Testing Distributions of Stochastically Generated Yield Curves Gary G Venter

advertisement

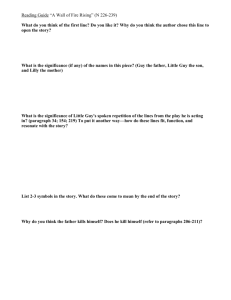

Testing Distributions of Stochastically Generated Yield Curves Gary G Venter AFIR Seminar September 2003 Advantages of Stochastic Generators Deterministic scenarios allow checking risk against specific outcomes Stochastic generators add dimension of probability of scenarios Can incorporate full range of reasonably possible outcomes Each scenario can be a time series of outcomes Guy Carpenter 2 Testing for Potential Problems of Stochastic Generators Model could miss possible scenarios Model could overweight some unlikely scenarios and underweight others – giving unrealistic distribution of results Traditional tests look at time series properties of individual scenarios – like autocorrelations, shapes of curves compared to historical, correlation of short and long term rates and their comparative volatility, and mean reversion Options pricing models test distributions across scenarios by their impacts on option prices For insurer risk models, we propose testing generators by comparing distributions of yield curves against historical Look for aspects of historical distributions that do not change too much over time Guy Carpenter 3 Some Models of the Yield Curve (Then we’ll look at testing) Example Short-Term Rate Models Usually defined using Brownian motion zt. After time t, zt is normal with mean zero and variance t. Cox, Ingersoll, Ross (CIR): dr = a(b - r)dt + sr1/2dz In discrete form for a short period: r t – r t–1 = a(b – r t–1) + sr t –11/2 CIR change in interest rate has two components: – A trend which is mean reverting to b, i.e., is negative if r>b and positive if r<b Speed of mean reversion given by a – A random component proportional to r1/2, so variance rts2 in time t Guy Carpenter 5 Adding Effects to CIR Mean that is reverted to can be stochastic: d b = j(q - b)dt + wb1/2dz1 This postulates same dynamics for reverting mean as for r Volatility can be stochastic as well: d ln s2 = c(p - ln s2)dt + vdz2 Here Brownian motion in log Power on r in dz term might not be ½ : dr = a(b - r)dt + srqdz CIR with these two added factors fit by Andersen and Lund, working paper 214, Northwestern University Department of Finance, who also estimate the power of r (1/2 for CIR). Guy Carpenter 6 Fitting Stochastic Generators If you can integrate out to resulting observed periods you can fit by MLE – CIR distribution of rt+T given rt is non-central chi-sq. – f(rt+T|rt) = ce-u-v(v/u)q/2Iq(2(uv)1/2), where – c = 2as-2/(1-e-aT), q=-1+2abs-2, u=crte-aT, v=crt+T Iq is modified Bessel function of the first kind, order q – Iq(2z)= Sk=0z2k+q/[k!(q+k)!], where factorial off integers is defined by the gamma function Can use this for mle estimates of a, b, and s Guy Carpenter 7 Fitting Stochastic Generators If cannot integrate distribution, some other methods used: – Quasi-likelihood – Generalized method of moments (GMM) Guy Carpenter E[(3/x) ln x] is a generalized moment, for example Or anything else that you can take an expected value of Need to decide which moments to match 8 Which Moments to Match? Title of paper developing efficient method of moments (EMM) Suggests finding the best fitting time-series model to the time-series data, called the auxiliary model Scores (partial derivates of log-likelihood of auxiliary model) are zero for the data at the MLE parameters EMM considers these scores, with the fitted parameters of the auxiliary model fixed, to be the generalized moments, and seeks the parameters of the stochastic model that when used to simulate data, gives data with zero scores Actually minimizes distance from zero Guy Carpenter 9 Andersen-Lund Results Power on r in r-equation volatility somewhat above ½ Stochastic volatility and stochastic mean reversion are statistically significant, and so are needed to capture dynamics of short-term rate Used US data from 1950’s through 1990’s Guy Carpenter 10 Getting Yield Curves from Short Rate Dynamics P(T) is price now of a bond paying €1 at time T This is risk-adjusted expected value of €1 discounted continuously over all paths: P(T) = E*[exp(-r tdt)] Risk adjustment is to add something to the trend terms of the generating processes The added element is called the market price of risk for the process Guy Carpenter 11 Testing Generated Yield Curves Want distributions to be reasonable in comparison to history Distributions of yield curves can be measured by looking at distributions of the various yield spreads Yield spread distributions differ depending on the short-term rate: spreads compacted when short rates