Chapter 21: Savings Models Lesson Plan

Chapter 21: Savings Models

Lesson Plan

For All Practical

Purposes

Arithmetic Growth and Simple Interest

Geometric Growth and Compound

Interest

A Limit to Compounding

A Model for Investment

Exponential Decay and the Consumer

Price Index

Real Growth and Valuing Investments

Mathematical Literacy in

Today’s World, 7th ed.

© 2006, W.H. Freeman and Company

Chapter 21: Savings Models

Arithmetic Growth and Simple Interest

Principal – The initial balance of the savings account.

Interest – Money earned on a savings account or a loan.

Example: The amount of interest on 10% of the principal of $1000 is

10% × $1000 = 0.10 × $1000 = $100

Simple Interest

The method of paying interest only on the initial balance in an account, not on any accrued interest.

Example: The following shows the simple interest of a savings account with a principal of $1000 and a 10% interest rate:

End of first year, you receive $100 interest.

The account total at the start of the second year is $1100.

End of second year, you receive again only $100, which is the interest from the original balance of $1000.

Account total at the beginning of the third year is $1200.

At the end of each year you receive just $100 in interest.

Chapter 21: Savings Models

Arithmetic Growth and Simple Interest

Bonds

An obligation to repay a specified amount of money at the end of a fixed term, with simple interest usually paid annually.

Interest Rate Formula: I = Prt

The total amount accumulated:

A = P (1 + rt )

Example: Say you bought a 10-year T-note

(U.S. Treasure note) today. What would be the total amount accumulated in 10 years at

4.0% simple interest?

Answer:

P = $10,000, r = 4.0% = 0.40, and t = 10 yrs.

Interest, I = Prt = (10,000)(0.04)(10) = $4000

Total A= P (1 + rt ) = 10,000(1 + (0.04)(10))

= 10,000(1.40) = $14,000

Interest Rate Formula –

I = Prt

Where:

I = Simple interest earned

P = Principal amount r = Annual rate of interest t = Time in years

Total Amount Accumulated

A = P (1 + rt )

Arithmetic Growth – (linear growth) A = P (1 + rt )

Chapter 21: Savings Models

Arithmetic Growth and Compound Interest

Geometric Growth

Geometric growth is the growth proportional to the amount present

(also called exponential growth).

Compound Interest

Interest paid on both the principal and on the accumulated interest.

Rate per Compounding

Period – For a nominal annual rate of interest r compounded n times per year, the rate per compounding period is: i = r

/ n

Compound Interest Formula –

A = P (1 + i ) nt

Where:

A = Amount earned after interest is made

P = Principal amount i = Interest rate per compounding period, which is computed as i = r / n n = Number of compounding periods t = Time of the loan in years

Chapter 21: Savings Models

Arithmetic Growth and Compound Interest

Compounding Period

The amount of time elapsing before interest is paid.

For the examples below (annual, quarterly, and monthly compounding) , the amount earned increases when interest is paid more frequently.

Example: Suppose the initial balance is $1000 ( P = $1000) and the interest rate is 10% ( r = 0.10). What is the amount earned in 10 years ( t = 10) for the following compounding periods, n?

To answer this problem you need to use the following equations:

Rate per compounding period, i = r / n

Compound Interest Formula, A = P (1 + i ) nt

Annual compounding: i = 0.10, and nt = (1)10 years

A = $1000(1 + 0.10) 10 = $1000(1.10) 10 = $2593.74

Quarterly compounding: i = 0.10/4 = 0.025, and nt = (4)(10) = 40 quarters

A = $1000(1 + 0.025) 40 = $1000(1.025) 40 = $2685.06

Monthly compounding: i = 0.10/12 = 0.008333, and nt = (12)(10) = 120mo.

A = $1000(1 + 0.00833) 120 = $1000(1.00833) 120 = $2707.

