METHODOLOGICAL SURVEY ON HOUSEHOLDS’ FINANCIAL ASSETS AND LIABILITIES (TABLE 7HH)

advertisement

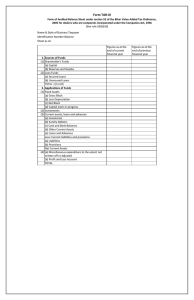

METHODOLOGICAL SURVEY ON HOUSEHOLDS’ FINANCIAL ASSETS AND LIABILITIES (TABLE 7HH) __________________________________________________________________________________ Country: Respondent: E-mail: __________________________________________________________________________________ 1. Period coverage and frequency of available data 1.1. Do your Q4 data correspond to your annual data? If not, why? Response: 1.2. Do data cover the calendar year? Response: 1.2.1. If not, when does the fiscal year start, at which quarters (Q2/Q3/Q4)? Response: 1.3. The period requested by the OECD Secretariat is 1995-up to now. If the data sent to the OECD do NOT cover this entire period, do you intend to extend your data backwards in the near future? If so, when and what year will the time series begin? Response: 1.4. Are data available for a longer period of time (before 1995)? If so, could you please provide the OECD with the entire historical time series? Response: 2. Sources 2.1. Are the data compiled on the basis of information sourced from surveys conducted specifically for the T7HH collection, or extracted/derived from the already compiled Financial Balance Sheets? Please describe your institutional arrangements for the production of data regarding the financial assets and liabilities of households. Response: 2.2. Are data comparable and consistent with data reported for the corresponding sectors of the Financial Balance Sheets (Table 720, non-consolidated)? Response: 2.3. Please describe your policy in terms of data revision (time table and numbers of revisions) by referring to each specific quarter if necessary. Response: 3. Sector coverage 3.1. Please describe in detail the content of the sectors covered by your data, by reporting information on the institutional units covered by the SNA sectors and on any deviation of your data from the SNA sectors definitions. Please refer to the “Guidelines on Households’ Financial Assets and Liabilities”. -Sector S1M (Households and non-profit institutions serving households) Response: -Sector S14 (Households) Response: 4. Coverage and definition of financial instruments 4.1. Please refer to the annex and complete the table by reporting information on the financial instruments by specifying, when required, any deviations from the SNA definitions. Please refer to the OECD “Guidelines on Households’ Financial Assets and Liabilities”. 5. Compilation Method 5.1. Is direct information available for sector S14 and S1M? Response: 5.2. Specify the use of counterpart sector information to derive financial accounts for sector S14 and S1M when there is a lack of direct information. Response: 5.3. Explain the residual calculation of financial accounts of the household sector (for which information is missing or of unreliable quality). Response: 6. Method of valuation 6.1 Please specify the method of valuation of each financial asset and liability reported in T7HH if it differs from the specific general recording rules set by the SNA 2008, as reported in the table below: SNA 2008 rules on the valuation of financial assets & liabilities Instrument Loans - F4 Equity and investment fund shares/units - F5 Insurance pension and standardised guarantees - F6 General recording Exceptions on the general recording Nominal Market Some forms of equity are not traded on the stock market, as a consequence of which alternative methods, such as own funds at book value are applied. More information can be found in SNA 08, §13.71-13.75. Net present value of (expected) future claims or entitlements. * Nominal value refers to the amount the debtor owes to the creditor, which comprises the outstanding principal amount including any accrued interest. 7. Dissemination 7.1. Please indicate the URL (if any) of the main website or the exact name of national publications used to disseminate your data. Response: ANNEX INFORMATION REGARDING INSTRUMENTS Precise definitions are given for each instrument (assets and liabilities) in the document “Guidelines on Households’ Financial Assets and Liabilities”. For each item below, you are requested - to specify when the definition of your data deviates from the OECD definitions (reply by YES or NO in the third column) - if YES, to list the types of financial assets/liabilities included and their characteristics and give the exact definition of the instruments - if NO, to add any relevant comment, if needed Deviation from the definitions reported in the OECD Guidelines? (Y/N) Financial instruments Y or N Financial assets Investment fund shares (F52) Money market fund shares (F521) Non-MMF investment fund shares (F522) Real estate fund shares (F5221) Bond fund shares (F5222) Mixed fund shares (F5223) Equity fund shares (F5224) Other fund shares (F5229) Life insurance and annuity entitlements (F62) Life insurance and annuity entitlements, of which unit linked (F62A) Life insurance and annuity entitlements, of which non-unitlinked (F62B) Pension entitlements (F63) Pension entitlements managed by autonomous pension funds (F63F) Defined contribution plans (DC) (F63A1) Defined benefit plans (DB) (F63B1) Hybrid schemes (F63C1) Y: List the types of financial assets/liabilities included and their characteristics and give the exact definition of the instruments N: Add any relevant comment, if needed Pension entitlements, pension funds (F63H) managed by non-autonomous Pension entitlements, managed by insurers (F63I) Other pension plans, including unfunded pension plans (F63O) Liabilities Loans (F4) Short-term loans (up to one year) (F4S) Consumer credit (up to one year) (F4AS) Revolving credit (up to one year) (F4A1S) Non-revolving credit (up to one year) (F4A2S) Short-term loans for other purposes (F4CS) Long-term loans (more than one year) (F4L) Consumer credit (more than one year) (F4AL) Loans for house purchasing (F4BL) Long-term loans for other purposes (F4CL)