“The Housing Divide: Habitat World 2002

advertisement

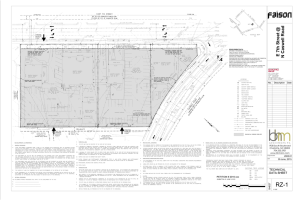

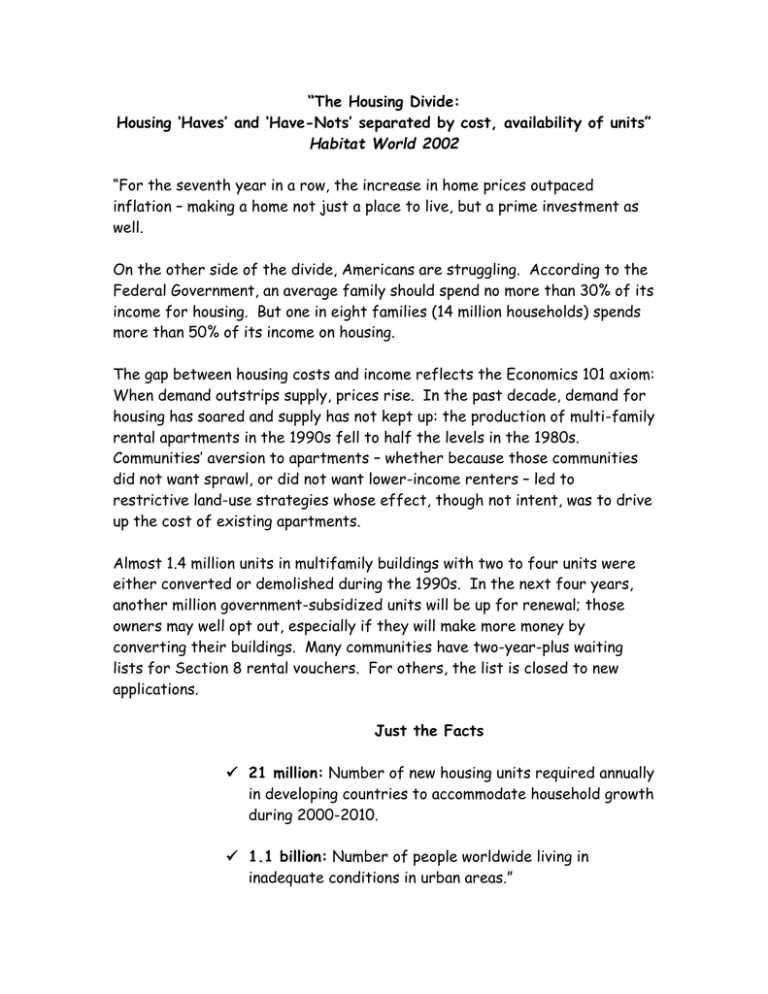

“The Housing Divide: Housing ‘Haves’ and ‘Have-Nots’ separated by cost, availability of units” Habitat World 2002 “For the seventh year in a row, the increase in home prices outpaced inflation – making a home not just a place to live, but a prime investment as well. On the other side of the divide, Americans are struggling. According to the Federal Government, an average family should spend no more than 30% of its income for housing. But one in eight families (14 million households) spends more than 50% of its income on housing. The gap between housing costs and income reflects the Economics 101 axiom: When demand outstrips supply, prices rise. In the past decade, demand for housing has soared and supply has not kept up: the production of multi-family rental apartments in the 1990s fell to half the levels in the 1980s. Communities’ aversion to apartments – whether because those communities did not want sprawl, or did not want lower-income renters – led to restrictive land-use strategies whose effect, though not intent, was to drive up the cost of existing apartments. Almost 1.4 million units in multifamily buildings with two to four units were either converted or demolished during the 1990s. In the next four years, another million government-subsidized units will be up for renewal; those owners may well opt out, especially if they will make more money by converting their buildings. Many communities have two-year-plus waiting lists for Section 8 rental vouchers. For others, the list is closed to new applications. Just the Facts 21 million: Number of new housing units required annually in developing countries to accommodate household growth during 2000-2010. 1.1 billion: Number of people worldwide living in inadequate conditions in urban areas.” (Jill’s note: That’s 1/6 of the world’s population – and just the estimate for urban areas! Remember, most people in developing regions of the world still live in rural areas.)