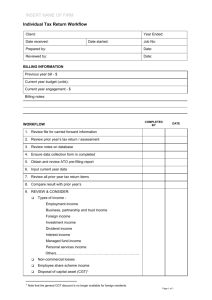

Using Environmental Offsets in Wetlands Management Roderick Duncan

advertisement

June 2006

Using Environmental Offsets in Wetlands Management

Roderick Duncan

School of Marketing and Management, Charles Sturt University

Institute of Land, Water and Society, Charles Sturt University

And

Mark Morrison

School of Marketing and Management, Charles Sturt University

Institute of Land, Water and Society, Charles Sturt University

Note:

1

June 2006

Using Environmental Offsets in Wetlands Management

Abstract

Environmental offsets have been proposed as a technique for managing the environmental impacts of new

developments in regions that are not in compliance with environmental standards. By requiring developers

to “offset” any impacts by purchasing “environmental credits”, environmental quality can be maintained or

even improved. The use of environmental offsets has a lot of intuitive appeal, and offsets are being used

widely in the USA and several pilot projects are either in operation or being developed in Australia. However

there is at present no theoretical framework for analyzing the use of offsets, which has led to some

confusions in the literature. We provide a model for analyzing the design of offsets policy and clear up some

of the existing difficulties, as well as proposing some improvements in policy.

Keywords: offsets, market-based instruments

1. Introduction

The primary goal of offsets is to enable further development in areas where environmental

quality standards are not being met and development would otherwise not be possible. An

offset occurs when a developer “offsets” impacts on the development site, by undertaking

equivalent environmental improvements at a second, nearby, site.

Developers either

undertake the offsets themselves or purchase environmental “credits” from a business or

government agency that specializes in generating these credits, which is known as an

“offset bank”. As a result, there is no net-environmental impact. Offsets may also be

designed so that they achieve net-environmental improvements. This would happen if

developers were required to achieve larger environmental improvements than any impacts

they have caused.

Most applications of offsets have occurred in the United States, where they have been used

in several different contexts. Perhaps its best-known application in the United States is

wetland mitigation banking (US Corps of Engineers et al 1995).

Here, if new

developments cause wetland impacts and it is not possible to mitigate these impacts on-site

2

June 2006

(using best available technology), then wetland offsets at secondary sites may be approved.

Some 219 wetland mitigation banks were found to be operating in the United States in

2001 with another 95 banks pending approval (Environmental Law Institute 2002). Other

applications include streambank mitigation banking, flood storage offsets, tree offsets and

air quality offsets. Recently, work has also commenced on an offset scheme for nonpoint

source pollution in Atlanta (Cummings et al 2003).

There has also been a lot of interest in Australia in the use of offsets. In NSW several

policies and trials are already in place. Since 1999, NSW Fisheries has had an offset

policy for aquatic habitat in place (NSW Fisheries 1999). Compensatory mitigation and

the lodging of environmental bonds1 are required for many developments as a condition of

consent to achieve no-net loss of habitat.

In 2001, the NSW Department of Land and Water Conservation released a discussion

paper on offsets, salinity and native vegetation (DLWC 2001). The discussion paper was

generally supportive of the use of offsets, but did note some obstacles to implementation.

In terms of advantages, for farmers it noted that it would provide more flexibility and

access to more effective and cost-effective remediation measures (by allowing offset

actions to occur anywhere within a defined boundary, remediation could occur at the site

of greatest environmental benefit, least risk and least cost). For farmers there would also

be the potential to diversify farm incomes through earning credits for positive vegetation

management. For environmental managers it would mean that the current approach to

trade-offs for clearing would be standardized and that the impacts of clearing on the

environment would be more easily accounted for. Finally for the environment there would

also be net-gains.

Other states in Australia are also developing offset policies or are undertaking pilot offset

projects. In Western Australia, a draft policy framework for the establishment of wetland

A 2:1 trading ratio is used (ie 2 ha of mangroves must be rehabilitated to replace 1 ha that is destroyed).

Environmental bonds ranging from $10,000 (small developments with minor environmental impacts) to $1m

(large developments with large impacts) may be required as part of the consent process, and which can be

forfeited if the consent conditions are breached (NSW Fisheries 1999).

1

3

June 2006

offsets was released in 2001 for comment (Western Australian Environmental Protection

Agency 2001).

In Victoria, the CSIRO is establishing an offset scheme focusing on biodiversity in a periurban area, while in Queensland offset trials involving salinity are planned. Further offset

trials, especially involving salinity, are expected given the additional funding being made

available by the Commonwealth government for this purpose.

Given the rapid move towards implementing offset trials in many states of Australia, it is

worth considering some of the theoretical and applied issues in implementing offset

schemes. While it appears that offset schemes do have promise, some of the evidence

about the outcomes of the Wetland Mitigation Schemes in the USA is disturbing.

Salzman and Ruhl (2001) reported evidence from Maryland that despite there being a gain

of 122 acres in the Chesapeake Bay area through mitigation between 1991 and 1996, there

had been a net loss of 51 acres of wetland functions. It appears that this environmental

outcome may have resulted from a liberal trading policy, designed to encourage a larger

volume of trades within the offset market. There is theoretical evidence to suggest that

offsets are more suited to certain environmental problems such as pollution control than

biodiversity management (Vernon and Godden 2002). So there is reason to consider both

the strengths and limitations of offset banking, some of the more important design issues,

and the circumstances where it is likely to be most effectively implemented.