Chapter 21: Savings Models

Arithmetic Growth and Compound Interest

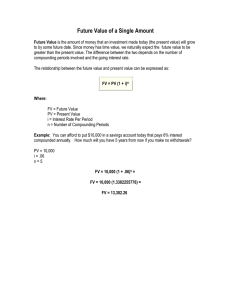

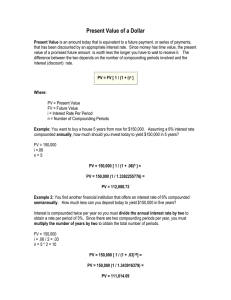

Present Value

The present value P of an amount A to be paid in the future, after earning compound interest for n compounding periods at rate i per period is the future amount paid, A divided by (1 + i ) nt .

The equation is obtained by

Present Value Formula – manipulating the formula for finding the amount to be Where:

P =

A

(1 + i ) nt paid in the future after compound interest is earned.

With the compound interest formula

A = P (1 + i ) nt , we can solve for the present value, P .

P = Present value (principal amount)

A = Amount to be paid in the future after compounding interest is earned i = Interest rate per compounding period which is computed as i = r /n n = Number of compounding periods in a year t = The years of the loan

Chapter 21: Savings Models

Arithmetic Growth and Compound Interest

Compound Interest Compared to Simple Interest

The graph compares the growth of $1000 with compound interest and with simple interest.

The straight line explains why growth simple interest is also known as linear growth.

Example of geometric and arithmetic growth:

Thomas Robert Malthus (1766

–

1843), an English demographer and economist, claimed that human population grows geometrically but food supplies grow arithmetically —which he attributed to future problems.

Chapter 21: Savings Models

A Limit to Compounding

A Limit to Compound Interest

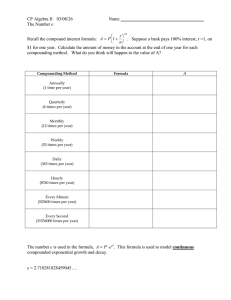

The following table shows a trend: More frequent compounding yields more interest.

As the frequency of compounding increases, the interest tends to reach a limiting amount (shown in the right columns).

Comparing Compound Interest

The Value of $1000 at 10% Annual Interest, for Different Compounding Periods

Years

Compounded Compounded Compounded Compounded Compounded

Yearly Quarterly Monthly Daily Continuously

1

5

10

1100.00

1610.51

2593.74

1103.81

1638.62

2685.06

1104.71

1645.31

2707.04

1105.16

1648.61

2717.91

1105.17

1648.72

2718.28

Chapter 21: Savings Models

A Limit to Compounding

Formula for Effective Rate

Effective rate is the actual percentage rate of increase for a length of time, taking into account compounding.

It equals the rate of simple interest that would realize exactly as much interest over that length of time.

effective rate = (1 +

i

)

n

− 1

Formula for Annual Percentage Yield (APY)

The annual percentage yield is the annual effective rate of interest. The amount of interest earned in 1 year when the principal is $1:

( n r

) n

APY = 1 + − 1

Example : Find the APY for a nominal annual rate of 6% compounded monthly:

( n r

) n

(

0.06

12

)

12

Chapter 21: Savings Models

A Limit to Compounding

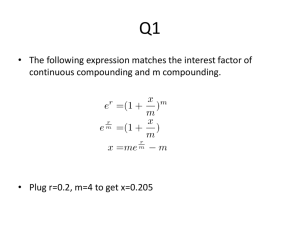

Continuous Compounding

As n gets very large, (1+

1

/ n

) n approaches the constant e ≈ 2.71828.

For a principal P deposited in an account at a nominal annual rate r, compounded continuously, the balance after t years is:

A

=

P e r t

Example: For $1000 at an annual rate of 10%, compounded n times in the course of a single year, what is the balance at the end of the year?

As the quantity gets closer and closer to

$1000( e 0.1

) = $1105.17.

No matter how frequently interest is compounded, the original $1000 at the end of one year cannot grow beyond $1105.17.

Yield of $1 at 100% Interest (i = 1)

Compounded n Times per Year n

1

5

10

50

100

1,000

10,000

100,000

1,000,000

(1+ 1 / n

) n

2.0000000

2.4883200

2.5937424

2.6915880

2.7048138

2.7169239

2.7181459

2.7182682

2.7182818

10,000,000 2.7182818

It approaches e

≈ 2.71828

(which is the base of the natural logarithms ) .

