MOBILIZING PRIVATE RESOURCES FOR FINANCING INCLUSIVE GREEN GROWTH Philippine Experience

advertisement

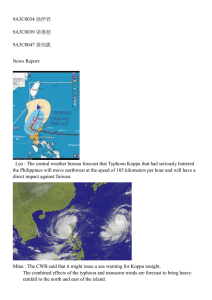

MOBILIZING PRIVATE RESOURCES FOR FINANCING INCLUSIVE GREEN GROWTH Philippine Experience Jerry Clavesillas Director, BMSMED Department of Trade and Industry 8 About the PHILIPPINES • 7,000 islands, 30,000 km2 • GDP 6.2% (2012) 7.6% Gross Domestic Product (GDP) 6.2% 6 3.9% 4 2 0 • • Employment generation: 997,000 (2012) Gains in industry sectors, particularly services 2010 2011 2013 Source: National Statistical Coordination Board National Income Accounts, Growth Rates (in %) Industry Origin 2010 2011 2012 Agriculture, hunting, forestry, fishing (0.2) 2.7 0.8 Industry 11.6 2.3 5.4 Services 7.1 5.1 7.7 Source: National Statistical Coordination Board Overview of Philippine Micro, Small and Medium Enterprises (MSMEs) Assets = Eu 52,000 Employees = 1 to 9 Contribution of MSMEs • 99.6% of total firms • 61% of employment 35.7% of value added • Micro - 90.6% (743,250) MSMEs - 99.6% (816,759) Small - 8.6% (70,222) RP Enterprises (820,255) Large - 0.4% (3,496) Source: 2011 List of Establishments, NSO Medium - 0.4% (3,287) Philippines and Climate Change World Risk Report 2011 1 Vanatu 2 Tonga 3 Philippines Typhoon Ondoy (September 2009): 350M Euros (World Bank, 2013) 4 Solomon Islands 5 Guatemala Storm surges will affect 14% of the total Typhoon Pedring (September 2011) and Typhoon Quiel (October 2011): population and 42% of 10M Euros, 80 dead, 500,000 population persons the coastal displaced (World Bank, 2013) Figure 1 Most Vulnerable Areas to Potential Climate Hazards in the Philippines Typhoon Sendong 4oC = 50cm sea level rise Typhoon Pablo Source: Department of the (December 2011): Environment and Natural Resources (December 2012 ): 2010:Euros, Philippine Strategy for Climate 75M 1,200 dead, 670m EUR Change Adaptation, 2010 - 2022 1,067 Dead, 834 missing 1M persons displaced 2,066 Injured Annual cost of damage due to extreme weather events = 1 percent of GDP/yr (1990-2008) Public Policy frameworks • Policies to promote a Globalization green economy • Solid Waste • • • • Management Act Clean Air Act Clean Water Act Renewable Energy Act National Climate Change Action Plan BE A2F MSME P&E A2M Market System Development Green Finance in the Philippines Green Investments • Renewable energy (solar, biomass, mini hydropower) • Cleaner production • Water conservation • Proper waste management • Energy efficiency RELENDING FACILITIES SUSTAINABLE ENERGY FINANCE PROGRAM (SEF) Challenges of Financing Inclusive Green Growth • Consciousness and responsibility towards the environment • Understanding the economic benefits of going green • Documented success stories • Availability, accessibility of technology and expertise on greening business operations Measures to Overcome the Challenges • International level • Revitalize the clean development mechanism (CDM) and carbon trading market • National architecture for green finance • In the Philippine setting, enterprise level interventions are critical to have a larger impact on the national economy • Enhancing the knowledge and awareness of MSMEs on the benefits of going green, technology and expertise available • Incentives for enterprises to go green • Adopt greening practices that require zero or minimal investments • Reduce documentary requirements, lower interest rates, collateral substitutes and cash-flow based lending Final Message • Green finance plays an important role in greening the national economy • In the Philippines, we need to approach it from a bottom- up perspective, looking at the importance of the MSMEs for a Green Economy • For MSMEs Green Finance should come in only where it is appropriate and economically beneficial for the MSME in the medium term. Thank you very much for your attention Maraming salamat Po! Jerry Clavesillas Director Bureau of Micro, Small and Medium Enterprise Development Department of Trade and Industry (BMSMED-DTI) jtclavesillas@yahoo.com