are high Look at conditional distributions of spreads given short-term rate Guy Carpenter 12 Now for Testing (Proposed Distributional Test) Three Month Rate and 10 – 3 Year Spread Clear inverse relationship Mathematical form changes Five periods selected Guy Carpenter 14 Ten – Three Year Spreads vs Short Rate Slope constant but intercept changes each period 0.025 0.020 0.015 R103 0.010 0.005 0.000 1 1960-1968 0.01096 - 0.272*x 2 1968-1979 0.0171 - 0.2526*x 44 4 3 1979-1986 4 4 1986-1995 4 44 44 44 4 4 4 444 5 1995-2001 4 4 4 4 4 4 4 4 42 2 22 44 44 442 33 3 2 3 22 3 3 333 33 4 2 2222 4 3 4 4 3 4 4 3 4 22 4 2 4 4 44 2 4 3 3 3 3 4 3 2 44 33 3 445224 224 33 3 4 4444 244 4 4 2 3 3 3 33 2 3 3 4 44 1 24 2 22 22 4 1 4 22 3 3 2 1 3 111 1 3 2 4 5 2 1 1 2 11 1 2 2 2 11 4 4 5 1 1 3 33 22 5 2 5 111 11 55 55 44 55 1 422 2 25 3 5554224224 1 5 2 11111 1 1 2 2 2 5 2 2 3 3 3 5 1 5 5 22 2 11 3 1 11 3 1 55 25 1 111 1 2 5 25 4 5 2 5 2 1 5 2 2 44 5 1 1 5 11 33 5555555552 5 1 1 5 55 1 1111 1 2 2 2 1 5 1 1 1 5 1 1 1 5 25 552 2 52 22 24 2 1 5 4222 3 4 55 11 1 1 2 3 222 22 44 1 1 5 44 2 2 3 5 2252 2222 2 2 22 44 3 3 3 1 1 11 22 44 3 22 1 1 111 1 1 11 1 1 1 -0.005 22 5 25 2 5 5 5 55 5 1 5 2 1 1 2 244 3 24 33 4 3 2 2 2 2 22 2 2 2 2 2 2 22 2 2 2 2 2 3 0.02485 - 0.2225*x 0.02446 - 0.2957*x 0.01247 - 0.205*x 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 33 3 3 33 -0.010 3 3 3 -0.015 -0.020 0.00 0.02 Guy Carpenter 0.04 0.06 0.08 0.10 R3M 0.12 0.14 0.16 0.18 15 Possible Tests of Generated Curves Individual scenarios – Could look at different time points simulated and see if slope and spread around line is consistent with historical pattern – For longer projections – 10 years + – expect some shift – For 20 year + projections a flatter line would be expected with greater spread, as in combining periods Looking across scenarios at a single time – Observing points over time can be viewed as taking samples from the conditional distribution of spreads given short rate – Alternative scenarios can be considered as providing draws from the same conditional distribution – Distribution of spreads at a time point could reasonably be expected to have the recent inverse relationship to the short rate – same slope and spread Guy Carpenter 16 Five - Year to Three - Year Spreads 0.025 1 1960-1968 2 1968-1979 0.020 3 1979-1986 4 1986-1995 5 1995-2001 0.015 R53 0.010 0.005 0.000 4 4444 44 4 4 44 4 44 4 4 4 4 4 4 444 4 4 44442442 333 3 333 3 3 4 2 22 22 2 24 33333 3 3 22 2 24 24 333 2 2222 3 4 22 2 333 3 24 3 3 4 2 2 3 4 4 4 2 2 3 4 2 2 2 11 4 3 22 2 2 4 44 2 3 33 3 3 1 4 44444 4 4 3 2 1 45 42244 11 1 11 111 1 4 4 3 3 2 3 4 2 4 2 3 2 11 1 4 4 5 4 11 1 11111 44 2 3 2 22 3 3 33 1 2 1 5 22 4454 24 1 225 2 244 4 4 3 3 11 1 1 1 5 5 55 5 1 1 11 1 5 5 25 5 22 1 55224 222 22 11 1 2 55 1 5 525 5 225 5 25 2 11 15 5 22255 244244 1 1 5 2 222 2 5 1 1 15 2 1 1 2 3 5 1 2 2 2 2 2 2 11 1 1 5 1 1 2 4 5 5 5 2 1 11 1 1 5 2 5 2 2 1 52 5 222 2 1 11 5 24 44 24 5 51 5 224 2 3 2 22 11 5 2 2 5 22 2 2 4 1 5 5 11 11 1 1 1 1 2 5 55 52 2 5 555 22 2 2 2 4422 4244444 3 2 2 2 2 2 2 3 333 3 2 2 3 0.005539 - 0.134*x 0.008277 - 0.1175*x 0.012 - 0.1055*x 0.01246 - 0.1564*x 0.003488 - 0.05258*x 3 3 3 333 3 33 3 3 3 3 3 3 3 33 3 33 3 33 3 3 3 -0.005 3 3 -0.010 -0.015 -0.020 0.00 Guy Carpenter 0.02 0.04 0.06 0.08 0.10 R3M 0.12 0.14 0.16 0.18 17 Spreads in Generated Scenarios GARP output 05/01 year 4 constant lambdas 0.025 0.020 5 – 3 spreads from Andersen-Lund with a selected market-price of risk 0.015 Slope ok, spread too narrow 0.0063 - 0.0853*x R53 0.010 0.005 Same problem for CIR – even worse in fact 0.000 -0.005 -0.010 -0.015 -0.020 0.00 0.02 Guy Carpenter 0.04 0.06 0.08 R3M 0.10 0.12 0.14 0.16 0.18 18 Add Stochastic Market Price of Risk GARP output 05/01 year 4 variable lambdas 0.025 Better match on spread 0.020 0.0085 - 0.0973*x 0.015 R53 0.010 0.005 0.000 -0.005 -0.010 -0.015 -0.020 0.00 Guy Carpenter 0.02 0.04 0.06 0.08 0.10 R3M 0.12 0.14 0.16 0.18 19 Can also test distribution around the line (Shape of distribution – not just spread) Distributions Around Trend Line Percentiles plotted against t with 33 df Historical Variable Fixed Variable looks more like data But fitted distribution misses in tails for all cases Guy Carpenter Test only partially successful 21 Summary Treasury yield scenarios should be arbitrage-free, and be consistent with the history of both dynamics of interest rates and distributions of yield curves Short-rate dynamics can be tested by fitting models Yield curve dynamics can be tested with individual generate series Yield curve distributions tested by conditional distributions of yield spreads given short rate Guy Carpenter 22