Interaction with Underwriters Casualty Actuarial Society Spring Meeting - May 17, 2005

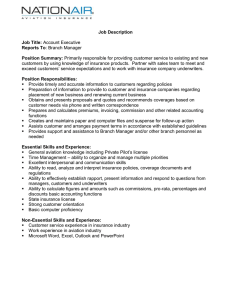

advertisement

Interaction with Underwriters Casualty Actuarial Society Spring Meeting - May 17, 2005 Brian Evans CPCU, ARe Vice President & UW Manager GE Insurance Solutions John Herder, FCAS, MAAA Sr. Pricing Actuary GE Insurance Solutions CAS 2005 Spring Meeting – Interaction with Underwriters Introduction to E&S (non-admitted) Market – Free of Rate Filing Requirements – Free of Form Filing Requirement – Account typically must get 3 rejections from standard markets before accessing the non-admitted market – Surplus Lines Brokers – Multiple Levels of Intermediaries possible – No Premium Tax (Surplus Lines Tax paid by Broker) – Commission Negotiable 2/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Business Overview -- First Specialty Insurance Corp. Excess & Surplus Lines – $100MM operation – Casualty Business (CGL, Umbrella, FF XS) – Risks consist of: – – – – Manufacturers Contractors Restaurants Distributors - Habitational Commercial Real Estate Service Businesses Amusement Parks – Large Account Deal Business – Minimum Premium is $50k for Primary, $15k for Excess – All UW’s on Staff have more than 20 years industry experience. 3/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters U/W Process – Broker submission – U/W Evaluates Exposure – U/W aligns Terms & Conditions to be offered for exposure considered acceptable – U/W calculates “Benchmark Premium” using Pricing Models & decides Premium to Quote – Authority Level – Within Authority, U/W can Quote – Outside Authority, referred for approval – Approval from U/W Management – Generally requires Actuarial approval 4/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters History / First Steps – 2001 & 02 – Hard Market, 400% Growth of book in 2 years – Unclear U/W Focus, Inconsistent Pricing, Minimal Metrics to manage book – Adverse results of the Soft Market beginning to surface – Spring 2003 – Brian & John brought in – Established U/W Strike Zone – Developed of Excel based rating tools – Began to Capture information on Benchmark Pricing, Quote Timeliness, Premium per Exposure – Created Standard Reports to monitor the book 5/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Present / Next Steps – 2004 & 05 – Revise & Fine Tune U/W Guides – Improvements in Processes: Processing of Quotes & Policy Issuance, Loss Control, Premium Audit, Claims Audit, Communications – Enhance Excel based rating tools (Accuracy of Pricing, Ease of Use, Coordination with Marketing Strategy) – 2005 & 06 – Develop & Migrate to Centralized web-based Workflow and Rating Tool – Develop on-line, on-demand reports – Avoid Soft Market Pricing & Underwriting mistakes of the past 6/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Actuary’s Perspective: Why Should Pricing Actuaries want to Spend Time with UW’s? – They are our “customers” – They bring income into our organizations whereas we are overhead expenses. – Their day-to-day decisions generate our companies’ future results. – Our job is to help them do their job better (faster, more focused, more accurately, more disciplined … better) – They can help us do our jobs better – They have a much deeper “hands on” understanding of the business than we do. – Real-world practicality to our models. – Identifying missing variables. – Together we can deliver better results than either of us alone can. 7/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Underwriter’s Perspective: Why Should UW’s want to Spend Time With Actuaries? – They can help us understand our business better: – Understand Trend – Learn the Mechanics of Loss Development – They can help us produce better results: – Development of Adequate Pricing – Metrics for better business management – They Provide a “Pricing Conscience” – Together we can deliver better results than either of us alone can. 8/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Underwriter’s Perspective: What should I do to make the Actuarial Process better? – Think of the actuary as a teammate – Provide input to the actuary – Accept input from the actuary – Think of the pricing models as helpful tools rather than roadblocks to writing business – Be willing to learn the theory of how the models get to an answer – Ask if not sure of how to use the tools – Help identify where & when the pricing models work / don’t work in the real world: – ID where/when the answer is unexpected (high or low) – ID where/when the gap between related quotes is wider or not as wide as expected – Feedback – Praise when justified – Suggestions for improvement when justified 9/ GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Actuary’s Perspective: What should I do to make the Underwriting Process better? – Be a member of the team – Build Tools to help the Underwriters to do their job better – Faster & easier not just more precise – Training – On use of tools – Actuary 101 Classes – Price Individual Deals (upfront assistance, not just referrals) – Monitor & Report out results – Timely – Interpret what I see, not just report it – Offer praise when justified & suggestions for improvement when justified 10 / GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Working Together = Business Success – Joint creation of UW Strike Zone – Consistent Benchmark Pricing – Rate Adequacy Research – Metrics for Managing the UW Staff – Portfolio Management Tools – Together, we accomplish better results 11 / GE Insurance Solutions May 17, 2005 CAS 2005 Spring Meeting – Interaction with Underwriters Audience Participation Time Examples of when the Actuary / UW relationship : – was less than ideal – worked great 12 / GE Insurance Solutions May 17, 2005