In Section 2 we develop a model of the use of offsets in wetlands management.

Theoretical issues have not received a lot of attention in the debate about offsets.

Arguably, a proper theory for offsets has not yet been developed, with only limited

treatment in Baumol and Oates (1988) and Vernon and Godden (2002). We show that

some of the present confusions in the literature arise out of the lack of a strong modeling

framework.

4

June 2006

In Section 3 we use the model developed in Section 2 to analyze some of the more applied

issues in designing offsets policy, including fungability, the effect on incentives, the effect

on planning control, and combining offsets with other market based instruments.

In

Section 4 the elements of an offsets program involving private banks are discussed.

Several of the programs proposed so far in Australia have a strong role for government,

such as in the provision of offset credits. Maintaining strong control of processes is not

surprising for pilot projects, however it is not the only alternative. Indeed, the majority of

wetland mitigation banks in the USA are now privately run (ELI 2002). Some final

thoughts about the prospects for the use of offsets in Australia are offered in Section 5.

2.

A Model of Offset Banking

Offset banking has a lot of intuitive appeal. An intelligent six year old would grasp the

concept and appreciate the sense of “fairness” involved. If you mess up an area and you

are unable to clean up that area, you should clean up an equivalent area elsewhere.

But whatever the intuitive strength of offsets, there is no agreed framework for

understanding the application of offsets. We develop a model for offsets policy based on

the models used for understanding pollution permits, such as Krupnick et al. (1983). This

relatively simple framework can clear up many of the existing confusions in the literature

on offsets.

Offset banking is a regulatory scheme where private developers must “bank” some

equivalent land for each private development that is pursued in a wetlands area. This

banked land is purchased by the private developer and handed over to a wetlands bank that

will restore the wetlands function of the land and hold that land in trust. In the following

we assume that the banking of land will guarantee the flow of environmental services from

that land, but the development of land will cut off all environmental services from that

land. The operation of wetlands banks are discussed in Section 4.

5

June 2006

How are we to value an environmental asset such as an acre of wetlands? It is the flow of

environmental services from the wetlands that are valued by society, although an existence

value for the acre could also be included. Valuation methods such as contingent valuation

surveys can place a value for society on a unit change in the environmental services.

In a wetlands area, we can identify the different environmental services that the area

produces. Assume we have n types of environmental services that we identify as of

interest from a wetlands area. The marginal social benefit for environmental service i

depends on the quantity of environmental services. Assume we can estimate the net

present value of an infinite flow of service i, call that value Pi. We have a vector P of

length n of the prices of the environmental services flowing from a wetlands.

We can estimate the flow of environmental services from an acre of the wetlands. We can

then divide the wetlands into m zones, where all of the acres in a zone have similar

environmental services flows. We can then define a vector of average environmental

services flows for each acre in zone i as the vector of length n, Di (a row vector). We stack

these vectors into a matrix of dimension m times n, D. The element Dij of matrix D then

represents what an acre of wetlands in zone i produces in terms of environmental service j.

The “region” concept here is flexible in the sense that we could define region

geographically or we could define region as a “type” of land, such as restored versus

original wetlands, or a mix of the two.

Offset banking is then represented by a set of purchases of land in the wetlands. The

development of an acre will remove the environmental service flow of that acre, so we

would represent that development by a negative number. The transfer of land for a land

bank or the rehabilitation of land is represented by a positive number, since it will

guarantee positive future flows of environmental services. We can represent an offset by a

vector of numbers of length m, O, where the element Oj represents an offset or

development of Oj acres in zone j.

6

June 2006

The net change in environmental service flows from a particular set of land purchases and

offsets can be represented by the vector product

O’D

And the social value of the net environmental flows affected under an offset is calculated:

O’DP

An offset scheme will typically specify the ratio at which land in different zones can be

swapped. Acres within the same zone will trade at one-for-one, but acres outside that zone

will typically transfer at a higher or lower rate. Define this transfer ratio by a vector, T.

An offset scheme then can be represented by the requirement that any development on land

within the wetlands be accompanied by a transfer of other lands into a land bank such that:

O’T >= 0

Where Ti/Tj is the rate at which the developer is allowed to transfer an acre from zone i

into an acre from zone j. An offset transfer ratio can be defined as one acre in region A is

equivalent to two acres in region B, or as one acre of original wetland is equivalent to two

acres of restored wetland.

The transfer of private land into a land bank for an offset will require the purchase of that

land on the open market. Let C(O) be the market cost of acquiring the vector O of acres of

private land for the development and the offset. The price in the open market is assumed

to be the private development value of the land. For negative values of O, the vector C(O)

represents the development value of an acre, while, for positive values of O, the vector

C(O) represents the cost of acquiring land to put in a bank. The marginal cost of acquiring

an acre in zone j is then δCj(Oj)/δOj which is a non-decreasing function of Oj.

7

June 2006

We can define a social optimum problem. Let the value of the private land to enter a land

bank be the market cost of the offset, then minimizing the purchases of private land

minimizes the market opportunity cost. The socially optimum distribution of private land

for development versus private land for offset banking occurs at:

Max {-C(O) + O’DP}

Where C(O) is the loss and gain of private development possibilities and O’DP is the gain

of environmental services in the bank.

