Tax Reform: An International Perspective

advertisement

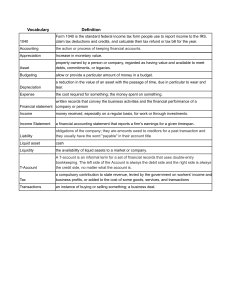

Tax Reform: An International Perspective The President’s Advisory Panel on Federal Tax Reform San Francisco March 31, 2005 By Jeffrey Owens Organisation for Economic Cooperation and Development OECD Member Countries OECD Member countries Countries which engage in Tax Dialogue 2 Since mid 1980s a Wave of Tax Reform in All OECD Countries Driven by: A fairer tax system • similar treatment for similarly placed taxpayers (horizontal equity) • achieve desired allocation of tax burden by income level (vertical equity) • improved compliance An efficient and competitive tax system • • promoting a competitive and flexible fiscal environment making work, savings and investment pay A simpler tax system • reduce compliance costs for taxpayers • reduce administrative costs for tax authorities Protecting the environment through tax and related measures 3 Main Characteristics of Tax Reform in OECD Countries Lower tax rates; broader tax bases Move towards flatter personal income taxes Move towards dual income taxes (lower rates on capital than on labor) Integrate social benefits into the tax system (earned income tax credits) Relief for taxation of dividend income Change in mix of income and consumption taxes (VAT) Reduction of complexity Introduction of market based environment instruments 4 Trends in the Taxation of Dividend Income (2000-2004) Country Reform Year Pre-Reform System Post-Reform System United States 2003 Classical Reduced scheduler PIT rate (15% federal) Germany 2001 Full imputation (with split rate) Classical (with PIT rate) 2002 Classical (with split rate) Partial inclusion Italy 2004 Full imputation Partial inclusion Korea 2001 Classical Partial inclusion Portugal 2002 Reduced scheduler PIT rate Partial inclusion Slovak Republic 2003 Classical Personal tax exemption Turkey 2003 Partial imputation Partial inclusion 5 60 50 40 Corporate and personal income taxes Social security contributions For more details, see Table 1 in the Appendix. Ita No ly rw ay Fr an c Fin e la Be nd lgi De um nm a Sw rk ed en Tax as % GDP Un Mex ic ite dS o tat es Ko re a Ja p Sw an it z e rl * an d Ire l an Au s tr d ali Po a * la n d* Slo va T k R urk e ep ub y lic * Ca na da Po Ne rtug al * Un w Ze ite ala dK n ing d do m Sp ain Gr ee Ge ce * rm Hu any ng ar y Ne t he * Cz r ec l h R and s ep ub li Ice c Lu l an xe mb d ou r Au g s tr ia The overall tax burden and structure 2003 Consumption taxes Other EU 15 Average 40.6 OECD 15 Average 36.6 30 20 10 0 6 18 For more details, see Table 1 in the Appendix. It al y Tax as % GDP Hu nga Cze ry ( ch *) Rep ubl ic Net her Slo lan vak ds Rep ubl ic ( *) Pol an d Un (*) i ted Sta Un i ted tes Kin gdo m Ge rm any Ir el an d Can ad a Sw i tze rlan d Me x i co Lux em bou rg No r wa y Jap an (*) Au st r ali a (*) Bel giu m Au st r New ia Z ea lan d Fin lan d Fra n ce Sw ed e n Den ma rk Ice l an d Ko r ea Por tug al ( *) Gr e ece (*) Tur key Spa in Change in tax to GDP ratios 1975 to 2003 16 14 12 10 8 6 4 2 0 -2 -4 -6 -8 7 Top personal and corporate tax rates 2004 Countries ranked by top PIT Rate Top CIT Rate PIT – EU average = 48 60.0 Top PIT Rate 50.0 PIT – OECD average = 44 CIT – EU average = 31 30.0 CIT – OECD average = 30 % 40.0 20.0 10.0 Ita ly Sp a Ic in e Sw la it z nd er la nd I Un re ite lan d d St at e Tu s rk Un e ite Po y la d n Ki ng d do G m re e Po ce rtu ga Ne Ko l w re Z a Lu e al xe a n m d bo u Hu rg ng ar Cz y M ec e x h i Sl c ov Re p o ak ub Re lic pu bl ic De n m a Sw rk ed en Fr an Be ce lg iu m F Ne inla n th er d la nd s Ja pa Au n s Au tria st ra l No ia rw G er ay m an Ca y na da 0.0 Includes Central, State and Local Taxes For more details, see Figure 2 and 3 in the Appendix. 8 ex ic Ne o K w o r Ze e al a a Ire nd la n Ja d A p Sw us a n tr Un it ze alia ite rla d nd St Un a ite Ic t e s e d Ki lan Lu n d xe gd m om bo Ca urg n Po ad rtu a G gal re e No ce rw a Sp y Sl ov D a ak e n in Re ma pu rk b Tu lic rk Ne Po ey Cz t la ec her nd h la Re nd pu s b Fi lic nl a Au nd st ria Hu Ital ng y a Fr r y an Sw c e e G de er n m Be an lg y iu m M The tax wedge – income tax and social security contributions as % of labor costs Single individual at average earnings 60 2004 50 40 % 30 20 10 0 Personal Income Tax Employee Social Security Contr. Employer Social Security Contr. and payroll taxes For more details, see Figure 4 and 5 in the Appendix. 9 DE HU NM NG A R K A RY SW ( 2 ED ) IC EN EL CZ A N EC O ND R H R WA EP Y U BL FI NL IC A PO N D L BE AN LG D IR IUM EL A SL AU ND O ST VA R K IA RE IT PU AL BL Y IC (2 NE F TH RA ) E N PO RL CE RT A N D U S G G AL R EE (3) CE UN IT ( T ED UR 2) KI KE NG Y DO M O EC G ER D M AN LU Y XE SP A M BO IN U NE M R G E W XI AU ZE CO A ST LA R AL N D IA SW K (2) IT O R ZE EA R LA CA ND N UN JA A D IT PA A ED N ST (2) AT ES VAT – tax rates and revenues (1) 30 2003 25 20 15 10 5 0 VAT/sales tax revenues as % of total tax revenues 1) Countries ranked from highest VAT standard rate to lowest rate. The comparisons include all levels of government 2) 2002 revenue figure VAT standard rate 3) 2001 revenue figure 10 Successful Tax Reform Requires Administrative Reform Tax administrations face challenges due to globalization • proliferation of tax shelters and abuse of tax havens • changing attitudes towards compliance The response of OECD tax administrations • • • • • • move to integrated tax administrations administration by segment/function rather than by type of tax move to cumulative withholding and information reporting improved risk management better access to information Use of new technologies Good compliance requires good taxpayer service and effective enforcement Putting tax compliance on the good corporate governance agenda 11 Key Elements for successful tax reform: Experience of OECD Countries Political champions who can mobilize popular support Clear and well-articulated principles A package approach, with gains and pains intricately linked Policy reform matched by administrative reform Limited time between announcement and full implementation Transition rules matter Education and guidance package available from Day One 12