Medical Professional Liability for Physicians– Current Actuarial Challenges

advertisement

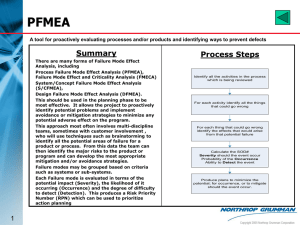

Medical Professional Liability for Physicians– Current Actuarial Challenges Midwestern Actuarial Forum September 24, 2003 Kevin Dyke, FCAS, MAAA American Physicians Assurance Corporation Topics to be Covered Company Background Coverage overview Tort reform Capacity Shrinking Retention Frequency/severity trends Investment income Occurrence coverage Free tail (DD&R) pricing and reserving American Physicians At a Glance Founded in 1975 as Michigan Physicians 19th largest medical professional liability insurance provider in U.S.* Headquartered in East Lansing, MI Focused on solo practitioners and small physician groups A- rated by AM Best and S&P Completed IPO in December 2000 American Physicians Assurance Corporation is a subsidiary of APCapital (NASDAQ: ACAP) *Source: Thomson Financial/OneSource Coverage Overview Coverage variations Occurrence Claims made Tail Hybrid products (e.g. Prepaid tail) Physicians rated by class, territory, specialty, number/types of procedures Death Disability and Retirement Free coverage in event of above Vesting periods for retirement Tort Reform Pending or enacted legislation at both the federal and state levels. Benchmark is California’s MICRA reforms Key is $250,000 cap on non-economic damages Average premiums are lower in California than in other states Common provisions Limiting non-economic damages Statutes of limitations/repose Caps on attorney fees Pitfalls Many attempts at previous tort reform have been overturned by the courts as unconstitutional. Need to monitor conservative/liberal tendencies of courts. Tort Reform (cont) Quantifying tort reform Ask the experts (claims) Select lower trend factors Rate selection < Rate indication Adjust step factors - earlier steps will be affected more than others Wait for results to emerge Courts have overturned tort reform in the past Ohio is on it s 3rd attempt at tort reform. Capacity Shrinking Carriers exiting markets (some by choice) St. Paul exited line in 2001. American Physicians exited Florida in 2002 MIIX, PHICO, PIE, Legion, Frontier, Reliance Some new capital entering market RRGs being formed by physician groups and hospitals Insurance companies being formed in KY, FL, NV Actuarial challenges Who picks up the pieces? Existing carriers already facing capacity constraints due to rate increases Prior acts coverage on insolvent/exiting markets Rate Changes Impacting Retention Carriers out in front of rate changes may suffer from retention woes Most research and modeling for personal lines companies Actuarial needs to monitor retention to ensure mix of business not materially changing May also want to develop diagnostic tests on new and renewal business (e.g. frequency) Physicians Loss Trends Conning and Co. trends Frequency flat or declining Severity increasing 50% from 1997-2001 American Physicians average trends vary by state and policy limit Frequency trend is flat Michigan requires only 200K/600K limits. Severity trends are modest (3-4%) Patient compensation funds limit severity trend to direct writer (e.g. IN, NM) States with $1M/$3M limits have trends in the 6-8% range Need to monitor on both a traditional coverage year basis and on a calendar (settlement) year basis Investment Income Tort reform opponents say stock market losses have led to insurer losses Quite the reverse – insurers invested in bonds at higher interest rates and have achieved greater returns than stock market Pricing considerations Monitor investment yields net of capital gains Rising cash positions Need about 4% additional rate for every 100 basis points reduction in interest rate. Peer Investment Returns 7.00% 6.80% 6.60% 6.40% 6.20% 6.00% 5.80% 5.60% 5.40% 5.20% 5.00% Investment Yield Investment Yield excl Realized Cap Gains Bond Yield 2001 2002 Bond Yield excl Realized Cap Gains Only fixed income investments are considered. Source: Thomson Financial OneSource, Internal analysis Cash Position Growing… Cash and Short Term Assets as a % of Fixed Income Investments - Peer Group 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 4Q00 1Q01 2Q01 3Q01 4Q01 1Q02 2Q02 3Q02 4Q02 Source: Thomson Financial OneSource, Internal analysis Occurrence coverage During the soft market, carriers were offering both occurrence and claims made products Industry wide, occurrence represents 25-30% of total med mal premium. Often pricing on occurrence products were less than 5% above the mature claims made rate Now, carriers are scaling back their occurrence offerings. Why not occurrence? Both frequency and severity unknown for years Years pass before a difficult risk and can be identified Longer investment horizon -> more investment income but greater interest rate risk Occurrence Challenges (cont) Difficulty in predicting ultimate losses more uncertainty in the company loss reserves Development methods highly leveraged in loss development factor Claims made 12 months – ultimate: less than 2.0 Occurrence 12 months – ultimate: greater than 7.0 Frequency/severity approaches highly dependent on ultimate severity Carriers have traditionally understated severity Hypothesis: Less incentive for doctor to report claims under occurrence than under claims made Do doctors report more slowly on occurrence covers? Report and Settlement Lag Analysis Incidents from 1987 - 2000 11 Years from initial report to settlement 10 9 Occurrence 8 7 6 5 4 3 2 1 0 0 1 2 Source: American Physicians internal data 3 4 5 6 7 8 9 Years from incident to initial report 10 11 12 13 14 Contrast with claims made… Report and Settlement Lag Analysis Incidents from 1987 - 2000 11 Years from initial report to settlement 10 9 Occurrence 8 Claims Made 7 6 5 4 3 2 1 0 0 1 2 Source: American Physicians internal data 3 4 5 6 7 8 9 Years from incident to initial report 10 11 12 13 14 Lag Observations Medical malpractice claims have a long tail. Reporting can occur 15-20 years following the incident (e.g. birth related). Average settlement lags longer than report lags Physicians under occurrence policies report slightly later than those under claims made policies But…the gap is narrowing in recent years. DD&R Coverage Provides “free” coverage for claims reported after a physician dies, becomes disabled, or retires. Free tail at retirement typically requires a vesting period (e.g. 5 years). Cost of coverage typically included as an expense in calculating the target loss ratio (commonly 5%). Cost vary by entry age but fairness considerations dictate a flat charge to all physicians DD&R Reserve NAIC requires companies to maintain a reserve for the promised future benefits. Actuarial calculation of DD&R reserve ( PV of future benefits – PV of future premiums ) Assumptions required for Retention Premium trend Loss cost trend Mortality, morbidity, retirement Similar to a pension funding model DD&R Reserve (cont) Actuarial considerations Declining retention less insureds are vested for retirement benefits Age of doctors displaced by existing markets older doctors require higher accruals Early retirement Be careful using % of unearned premium to accrue DD&R reserve Rate increases will increase the adequacy of the UPR