The social optimum occurs when for an acre in region j

δCj(Oj)/δOj = DjP

Where the development value of a marginal acre in region j (δCj(Oj)/δOj) is just equal to

the value of the environmental flows from an acre in region j (DjP).

First-best outcome: At the social optimum, all acres in region j with a development value

greater than DjP will be developed, while some or all of the acres with a development

value less than DjP will be banked.

Under an offset we are typically in a second-best situation where instead of maximizing

social welfare, we maximize some constrained problem. Offsets were initially designed

for a case where the area was already in violation of some environmental standards, so that

no scheme could proceed that involved lowering any of the environmental flows.

The restricted social optimum in this case is:

Max {-C(O)}

Subject to O’D >= 0 (n constraints)

8

June 2006

Where the private developer is achieving the high net value of land purchases subject to

the requirement that there is no net loss of any of the n environmental service flows. This

model is just a variant of Krupnick et al (1983). From Krupnick we know that an offset

that minimizes the market value of private land withdrawn from the market is feasible.

Typically in an offset banking scheme, the problem facing a developer is:

Max {-C(O)}

Subject to O’T >= 0 (one constraint)

Where the private developer is achieving the net value of land purchases subject to meeting

the transfer requirement under the offset banking scheme.

Using this notation, some of the previous discussion about offsets becomes clearer. We

will explore some of these issues in the design and implementation of offsets in the next

Section.

3. Some Challenging Issues with Environmental Offsets

Fungability

Fungability refers to the equivalence of different types of pollution or biodiversity. The

concern is that the implementation of an offset scheme will lead to a drop in environmental

services in a particular region or of a particular type.

There are two separate issues in the discussion of fungability. The first is one of incorrect

implementation. In this case the designer of the scheme (in the mind of the person raising

the issue of fungability) has either:

9

June 2006

(1) set the transfer rate, the Ts, at an incorrect value so that in the process of

developing, too little land has been set aside in the offset bank and too few positive

environmental flows guaranteed; or

(2) set like against non-like, so an environmental service in one area is being

balanced off against a very different environmental service in another area, when

there should be two separate environmental services.

The first complaint is raised in the Chesapeake Bay case by Salzman and Ruhl (2001).

They estimated that despite there being an offset scheme in place a net loss of 51 acres of

wetlands function was experienced during 1991 and 1992. This loss was due to high

environmental flow acres being developed while low environmental flow acres were

banked. The solution is to redesign the offset scheme so that the transfer rates are raised

across either region or across type of acreage. In the notation of the model developed in

Section 2, we would want the transfer ratios to be set equal to the ratios of the values of the

environmental flows from each region/type:

Ti/Tj = DiP / DjP

The second complaint is raised with respect to issues such as “hot spots”, where

environmental flows are said to be at a critical level in a region. In such a case, extra flows

in a different region may not balance out the loss of flow in a different critical region. A

separate category of the environmental flows might be created to account for this critical

flow in region under threat.

The critical flow argument could however be carried to the conclusion of declaring all

flows and all acres unique. This would be a way to make all offset schemes impossible,

without having to directly oppose them.

In some cases this argument appears to be

disguising a philosophical disagreement with the possibility of offset schemes.

10

June 2006

A second issue is with respect to the adequacy of an offset trading scheme. If there is only

one environmental flow, then the socially optimal transfer ratios are simply the ratio of the

flows. However if we have more than one type of environmental service, the ratio for

which areas can be traded, T, does not contain as much information as the matrix of

environmental flows from each acre D if we have more than one type of environmental

service.

If the transfer ratios are calculated from the ratios of values environmental service flows,

DjP, we can have offset developments that result in increases in social value and also

satisfy the offset requirement O’T > 0, but result in a drop in one of the environmental

flows as O’T > 0 is not sufficient for O’D >=0.

We could require that the transfer ratio, T, be calculated so that it guaranteed that all offset

developments into a particular region would result in no net loss of environmental flows.

The transfer rations would be calculated as (assuming region A is the region in which

development will be sought):

Ti/TA = max [Dij/DAj] over all the types of services j

In this case there will be possible developments that:

(1) would increase social welfare;

(2) would result in no net loss of environmental service value, O’DP >=0; and

(3) would be rejected as O’T < 0.

An offset banking scheme can either guarantee improvements in social welfare or

guarantee improvements in environmental flows but can not do both.

In the special case where there is one environmental service that is critical, perhaps water

flow, we would set the transfer rations equal to the water flow produced by an acre in each

region:

11

June 2006

Ti/Tj = Diw/Djw

This transfer ratio would require that all development not reduce water flow, but would

reject some developments that would increase social value and improve the value of

environmental flows.

This special version of an offset scheme resembles “strong sustainability”. We reject any

change that would result in a lowering of a critical environmental flow- no matter how

beneficial such a change might be for social welfare. The defense of this position rests on

the critical nature of the environmental flow.

Yet the questions should still be asked whether a superior outcome might not be achieved

by using the vector of environmental flow prices, P, to indicate the critical value of the

environmental flow at risk. The critical flow transfer ratio (where “w” denotes the critical

flow):

Ti/Tj = Diw/Djw

Is the environmental flow price weighted transfer ratio

Ti/Tj = DiP / DjP

Where we have let the price of the critical flow be infinite.

