New ISAE Questions on Trade credit OECD Workshop on Business and

advertisement

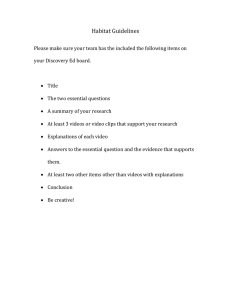

New ISAE Questions on Trade credit by Marco Malgarini ISAE, Rome OECD Workshop on Business and Consumer Tendency Surveys Rome, September 19th 2006 New ISAE Questions on trade credit • Starting from the first quarter of this year, ISAE has inserted in its manufacturing survey two new questions on trade credit, administrated in April, July, October and January, with reference, respectively, to the first, second, third and fourth quarter of the year. – In the last quarter, days of trade credit allowed to the clients have: • Increased • Stayed the same • Decreased – In the last quarter, days of trade credit obtained from the suppliers have: • Increased • Stayed the same • Decreased Definition of trade credit • A simple definition of trade credit is available on Wikipedia, the publicdomain encyclopaedia on the web: – “Trade credit exists when one provides goods or services to a customer with an agreement to bill them later, or receive a shipment or service from a supplier under an agreement to pay them later”. • Trade credit may be supplied: – in net terms, in case the payment is the same as for the “cash” payment – On a two part terms basis, if the cash payment is given a discount • According to some estimates, at the end of the nineties in Italy trade credit amounted to some 500 billions euro, some 10% more than the traditional short term bank credit (Cannari, Chiri e Omiccioli, 2005). The economics of trade credit • Two main explanations have been advanced in the literature to explain the supply and demand of trade credit: – “Real” motivations – Financial and transactional motivations • Real explanations of trade credit: – TC is seen as a way for the firm to strengthen the relationship with its clients, in case there is asymmetric information between the seller and the buyer – It can be expected to vary over time, possibly showing a countercyclical behavior, the firms using more trade credit to stimulate weak demand. Real Explanations of trade credit • More specifically, TC may be considered as a method: – To warrant product quality: • payment is due only after the shipment, once the client has been able to evaluate the characteristic of the product • Supply of trade credit will be negatively correlated with the firm reputation and positively with the quality of the product and the difficulty in its evaluation; • It will be particularly used: – by new or small firms – when the quality of the product is particularly important or difficult to estimate – when the relationship with the client is unstable – As an insurance against high demand variability: • It will be supplied in case of weak demand, in order to stimulate inventory accumulation. • It will be counter-cyclical • It will be higher in sectors where demand is more volatile and in which there are high stocking costs (Emery, 1997). Financial explanations of trade credit • With financial markets imperfections, the financial structure is not neutral for the firm as postulated in the Modigliani-Miller theorem. • Use of trade credit may be determined by: – fiscal distortions – asymmetric information – agency costs • In these cases, trade credit may vary not only across industries, but also over time, according to financial market conditions and tax policies Financial explanations of trade credit • Fiscal effect: if clients have a lower fiscal rate they would show a preference towards trade credit; on the other hand, supply of trade credit will be positively correlated with the fiscal rate of the supplier (Brick and Fung, 1984). • Asymmetric information and agency costs: – trade credit is supplied if (Schwartz (1974)), the interest rate paid by the supplier is lower than that of the (credit rationed) client – Similarly, trade credit may be seen as a “last resort” for firms that have not been able to obtain short term credit on the financial markets (Jaffe and Stiglitz, 1990). • In this cases trade credit supplier is able to better evaluate (with respect to financial institutions) the client accountability, and has also stronger enforcement powers towards him. Transaction explanations of trade credit o According to this explanation, firms demand trade credit in order to: o optimize cash flows and obtain a better synchronization between turnover and payments (Schwartz, 1974). o reduce money demand for transactions and precautionary motives (Ferris, 1981). o In both cases, trade credit will show o positive correlation with firm specific characteristic (e.g. cash flow variability, uncertainty) o wide intra-industry variability o inter-temporal stability. Trade credit and the business cycle • According to transactions explanations TC is expected to vary across industries, but to be stable over time • According to “real” and financial explanations, TC will vary also over time. • Cannari, Chiri and Omiccioli (2005) find that TC shows a negative correlation with business cycle • Moreover, according to the financial explanation, trade credit may also influence the transmission mechanism of a monetary policy impulse Trade credit and the business cycle • A tightening of monetary policy reduces financial resources available to firms, inducing them to cut back investment (especially liquid inventories) • Impact of monetary policy may be less strong if trade credit is available: instead of cutting inventory, firms may – raise trade credit demanded (i. e. asking for further and longer payment delay), or – supply less credit to their clients • In this sense, TC may be seen as a substitute to bank credit, especially for small firms or in general for firms having difficulties in resorting to more traditional forms of short term debt (Meltzer, 1960). First results Credit from suppliers 100 I trim IItrim 90 80 70 60 50 40 30 20 10 0 Increase Stable Decrease First results Credit from suppliers 100 I trim IItrim 90 80 70 60 50 40 30 20 10 0 Increase Stable Decrease First results Credit supplied to clients by size of the firm 90 I trim II trim 80 70 60 50 40 30 20 10 0 Increase Stable Small Decrease Increase Stable Medium Decrease Increase Stable Large Decrease Further research • Results provided are derived from a very limited data-base • In the future it is possible to exploit the potential information content of the ISAE survey, considering other firm-specific data beside those on trade credit: – structural data on the size, industry and region of residence of the firms, – cyclical figures on the current and future state of demand, production, liquidity and inventories Trade credit supplied and demand, by industry 35 30 25 Credit supplied 20 15 10 5 0 -40 -20 0 20 -5 -10 Demand 40 60 80 Trade credit obtained and production expectations, by industry 20 15 10 Credit obtained 5 0 0 10 20 30 40 -5 -10 -15 -20 -25 Production expectations 50 60 70 Trade credit obtained and inventories, by industry 20 15 10 Credit obtained 5 0 -10 0 -5 5 -5 -10 -15 -20 -25 Inventories 10 15 20 Trade credit supplied and liquidity, by industry 35 30 25 Credit supplied 20 15 10 5 0 0 10 20 30 40 -5 -10 Liquidity 50 60 70