Enterprise DFA™ Application of Dynamic Financial Analysis in the Oil Industry

advertisement

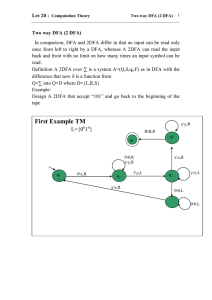

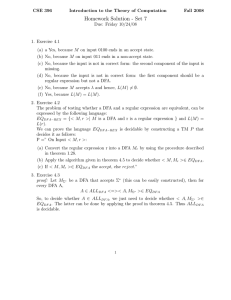

Enterprise DFA™ Application of Dynamic Financial Analysis in the Oil Industry -1OMP 1 Discussion Outline Background Oil Company Imperatives Problem Diagnosis The Application of DFA The Opportunities for Actuaries -2OMP 2 Background Stochastic Financial Modeling Not New Significant Academic Interest Standard in 1970’s Finance Texts Promoted Heavily by IBM et a Did Not Gain Wide Acceptance in Practice Miscast as Predictive Tool Difficult and Expensive to Implement Measuring / Understanding Risk Not Valued -3- OMP 3 Background Considered Evidence that Long Term Forecasting Was Not Practical OMP 4 Time -4- Background New Focus in Investment Management Earnings Growth Was Theme Results Now Handicapped on Risk New Pressure From the Market Earnings Predictability Managing Analysts’ Expectations Managements Search for Tools to Understand / Manage Earnings Volatility -5OMP 5 Oil Company Imperatives Large Oil Company’s Stock Under Performing Management Believed It Undervalued Earnings “Surprises” Had Hurt Values Perceived as High Risk Company Board Losing Confidence in Management Huge Bets on High Risk Projects Unsure How Risks Managed “We Going to Lose the Ranch?” -6OMP 6 Oil Company Imperatives Project Undertaken to Evaluate Earnings and Business Risks. Objectives Included: Understand Earnings Forecast Failures Communicate Risks to Board Change Market’s Perception of Company Risk -7OMP 7 Problem Diagnosis - Forecast Failures EPS Forecasts Only Compiled by Corporate No True Enterprise Model Roll Up Of Divisional Forecasts Tied to Business Planning / Challenge Process Significantly Different Risk Levels / Drivers Each Used its Own Economic Assumptions Forecasts were Deterministic Point -8- OMP 8 Problem Diagnosis - Board Investment Project vs. Enterprise Focused Analyses - Complex Issues High Detail - Low Information Lack of Context and Comparability No Enterprise Level Conclusions -9OMP 9 Problem Diagnosis - Market Market Perceived Company High Risk v. Competitors Reinforced by Earnings “Surprises” Low Appreciation for Risk Hedging Programs Resulted in Lower than Market P/E - 10 OMP 10 Application of DFA Project to Address Issues Using DFA Type Analysis Enterprise Level Financial Model Developed - Tied to Corporate Plans High Impact Variables Identified Assumption Variability from Key Executives Disaggregation Analysis Competitive Analysis Board Presentations - 11 OMP 11 DFA Methodology Enterprise Model Common Environmental Assumptions Economic - Common for All SBU’s Non Management Controlled Issues Corporate Financial Leverage Strategy Based Management Assumptions Business Unit Based Probability of Strategy Implementation - 12 OMP 12 Enterprise Model Structure DFA - Methodology Exploration / Production Economic Environment - Weather - Economic Growth - Supply Constraints - Spot Market Prices Refining / Marketing Management Interventions Chemicals Coal / Power - 13 OMP 13 Common Environmental Assumptions DFA - Methodology Economic - Non Management Controlled Energy Price / Demand Drivers » Weather » Economic Growth » Supply Conditions Capital Markets Conditions Corporate Financial Structures Financial Leverage Hedging / Market Risk Control - 14 OMP 14 Business Strategies DFA - Methodology Exploration / Production Profitability of Existing Production Success of Exploration Opportunities Project Selection / New Market Growth Refining & Marketing Sales Growth in High Value Fuels Expansion in High Growth Markets Shut Refining in Low Growth Markets Reduce Unit Expenses - 15 - OMP 15 Business Strategies DFA - Methodology Chemicals Reduce Unit Costs Redesign Major Processes Commercialize New Technologies Coal, Minerals & Power Increase Facility Utilization Mine Expansions Expand Electric Power Business - 16 OMP 16 Earnings Forecast Failures DFA Results x Earnings per Share - 17 OMP 17 Consolidated Forecast Earnings Forecast Failures DFA Results Capital Requirement Aggressive vs. Most Likely Assumptions Used in Forecasts Expected Value x x Consolidated Forecast 95% Confidence Level 0 100 Earnings Per- 18Share OMP 18 Communicate Risks to Board DFA Results Financial Leverage Added High Risk and Small Earnings Gain Expected Value x x With Leverage Without Leverage Earnings per Share - 19 OMP 19 Communicate Risks to Board DFA Results Businesses Differ in Risk - Exploration Forecasts Aggressive Refining / Marketing x x Coal x Exploration/ Production 0 Earnings per- 20Share OMP 20 x Chemicals Communicate Risks to Board DFA Results Energy Market Price Greatest Risk Source Base Strategy x x 0 Earnings per- 21Share OMP 21 Hedge All Price Risk Communicate Risks to Board DFA Results Strategies to Lower Costs Had Small Impact on Risk x 0 Earnings per- 22Share OMP 22 Market Perception of Risk DFA Results Client Had Lower Risk than Most Competitors Comp. C Competitor B Competitor A Client 0 Earnings % of Revenue - 23 OMP 23 Opportunities for Actuaries Risk Analyses are Central to Industrial Managers DFA Type Analysis is High Value Added Actuaries Must Expand beyond Technicians to become Strategists If Actuaries Don’t - Others Will - 24 OMP 24 Preliminary DFA Results - 25 OMP 25