If there are no restrictions placed on trading, there is a real risk that environmental

functions may be compromised by a large charge in the location of development. A large

change in development could alter the flows- the Dj’s- on which the transfer ratios are

calculated or simply that there is uncertainty about the size of the flows. The outcome may

be the same as what was found with wetland mitigation in the Chesapeake Bay: a large

12

June 2006

increase in wetland area, but a 50% decrease in wetland functions.

We discuss the

consequences of uncertainty later in this Section.

This is a difficult dilemma to resolve. Salzman and Ruhl (2000, p.647) suggested the

approach of having a fat market, but disallowing undesirable trades. In practice this may

not have the desired effect of encouraging efficient development if it introduces

uncertainty about what is an “acceptable” trade, and also may lead to increased litigation.

Another perhaps idealized alternative is to attempt to devise a set of restrictions that will

create acceptable certainty that environmental functions will not be compromised, but are

not so restrictive that they substantially reduce market potentially. If this is not possible,

the appropriateness of using an alternative market based instrument may need to be

considered.

Distributional consequences of offsets

An offset scheme will have the effect of lowering the value of high development/low

environmental flow land, while raising the value of low development/high environmental

flow land.

An offset scheme also advantages those who have already developed their land versus

people who held on to their land in order to develop in the future. A development that

occurred prior to the introduction of the offset scheme will avoid the banking requirements

imposed on an identical development built after the introduction.

There is also an equity based reason for combining the use of offsets with another MBI.

Offsets do not penalize existing polluters – the responsibility for maintaining and

improving environmental quality rests on new developers only, which is not fully

consistent with the polluter pays principle. With offsets only new polluters pay, not old

ones. Thus there is a case for sharing the burden of environmental improvement between

both new and existing developers.

13

June 2006

A related issue is that there may be a change in the distribution of benefits across the

community.

The environmental impacts from development may affect one group of

people in the community, while the benefits from offsetting may affect a different group.

This is a similar problem to what is typically faced in benefit-cost analysis. In benefit-cost

analysis the Kaldor-Hicks Potential Pareto criterion is used. That is, the question is asked

whether the gainers can compensate the losers, and there still be a net gain. In practice,

quality cost-benefit analyses also examine the effect of a new project or policy on different

income groups. This is something that also ought to be done in economic analyses of

offset programs, particularly if there is likely to be a distinction between the gainers and

losers of an offset program.

Uncertainty and offsets

We may have imperfect ecological and hydrological data, so that the size of the flows out

of acres in our wetlands- the Dj’s- are estimated imprecisely.

Secondly, there is also the possibility that the use of offsets may still result in externalities.

While offsets aim to maintain or improve levels of environmental quality, there will

always be a change in the mix of environmental assets. It is possible that the new mix of

assets may be valued differently by the community (arguably this is more likely to be the

case for biodiversity offsets than pollution offsets). For example, suppose that use of

offsets meant that environmental quality is reduced within an urban area, but improved

upstream. This may cause environmental quality to be maintained, but the new mix of

environmental assets may be valued less in total by the community4. This would be

represented by a further shift in the marginal social cost curve to the left in Figure 2,

leading to a reduction in the socially optimal equilibrium level of environmental quality.

4

Empirical evidence indicates that Wetland Mitigation Banking in the US has cased the supply of wetlands

to shift from highly populated to less populated areas. So while there has been no net loss of wetlands, it is

likely that has been a loss of functional values for resident populations (Salzman et al 2004).

14

June 2006

By implication, if this occurs the offset program has created its own externalities. Indeed,

Kerr and Sharp (2004) used choice modeling in a case study involving stream mitigation in

New Zealand to identify the value that the community had for the losses in environmental

quality created by development, and the environmental gains created by offsetting. They

found that there are differences in the values that the community has for the gains and

losses, even though they involved the same environmental outcomes (eg changes in the

number of fish species, changes to water clarity etc). The implication is that developers

would need to more than offset any environmental impacts to avoid creating additional

externalities.

Effects on incentives

Environmental offsets involve offset banks undertaking projects to improve environmental

quality. These projects can happen on both private and public property. The existence of

offset banks that pay land owners to improve environmental quality, or undertake the

projects themselves to improve environmental quality, may change incentives. In a large

market with imperfect information an offset program may have very little effect on

incentives. However, in a smaller rural or semi-rural catchment, where there is regular

communication in the community, or where there is a dominant ethnic group, there may be

sizeable effects on incentives. Behaviour could be conceived of changing in several

different ways:

Landholders who are planning to improve environmental quality may wait until

they receive an “offer” from an offset bank

Landholders may deliberately reduce environmental quality in the hope of

receiving a future offer

Landholders may allow environmental quality to decline (reduce maintenance) in

the hope of receiving a future “offer”

15

June 2006

If these behavioural changes occur, they may reduce the environmental gains that would

otherwise be achieved by an environmental offset program, effectively creating a

“slippage”.

Offsets may also communicate a negative message to environmentally responsible farmers.

It is apparent that a naïve offset program runs the risk of rewarding non-performers, which

is contrary to the polluter-pays principle. This may create a moral hazard where those who

have been environmentally less responsible benefit. It is unlikely that this would be well

received by property owners who are currently good stewards of the environment. This

suggests a need to include duty of care provisions within offset programs, such that offsets

can only proceed when environmental quality at the offset site is above some minimum

level of environmental quality.

The question remains unanswered, however, about the extent of these effects and whether

they are generalisable to all contexts. If these effects are found to occur, it may be possible

to minimize their effect through the use of differential cost-sharing, where the proportion

of cost paid by the offset bank increases with the level of environmental quality achieved.

