External Trade in Brazil: Recent Developments Pablo Fonseca P. dos Santos

advertisement

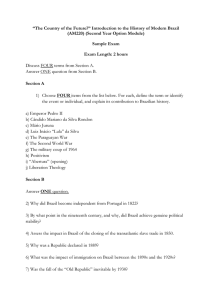

Ministry of Finance of Brazil Secretariat of International Affairs November 2004 External Trade in Brazil: Recent Developments Pablo Fonseca P. dos Santos Paris - OECD November 22, 2004 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Graph I: Nominal and Real Exchange Rate1, 1998 - 2004 (October) (index: July 1994 = 100) 425 400 375 350 325 300 275 250 225 200 175 150 125 100 75 50 425 400 375 350 325 300 275 250 225 200 175 150 125 100 75 50 Nominal Exchange Rate (R$/US$) Oct-04 Jul-04 Apr-04 Jan-04 Oct-03 Jul-03 Apr-03 Jan-03 Oct-02 Jul-02 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 Oct-00 Jul-00 Apr-00 Jan-00 Oct-99 Jul-99 Apr-99 Jan-99 Oct-98 Jul-98 Apr-98 Jan-98 Real Exchange Rate Sources: Central Bank of Brazil and Federal Reserve Bank of Saint Louis. 1. Monthly average. Deflators: consumer price indices of Brazil (IPCA) and the US (CPI). 2 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Graph II: Trade Balance, 1998 - 2004 (October) (US$ billions; accumulated over 12 months) 100 35 90 30 80 25 Imports (left scale) 70 20 60 15 50 40 10 Exports (left scale) 5 30 0 20 Trade Balance (right scale) 10 0 1998 -5 -10 1999 2000 2001 2002 2003 2004 Sources: Central Bank of Brazil and Ministry of Development, Industry and Trade. 3 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table I: Exports by Main Markets, 1997 and 2004 (US$ billions) Items Total Exports 1997 US$ billions % of total 2004* US$ billions % of total 53.0 100.0 90.6 100.0 14.5 27.4 22.6 25.0 USA 1 9.4 17.8 18.9 20.9 Argentina 6.8 12.8 6.8 7.5 China 1.1 2.1 5.5 6.1 Mexico 0.8 1.6 3.6 4.0 Japan 3.1 5.8 2.6 2.9 Others 17.3 32.7 30.5 33.7 Russia 0.8 1.4 1.6 1.7 Iran 0.2 0.5 1.2 1.3 South Africa 0.3 0.6 0.9 1.0 European Union Sources: Central Bank of Brazil and Ministry of Development, Industry and Foreign Trade. * Acumulated over 12 months until September. 1. Includes Puerto Rico. 4 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Graph III: Exports Quantum by Class of Products (12 months moving average) 300 250 Primary 200 150 Manufactured Semimanufactured 100 50 out/92 out/94 out/96 out/98 out/00 out/02 out/04 Source: Funcex. 5 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table II: Exports by Main Products, 1997 and 2004 (US$ billions) Items 1997 US$ billions Total Exports 1 Primary Products 2 soybeans crude petroleum chicken meat Semimanufactured chemical wood pulp soybean oil Manufactured transportation equipment 3 4 passenger motor vehicles airplanes transmission and reception apparatus and components petroleum products % of total 2004* US$ billions % of total 53.0 100.0 83.4 100.0 14.5 5.1 0.6 0.9 27.3 9.7 1.1 1.7 25.2 8.4 2.4 2.1 30.2 10.1 2.9 2.6 8.5 1.0 0.5 16.0 1.9 1.0 11.9 1.7 1.2 14.3 2.1 1.5 29.2 55.1 45.0 53.9 7.3 13.7 12.4 14.9 1.5 0.7 2.8 1.3 3.0 2.6 3.6 3.1 0.6 1.0 1.1 1.9 1.5 2.8 1.8 3.3 Sources: Central Bank of Brazil and Ministry of Development, Industry and Foreign Trade. * Acumulated over 12 months until June. 1. Includes special operations. 2. Includes grinded, oil-cake and other residues from soybeans. 3. Includes parts and components. 4. Includes automobiles, buses, trucks and tractors. 6 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Some Facts About the Structural Component of the Brazilian Trade Performance • Liberalizing reforms of the 1990’s - Privatizations - Reduction of trade tariffs • Some industry examples - airplanes - steel - textiles • FDI - automobiles - mobile phones • R&D and investments in the agricultural sector Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Graph IV: Export Quantum, 1997 - 2004* (% change over previous year) 22 22 Brazil 18 18 14 14 10 10 6 6 World 2 2 -2 -2 1997 1998 1999 2000 2001 2002 2003 2004* Sources: FUNCEX and IMF. *2004 Brazil's data is the percentage change of the average index of January - October over the same period of the previous year. 8 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Graph V: Exports of Goods and Services, 1999 - 2003 1.0 24.0 20.0 Brazil's exports / Worldwide exports (%; scale to the left) 0.9 16.0 Brazil's exports / GDP (%; scale to the right) 0.8 0.7 12.0 8.0 1999 2000 2001 2002 2003 Sources: IMF and Central Bank of Brazil. 