– Random, Shmandom Just gimme the number MAF 3/22/2007

advertisement

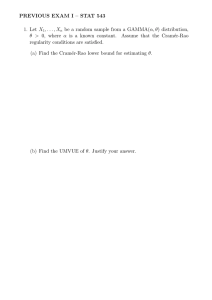

Random, Shmandom – Just gimme the number MAF 3/22/2007 Rodney Kreps The (obvious?) essentials • Any measure of interest in the real world has uncertainty, and is not meaningful without it. • A single number chosen to represent a random variable will depend on the purpose for which the number is to be used. A Fundamental Truth • In order to be meaningful and useful, any measurement or estimate must also have a sense of the size of its uncertainty. • And, different uncertainties are physically and psychologically different situations. Wait a minute, Dr. Physicist • What about the charge on an electron? • It is a constant, at least according to most scientists. • But, any measurement of it involves intrinsic noise. The measurement has uncertainty (currently 8.5 parts in 100,000,000 relative). • To the extent that this is small compared to the question we are asking, the measured value is useful. We know this • We use this knowledge automatically, often without doing a conscious calculation. • For example, when crossing the street. • Or, 5 yards 15 feet 180 inches. As CEO, are you indifferent? 1.8 underwriting comparison with mean solvency = 1.00 1.6 1.4 loss cv = 5% 1.2 loss cv = 50% 1 assets 0.8 0.6 0.4 0.2 0 95 97 99 101 103 105 107 Corollaries • The statement of the estimate frequently implies the size of the uncertainty, correctly or not. • When the uncertainty gets too big, the estimate loses all meaning. Consequences • Any measurement or estimate of interest is a random variable. • There may or may not be an explicit distribution to represent it. • Most importantly, “THE” number does not exist. If you provide one naively you will get hung out to dry. However… • We often have to provide a number. • Hopefully we can also provide some sense of the associated uncertainty. Usually there is some intuition. • Assuming we have a distribution, what is the “intrinsic softness” of a number representing it? We do not know a number to better than that. • My personal choice is the middle third of the distribution. Hurricanes MPLs are 50% or greater. An Example • 100,000 policies each of which has a 10% chance of a $1,000,000 loss. More severe than Personal Auto, but otherwise not too dissimilar. • The aggregate distribution for independent losses has a coefficient of variation of 1%. • Do you know any insurer with a PA book that stable? Clearly, parameter risk is substantial. Sources of Uncertainty, the Usual Mathematical Suspects: • Limited and erroneous data. • Projection uncertainty in the form of – changing physical and legal conditions. – on-level factors not very accurate. – other parameter risk. • Model choices. Risk more Generally • Inherent risk, simply due to the insurance process. • Internal risks of mistaken planning or models which do not reflect the current reality. • External risks from competition, regulatory intervention, court interpretations, etc. • Add your own favorites… Our “Best” Distribution • In principle is the Bayesian posterior after all the sources of parameter and other uncertainty are included. • Will rely heavily on intuition. • May not have an explicit form, but experienced people have a sense for it. • Probably is not uniform, in spite of the accountants’ view. Three interesting numbers • Loss for ratemaking. • Liabilities for reserving. • Required capital for the projected net income. • How do we get these from their distributions? Ratemaking • Since we will pay the total, the mean of the severity times the expected frequency is popular. • Loss ratio time series also use the mean. • Regulators, political appointees, and history look favorably on the mean. • The mean it is. Reserving • As a balance sheet item, the estimate should ideally reflect the economic position of the company. • SAP do not really allow that, and there are analyst and internal pressures to push reserves from the ideal. • But if we at least start from there, what would it be? Best Reserving Estimate • Take an annual context, where each year the prior years’ reserves are restated to their correct value and we are setting current reserves. • Assume we have a distribution of outcomes and our job is to pick an estimate that will be as close as possible on restatement. • What does this mean? Least Pain • Define a function which describes the pain to the company on the estimate being wrong. • Candidate: the decrease in value upon announcement of the restatement. • Overestimating reserves is not as bad as underestimating. • Pain function is not linear. What should the pain reflect? • The reserve estimator is supposed to display the state of the liabilities for public consumption. • The pain should depend upon the deviation of the realized