Chapter 21: Savings Models

A Model for Investment

A Savings Plan

To have a specified amount of money in an account at a particular time in the future, you need to determine what size deposit you need to make regularly into an account with a fixed rate of interest.

Savings Formula

The amount A accumulated after a certain period of time can be calculated by stating a uniform deposit of d per compounding period (deposited at the end of the period) and using a certain interest rate i per compounding period.

Savings Formula

A = d [ (1 + i ) i nt

Where:

A = Amount accumulated in the future after compounding interest is earned d = Uniform deposits (or payments made) i = Interest rate per compounding period which is computed as i = r /n n = Number of compounding periods in a year t = The years of the savings plan (or loan)

Chapter 21: Savings Models

Exponential Decay and the Consumer Price Index

Exponential Decay

Exponential decay is geometric growth with a negative rate of growth.

Inflation Example

Suppose there is a constant 3% annual inflation from mid-2006 through mid-

2010. What will be the projected price in mid-2010 of an item that cost $100 in mid-2006?

Answer: Using the compound interest formula, P = $100, i = 0.03, and n = 4.

The projected price is A = P (1 + i ) n = $100 (1 + 0.03) 4 = $112.55.

Depreciation Example

Suppose you bought a car at the beginning of 2006 for $12,000 and its value in current dollars depreciates steadily at a rate of 15% per year. What will be its value at the beginning of 2010 in current dollars?

Answer: Using the compound interest formula, P = $12,000, i = −0.15, and n = 4. The projected price is A = P (1 + r ) n = $12,000 (1 - 0.15) 4 = $6264.08

Chapter 21: Savings Models

Exponential Decay and the Consumer Price Index

Consumer Price Index

The official measure of inflation is the Consumer Price Index

(CPI), prepared by the Bureau of Labor Statistics.

This index represents all urban consumers (CPI-U) and covers about

80% of the U.S. population.

This is the index of inflation that is referred to on television news broadcasts, in newspapers, and magazine articles.

Each month, the Bureau of Labor Statistics determines the average cost of a “market basket” of goods, including food, housing, transportation, clothing, and other items.

The base period used to construct the CPI-U is from 1982 –1984 and is set to 100.

CPI for other year cost of market basket in other year

100

= cost of market basket in base year

From this proportion calculation, you can also compute the cost of an item in dollars for one year to what it would cost in dollars in a different year.

cost in year A CPI for year A cost in year B

=

CPI for year B

Chapter 21: Savings Models

Real Growth and Valuing Investments

Real Growth

If your investments are growing at say 6% a year and inflation is growing at 3% a year, you cannot simply subtract the two to find the purchasing power of your investments. It’s not that simple.

At the beginning of the year, your investment would buy the quantity: q old

= P/m

Where P is the initial investment principle and m is the price of goods.

At the end of the year, the investment would be: P (1 + r ) q new

= m (1 + a )

The investment rate is r and the inflation is a .

Here, you see the two influences on the investment (investment growth rate r and inflation a) have directly opposite effects.

Fisher’s effect –

Named after the economist Irving Fisher (1867 –1947). To understand why you cannot simply find the difference between interest and inflation, you must realize that the gain itself is not in original dollars but in deflated dollars.

Chapter 21: Savings Models

Real Growth and Valuing Investments

Valuing a Stock

How can you tell if a stock is overvalued?

The rational price to pay would be the present value of the future dividends, with their value “discounted” by a factor (the discount rate) that recognizes that getting a dollar a year from now is not as valuable as getting it today.

The discount rate takes into account inflation, rate of interest of other investments, measure of the stock’s risk—known as the risk premium —that reflect the uncertainty.

This method of valuing a stock is called the discounted cashflow method.

To calculate the total present value of all the dividends of the stock over the next n years, where n is very large, we can use the approximation:

P ≈

D (1 + r − g g

)

Where D is the dividends that grow at a rate of g per year and the discount rate is r.