Long-Term Budget Projections: Can They Help Governments Address The Ageing Problem? Presentation by

advertisement

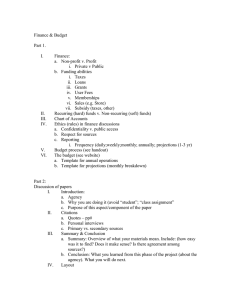

Long-Term Budget Projections: Can They Help Governments Address The Ageing Problem? Presentation by Barry Anderson At the 2006 Meeting of the OECD Asia Senior Budget Officials Network Bangkok, Thailand December 14-15, 2006 1 Outline Goals of Presentation Why do long-term projections? How are long-term projections prepared? How can long-term projections be used? An example of the use of long-term projections 2 Goals of Presentation Increase your awareness of long-term budget projections as a mechanism to assess fiscal risks Describe how long-term projections are made Describe how long-term projections can be used Provide and discuss an example of their use This presentation is based on OECD’s recent paper: “Assessing Fiscal Risks Through Long-Term Budget Projections” by Paal Ulla, which was presented at the 27th Annual Meeting of Senior Budget Officials held in June 2006 in Sydney. 3 Why Do Long-Term Projections? Addresses fiscal sustainability by identifying the longterm fiscal consequences of near-term political decisions Promotes transparency by forcing the estimation of the costs and consequences of policy actions Better quantifies significant fiscal risks—and thus helps plan for funding core functions—through use of sensitivity analysis Allows for analyses of contingent liabilities and the potential costs of natural disasters Most of all, unlike generational accounting & balance sheet analysis, it is relatively easy to understand & use 4 How are long-term projections prepared? Demographics Economics Current policy baseline – Spending • Age related • Other mandatory • Discretionary • Contingent liabilities – Revenues – Debt service 5 Demographic Projections The most important are: – Life expectancy – Fertility rates – Net immigration But demographic factors usually don’t change quickly, and immigration changes have to be huge to have much of an influence 6 Economic Projections The most important are: – Productivity – Labour market participation – Interest rates As the future is unknowable, sensitivity analysis is particularly valuable Use of past trends as possible indicators of the future can also be instructive 7 Current Policy Baseline A good starting point in that it permits displaying the potential costs of proposed legislation Assumes current policies/laws are in place until/unless they expire under law The major exception to this unchanged policy baseline is revenues—see below 8 Age Related Spending Public pensions Health Long-term care Education Unemployment 9 Other Spending Categories Other mandatory – Usually done as a percentage of GDP Discretionary – Usually done as a percentage of GDP Contingent liabilities – Credit, especially insurance & loan guarantees – Government-owned enterprises – Public-Private Partnerships – Fiscal consequences of natural disasters 10 Revenues The unchanged policy scenario can be unrealistic here. – Even if kept constant in real terms, real growth over the long run would eventually push the entire population to paying income taxes at the highest marginal rate. So, an option is to keep the overall tax rate constant on household income. 11 Debt Service Base is determined by above calculations Strongly influenced by interest rates 12 How can long-term projections be used? Sensitivity analyses on, for example: – Life expectancy – Immigration rates – Productivity growth – Size if the labour force – Pension reforms – Health care expenditures – Interest rates – Medium-term objectives 13 Examples of the Time Frames Covered in Long-Term Projections Projection Time Frame Covered Australia 40 years Canada 10 years Denmark 10 years Germany 45 years New Zealand 45 years Norway 55 years United Kingdom 50 years United States 75 years European Commission 45 years 14 An Example of the Use of LongTerm Projections Based on a Special Policy Briefing before the Lisbon Council on the “Sustainability of Public Finances” by Joaquin Almunia, EC Commissioner for Economic and Monetary Affairs, Brussels, October 9, 2006. (http://www.lisboncouncil.net/index.php?option=com_content&ta sk=view&id=32&Itemid=&lang=en) See also “The Long-Term Sustainability of Public Finance in the European Union”, a report by the European Commission Services, October, 2006. (http://ec.europa.eu/economy_finance/publications/european_ec onomy/2006/ee0406sustainability_en.htm) 15 Population Pyramids for EU25 2004 2050 16 Population Pyramid Summary for the UNITED STATES, 2004 & 2050 17 Population Pyramid Summary for AUSTRALIA, 2004 & 2050 18 Population Pyramid Summary for JAPAN, 2004 & 2050 19 Population Pyramid Summary for THAILAND, 2004 & 2050 20 Population Pyramid Summary for KOREA, 2004 & 2050 21 Population Pyramid Summary for SINGAPORE, 2004 & 2050 22 Population Pyramid Summary for INDIA, 2004 & 2050 23 Population Pyramid Summary for CHINA, 2004 & 2050 24 The EU Sustainability Gap* = 2¼% of GDP (*the gap between the structural budgetary position in 2005 and the 60% reference value used by the EC) 25 Impact of Changes in Assumptions on the Sustainability Gap for the EU Demographic & Economic Assumptions Higher life expectancy, of which: % of GDP .5 -pensions .2 -health care .2 -long-term care .1 Higher labour productivity -.3 Higher employment of older workers -.2 Higher employment if due to: -an increase in the labour supply -.1 -a decrease in the NAIRU -.3 Higher interest rates .2 26 Employment Rates Projected to Increase in the EU 27 The Cost of Delay in Implementing Structural Government Balance by 2010 Selected Countries % of GDP Portugal 1.4 Hungary 1.3 Germany .7 Italy .7 Luxembourg .7 France .6 Greece .6 United Kingdom .6 Czech Republic .4 28 Average Exit Age from the Labour Market in 2004 Luxembourg 57.7 Italy 61.0 Poland 57.7 Netherlands 61.1 Slovak Republic 58.5 Germany 61.3 Austria 59.2 Denmark 62.1 France 58.9 United Kingdom 62.1 Belgium 59.4 Portugal 62.2 Greece 59.5 Spain 62.2 Czech Republic 60.0 Ireland 62.8 Finland 60.5 Sweden 62.8 Hungary 60.5 29 The Benefits of Implementing Balance Budgets (MTO Scenario) by 2010 30 Commissioner Almunia’s 3-pronged Strategy to Ensure Sustainability 31 Commissioner Almunia’s Conclusions “The status quo is not sustainable and therefore not an option.” More movement towards structural balance in needed. “Growth potential needs to be improved by raising productivity and employment and this means that Europe’s social models have to be adapted.” “Structural reforms, notably in pensions, should improve government finances over the long-term and make Europe’s social models more sustainable.” “Implementing the Lisbon strategy by fostering productivity, employment creation and adaptability of the economies is paramount, as it is the best way to increase economic growth and prosperity and contributes to fiscal sustainability.” The “challenge is considerable, but manageable.” This is supported by the progress towards sustainability made by countries who have cut deficits and reformed pension systems. “Our future is in our hands.” 32 My Observations There are no easy answers. – Higher growth alone is not sufficient. – Higher productivity alone is not sufficient. – Higher population or labour force growth alone is not sufficient—and mechanisms to induce greater labour force participation are not cheap or easy. Higher taxes and/or higher debt can have serious detrimental effects. Thus, benefit cuts must be part of a solution. The sooner a country begins, the easier it will be. For example, the best way to prevent firing public employees in the future is not to hire them today. Incorporating long-term projections into the annual budget process is worthwhile. 33