9 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table III: Balance of Payments, 1998 - 2005 (US$ billions) p p Items 1998 1999 2000 2001 2002 2003 Current Account -33.4 -25.3 -24.2 -23.2 -7.7 4.0 6.7 0.1 -6.6 -1.2 -0.7 2.7 13.1 24.8 30.0 24.5 Exports 51.1 48.0 55.1 58.2 60.4 73.1 90.0 94.5 Imports 57.7 49.2 55.8 55.6 47.2 48.3 60.0 70.0 Non-Factor Services -10.1 -7.0 -7.2 -7.8 -5.0 -5.1 -5.7 -6.9 Balance of Goods and Non-Factor Services -16.7 -8.2 -7.9 -5.1 8.1 19.7 24.3 17.6 Factor Services -18.2 -18.8 -17.9 -19.7 -18.2 -18.6 -20.8 -20.5 1.5 1.7 1.5 1.6 2.4 2.9 3.2 3.0 Foreign Direct Investment 28.9 28.6 32.8 22.5 16.6 9.9 17.0 14.0 Other Capitals 1 -3.4 -11.1 -10.8 4.1 -8.6 -5.4 -22.2 -8.7 Overall Balance -8.0 -7.8 -2.3 3.3 0.3 8.5 1.5 5.4 86.4 112.8 135.3 96.7 215.2 - - - Trade Balance ( FOB ) Unilateral Transfers 2004 2005 Memo Foreign Direct Investment over Current Account Déficit (%) Source: Central Bank of Brazil. 1. Includes errors and omissions and IMF loans. p. Projection. 10 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table IV: Balance of Payments: Selected Indicators, 1998 - 2005 Items p 1998 1999 2000 2001 2002 2003 2004 Current Account -4.2 -4.7 -4.0 -4.6 -1.7 0.8 1.3 Exports of Goods and Services 7.5 10.3 10.7 13.2 15.2 16.9 17.9 2 n.a 17.1 22.1 22.8 27.5 28.7 29.9 31.2 2 n.a 63.2 70.8 56.2 58.4 38.8 23.2 28.1 32.2 IMF Loans Amortizations (US$ billions) 0.0 2.0 6.9 0.0 4.6 12.8 4.3 6.7 Intercompany Loans Amortizations (US$ billions) 3.1 6.5 3.8 5.2 7.4 4.6 9.4 3.8 International Investment Position (US$ billions) n.a. n.a. n.a. -265.0 -230.5 -272.3 -276.7 2005 (% of GDP) Exports and Imports of Goods and Services 0.0 (US$ billions) Gross External Financing Needs 1 Memo 3 n.a Source: Central Bank of Brazil. 1. Excludes payments of Central Bank debt and intercompany loans. 2. Acumulated over the last 12 months until June. 3. In March. p. Projection. n.a. Not available. 11 p Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table V: External Debt Indicators, 1999 - 2004 (%) Items 1999 2000 2001 2002 2003 2004 3 June Net External Debt 1 over Exports of Goods and Non-Factor Services 342.8 284.8 257.7 247.1 198.1 163.3 35.3 30.5 34.1 37.6 33.6 29.4 127.5 80.6 74.9 72.9 64.7 61.1 13.1 8.6 9.9 11.1 11.0 11.0 1 Net External Debt over GDP External Debt Service 2 over Exports of Goods and Non-Factor Services 2 External Debt Service over GDP Source: Central Bank of Brazil. 1. Net of international reserves (international liquidity concept). 2. Includes payments of Central Bank debt and excludes refinanced amortizations and amortizations of intercompany loans. 3. Acumulated over last 12 months 12 Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Will Export Performance Keep Up? • Brazilian firms are increasingly becoming more export oriented - Policies to incentive exports • Macroeconomic Stability - Necessary but not sufficient condition • Microeconomic Reforms Agenda - Improvement of the business environment - Reduction of the cost of credit - Infrastructure investment (PPP, regulatory framework) - Improvement of the tax structure - R&D (new law being discussed by the Senate) - education • Trade negotiations - High tariffs and non tariff restrictions on products that Brazil is more competitive Ministry of Finance of Brazil Secretariat of International Affairs November 2004 Table VI: Improving Business Climate Structural Reform Checklist Status Type of Approved Reform/measure measure /issued Transformation of COFINS in a VAT Law Elimination of PIS/COFINS on Financial Decree Receipts Work in progress Real Estate Sector Reform Law Law Loans guarateed by Payroll Law Securitization of Bank Credits Law Investment Account Law Law Tax incentives for long-term Decree investment, M Ps206/9 Bankruptcy Law Draft Law Approved by the Senate. Expects ratification in the Lower House Framework to subject the financial Draft Law Approved in the Financial and Tax Commission, is under consideration in system to the Anti-trust Authority the Constitution and Justice Commission Private-Public Partnership Law Draft Law Being discussed by Senate Committees; eventual ratification at the House Regulatory Agencies Law Draft Law Under discussion in the Lower House Judicial Reform Draft Law The base text was approved in the first reading in July 2004. Industrial Development Agency Act Draft Law Under discussion in the Senate Technological Innovation Law Draft Law Approved in the Lower House in July 2004, going to the Senate vote 14