Presenting DFA Results to Decision Makers Spring 2008 Midwest Actuarial Forum

advertisement

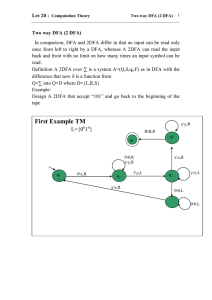

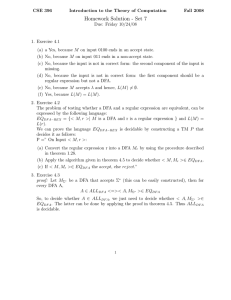

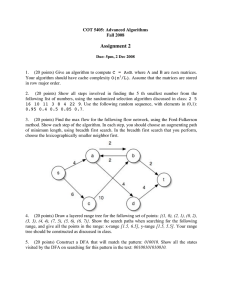

Presenting DFA Results to Decision Makers Spring 2008 Midwest Actuarial Forum Agenda Overview of committee work Sample presentation (illustration purposes only) Examples of slides using Power Point Presenting DFA Results to Decision Makers 2003 CAS Research Working Party: Executive Level Decision Making using DFA Scott Sobel, FCAS, MAAA Agenda What are the challenges in presenting DFA results? What are some common elements in a DFA presentation? What elements vary in DFA presentations? What are the end products of the working party’s efforts? Challenges in Presenting DFA Results DFA studies driven by probability distributions Volume of data can be overwhelming Complexity of the modeling process Easy to get lost in the details Common Elements in DFA Presentations State the options to be evaluated State the financial metrics for the evaluation Summarize the model assumptions Display ranges of results for the financial statistics of interest Compare key financial statistics Conclude with evaluation of the options Varying Elements in DFA Presentations Options to be evaluated are specific to the DFA study Financial metrics are the choice of the management team – varies by company Display of results need to reflect these choices The particular graphs selected Comments placed on the graphs Conclusion – dependent on option types End Products of the Working Party Efforts Summary report PowerPoint template for graphs Paper describing concepts behind template Three sample presentations applying template graphs Guidelines for Presenting DFA.doc Web site http://www.casact.org/research/drmwp/ Investment Option Review Example 2003 CAS Research Working Party: Executive Level Decision Making using DFA Michael R. Larsen, FCAS, MAAA Goals of Study Review Reinvestment Options Measure results using simulation model results Risk as Average Loss in Surplus in Worst 1% of Cases over Five Years Return as Average Increase in Policy Holder Surplus at End of Five Years Change in Reinvestment Allocation Reinvestment Strategy 100% 2% 0% 2% 2% 15% 15% 90% 2% 20% 10% 80% 54% 25% 70% 30% 60% 44% 50% 29% 40% 24% 30% 44% 20% 29% 29% 24% 10% 0% Option A Option B Option C Cash 2% 2% 2% Option D 2% Common Stock Unaffiliated 0% 15% 15% 20% 0% 10% 25% 30% Municipal 54% 44% 29% 24% U.S. Govt Bond 44% 29% 29% 24% Unaffiliated Bonds DFA flow Work Comp Grow 5% a year Starting Policy Holder Surplus 40,000 Multi_Peril Grow 5% a year Corporate Elements Reinsurance Investment Capital Mix Taxes Financial Calculator Analyze Results Financial Results Simulated over Five Years Measures of •Risk •Return Change in Policy Holder Surplus Model / Assumptions Assume Underwriting Operations Not Affected Assumption s Behind Simulation • Ability to take rate changes not driven by investment results • Growth rates in exposure does not change Investment Scenario • Long run average interest rate of 4% •Starting interest rate of 4% Investment