Top-down Budgeting A Tool for Central Resource Management December 15, 2006

advertisement

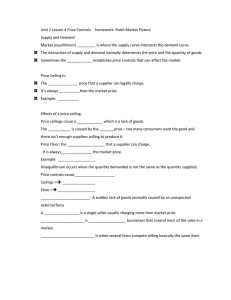

2006 OECD Asian SBO Top-down Budgeting A Tool for Central Resource Management December 15, 2006 Korea Institute of Public Finance John M Kim, PhD jhrv@kipf.re.kr Outline 1. What is it? 2. Why do it? 3. How to do it? 4. Caveats 2 What is Top-down Budgeting? KO REA INSTITUTE O F PUBLIC FINANC E It is not: Bottom-up Budgeting – – – Traditional way of budgeting Sum of ministry budgets Total budget • Difficult to control aggregates (total budget, deficit) • Difficult to control allocation among major sectors – Defense vs. pollution control vs. infrastructure, etc. Additional Problems • Focus on annual numbers (myopic) • Inefficient process – Iterative negotiations (game-playing & adjusting for totals) – Inability to utilize ministries’ expertise 3 What is Top-down Budgeting? (2) KO REA INSTITUTE O F PUBLIC FINANC E It is: Budgeting in 2 Steps ① Ceilings (aggregate numbers) 1) Decide total spending & deficit levels (agg. ceiling) 2) Decide allocation among major policy areas (sectoral ceilings: about 30) – Defense vs. pollution control vs. infrastructure, etc. ② Intra-sectoral allocations (details) 1) Ministry/agency budgets 4 What is Top-down Budgeting? (3) KO REA INSTITUTE O F PUBLIC FINANC E It is: A Division of Roles/Responsibilities ① Ceilings (aggregate numbers) 1) Final decision by PM & Finance Minister 2) Focus on Aggregate fiscal management Medium-term perspective (multi-year ceilings) Policy priorities ② Intra-sectoral allocations (details) 1) Ministries formulate their own budgets 2) But must follow rules 5 What is Top-down Budgeting? (4) KO REA INSTITUTE O F PUBLIC FINANC E It is: ① Effective for fiscal consolidation ② A key tool for enforcing MTEF (NFMP) decisions (ceilings are often multi-year limits) ③ Ensures spending is aligned with priorities ④ Efficient in time and effort ⑤ Utilizes ministries’ expertise 6 Outline 1. What is it? 2. Why do it? 3. How to do it? 4. Caveats 7 Urgency of Reform? KO REA INSTITUTE O F PUBLIC FINANC E Huge deficits ca.1990 in many OECD countries forced them to adopt major fiscal reforms 1991 • Fiscal 1992 1993 1994 1995 1996 1997 1998 1999 2000 Balance (% GDP) Australia -3.8 -6.0 -5.6 -4.6 -3.7 -2.2 -0.5 0.6 1.6 0.1 Canada -8.3 -9.1 -8.7 -6.7 -5.3 -2.8 0.2 0.5 1.6 3.2 Denmark -2.4 -2.2 -2.9 -2.4 -2.3 -1.0 0.4 1.1 3.2 2.5 1.8 1.4 2.5 3.1 4.2 3.8 3.6 1.9 3.1 6.9 Netherlands -3.2 -4.4 -3.6 -4.2 -4.2 -1.8 -1.1 -0.8 0.4 2.2 Sweden -2.0 -7.8 -11.4 -10.8 -7.7 -3.1 -1.6 2.1 1.3 3.7 Utd. Kingdom -3.1 -6.4 -7.9 -6.7 -5.8 -4.4 -2.2 0.4 1.1 1.6 OECD -3.7 -4.6 -5.0 -4.2 -3.9 -3.2 -1.8 -1.4 -0.9 0.0 Korea 8 Different Motivation for Korea KO REA INSTITUTE O F PUBLIC FINANC E Top-down adopted as key part of 4 fiscal reforms 1) Need for longer-term perspective Anticipate need for controlling future spending growth in social welfare, etc. 2) Efficiency a. Need to focus on broader policy priorities b. Eliminate unproductive games in budget negotiations c. Utilize ministries’ expertise 3) Need to focus on performance management, rather than controlling inputs 9 (What are Korea’s 4 Reforms?) KO REA INSTITUTE O F PUBLIC FINANC E 1. National Fiscal Management Plan – 2. Medium-term (5-year) fiscal plan for 14 sectors Top-Down budgeting – – 3. Tier 1: Fixed spending envelope for each sector/ministry Tier 2: Autonomy for line ministries in own budgets Performance Management – – 4. Assess performance of spending programs Enhance link between performance and budget Digital Budget and Accounting System – – – Program Budgeting Accrual Accounting Computerization of accounting system 10 (Why the 4 Reforms?) KO REA INSTITUTE O F PUBLIC FINANC E Anticipate fiscal difficulties driven by aging & other socioeconomic changes – Population aging and low fertility rate • Old population (65 and above): 7.2 (2000) 14.4(2019) • Total fertility rate: 6.0(1961) 2.1(1982) 1.19(2003) Less workers must support welfare of more elderly people Public pensions and health care financing will suffer most – Society demands better quality of life (social