state from the previously estimated state in some quantitative fashion. Recipe • For every fixed estimator, integrate the pain function over the distribution to get the average pain for that estimator. • Choose the estimator which gives the minimum pain. Mathematical representation • f(x) – the distribution density function • p(m,x) – the relative pain if x ≠ m • Choose the pain to represent business reality. • P(m) = ∫ p(m,x) f(x) dx – the average of the pain over the distribution • Choose m so as to minimize the average pain. Claims for this Recipe • All the usual estimators can be framed this way. • This gives us a way to see the relevance of different estimators in the given business context. Example: Mean • Pain function is quadratic in x with minimum at the estimator: • p(m,X) = (X- m)^2 • Note that it is equally bad to come in high or low, and two dollars off is four times as bad as one dollar off. • Is there some reason why this symmetric quadratic pain function makes sense in the context of reserves? Squigglies: Proof for Mean • Integrate the pain function over the distribution, and express the result in terms of the mean M and variance V of x. This gives Pain as a function of the estimator: • P(m) = V + (M- m)^2 • Clearly a minimum at m = M Example: Mode • Pain function is zero in a small interval around the estimator, and 1 elsewhere, higher or lower. • The estimator is the most likely result. • Could generalize to any finite interval. • Corresponds to a simple bet with no degrees of pain. Example: Median • Pain function is the absolute difference of x and the estimator: • p(m,X) = Abs(m -L) • Equally bad on upside and downside, but linear: two dollars off is only twice as bad as one dollar off. • The estimator is the 50th percentile of the distribution. Example: Arbitrary Percentile • Pain function is linear but asymmetric with different slope above and below the estimator: • p(m,X) = (m -X) for X< m and S*(X- m) for X> m • If S>1, then coming in high (above the estimator) is worse than coming in low. • The estimator is the S/(S+1) percentile. E.g., S=3 gives the 75th percentile. Decision Functions for common statistics mean mode median 75th percentile Reserving Pain function • Climbs much more steeply on the high side than on the low. • Probably has steps as critical values are exceeded. • Is probably non-linear on the high side. Underestimation is serious. • Has weak dependence on the low side. Overestimation is not as serious. Some interested parties who affect the pain function: • • • • • • • policyholders stockholders agents regulators rating agencies investment analysts lending institutions And the mean? • The pain function for the mean is quadratic and therefore symmetric. • It gives too much weight to the low side • Consequently, the mean estimate is almost surely too low. Required Capital • Really, this is backwards because usually the capital is fixed and the underwriting and investment are limited by it. • The question is “how dangerous is our projected net income distribution?” • Again, we can define a pain function to be integrated over the distribution. The pain will depend on the distribution values compared to the available surplus. Riskiness Leverage • A generic form of pain function that can be arbitrarily allocated in an additive fashion. • The usual measures for managing to impairment (or insolvency) are all special cases. • For actuaries, we frame it in terms of net loss, so that negative values are good. For most people, this does not make sense. Riskiness Leverage Examples VaR: L x TVaR: L x Semivariance: L m x Generic Riskiness Leverage • Should be a down side measure (the accountant’s point of view); • Should be more or less constant for excess that is small compared to capital (risk of not making plan, but also not a disaster); • Should become much larger for excess significantly impacting capital; and • Should not increase for excess significantly exceeding capital – once you are buried it doesn’t matter how much dirt is on top. Note: the regulator’s leverage increases. A miniature company portfolio example using TVAR • ABC Mini-DFA.xls is a spreadsheet representation of a company with two lines of business, available online. • How do we as company management look at the business? • “I want the surplus to be a prudent multiple of the average horrible year.” • What is the average horrible year? The worst x%? • What is prudent? 1.5, 2, 5, 10? Conclusions • The reality is that numerical answers to interesting questions are always random variables. • There is no one number which represents a distribution. There may be a best number for a given purpose. • Outcomes always have uncertainty, which can be approximately estimated. This is not the same as the uncertainty in the number representing the distribution.