Or alternatively, measures that do not require landholder participation (eg engineering

works) should be prioritized. This also potentially has the added advantage of reducing the

number of transactions involved in an offset program. In some currently operating offset

schemes, such as the offsets undertaken in the Catskills to improve drinking water quality

in New York City, the majority of funds have been directed at infrastructure projects

(Salzman et al 2004).

A related issue is the effect on strategic behaviour. It is possible that owners of potential

offset sites may over time begin to operate strategically. For example, in smaller farming

communities it is possible that through informal conversations landholders may become

aware about what are “acceptable” bids. This may lead to an increase in the average price

of credits and reduce the gains from an offset trading program. When evaluating the Bush

Tender in Victoria using agent-based modeling, Hailu and Schilizzi (2003) found that the

cost savings for government may be limited to the first few years, after which bids

16

June 2006

converged towards an “acceptable band”, indicating that over time farmers are able to

capture more of the producer surplus. Empirical evidence also confirms this finding.

Salzman et al (2004, p.9) reported evidence from the Conservation Reserve Program in the

USA where “in many cases farmers have colluded in the bidding process, all setting bids

just below the program’s maximum acceptance price”.

Given these effects and shifts of the marginal cost curves described above the questions

that need to be asked are: (1) will the use of offsets lead to an efficient outcome, and (2)

will this outcome improve equity. The answers to these questions will clearly depend on

several factors including the extent of the damage costs create by the development, the

costs to developers of purchasing offsets, the costs of administering the offset scheme plus

any other transaction costs and the change in community benefits due to changes in

environmental assets.

It is apparent that these are important factors that may affect the success of an offset

program. Given that these factors will be context specific, there is a case for using

economic analysis to determine whether there will be net benefits from proposed offset

programs. An important implication of this discussion is that when considering the use of

offsets the focus should not just be on whether levels of environmental quality are

maintained and whether there are cost savings to business. Rather, changes in the benefits

to the community and wider social welfare from using offsets should be assessed.

Thin markets

A significant problem with offsets schemes is that they might lead to insufficient levels of

land banking. Under an offset scheme the mechanism for banking land is new private

development activity. But the offset scheme simultaneously reduces the value of new

private development by imposing an offset burden on any new development. The net

result might be little or no banking occurring.

17

June 2006

If there is no new development, the movement of low economic value but high

environmental value to land banks will cease. Land with low economic value may have

been developed prior to the offsets scheme coming into effect because the developers did

not have to be aware of the environmental costs of their development. It is socially

efficient to restore this low economic value land to wetlands, but unless there is private

development occurring elsewhere in the wetlands area, this land will not be restored.

The problem is that only new development faces the environmental cost imposed upon

society. Pre-existing development does not bear any environmental cost, except through

the lower future redevelopment options that an offset scheme may impose. Owners of low

economic value land have no incentive to return this land to wetlands unless that land

might be purchased for the offset bank. The first-best outcome will not be achieved in the

case of thin markets in an offsets scheme.

Alternative regulatory structures

An offset scheme is just one possible form of regulation for this market. Other forms are:

(1) a Pigouvian tax or (2) a cap and trade system.

One possible scheme that would avoid the thin markets problem is an externality tax on

developed land. The Pigouvian tax for an acre of land in zone j would be

Dj P

so that the owner of developed land within the wetlands area pays a tax equal to the social

value of the environmental flows that are disrupted.

However a Pigouvian tax alone would not be sufficient to maximize social welfare in this

case. If there are existing developments for which the development value of the land is

less than the value of the environmental flows after rehabilitation, the private value of this

18

June 2006

land is negative. These lands are exactly those lands that should be in the offset bank- the

acres that should be restored to wetlands.

Combining a Pigouvian tax with a land bank that purchased low economic value land and

restored that land to wetlands would achieve the first-best outcome and avoid the problem

of thin markets that offsets might suffer. The revenue raised by the Pigouvian tax could be

used to purchase the land for the land bank.

A cap and trade system would enable the regulator to adjust the scheme so as to better

approach the social optimum. One problem with offsets is that the status quo is given

possibly unwarranted prominence. Any offset such that:

O’DP > = 0

Results in an increase in the value of environmental services. However this may not be the

same as

O’D >= 0

Perhaps in the status quo, there is some environmental flow that could be traded off with

another environmental flow and increase total social benefit. However such a trade-off is

not allowed under the offset requirement.

In assessing the likely marginal costs of an offset program, it should be noted that the costs

of an offset program will be more than simply the cost of undertaking new environmental

works. First, a component of the cost of any market-based instrument, including offsets,

are transaction costs related to administering the instrument. Government interventions are

not costless to government or business, and transaction costs do differ across market-based

instruments.

It is possible, even likely, that offset programs will be more costly to

19

June 2006

administer than some other market based instruments. This is because of the need for

ongoing monitoring and management of offset sites, the need to search out potential offset

sites and negotiate with landholders about management changes, and the need to deal with

potentially a large numbers of developers in a fully developed offset program5.