Models • Short term interest rate model is a mean reversion model •Long term rates are a function of short term rates •Stock returns modeled as a function of short term rates and interest rate changes •Stable relationship between bond and equity market Policyholder Surplus Change by Reinvestment Option Option A Option B 0.4 1 0.4 0.36 0.32 0.8 0.32 0.8 0.28 0.24 0.6 0.2 0.16 0.4 Probability 0.28 Probability 1 0.36 0.12 0.24 0.6 0.2 0.16 0.4 0.12 0.08 0.2 0.08 0.04 0.2 0.04 0 0 -40 -30 -20 -10 0 10 20 30 0 40 0 -40 -30 -20 -10 0 10 20 30 40 Mil pdf Mil cdf pdf Option C Option D 0.4 1 0.4 0.36 1 0.36 0.32 0.8 0.32 0.28 0.8 0.28 0.24 0.6 0.2 0.16 0.4 0.12 Probability Probability cdf 0.24 0.6 0.2 0.16 0.4 0.12 0.08 0.2 0.04 0.08 0.2 0.04 0 0 -40 -30 -20 -10 0 10 20 30 40 0 0 -40 -30 -20 -10 0 10 Mil pdf cdf 20 30 40 Mil pdf cdf Surplus Change Over Time by Investment Option Option B (10 - 90 percentiles) 20.0 Thousands Thousands Option A (10 - 90 percentiles) 15.0 20.0 15.0 10.0 10.0 5.0 5.0 0.0 0.0 2004 2005 2006 2007 2008 2004 -5.0 -5.0 -10.0 -10.0 2005 2007 2008 2007 2008 Option D (10 - 90 percentiles) 20.0 Thousands Thousands Option C (10 - 90 percentiles) 2006 15.0 20.0 15.0 10.0 10.0 5.0 5.0 0.0 0.0 2004 2005 2006 2007 2008 2004 -5.0 -5.0 -10.0 -10.0 2005 2006 Investment Option Comparison Average Surplus Gain Thousands Risk-Reward 20 19 Option D highest return less risk 18 17 16 Option A 15 Option B Option C 14 Option D 13 12 11 10 10 11 12 13 14 15 16 Average Surplus Loss in Worst Case 17 18 19 20 Thousands Investment Option Summary Option Return Risk A 12.6 17.2 B 13.6 17.0 C 13.8 17.0 D 14.2 16.9 Conclusion Reviewed four reinvestment options Option D gives best gain in Surplus with less additional risk DFA presentation Template Uncertainty Aggregate Distribution Profit distribution 1 0.28 0.24 0.8 Probability 0.2 0.16 0.6 Stop Loss 0.12 0.4 0.08 0.2 0.04 0 0 -60 -50 -40 -30 -20 -10 10 0 20 30 40 Mil pdf cdf Liability cash flow Billions Range of Liability Cash Flow Over Time 3.0 Max 90-95%ile 2.5 75-90%ile 50-75%ile 2.0 25-50%ile 10-25%ile 1.5 5-10%ile 0-5%ile 1.0 Min Avg 0.5 0.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Ranking Value of Reinsurance Projected Combined Ratios with and without reinsurance 3.4 2.9 current reinsurance Projected Likelihood 2.4 1.9 no reinsurance 1.4 0.9 what you get back 0.4 what you give up -0.1 0.6 0.8 1 1.2 1.4 1.6 1.8 2 Development & Trends Cash Flow over time Billions Run-Off Payout 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 1997 1998 1999 2000 2001 2002 2003 2004 Cash Flow over time Billions Range of Liability Cash Flow Over Time (10 - 90 percentiles) 3.0 2.5 Theoretically possible ranges 2.0 More realistic outcomes 1.5 1.0 0.5 0.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Allocations Change in Allocation 11.0% 7.0% 51.0% Bonds 31.0% Equity Cash 7.0% Other 11.0% 11.0% 71.0% Less Equity More bonds Change in Allocation Investment Strategies More bonds Less Equity 71.0% 80.0% 70.0% 60.0% 50.0% 51.0% 40.0% Curr 30.0% 31.0% 20.0% 11.0% 11.0% 10.0% 11.0% 0.0% 7.0% 7.0% Bonds Equity Alt Cash Other Curr Alt Not to Do Too Much Info