Catastrophe Modeling in the Caribbean 17 May 2005

advertisement

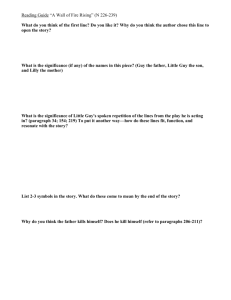

Catastrophe Modeling in the Caribbean 17 May 2005 The Issue Hurricane Ivan caused an estimated $11 billion damage in the Caribbean and USA – Grenada (7 Sep 04) – Cayman Islands (11-12 Sep 04) – Gulf of Mexico / Offshore Marine (13-15 Sep 04) – United States (16-24 Sep 04) Third highest insured natural perils loss in history “According to the NHC, Ivan is the sixth-strongest storm to ever hit the Atlantic basin” (13 Sep 04) Guy Carpenter 2 Hurricane Ivan track Guy Carpenter 3 The Issue Insurer insolvencies and impairment – “Industry PMLs” provided insufficient levels of protection – Cat models did not generally anticipate the extent of storm surge damage in the Cayman Islands Guy Carpenter 4 The Caribbean 26 countries Hundreds of islands 38 million people – Three major languages Spanish 65% French 22% English 14% Approximate land size and population of the USA between Pennsylvania and Maine Spread out over an area roughly equivalent to the USA east of the Mississippi Guy Carpenter 5 Guy Carpenter 6 The Caribbean Huge natural perils exposure – Atlantic hurricane track – Caribbean plate Market standard natural perils deductibles – Typically 2% of insured values – Can be higher Property insurance rates vary from 0.3% to 3.0% (and higher) – Depending on geographical location, recent loss activity, historical activity, perceived exposure, occupancy, construction, coverage, quality, cat modeling, and market practice – Little or no rate regulation Guy Carpenter 7 “PML” Definitions “MPL” (Maximum Possible Loss) for any given portfolio is 100% of insured values (less deductibles) – Absolute worst case “MFL” (Maximum Foreseeable Loss) for any given portfolio may be lower than 100% – Generally associated with the extreme “tail” of a distribution (e.g., cat model output, realistic disaster scenario) “PML” (Probable Maximum Loss) for any given portfolio may be lower than 100% – Explicitly or implicitly associated with a frequency (“return period”) – There exist a range of PMLs for various interested parties with various risk appetites Guy Carpenter 8 “PML” Could be 100% for any given location Mathematically, limited to the range (0%, 100%) – 0% at frequent return periods (e.g., per day, per month) – 100% at remote return periods (e.g., per millenium, per eon) Guy Carpenter 9 “PML” Historical practice Historically, based on extrapolation of extreme events from relatively small sample event sets Insurance and Reinsurance market rules of thumb Regulatory requirements Rating agency requirements Guy Carpenter 10 “PML” Caribbean practice Caribbean companies have historically been among the leaders in cat risk management of necessity – Reinsurer pricing and PMLs guide market practice – Explicitly split rates (Fire vs Cat premium) – CRESTA system set up in 1977 to capture exposure data by zone – Caribbean exposures by CRESTA zone were generally provided on reinsurance submissions Guy Carpenter 11 “PML” Caribbean practice USVI Caymans 15% - 20% Bahamas 8% - 15% Barbados 10% - 15% BVI 10% - 25% Market practice can and does vary widely from insurer to insurer due to variances in deductibles, spread of exposure, quality of construction, level of capitalization, and risk appetite Guy Carpenter 25% 12 “PML” Current practice Exposure data capture and quality Hazard frequency and severity – Hurricane – Earthquake – Other perils Damage functions – Wind – Water – Shake – Fire following Guy Carpenter 13 “PML” Current practice Financial variables – Coverages – Deductibles – Coinsurance – Insurance to value – Sublimits – Hours clauses – Loss Adjustment Expense – Demand surge Combination of factors produces “PML” estimates – Cat models often provide our current best estimates of damage for “modeled” perils and events Guy Carpenter 14 “PML” Current practice Cat models – RMS – EQE – AIR – Reinsurer models – Insurer models – Broker models – Consultant models Guy Carpenter 15 “PML” Current practice Post-event, cat modelers learn from losses and adjust models Recent Caribbean events – Gilbert (1988) – Hugo (1989) – Marilyn & Luis (1995) – Georges (1998) – Ivan (2004)? Guy Carpenter 16 Caribbean PMLs Scenario estimates Caribbean “MFLs” often assume it’s possible for an island to be hit with a SS-5 hurricane – “Close” vs. “Direct” hit? – Fast-moving vs. slow-moving? – Dry vs. wet storm? – Without storm surge or with? Guy Carpenter 17 Caribbean PMLs Scenario estimates Limited geographical scope (single island) – Easier to model “small” islands (e.g., Caymans, Barbados, St Croix) – More difficult for “larger” islands (e.g., Puerto Rico, Hispaniola, Cuba), as storm intensity will vary over the island – Portfolio damage is weighted average of individual location damage Guy Carpenter 18 Caribbean PMLs Probabilistic estimates Cat models are collections of event scenarios – Discrete approximations, with probabilities attached to each scenario – Not exhaustive – Limited perils – Calibrated using historical experience Recalibrated as required, based on research and actual event experience Guy Carpenter 19 Risk Management in the Caribbean Define “PML” as the maximum loss an insurer can reasonably expect to pay with 99% certainty Define “PML Bust” as the occurrence of an event that produces loss in excess of the “PML” – “PML Bust” is unlikely, but not impossible – “PML Bust” events will in all likelihood happen every year, somewhere in the world Guy Carpenter 20 Risk Management in the Caribbean First principles – PMLs range from 0% to 100% – PMLs are associated with return periods (frequency) – PMLs less than 100% will always (eventually) be exceeded Guy Carpenter 21 Risk Management in the Caribbean Many Caribbean insurance companies cede away most premium proportionally – Geographically concentrated portfolios and high levels of natural perils exposure – Security of insurance product is dependent on security of backing reinsurance and Event Limits purchased – Insurance company net results are largely dependent on overrides and volume (rather than profitability of rates and risk appetite) Costs can still be high for those who purchase a mix of excess of loss and proportional reinsurance – Geographically concentrated portfolios and high levels of natural perils exposure Guy Carpenter 22 Risk Management in the Caribbean Insurance is a business – It’s impractical to hold capital and/or purchase reinsurance up to full limits (“MPL”) Suboptimal use of capital – The market (e.g., insureds, regulators, ratings agencies) deems it acceptable to provide less than perfect insurance and reinsurance security – Need to quantify risk appetite Probability of default Risk-equivalent returns – Need to use best available tools in a cost-effective manner to make sound business decisions Multiple cat models, combined with first principles Guy Carpenter 23 Risk Management in the Caribbean Most people want certainty, not “sufficiently low probabilities” – Most insurance companies think and plan in terms of “point estimates” rather than distributions – Regulators want policyholders to be paid – Cat models should be used as a guide, not a rule Never lose sight of first principles – Deterministic thinking pervades society Guy Carpenter Statistics is a relatively young science 24 Guy Carpenter 25 CARIBBEAN Guy Carpenter SEA 26