Accrual Concepts in the U.S. Federal Budget Bob Dacey Chief Accountant

advertisement

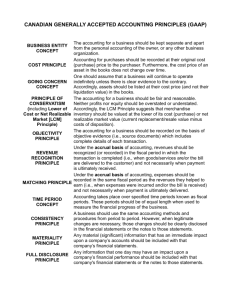

Accrual Concepts in the U.S. Federal Budget Bob Dacey Chief Accountant U.S. Government Accountability Office March 3, 2008 Why Were We Interested in Accrual Budgeting? • The U.S. federal government’s financial condition and fiscal outlook have deteriorated dramatically since 2000. • Increased information and better incentives to address the long-term consequences of today’s policy decisions can help put the U.S. Government on a more sound fiscal footing. 2 Current Use of Accrual Measurement in the U.S. Federal Budget Budget authority and outlays are measured on a cash/obligations basis except for the following programs that are measured on an accrual basis: • • • • Credit programs Certain interest payments Some federal employee pensions (agency level) Some retiree health care (agency level) The federal government’s consolidated financial statements are prepared generally on an accrual basis • Most revenue is recorded on a modified cash basis • Net operating cost is reconciled to the unified budget. 3 Some Key Budgetary Objectives in the U.S. • Establish national spending priorities and allocate resources • Ensure that the government spends taxpayers’ money in accordance with applicable laws • Upfront control over the government’s full cash commitment • Provide some information on the government’s borrowing requirements and effect on the economy 4 Does Current Budgeting Meet Budgetary Objectives? • For most areas, the current cash-/obligationsbased budget supports these objectives and provides equal or better control than accrual measurement would, particularly over capital investment. • However, for some areas cash measurement does not support upfront control of resources: • veterans compensation • federal employee pensions and retiree health • insurance • environmental liabilities 5 Potential Benefits of Accrual Budgeting • Better information on the cost of annual operations and performance can: • Inform tradeoffs between competing programs or priorities. • Help policymakers recognize the full cost of resources used to produce goods or deliver services during the period regardless of when cash is used • Improve efficiency and performance and management of assets and liabilities 6 Potential Challenges With Accrual Budgeting • Need reliable financial data and agreed upon standards. • Asset identification and valuation can be cumbersome and difficult for public sector. • Management and oversight of noncash expenses, which may signal a need for cash controls over capital purchases. • Accrual accounting inherently more complex than cash accounting and can be more volatile. • Existence of cash-based fiscal targets may reduce the focus on accrual measures. 7 Range of Accrual Budgeting Use 8 GAO Conclusions • Accrual budgeting only part of the answer • Useful for recognizing the full annual cost of certain programs that will require future cash resources; but • Not useful for recognizing longer-term fiscal challenges that are driven primarily by aging populations and escalating health care cost. • Fiscal sustainability reporting also needed • Multiple measures needed to understand fiscal sustainability. • Fiscal sustainability reporting can increase public awareness and understanding of the long-term fiscal challenges, stimulate public and policy debate, and help policymakers make informed decisions. • Comprehensive picture of the long-term financial condition of the government as a whole. 9 GAO Conclusions • Fiscal sustainability reporting would: • Highlight the trade-offs between all federal programs competing for federal resources, and • Improve policymaker’s understanding of the tough choices that will have to be made to ensure that future generations do not bear an unfair tax or debt burden for services provided to current generations. • Accrual budgeting and fiscal sustainability reporting are only means to an end; neither can change decisions in and of itself. 10 Matters for Congressional Consideration Congress should • require increased information on major tax and spending proposals; • consider requiring increased reporting of accrual-based cost information alongside cash-based budget numbers for both existing and proposed programs where accrualbased cost information includes significant future cash resource requirements that are not yet reflected in the cash-based budget; • explore further use of accrual-based budgeting for these programs to ensure that the information affects incentives and budgetary decisions; and • require periodic reports on fiscal sustainability for the government as a whole. 11 Appendix A: Recent GAO Long-Term Simulations 12 Unified Surpluses and Deficits Under GAO’s Alternative Fiscal Policy Simulations Percent of GDP 5 0 -5 -10 Baseline Extended Alternative Simulation -15 -20 2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050 Fiscal year Source: GAO’s August 2007 analysis. 13 Federal Fiscal Gap Under GAO’s Long-term Simulations - 2007-2081 (Maintaining Debt-to-GDP at or below current rate) Options to Close Fiscal Gap Federal Fiscal Gap Trillions of 2007 Dollars Baseline Alternative $31.1 $54.3 Share of GDP 4.3% 7.5% % Increase In Individual % Increase Income in Revenue Taxes 22.9% 39.9% 50.6% 88.2% % Decrease In NonInterest Spending 23.6% 41.0% Source: GAO August 2007 analysis. 14 Appendix B: Objectives and Countries Included in Study 15 Objectives • Where, how, and why accrual budgeting is used in select OECD countries and how it has changed since 2000; • What challenges and limitations were discovered and how select OECD countries responded to them; • What select OECD countries perceived the effect to have been on policy debates, program management, and the allocation of resources; • Whether accrual budgeting has been used to increase awareness of long-term fiscal challenges and, if not, what is used instead; and • What the experience of select OECD countries and other GAO work tell us about where and how the increased use of accrual concepts in the budget would be useful and ways to increase the recognition of long-term budgetary implications of policy decisions. 16 Countries Included in Study To address these objectives, we primarily focused on the six countries: • • • • • • Australia, Canada, Iceland, the Netherlands, New Zealand, and the United Kingdom. We also did a limited review of two other nations— Denmark and Switzerland—that have recently expanded the use of accrual measures in the budget and two countries—Norway and Sweden—that considered expanding the use of accrual measurement in the budget but decided against it. 17