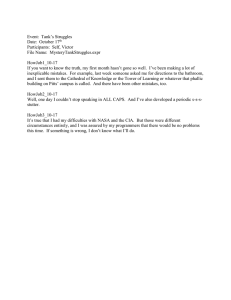

Overcoming Mistakes

advertisement

Ivette Urbina 5/25/2009 Huc 108 Prof. Gardner Overcoming Mistakes -To persuade the audience that even though we have made mistakes in the past to bring us to a recession we can still make a recovery. - Corporate businesses, financial institutions and individuals have had a vast role in the trickling down of the economy. I. “He remembers the families that ate canned dog food.” A. Mr. Newburger, who is a veteran of the worst economic crisis ever saw this kind of life during the great depression. 1. He believes if we look back at history hopefully we won’t repeat the same to bring us to a depression. 2. At the age of ninety-five he has seen the highs and lows of the market but says today’s situation is different. C. Corporate businesses, financial institutions and individuals have hade a big role in the vast trickling down of the economy. Hopefully the mistakes will not be made and we will learn how to be productive so we can make a magnificent recovery. II. Corporations have taken over the United States and are solely attached to their business agendas. A. Corporations’ main concern is to make profits usually at the expense of the people. 1. The government has allowed them unusual power and access. 2. Company’s impact on the recession is a mixture of many liberties that have not been beneficial to the greater good, such as setting up sweat shops around the world instead of paying the U.S. minimum wage so only their pockets can be filled. B. Corporations can do great things to boost the economy. They must take social responsibility and make more work for people here in the U.S. so that trade can build and have that sector work for Americans. C. The loss of billions of dollars for many financial institutions is alarming. 1. According to National Affairs around some $61.7 Billion dollars were lost at AIG. a. That was around 465,000 every minute in the final three months of last year. b. AIG, like many other financial institutions was completely unregulated for many years and without anyone looking at their balance sheets, they were gambling with and wasting individuals assets 2. The bailout is just a temporary fix; government will try to transfer the government accessible loans into common stock. Converting those loans into common stock would the federal aid into available capital for the bank. 3. Financial institutions are also developing a system called stress tests to get their clients to believe in their capabilities and rely on them for investments. D. Individuals in the U.S have for so many years ignored the threats that would lead to the recession, according to time magazine our actions have been “childish, irresponsible, fat and happy.” 1. So much debt accumulated that we have not seen the way we spend and have drowned in debt. “Over the past thirty years, the savings rate had dropped from over fourteen percent in the 1970’s to negative 2.7 in 2005, meanings Americans were spending more than they made.” 2. There are a few things we can do as individuals to relieve ourselves of the recession. a. People are burning to create and sell new kinds of transportation and media in new economic ways will have a clearer field in which to expand. b. Analysts say that more saving will make investments greater and will make standard of living greater III. This brings me to the conclusion that not one person or entity is responsible for the economic downturn we are facing. A. Corporations, financial institutions and individuals have made mistakes throughout the years and each sector is suffering from the meltdown. B. Whether you’re a big shot on Wall Street or a student struggling to finish college, “forced financial conservatism” may be a good idea. C. If we work together, we can shun the greedy mistakes from the past, making our future brighter for ourselves and those around us.