4. Private versus Public Banks: Issues in the Establishment of a

Private Banking System

Many of the offset programs that are currently being trialed in Australia are aiming to be

serendipitous. It is recognized that relatively little is known about how offset schemes do

and should work. The pilots are being undertaken to gather information about the future

design of more permanent offset schemes. Therefore, in some cases, government agencies

are choosing to maintain a high degree of control over the pilot projects. This is seen in

the case of the South Creek Pilot being run by the NSW Environment Protection

Authority:

The pilot scheme will be implemented by the EPA in partnership with participants and stakeholders

through an Advisory Panel. The EPA would be responsible for approving and securing off-site

actions proposed to be implemented directly by a participant. The EPA would also be responsible

for receiving and allocating funds for works where licensees or developers chose to implement

works through the interim pilot scheme manager (NSW EPA 2002b).

However, the question about who will manage the South Creek program permanently has

not been decided. As shown in the following quote, it is possible that a private bank will

eventuate, however a monopoly rather than a competitive model appears to have been

embraced:

5

Relatively little is known about the comparative cost of implementing alternative market-based instruments

(MBIs). Initial applications of MBIs are likely to be expensive because of costs of developing new

legislation, rules and other institutions, websites, simulation software and the need for additional community

consultation. However, the long run average costs of different MBIs may well be different, and this

20

June 2006

For a permanent trading scheme, a scheme manager would be established separate from the EPA to

receive money for the issue of credits. The manager would be responsible for undertaking costeffective programs to reduce pollution in the catchment…The scheme manager could be an existing

government agency or a private sector body established for the purpose of running the scheme.

(NSW EPA 2002b).

This is similar to the perspective of the NSW Department of Land and Water Conservation

(DLWC 2001) in their discussion document relating to the use of offsets for salinity and

vegetation management. They note the possibility of using private brokers to match

buyers and sellers, but appear to be more supportive of the use of a consolidated fund run

by the government. The rationale given is the possibility of economies of scale and more

effective environmental rehabilitation:

Instead of carrying out the offset action themselves, proponents could pay a sum of money to a body

responsible for offset development and management…The fund would be Government-administered

and could form part of the Environmental Services Investment Fund, announced in the NSW

Salinity Strategy.

This approach would be simplest for the proponent to manage and, by

consolidated offset actions in larger areas, would be economically and environmentally effective

(DLWC 2001, p.13).

In contrast, the Western Australian government has firmly embraced the competitive

model for a future wetland offsets program. They note that:

A wetland bank may be created when a government agency, industry, corporation or non-profit

organization undertakes such activities under a formal agreement with the Department of

Environmental Protection…The EPA itself would not be the sponsor, custodian or operator of a

wetland bank. Rather the EPA would ‘authorize withdrawals’ and help define the rule sets which

would need to be developed to ensure the successful establishment and operation of a wetland bank

(Western Australian EPA 2001).

information could be used to help in selecting the most appropriate MBI for a particular environmental

problem.

21

June 2006

Thus a consensus has not yet developed about the appropriate structure for offset programs

in Australia. In the US, the experience with wetland mitigation banking was that initially

most banks were privately run.

The first private bank was only approved in 1992.

Currently, private banks make up about 65% of all wetland mitigation banks in the USA

(Environmental Law Institute 2002). Little empirical analysis has been undertaken to

determine the relative merits of different types of bank ownership. From a theoretical

perspective, public ownership would provide potential for economies of scale. However,

private ownership would deliver greater entrepreneurial effort and cost reduction, and

potentially a more competitive and efficient market outcome.

In economics this is

described as being the difference between scale efficiency (due to economies of scale) and

X-efficiency (due to smaller private firms having higher productivity). In many nonenvironmental industries, X-efficiency has been found to be more important than scale

efficiency (eg Walker 1998 OTHER REFERENCES????), which may also be the case for

offset banks. Clearly, this appears to be an area in need of further research.

Several issues specifically associated with the establishment of a private banking program

are now considered. There are many other issues germane to the establishment of both

private and public banking programs that are not discussed, but are considered elsewhere

(eg ELI 2002, Morrison 2002, Cummings, Taylor and Beck 2003).

Enabling Legislation

The Environmental Law Institute’s 1993 study on wetland banking in the USA found that

the major impediment to the development of a private market was poor institutions. There

was a “lack of consistency in permitting and mitigation decisions that would allow the

market to produce an appropriate number of credits with a reasonable expectation of

return” (ELI 2002). However, this situation changed with the promulgation of federal and

state guidance on the establishment and use of banks and subsequently there has been a

large increase in the number of wetland mitigation banks in the USA.

Thus the first step in developing a private offset program is to establish appropriate

legislation. For example, NSW EPA (2002b) commented that while a pilot scheme could

22

June 2006

be implemented under existing legislation, a permanent scheme would require legislative

and/or regulatory change.

Any enabling legislation would be required to prohibit

development unless (1) all impacts are mitigated on site or (2) any new net impacts are

offset through the purchase of offset credits. The legislation would also have to establish

rules for the offset program. These rules would have to cover a number of areas (US Corps

of Engineers et al 1995).

A. Acceptable sites for establishing banks. This will include ecologically suitable degraded

sites where no remediation plans currently exist. Banks can be sited on public or private

lands.

B. Mitigation, performance, monitoring and maintenance. This would involve specifying

offset techniques, criteria for determining whether offsets have been successful, amount of

time monitoring is required, and maintenance standards.

C. Long-term site maintenance at offset sites.

This could include use of perpetual

conservation easements or the purchase of land. Inclusion of bank funds in long-term trust

funds and annuities could be used to provide funding for site maintenance.