welfare, education, culture, environment) – Economic growth slowing down so will tax revenues Increase rate of national tax revenues(annual average) 1980~1990 1991~1997 1998~2003 2004~2008(Proj.) 17.0% 14.7% 8.6% About 8% – Emphasis on participation and transparency Spending growth may outrun revenue increase, so try to get fiscal system in good shape before it’s too late 11 (Some Background: Current Fiscal Status) KO REA INSTITUTE O F PUBLIC FINANC E Up to the financial crisis, Korea’s public finances were solid, thanks to two decades of balanced budgeting Some deterioration resulted from coping against crisis (national debt more than doubled), but fiscal situation remains better than most other OECD countries <Korea’s National Debt> Total Debt (in tn. won) % of GDP 1997 60 12.3 2000 111 19.2 2001 122 19.6 2002 134 19.5 2003 166 23.0 2004 204 26.2 <General Government Debt in OECD Countries, 2003> Korea USA Japan OECD Total Debt (% of GDP) 23.0 62.8 157.3 76.0 What does this mean for the 4 Reforms? Korea’s reforms are not driven by an immediate crisis, but this may end up somewhat undermining the momentum of the reforms 12 Top-down vs. Bottom-up KO REA INSTITUTE O F PUBLIC FINANC E Comparison of Bottom-up & Top-down Approaches Bottom-up Top-down Ministry-by-ministry analysis that ignores economic forecasts Macro-oriented fiscal analysis based on economic forecasts Annual, myopic time horizon Multi-year perspective, especially for investments Time-consuming negotiations Delegated authority Ownership of proposals is more agency-specific Creates joint ownership of proposals Reactive Proactive 13 Top-down vs. Bottom-up (2) KO REA INSTITUTE O F PUBLIC FINANC E • Top-down and bottom-up methods are complementary − Information for evaluating new initiatives − Program reviews for monitoring programs/activities Approaches to Determining Expenditure Ceilings Top-Down Approach Bottom-Up Approach Overall Ceiling Sectoral Ceiling Overall Ceiling Sectoral Ceiling Program Review Sweden ○ ○ - - △ Netherlands ○ ○ - △ ○ Utd. Kingdom ○ ○ - △ ○ Denmark ○ ○ - △ ○ Korea ○ ○ - △ ○ Canada ○ - - ○ ○ Australia ○ - - ○ ○ Chile ○ - - ○ ○ ○ : actively used, △ : used as reference, - : not used 14 Results? KO REA INSTITUTE O F PUBLIC FINANC E No more excessive budget requests – Increase rate of budget requests in the general account dropped significantly: 30.8%(’04) 11.7%(’05) 7.0%(’06) Self-initiated restructuring of spending by line ministries – Restructuring of multi-year programs and introduction of new programs have nearly doubled <Comparison of FY 2004 and FY 2005 budget requests> ’04 Budget ’05 Budget Change Programs 308 416 134 Restructuring Amount multi-year programs -1.6 -2.7 -1.1 (trillion won) Introduction of new programs Programs 351 459 108 Amount (trillion won) 1.5 3.0 1.5 15 Outline 1. What is it? 2. Why do it? 3. How to do it? 4. Caveats 16 Example of Linking Multi-year Plans to the Annual Budget (Sweden) Current Year (n) KO REA INSTITUTE O F PUBLIC FINANC E Plans for Future Years n+1 n+2 n+3 2004 FY 2005 •Total Ceiling Fixed •Finalize 27 sect. ceilings and annual budget FY 2006 •Total Ceiling Fixed •Adjust 27 sect. ceilings using budget margin FY 2007 •Total Ceiling Fixed •Set 27 Sect. Ceilings + budget margin 2005 FY 2006 •Total Ceiling Fixed •Finalize 27 sect. ceilings and annual budget FY 2007 •Total Ceiling Fixed •Adjust 27 sect. ceilings using budget margin FY 2008 •Total Ceiling Fixed •Set 27 Sect. Ceilings + budget margin 2006 FY 2007 •Total Ceiling Fixed •Finalize 27 sect. ceilings and annual budget FY 2008 •Total Ceiling Fixed •Adjust 27 sect. ceilings using budget margin FY 2009 •Total Ceiling Fixed •Set 27 Sect. Ceilings + budget margin 17 Budget Formulation in Bottom-up vs. Top-down Systems PUBLIC FINANC E Strategic resource allocation emphasized Line Ministries Before MoF NFMP Now KO REA INSTITUTE O F MoF Budget Requests Budget Formulation ( by line items) (line item-oriented) Cabinet Meeting Total Ceiling Sectoral Ceilings Line Ministries Budget Formulation Within Ceilings Y+1 MPB Consultation and Review Y+1 Y+5 18 Determining Expenditure Ceilings KO REA INSTITUTE