Document 17784340

advertisement

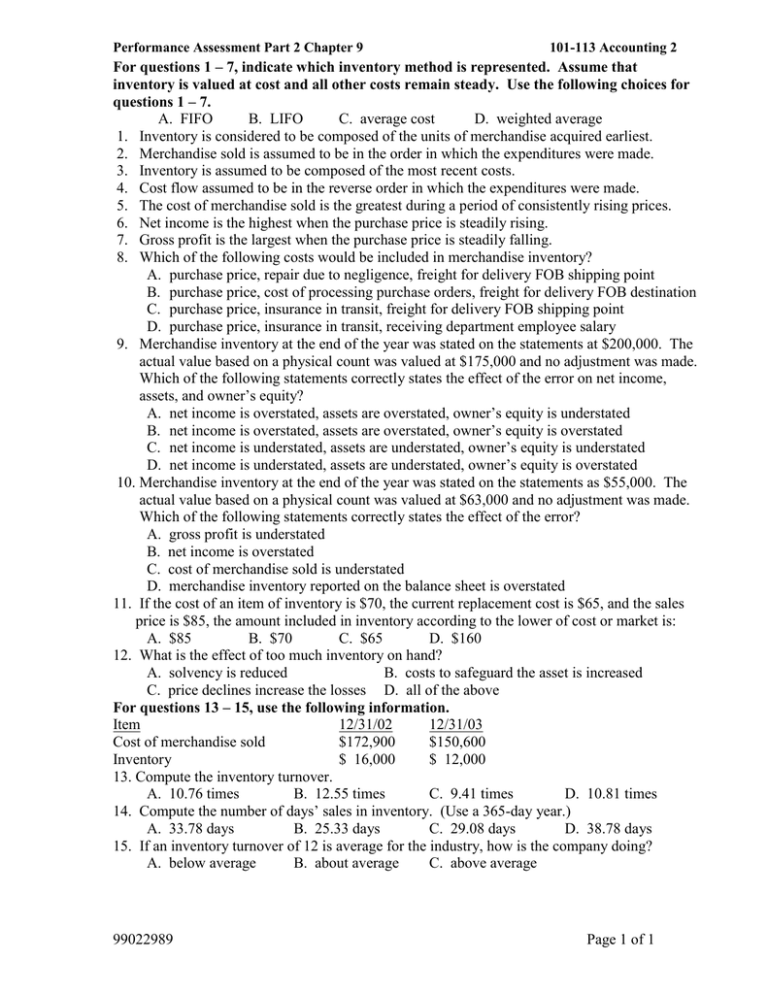

Performance Assessment Part 2 Chapter 9 101-113 Accounting 2 For questions 1 – 7, indicate which inventory method is represented. Assume that inventory is valued at cost and all other costs remain steady. Use the following choices for questions 1 – 7. A. FIFO B. LIFO C. average cost D. weighted average 1. Inventory is considered to be composed of the units of merchandise acquired earliest. 2. Merchandise sold is assumed to be in the order in which the expenditures were made. 3. Inventory is assumed to be composed of the most recent costs. 4. Cost flow assumed to be in the reverse order in which the expenditures were made. 5. The cost of merchandise sold is the greatest during a period of consistently rising prices. 6. Net income is the highest when the purchase price is steadily rising. 7. Gross profit is the largest when the purchase price is steadily falling. 8. Which of the following costs would be included in merchandise inventory? A. purchase price, repair due to negligence, freight for delivery FOB shipping point B. purchase price, cost of processing purchase orders, freight for delivery FOB destination C. purchase price, insurance in transit, freight for delivery FOB shipping point D. purchase price, insurance in transit, receiving department employee salary 9. Merchandise inventory at the end of the year was stated on the statements at $200,000. The actual value based on a physical count was valued at $175,000 and no adjustment was made. Which of the following statements correctly states the effect of the error on net income, assets, and owner’s equity? A. net income is overstated, assets are overstated, owner’s equity is understated B. net income is overstated, assets are overstated, owner’s equity is overstated C. net income is understated, assets are understated, owner’s equity is understated D. net income is understated, assets are understated, owner’s equity is overstated 10. Merchandise inventory at the end of the year was stated on the statements as $55,000. The actual value based on a physical count was valued at $63,000 and no adjustment was made. Which of the following statements correctly states the effect of the error? A. gross profit is understated B. net income is overstated C. cost of merchandise sold is understated D. merchandise inventory reported on the balance sheet is overstated 11. If the cost of an item of inventory is $70, the current replacement cost is $65, and the sales price is $85, the amount included in inventory according to the lower of cost or market is: A. $85 B. $70 C. $65 D. $160 12. What is the effect of too much inventory on hand? A. solvency is reduced B. costs to safeguard the asset is increased C. price declines increase the losses D. all of the above For questions 13 – 15, use the following information. Item 12/31/02 12/31/03 Cost of merchandise sold $172,900 $150,600 Inventory $ 16,000 $ 12,000 13. Compute the inventory turnover. A. 10.76 times B. 12.55 times C. 9.41 times D. 10.81 times 14. Compute the number of days’ sales in inventory. (Use a 365-day year.) A. 33.78 days B. 25.33 days C. 29.08 days D. 38.78 days 15. If an inventory turnover of 12 is average for the industry, how is the company doing? A. below average B. about average C. above average 99022989 Page 1 of 1