Financial

guarantees could be used to safeguard future funding.

D. Governing market structure. Rules are needed to determine whether any or all of the

credits can be sold prior to the completion and testing of the environmental gains. Different

rules for the latter may apply to government and privately owned offset banks. Financial

assurances or insurance requirements may be specified if an offset bank partly or fully fails.

E. Pricing rules. May be established for government-managed banks.

F. Identifying the service area for offset banking.

development and the offset need to be located.

That is, the areas within which a

This will typically be within regional

watersheds or other more narrowly defined areas. Consideration will also need to be given to

whether offsets will only be allowed within county boundaries or within watershed

boundaries.

23

June 2006

G. Calculation of trading ratios. Before an offset bank is established, trading ratios need to be

developed. These need to be developed because they will affect the viability of specific offset

banks. The trading ratio determines the number of credits that must be purchased from an

offset bank to offset an environmental impact. Trading ratios are typically a function of

several factors, including environmental gain, the nature of the offset activity, uncertainty and

distance between the impact and offset (see Morrison 2002).

Development of Offset Banks

Once the enabling legislation has been developed, and guidance provided on how trading

ratios are to be applied, the development of private and public offset banks can proceed.

The US Corps of Engineers et al (1995) suggested several steps in developing mitigation

banks. First, entrepreneurs proposing an offset bank discuss the appropriateness of a

particular offset banking site with the regulatory authorities. Second, the entrepreneurs

submit a prospectus that outlines the objectives of the bank, how it will be established and

operated. This will provide the opportunity for feedback prior to the development of an

offset banking instrument.

An offset banking instrument is a written agreement that formalises the establishment of an

offset bank. The instrument would be prepared by the bank proponent and would be

expected to

include

information

about

(see US

Corps

of

Engineers 2002,

http://sas.usace.army.mil/permit/bankguid.htm):

Ownership of bank lands

Bank goals and objectives

Geographic service area

Description of baseline conditions at the bank site

Potential offsets

Specific success criteria to determine when credits are available

Assessment methodology or procedures for determining credits and debits

Accounting procedures for tracking credits and debits

A monitoring plan that identifies an evaluation schedule and reporting responsibilities

Contingency and remedial actions and responsibilities

24

June 2006

Financial assurances if early credit withdrawal is proposed

Method for determining trading ratios

Provisions for long-term management and maintenance

Method or instrument for the perpetual legally binding protection and preservation of the

bank site

Approval of the banking instrument would be via a regulatory authority.

Approval Process

With any offset banking program (both private and public), individual offset trades would

need to be approved by the regulatory authority or the body charged with overseeing the

program. Separation of powers should arguably occur for the integrity of the scheme.

Thus, the organization in charge of the approval processes should be different from the

organization(s) responsible for generating offset credits, even if both are government

agencies.

Thus, in practice, the approval process should not differ substantially for

government or private run banks.

Site inspections and submission of development and site plans would be expected to be

part of this process and used to confirm debits. Accredited agents could be used to

expedite this process for smaller developments (eg smaller than five acres). Web-based

purchase of credits could be allowed for smaller developments, through a clearinghouse as

occurs in other incentive programs currently operating. Larger developments could be

overseen, and debit calculations and credit purchases approved directly by the regulating

authority.

Ensuring long term management and monitoring

A limitation of private banks is that they do not have the same capacity to guarantee

outcomes and continuance that are found with public banks.

Therefore, greater

consideration needs to be given to methods for reducing the risk of bank failure. Several

different methods are used in practice. The first is to stagger the release of credits to

provide some guarantee of the effectiveness of environmental controls.

25

Credits are

June 2006

released slowly to ensure that environmental outcomes are being achieved. However, this

does not ensure long term management of offsets.

With wetland mitigation banking in the US, the most common method to ensure long term

achievement of environmental outcomes is the use of financial assurances. The Corps of

Engineers (1995) guidelines required that banks should have financial assurance to reflect

the costs of monitoring, long-term maintenance, contingency and remedial actions. In

practice, the most common form of financial assurance for long-term management is a trust

fund (41%) (ELI 2002). For a number of banks, the amount of money that must be set

aside for long-term maintenance and monitoring is specified per credit.

In practice,

financial assurances are set for each stage of the life of a private bank (establishment,

operation, and long term management).

Other methods area also available to ensure long term outcomes with private banks. These

include the ownership of key resources and use of easements (US Corps of Engineers et al

1995).

5. Conclusions

The use of environmental offsets potentially provides an opportunity for allowing

development and achieving environmental goals simultaneously.

They are intuitive

programs that have the advantage of providing a practical means for allowing future

development, and providing developers with a defined process for dealing with impacts

associated with new developments. It is possible that they may prove to be an effective

way of maintaining existing levels of environmental quality, despite population growth and

increased development. Moreover, as argued by the Wentworth Group, existing policies

aimed at controlling the impacts of development have not been wholly effective.

However, offsets may not be the most efficient and equitable tool to use in all contexts. A

simple economic analysis suggests that in some in some contexts (eg highly urbanized

areas), the use of offsets may result in decreases in community welfare. The full costs of

26

June 2006

operating an offset program are also not yet well known; it some contexts there may be

more cost-effective ways of maintaining environmental resources.

Finally, the use of

offsets may lead to the creation of other externalities or have distributional consequences.

The implication is that, like any other regulation or government policy, offset programs

should be subject to a cost-benefit analysis to demonstrate that they are the most preferable

regulatory tool in a given context.

