The University of Tennessee Health Science Center _____________________________________________________________________

advertisement

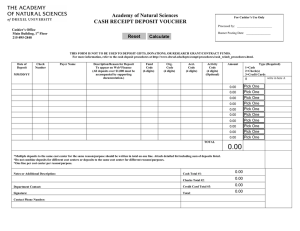

The University of Tennessee Health Science Center _____________________________________________________________________ RECEIVING AND DEPOSITING MONEY _____________________________________________________________________ Effective Date: 07/01/78 Fiscal Procedure F310 Revision (3) 12/15/03 _____________________________________________________________________ University Fiscal Policy F10310 Receiving and Depositing Money* sets forth in detail the procedures and guidelines to be followed by departments and offices in receipting and depositing money received. Additionally, the University’s Best Business Practices in the IRIS Environment **( Business Practices - IRIS) provides instruction for departments utilizing the IRIS accounting system for receipting deposits. These documents should be utilized as the official reference for receipting and depositing money received with the exception of and in addition to the notations set forth below which are specific to the Health Science Center (HSC). At the HSC administrative responsibility for monies received is assigned to the Bursar. Departments which routinely receive monies may be assigned the responsibility for preparing deposit slips and for entering that department’s deposit information into IRIS. Departments or offices which receive money only occasionally should carry the money to the Cashier’s Office. General Policies on Receiving Money Departments which receive an electronically (wire) transferred payment must notify the Cashier’s Office via e-mail of the expected amount and the account to be credited. Policy Item 2. The HSC requires the bookstore and clinics or any other area which receives money daily to deposit each day’s receipts no later than noon of the following day. All other campus areas must deposit as quickly as possible but no later than three business days from the date the department receives the payment. (See also Policy Item 14 “Frequency of Transmittals and Deposits.”) Policy Item 4. HSC departments receiving money should develop written procedures for handling the money. Fiscal Policy FP10310* Appendix C Sample Written Procedures provides a guide or Internal Audit may be contacted for advice. These procedures should be maintained by the person handling the money and by the department administrator. Recording Money Received Policy Item 6. The University receipt book Form T-43 is used at the HSC unless otherwise stipulated by the Chief Business Officer. This form is available from the Cashier’s Office or on-line as Appendix D of University Fiscal Policy FP10310*. Policy Item 6.a. Cash payment must be in the possession of the employee preparing the receipt before a receipt may be given to the payer. Control Guidelines Policy Item 7. Departments routinely receiving checks are required to use an individualized endorsement stamp that is provided by the HSC Cashier’s Office. Policy Item 8. Departments should never assign duties involving receipt of payments to employees from temporary personnel services. An employee receiving money should not perform reconciliation of the fund. Policy Item 9.b. Deposits should never be sent through campus or other mail. Deposits are to be carried directly to the Cashier’s Office or the appropriate bank. Preparing Bank Deposits. Policy Item 15. Most HSC departments should follow the procedures set forth in the Best Business Practices in the IRIS Environment, “Deposits” section. See also Policy and Procedure Items 29-30 regarding credit and debit card deposits. Policy Item 15.a. Large coin deposits should be made on a separate deposit slip from currency and checks and placed in a sealed cloth bag (provided by the Cashier’s Office) and labeled. Small coin deposits (less than $20) should be placed in a sealed envelope and included with the currency and check deposit. Policy Item 15.d. When deposits are transported in a locked moneybag, departments should attach a photocopy of the deposit slip and any deposit slip attachments (such as a supplementary listing of payers) to the bank deposit transmittal on the outside of the bag. This enables the Cashier’s Office to assist the bank when questions concerning the deposit arise. HSC Campus Police use a Money Bag Movement Report to document the physical transfer of the deposit. The departmental employee must verify that Campus Police have possession of each/all money bags before signing the Report. Deposit Document or Form T-33. Policy Items 16 and 17. Follow procedures set forth in the Best Business Practices section on “Deposits.” Transporting Deposits and Change Requests by Security Officers. Policy Item 18. HSC Campus Police will transport deposits in a locked moneybag upon advance request or scheduling. Campus Police document the transportation on a “Money Bag Movement Report” rather than initialing the T-33. Collecting and Paying State Sales Tax. Policy Items 20-25 The Accounts Payable Office coordinates the HSC sales tax reporting function. HSC departments required to report sales must submit completed forms to Accounts Payable by the tenth (10th) calendar day of each month. All sections of the form must be completed and the form must be signed by the department administrator. Accounts Payable reviews the forms for completeness and forwards them to the Treasurer’s Office for payment. Accepting Credit and Debit Cards. Policy Item 26. Departments interested in accepting credit and debit cards must request advance approval from the Chief Business Officer. If approval is granted the campus Internal Audit Office should assist the department in establishing proper controls and procedures prior to acceptance of credit and debit card payments by the department. Internet Sales. Policy Item 27 Prior approval of the Chief Business Officer is required to engage in Internet sales. Internal Audit is available for consultation on development of procedures to handle Internet sales. Credit and Debit Card Deposits. Policy Items 29-30 HSC departments should follow procedures set forth in the Best Business Practices in the IRIS Environment. Paper transactions are not accepted at the HSC. Custody of Third Party Funds. Policy Items 32-34. Prior approval for handling third-party funds must be obtained from the HSC Chief Business Officer. ___________ * Click here to access Fiscal Policy: FP 10310 Receiving & Depositing Money ** Click here to access Best Business Practices in the IRIS Environment: Business Practices - IRIS