Innovation and Human Resources: The Experience of Middle Income East Asian Countries

advertisement

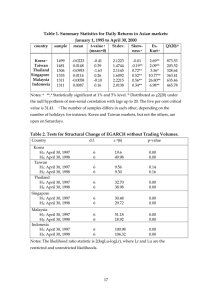

Innovation and Human Resources: The Experience of Middle Income East Asian Countries OECD/Germany Workshop on Advancing Innovation: Human Resources, Education and Training Shahid Yusuf DRG World Bank November 17-18, 2008 East Asia: After manufacturing catch-up, the need to innovate Middle income East Asian economies have growth momentum based on manufacturing capability, have achieved stability, and have embraced openness. However, growth and investment is slowing in many East Asian countries, and the ongoing crisis might dampen economic activity further. Future performance depends on successful transition to higher value adding, knowledge and human capital intensive activities. Innovation and gains in productivity have priority. GDP growth is slowing, as investment slackens and net exports contribute less to demand, in many countries 12.0 10.0 8.0 1995 6.0 2000 2006 4.0 2.0 0.0 i Ch na Source: WDI dia In ia es n do In n pa a J . d e or sia ina ep an l y h p i R a a C , ala Th n, ing ea M r a S iw Ko Ta Capital Accumulation is down from its peak in most countries, China and India being exceptions Capital Formation (% of GDP) 50 45 40 35 30 25 1995 20 2005 2000 15 10 5 Source: WDI C hi Ta na iw an ,C hi na K or ea ,R ep . In do ne si a S in ga po re Ja pa n al ay si a Th ai la nd M In di a 0 More growth must now come from total factor productivity especially as labor force increase is slowing TFP growth for some South-East Asian Countries Country Period TFP Malaysia 2001-2005 1.3% Thailand 1999-2004 2.1% China 1993-2004 4.0% India 1993-2004 2.3% Korea 2000-2004 1.0% Source: Data for Malaysia is from EPU (2006) and World Bank (2005), for Thailand is from Bosworth (2005), for China and India are from Bosworth and Collins (2007), and for Korea is from Kanamori and Motohashi (2007). Hence, spending on R&D is increasing 0 1 2 3 R&D spending (% of GDP) 1996 1998 2000 2002 2004 year Malaysia Japan Singapore Indonesia Source: UNESCO Institute for Statistics S&T database Thailand China India Korea, Republic of 2006 Achieving innovativeness will determine competitiveness and growth Patents Granted by Country of Origin China Indonesia India Japan Korea Malaysia Philippines Singapore Thailand 1995 1,679 -494 140,806 8,796 29 -20 1 2000 6,712 1 584 166,689 29,412 -8 110 45 2006 21,519* 13 819 201,611 97,738 147 38 995 40 Note: * indicates that data is for the year 2005. Source: WIPO 2007 Tertiary level enrollment is expanding China Japan Korea Malaysia Thailand Brazil Mexico 1991 3.0 29.6 38.6 8.1 .. 11.3 14.7 2006 21.6 57.3 92.6 28.6 45.9 25.5 26.1 Note: Data for Malaysia and Brazil are from 2005, data for Korea is from 2007 Source: WDI Science, technology, and engineering skills are key The share of S&E first university degree 1985 1995 2004 China 55.4 62.4 51.0 Japan 25.8 26.2 24.4 South Korea 32.6 36.6 39.6 Germany 32.1 27.9 28.4 Mexico 28.3 Source: Science and Engineering Indicators 2008 What is holding back innovation: weak demand Business models of export oriented large firms emphasize cost reduction and diversification into other areas with low entry barriers. Small firms with limited managerial capital seek quick returns and are not motivated to pursue innovative activities. Both large and smaller firms rely on technological advance embodied in imported equipment. Even large companies rarely maintain sizable research departments, much of the ‘research’ is on testing, adaptation, troubleshooting, incremental improvements, and customization. Firms: weak demand for innovation Few incentives for internal generation of suggestions for product and process innovation. Little outsourcing of R&D and sparse links with universities. Market for researchers is small and salaries are modest. This affects supply of doctoral students and post-doctoral training opportunities. Small internal research capability constrains search for ideas and ability to absorb new technology. Firms’ demand for innovation Where large domestic firms from China, Korea or Taiwan are actively competing on the basis of innovation as in telecoms, or semiconductor design and fabrication, R&D has strong support. But these firms are the exceptions. MNCs that drive export performance in several East Asian Economies are not playing a leading role Backward linkages and technological spillovers from MNCs are fairly sparse. MNCs not trying to groom local suppliers of high tech components. Foreign firms increasingly protective of own IP and careful about locating key research activities in Southeast and East Asia. They are building little research capital in host countries. Few employees leave MNCs to start-up technologically innovative firms. Universities: Issues of education quality, research orientation, and initiative Quality of tertiary education in STEM areas needs improving. Elite schools do better but not much better. Students have weak analytical/problem solving skills and practical knowledge. Tend to be passive. Employers frequently note these problems and others. Research and post-doc training undervalued. Few incentives for faculty to do research that could lead to commercializable findings. Job opportunities and salaries do not encourage pursuit of research. Universities do not actively seek links with firms to engage in collaborative research – and vice versa. Starting up high-tech firms is a struggle Research and innovation in and out of universities, also hampered because entrepreneurs attempting to commercialize innovative products or services must struggle to find risk capital. East Asian governments have set up public venture funds and other intermediaries to assist start-ups with financing. But – Access is difficult. – Most venture capital goes to safe and conventional activities. – Public venture capitalists are inexperienced and cannot provide firms with the guidance and expertise sought. – Private venture capital is limited because deal flow is small and exit options are not well developed. Environment for innovation in urban centers still evolving in East Asia Innovation is an urban phenomenon and large, cosmopolitan cities have an edge. Few cities in East Asia have the desired characteristics. E.g. – – – – – – – – Size and significant urbanization economies (industrial diversity) Presence of multiple research intensive activities Cultural heterogeneity and milieu supportive of innovation Large pools of knowledge workers with tertiary level skills – this is changing (e.g. Korea, China) Diverse and experienced services providers to assist start-ups. Concentration of research universities, company HQs, and corporate research activities International connectivity and openness to ideas Sate-of-the-art IT infrastructure (Seoul and Singapore are exceptions) Government innovation policies need rethinking Many programs without an innovation strategy or focus. Stress on tertiary level S&T programs but means for raising quality of teaching and research are lacking. Fixation on short and medium term input targets such as R&D spending. Or on output targets such as patents, published papers, and university rankings. Dispersed responsibilities and funding for promoting innovation and cumbersome application procedures limits awareness of incentives and access to resources. Past or existing policies rarely evaluated, modified, and improved or terminated. Unwillingness to acknowledge the long gestation, culture and institution bound nature of an innovation system. Thank you