 $ 4 80 Fuel Cells and Gas Turbines removed from 1996-1999 for comparison 3 60 40 20 2 1992 1994 Private Sector Data: Chris Ross, World Energy (2001, v. 4, no. 2) Scott Tinker, Director Bureau of Economic Geology August 4, 2003 1996 1998 Year 2000 2002 2004 DOE O&G Million $ 100 Billion $ Private Sector 5 Meeting Demand Number of employees (thousands) Oil Company Employment 1,800 Largest 25 Oil Companies 1,400 1,000 600 1974 1978 1982 1986 Year Scott Tinker, Director Bureau of Economic Geology August 4, 2003 1990 1994 1998 Meeting Demand UNIVERSITY ENROLLMENTS 20,000 10,000 Geoscience Graduate Students Petroleum Engineering QAd1731c Source: AGI Scott Tinker, Director Bureau of Economic Geology August 4, 2003 The Challenge Demand, esp. Natural Gas Technology Requirements O&G R&D Funding University Enrollments O&G Employment Time Scott Tinker, Director Bureau of Economic Geology August 4, 2003 160.00 140.00 Summary Quad BTU 120.00 100.00 Gases and Renewables 80.00 Liquids 60.00 Solids 40.00 20.00 0.00 Global oil and coal consumption will remain at current levels for 30-50 years. Natural gas and other energy sources will need to fill the global demand gap. The global economy and environment will benefit from a transition to natural gas. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Global Opportunities & Benefits Research and technology for a gas industry are different than for an oil industry. Unconventional sources will require significant geoscience and engineering advancements to be economically viable. Sequestration of greenhouse gases will be required to handle atmospheric emissions, and will need geoscience and engineering understanding. Scott Tinker, Director Bureau of Economic Geology August 4, 2003 QAd1023 Thank You! Scott Tinker, Director Bureau of Economic Geology August 4, 2003