Provident Financial Holdings, Inc. Covering analyst: Christian Meunier Email:

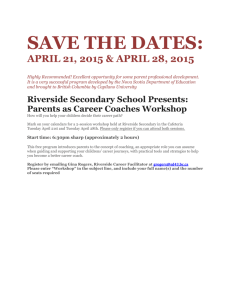

advertisement

Provident Financial Holdings, Inc. Covering analyst: Christian Meunier Email: Meunier@uoregon.edu Business Overview › Founded in 1956 › Headquartered in Riverside, California › 5th largest deposit market share in Riverside County. › $1.5 Billion in assets, $971.4 million in deposits › Community Savings and Loan bank Products and Offerings › Community Banking – – – – Single-Family Mortgages Multi-Family Mortgages Commercial Real Estate Mortgages Commercial and Consumer Loans › Mortgage Banking - Origination for sale of Single-Family Mortgages › Volume of loan origination has gone up last 3 years. Loans held for investment analysis Market/Location › 15 banking offices in Riverside County › Inland Empire › 18 mortgage offices in California Operations Loans Originated, Sold, and Purchased ($thousand) Revenue Savings and Loans › Struggling Industry. › Expected to see an annual growth percentage of -1.8% – – – – Regulation Commercial Banks Still seeing impact of housing collapse Low interest rates Prime Rates › Current Prime Rate is 3.25% (record low) – Available to most credit worthy customers › “Operation Twist” will keep rates low till 2015 › Growth will come Housing Price Index › Captures trends in the national housing market › Peaked in 2006 › Growth is forecasted until 2018 Local Economy › Riverside hurt by housing collapse – 3.1% drop in average wages – Housing prices fell 55% › Currently fastest growing recovery – – – – – – Housing prices increased 10.9% Housing inventory down 32.3% 65% decrease in foreclosures 8 months of home sale improvement 10.5% unemployment Still poor compared to national economy Comparable › PACW -35% › PPBI -35% › BOFI -15% › HMST -15% › SMPL -0% Valuation Beta › Regressions came out to around 0.44 – High standard deviation › Used Hamada to get 0.96 – Closer to industry beta – More reasonable Excess Return › Used Excess Return Model – – – – Pin-pointing debt is difficult in banks Does not use WACC Depreciation and Amortization Capital Expenditure – Only take into account equity – Trust Book Value (financials more likely to be at market value) Valuation Final Valuation QUESTIONS? Recommendation › Buy for Svigal and Tall Fir portfolios