FY2015 Annual Financial Report Operating Statement (SRECNP) Highlights January 2016

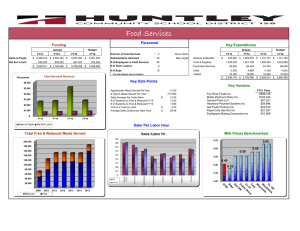

advertisement

FY2015 Annual Financial Report Operating Statement (SRECNP) Highlights January 2016 Annual Financial Report Highlights • Comprised of three primary statements with many supporting schedules: – Statement of Net Position (Balance Sheet) – Statement of Revenues, Expenses and Changes in Net Position (Operating Statement or SRECNP) – Statement of Cash Flows Statement of Revenue, Expenses, and Changes in Net Position (SRECNP) This statement reports the results of operations for the year. Tuition and Fees increased by $14.5M. Discount and Allowances increased by $7.1M for a net increase of $7.4M. The net increase is primarily due to an earlier fall semester start date with more class days in August 2015 than in August 2014. Other Operating Revenue increased $5.8M primarily due to an increase in educational activities sales and services, housing revenue and athletics conference revenue. Operating Loss does not include State Appropriations or Pell revenue. Net Investment Income increased $7.1M due to increases in both the short-term and distributed investment account earnings. That increase was offset by a $54.0M net decrease in the fair value of investments due to a decrease in long-term investments as well as market performance. Cash was needed to cover operations due to delays in state reimbursements. Transfers include: Mandatory: debt service payments Non-Mandatory: anticipated bond proceeds used to fund construction projects. Net Position decreased by $11.6M in FY 2015. ($ In Millions) Operating Revenue FY 2015 FY2014 VARIANCE Student Tuition and Fees, Net of Discounts $ 192.6 $ 185.2 $ 7.4 Sponsored Programs 67.3 67.9 (0.6) Other 58.6 52.8 5.8 Total Operating Revenues 318.5 305.9 12.6 Total Operating Expenses 485.4 463.9 21.5 Operating Income (Loss) (166.9) (158.0) (8.9) Non-Operating Revenue (Expenses) State Appropriations Non-Exchange Sponsored Programs and Non-Exchange Pass Through Gift Contributions for Operations Net Investment Income Net Inc. (Dec.) in Fair Value of Investments Loss on Disposal of Capital Assets and Other Non-Operating Revenue Net Non-Operating Revenue (Expenses) Income Before Other Revenue, Expenses, Gains/(Losses) and Transfers Gifts and Sponsored Programs for Capital Acquisitions Additions to Permanent Endowments Re-Class From (To) Institutions Transfers Change in Net Position Net Position, Beginning of Year Net Position, End of Year 125.4 122.2 3.2 46.9 10.3 24.8 (28.5) 45.6 9.9 17.7 25.5 1.3 0.4 7.1 (54.0) (1.5) 177.4 (0.3) 220.6 (1.2) (43.2) 10.6 62.6 (52.0) 2.7 6.5 (3.3) (28.1) (11.6) 3.1 2.6 9.2 (31.4) 46.1 (0.4) 3.9 (12.5) 3.3 (57.7) 1,133.3 1,087.2 $ 1,121.7 $ 1,133.3 $ 46.1 (11.6) FY2015 Sources of Operating Revenue by Category ($ in Millions) State of Texas, $147.0 , 28% Federal Government, $83.8 , 16% Institutional Resources, $101.4 , 19% Student & Parent, $192.6 , 37% FY2015 Sources of Operating Revenue by Category – 5 Year Trend ($ in Millions) 100% 90% 28% 29% 36.7% 37.0% 19.3% 16.3% 16.0% 17.8% FY15 FY14 27% 26% 28% 36.0% 38.9% 36.2% 15.3% 13.0% 22.3% 20.1% 22.4% FY13 FY12 FY11 80% 70% 60% 50% 40% 30% 15.0% 20% 10% 0% Federal Government Institutional Resources Student & Parent State of Texas FY 2015 Sources of Operating Revenue ($ in Millions) Net Auxiliary Enterprise, $42.6 , 8.1% Other Income, $2.5 , 0.5% Sales & Services, $12.2 , 2.3% State Appropriations, $119.7 , 22.8% Private Gifts & Grants, $15.7 , 3.0% Local Government, $3.6 , 0.7% Endowment & Interest Income, $24.8 , 4.7% State Grants & Contracts - Restricted, $21.5 , 4.1% Research Development Funds, $5.7 , 1.1% Federal Grants & Contracts, $83.8 , 16.0% Tuition and Fees, Net, $192.6 , 36.7% FY 2015 Sources of Operating Revenue – 5 Year Trend ($ in Millions) 100% 8.1% 7.7% 6.5% 6.3% 5.7% 16.0% 17.8% 22.3% 20.1% 22.4% 36.7% 37.0% 36.0% 38.9% 36.2% 22.8% 23.3% 21.6% 21.6% 22.7% FY15 FY14 FY13 FY12 FY11 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% State Appropriations State Grants & Contracts - Restricted Research Development Funds Tuition and Fees, Net Federal Grants & Contracts Endowment & Interest Income Local Government Private Gifts & Grants Sales & Services Net Auxiliary Enterprise Other Income FY15 Operating Uses of Funds ($ in Millions) Auxiliary Enterprises, $50.6 , 11.4% Scholarships & Fellowships, $33.8 , 7.6% Capital Outlay, $7.5 , 1.7% Instruction, $133.0 , 29.9% Operations & Maintenance, $42.3 , 9.5% Research, $42.0 , 9.4% Institutional Support, $36.7 , 8.3% Public Service, $18.1 , 4.1% Student Services, $26.6 , 6.0% Academic Support, $54.5 , 12.2% FY15 Operating Uses of Funds – 5 Year Trend ($ in Millions) 100% 90% 80% 11.4% 11.0% 9.9% 9.6% 7.9% 7.6% 7.3% 10.1% 9.9% 10.3% 9.5% 9.0% 10.1% 10.0% 9.7% 8.3% 9.0% 8.2% 8.8% 10.7% 12.2% 12.9% 12.1% 11.2% 9.7% 9.4% 9.0% 9.9% 9.9% 10.9% 29.9% 30.4% 28.3% 28.5% 28.5% FY15 FY14 FY13 FY12 FY11 70% 60% 50% 40% 30% 20% 10% 0% Instruction Academic Support Operations & Maintenance Capital Outlay Research Student Services Scholarships & Fellowships Public Service Institutional Support Auxiliary Enterprises Reconciliation of Research Expenditures to AFR Operating Expenses - Research Reconciliation: Statement of Revenues, Expenses and Changes in Net Assets - Research Expenses FY15 $ FY14 42,033,631 $ 37,961,038 Facilities and Administration (F&A) 6,052,113 5,609,170 Capital Outlay 3,736,342 1,811,649 *Total Research Expenditures * As Reported on THECB Research Expenditure Report $ 51,822,086 $ 45,381,857 FY 2015 AFR Summary UTSA continues to receive a “Satisfactory” rating from UT System as a result of a healthy financial condition. UTSA’s operating margin ratio increased from 2.4% for FY2014 to 3.8% for FY2015. Increase attributable to an increase in total operating revenues of $27.9M that outpaced the growth in total operating expenses of $20.3M. FY2015 included the revenue associated with seven additional class days.