O F PUBLIC FINANC E Overall Ceiling Prudent Economic Assumptions (Growth, etc.) – Sensitivity analysis – Independent panel or private sector forecasting – Built-in bias for lower growth rate ② Fiscal Rules for Good Discipline – Sweden: structural surplus of 2% GDP – Chile: Structural surplus of 1% GDP – UK: Balance current budget over econ. cycle – Surplus automatically goes to repaying debt ① 19 Determining Expenditure Ceilings (2) KO REA INSTITUTE O F PUBLIC FINANC E Sectoral Ceilings – Must not affect overall ceiling – Usually overlaps with ministerial boundaries (good program budget design) − New initiatives may be required to be funded from savings from existing programs 20 Determining Expenditure Ceilings (3) KO REA INSTITUTE O F PUBLIC FINANC E Operating/Capital Ceilings – Ministries tend to favor operating expenses – Denmark: separate ceilings for current & capital expenses • − Sub-ceiling for salaries/wages in operating ceiling UK • Current expenses: Golden Rule • Capital expenses: Sustainable Investment Rule 21 Determining Expenditure Ceilings (4) KO REA INSTITUTE O F PUBLIC FINANC E Number of Ceilings – − Korea (200+) vs. Sweden (27) Optimal number is around 30 • More ceilings make budgeting decisions politically difficult • Need to give ministries room to exercise autonomy to ensure their proactive participation • This means Budget Office needs better tools: • Performance management • Information system to monitor execution • Enhanced analytical capacity for policy assessment 22 Determining Expenditure Ceilings (5) KO REA INSTITUTE O F PUBLIC FINANC E Buffers against Contingencies – Built-in buffers in prudent forecasts Windfalls (repay debt, tax cut, etc.) − Budget Margin • Overall Ceiling = Sect. Ceilings + Budget Margin • Covers unexpected changes (forecasts errors, etc.) and institutional reforms after ceilings were fixed • Usually does not cover new policy initiatives 23 Determining Expenditure Ceilings (6) KO REA INSTITUTE O F PUBLIC FINANC E Expenses in or excluded from ceilings? 1) Discretionary expenses usually included 2) Mandatory expenses (social security entitlements, etc., mandated by law) • Sweden, Korea, Chile, Netherlands: included • Canada, Denmark: excluded 3) Interest on debt • Sweden, Denmark: excluded • Chile, Netherlands, Korea: included 24 Determining Expenditure Ceilings (7) KO REA INSTITUTE O F PUBLIC FINANC E Funding for new policy initiatives • Sweden: must come from existing ceilings • Most countries have review process to judge new initiatives adjust ceilings • Australia, Canada: Cabinet committees • Netherlands, Denmark: simply verify fit with coalition agreement • Chile: pooled “Bidding Fund” from savings on obsolete or poorly performing programs 25 Outline 1. What is it? 2. Why do it? 3. How to do it? 4. Caveats 26 Conditions for Top-down Budgeting KO REA INSTITUTE O F PUBLIC FINANC E Good monitoring system to compensate for delegation of authority to ministries – – Enhanced policy capacity + Behavioral change – – Budget Office: better forecasts & projections, must be able to defend fiscal rules, but work better “together” with line ministries Ministries: need to learn internal allocation decisions Strong PM & Finance Minister Commitment to rule-based budgeting (Fiscal Rules) – Performance & program reviews Information system to monitor execution Remove arbitrariness in budgeting decisions, but leave room for flexibility and judicious discretion/autonomy Support from the legislature 27 Remaining Tasks (Korea) KO REA INSTITUTE O F PUBLIC FINANC E Areas for improvement – – – – Consensus and understanding on the top-down system Ex-ante consultations with line ministries when setting spending ceilings Further expansion of autonomy at line ministries Insufficient preparation and guidelines by MPB Future plans – – – – Surveys and consultations with line ministries Sectoral and ministerial spending ceilings set after sufficient discussions Active use of performance assessments to restructure spending programs Detailed budget formulation guidelines 28 KO REA INSTITUTE O F PUBLIC FINANC E This ends the presentation Thank You! 29