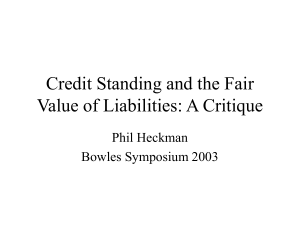

Credit Standing in the Fair Value of Liabilities

advertisement

Credit Standing in the Fair Value of Liabilities by Sam Gutterman & Mo Chambers presented at the 2003 Bowles Symposium by Sam Gutterman Topics to be covered • • • • • • The issue Users of financial statements The arguments Useful information Measurement issues Could recognition vary by type of obligation or timing? 2 The issue • Why credit standing risk is relevant to fair values • Whether to recognize credit standing risk in liability measurement • If so, how should it be measured 3 Users of financial information • • • • • Owners / potential owners Creditors Managers Customers Regulators 4 Arguments of proponents 1. Value of an obligation as an asset should equal to that of a liability 2. Reflect market reality 3. Illogical result if applied to debt 5 Arguments of Opponents 1. 2. 3. 4. 5. 6. 7. Proper markets don’t exist for liabilities Illogical / misleading Transparency demands separate recognition Inconsistent with the going concern assumption Inconsistent with asset and liability approach Credit risk doesn’t transfer with sale Effect of implied regulatory guarantees 6 Usefulness of information • Perspective of entity – Does such an adjustment serve a useful purpose • Present value of expected payments – Does such an adjusted liability mean anything • Multiple users muddies usefulness – Disclosure as an alternative 7 Measurement issues • Whose credit standing – Group or company – Effect of policyholders, particularly par ones • Ceded reinsurance – whose obligation is it • Effect of third party guarantees – how to pre-assess government actions in different jurisdictions • Company or contract specific 8 (more) Measurement issues – The same or different credit standing – Different timing of credit risk emergence and outcome can unbalance income statement – Complexity of partial guarantees – Complex to isolate credit standing risk – Possible double-counting if cost of capital reflected 9 (even more) Measurement issues • How to measure it – FASB indicates more likely in cash flows than in discount rates – Are rating agencies up to it? – Difficulty if source of credit standing risk change is an intangible 10 Alternatives • Disclosure • Separate recognition treatment of debt that explicitly reflects credit standing risk and other financial instruments • Separate treatment of initial measurement and changes 11 Summary • Controversial issue – Might not be significant to highly rated companies • Pro arguments strong for initial measurement if debt is involved or if measurement of tangible assets are similarly affected • Already considered to some extent if cost of capital reflected • Con measurement arguments are strong – Measurement difficult – May not provide useful information if timing of recognition is not consistent 12 What is most useful?