The Practice and Questions of FOF (Non-financial) Compilation of NBS

advertisement

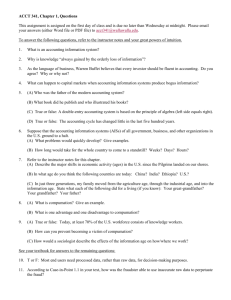

The Practice and Questions of FOF (Non-financial) Compilation of NBS NBS-OECD Workshop on National Accounts Paris, 9 Dec. – 11 Dec. 2013 XU Yating Department of National Accounts of NBS Outline Background of FOF compilation of China Format of FOF, including financial account and nonfinancial accounts. Structure of FOF (non-financial accounts) Sectoring in FOF (non-financial accounts) Main accounts and transaction items in FOF (non-financial accounts) Comparison with 2008 SNA Questions in compilation practices Background 1992 – The first Flow of Funds Table ( non-financial & financial accounts) 2006 – update after the first economic census 2010 – update after the second economic census 2012 – recent update according to 2008 SNA and fresh fiscal data 2013 – first fill in “non-financial accounts table ( 0800 ) “ in OECD questionnaire from year of 2000-2011 This presentation will focus on the practices of non-financial FOF. Format of FOF (financial) Sectors Items Non-financial Corporations Uses Net Financial Investment Financial Uses Financial Sources Currency Deposits Loans Securities Investment Funds Deposits with Margin Securities Trading Account Insurance Technical Reserves Inter-financial Institutions Accounts Required and Excessive Reserves Cash in Vault Central Bank Loans Miscellaneous (net) Foreign Direct Investment Changes in Other Foreign Assets and Debts Changes in Reserve Assets Errors and Omissions in the Balance of Payments Financial General All Domestic The Rest of the Households Institutions Governments Sectors World Sources Uses Sources Uses Sources Uses Sources Uses Sources Uses Total Sources Uses Sources Format of FOF (non-financial) Sectors Items Non-financial Corporations Financial Institutions General Governments Households All Domestic Sectors The Rest of the World Total Uses Sources Uses Sources Uses Sources Uses Sources Uses Sources Uses Sources Uses Sources Net Exports Value Added Compensation of Employees Taxes on Production, Net Income from Properties Interest Distributed Income of Corporations Rent on Land Natural Resources, Others Total Income from Primary Distribution Current Transfer Taxes on Income Payment to Social Security Social Security Welfare Allowances Others Total Disposable Income Final Consumption Expenditure Household Consumption Government Consumption Savings Capital Transfers Investment Allowances Other Gross Capital Formation Gross Fixed Capital Formation Changes in Inventories Acquisitions Less Disposals of Other Non- financial Assets Net Financial Investment Sectoring Institutional units are allocated to five institutional sectors: sectors contents Domestic 1.The Non-financial sectors corporations 2.The Financial corporations 3.The General government central government & local government social security funds NPISH 4.The Households resident households unincorporated enterprise owned by a household 5.The rest of the world Accounts & Transaction Items FOF (non-financial) including 5 main accounts with 14 transaction items: Production account 1. Net export: directly from expenditure-based GDP 2. Value-added: directly from production GDP The distribution of income account 3. Compensation of employees: directly from income GDP 4. Production Tax (net): calculated from fiscal income 5. Property income 6. National income Accounts & Transaction Items(cont) 7. 8. 9. 10. 11. 12. 13. 14. The redistribution of income account Current transfer Disposable income The use of income account Final consumption expenditure: directly from expenditurebased GDP Savings The capital account Total capital transfer Gross capital formation: directly from expenditure-based GDP Acquisitions less disposals of non-produced non-financial assets Net lending/borrowing Comparison with 2008SNA Generally in accordance with 2008SNA. Still has some differences and shortcomings: NPISH is included in General Government instead of accounted independently or included in household. Production account is incomplete. Compensation of fixed capital is included in total operating surplus, didn’t calculate net disposable income and net savings. Comparison with 2008SNA (cont) Omissions in some non-monetary transactions, such as compensation in kind and transfers in kind. Didn’t calculate current transfer in kind, as well as adjusted disposable income account and actual final consumption. Didn’t calculate the adjustment for the change in pension entitlements. Difference between production-based GDP and expenditurebased GDP induces unbalance of capital account, representing as non-zero net lending/borrowing in total uses. Questions Q1: How to define market production in practice? Q2: Which sector should public hospital ( or public university), who is partly financed ( far less than 50% of its cost) by government, be incorporated? Q3: How to understand the difference in net lending / borrowing between financial account and capital account, if the difference is large especially by sectors? Which account is more reliable? Questions (cont) Q4: Housing provided by government to it’s employees at very low price, and employees only have limited property right to the house, for example the house shouldn’t be rented or sold. How should this kind of welfare be recorded? Is it a kind of compensation of employees in kind? Q5: The definition of “Investment income attributed to investment fund shareholders”: If the income is from the price change of the equity, is the income still treated as investment income? If the investment fund seldom share out dividents, the investor’s income only represented as price increase of the fund, how could the investment income be recorded? Questions (cont) Q6: Residential Land (70 years use right) transaction process: government purchases land from peasant real estate development company buy the land from government household buy land (with housing) from company recording: government acquire land, household disposal land Real estate development company acquire land, government disposal land Household acquire land, company disposal land result: land is still acquired by household. If during the process, the land is appreciated, should the appreciation be recorded, or use the original price that government give to peasant? How to estimate the value of land and building when they are sold together, especially faced with the high price of housing in china? Questions (cont) Q7: How to calculate production tax? Data from fiscal income and from enterprise survey, which one is more reliable? Q8: Retained earnings on foreign direct investment is totally recorded as property income of foreign investors in income distribution account and as reinvestment in financial account. Could this treatment be used in state-owned enterprises? Q9: Difficulties in evaluating non-monetary transactions. Thank you for your attention!