Aaron J Hudson September 23 , 2005

advertisement

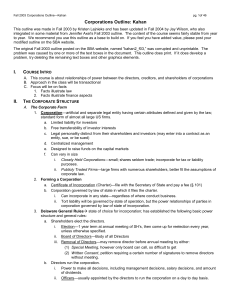

September 23rd, 2005 Aaron J Hudson AMM 101 Dr. Silverman Chapter 5: Review Questions 7) Stockholders have the right to share in the profit earned by the corporation, rights to receive information about the corporation, rights to vote on changes to the Corporate Charter, the rights to attend the corporation’s annual stockholder’s meeting, and the rights to vote on corporate matters if they own common stocks. 8) The primary duties of the Board of Directors are setting company goals and developing plans or strategies to achieve those goals. The directors are elected by the corporation’s stockholders. 14) A hostile takeover is where the management and the Board of Directors of the firm, targeted for acquisition, disapprove of the merger because they know that their company will become a subsidiary of the purchasing firm and most likely will lose their control. Management of the purchasing firm can do 1 of 2 things to prevent this hostile takeover. First, they can make a tender offer, a tactic to purchase the stock of the targeted firm at a high enough price that it will temp the stockholders to sell all their shares. Secondly, the purchasing firm can start a proxy fight which if enough of the stockholder’s votes are gathered, the purchasing firm can control the targeted firm. 15) A horizontal firm is a merger of 2 firms that make and sale similar products or services in similar markets. A vertical merger is when 2 firms operate at different but related levels in the production and marketing of a product. A conglomerate merger is a merger of 2 complete different companies in unrelated industries.