Given that there is still a lot that is not known about how and where environmental offsets

should be implemented, it is appropriate to undertaken offset pilots in Australia. One of

the recommendations made in this paper is that consideration be given in any permanent

programs to the use of private markets as opposed to centrally run offset banks. Attention

has also been drawn to several important issues that may affect the design of offset

programs, including the appropriate level of fungability, whether offset programs create

perverse incentives and the potential for litigation. These are not easy issues to resolve,

although some possible solutions have been suggested. The existence of these issues

indicates that further research and experimentation is needed to understand how

environmental offset programs can most effectively be designed, and in what contexts they

can most cost-effectively be applied.

27

June 2006

Bibliography

Austin, S.A., 2001. Designing A Selenium Load Trading Program to Reduce the Water

Quality Impacts of Discharge From Irrigated Agriculture, Harvard Environmental

Law Review 25(2), 337-403.

Australian Conservation Foundation (2001). ACF Position on Offsets for Native

Vegetation (13 September 2001). www.acfonline.org.au downloaded 7 June 2004.

Baumol, W.J. and Oates, W.E., 1998. The Theory of Environmental Policy. Cambridge

University Press, Cambridge.

Cummings, R.G., Taylor, L.O. and Beck, M.B. (2003). Developing Offset Banking Systems

in Georgia.

Water Policy Working Paper #2003-002, Environmental Policy

Program, Georgia State University.

DLWC (2001). Offsets, Salinity and Native Vegetation Discussion Paper. NSW

Department of Land and Water Conservation.

http://www.dlwc.nsw.gov.au/care/salinity/offsets.html

Downloaded 15 June 2004.

Environmental Law Institute (2002). Banks and Fees: The Status of Off-Site Wetland

Mitigation in the United States. ELI, Washington DC.

Godden, D. and Vernon, D. (2003). Theoretical Issues in Using Offsets for Managing

Biodiversity. Paper presented at the Annual Conference of the Australian

Agricultural and Resource Economics Society, Fremantle, February.

Hailu, A and Schilizzi, S. (2003). Learning in a ‘Basket of Crabs’: An Agent Based

Computational Model of Repeated Conservation Auctions.

Discussion Paper,

School of Agricultural and Resource Economics, University of Western Australia.

28

June 2006

Hanley, N., Shogren, J.F. and White, B. (1997). Environmental Economics in Theory and

Practice, Macmillan Press, Houndmills.

Hornsby Shire Council (2004). Hornsby Development Contributions Plan 2004 to 2010.

Hornsby Shire Council.

http://www.hornsby.nsw.gov.au/planningdevelopment/index.cfm?NavigationID=952

Downloaded 23 December 2004.

Kerr, G.N. and Sharp, B.M.H. (2004). Lost Streams: Offsite mitigation evaluation using

choice modeling. Paper presented to the 48th Annual Conference of the Australian

Agricultural and Resource Economics Society, Melbourne, Feb 11-13.

Morrison, M. (2002). Offset Banking: A Way for Controlling Nonpoint Source Pollution in

Urban Areas in Georgia. Working Paper #2002-04, Environmental Policy

Program, Georgia State University.

NSW Fisheries (1999). Policy and Guidelines – Aquatic Habitat Management and Fish

Conservation 1999 Update. www.fisheries.nsw.gov.au/hab/policies/policy-guidecontent.htm Downloaded 22 June 2004.

NSW Government (2003). Natural Resources Commission Bill, Native Vegetation Bill,

Catchment Management Bill. Second Reading.

http://www.parliament.nsw.gov.au/prod/parlment/NSWBills.nsf/0/4bb2767fe4b74

c49ca256ddc002e73a0/$FILE/A10203.pdf

NSW Environment Protection Authority (2002). Green Offsets for Sustainable

Development: Concept Paper. EPA, Sydney.

NSW Environment Protection Authority (2002). Pollution Reduction Trading Scheme for

South Creek: Pilot Proposal. Unpublished Paper.

29

June 2006

Salzman, J. and Ruhl, J.B. (2000). Currencies and the Commodification of Environmental

Law, Stanford Law Review 53(3), 607-694.

Salzman, J., Whitten, S.M., Proctor, W. and Shelton, D. (2004). Investing in Natural

Capital: An Ecosystems Services Approach. Report prepared for RIRDC/ Land

and Water Australia/FWPRDC Joint Venture Agroforestry Program.

US Corps of Engineers et al. (1995). Federal Guidance for the Establishment, Use and

Operation of Mitigation Banks. Federal Register 60(228), 58605-58614.

Walker, G. (1998). Economies of Scale in Australian Banks: 1978-1990. Australian

Economic Papers 37(1), 71-87.

Wentworth Group (2003). Wentworth Group of Concerned Scientists. A New Model for

Landscape Conservation in New South Wales. Report to Premier Carr.

Western Australian Environmental Protection Agency (2001). A Policy Framework for the

Establishment of Wetland Banking Instruments in Western Australia. Draft for

Public Comment. EPA, Perth.

Whitten, S., Khan, S., Collins, D., Shelton, D., Proctor, W. and Robinson, D. (2003).

Tradeable Recharge Credits in Coleambally Irrigation Area. Poster Paper

Presented at the 6th Annual AARES Symposium: Market Based Tools for

Environmental Management, Canberra.

30