Using the Public-Access DFA Model: A Case Study

advertisement

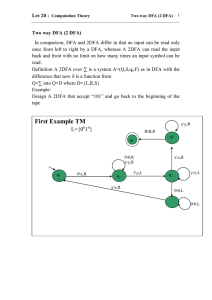

Using the Public-Access DFA Model: A Case Study Richard Gorvett, FCAS, Ph.D. The College of Insurance Thomas Hettinger, ACAS Miller, Rapp, Herbers & Terry, Inc. Robert Walling, ACAS Miller, Rapp, Herbers & Terry, Inc. CAS Seminar on Dynamic Financial Analysis July, 1998 Outline of Our Case Study • Description of the MRH&T Public-Access DFA Model • Description of the Company • Information Requested From the Company • Initial Findings • Presentation to Company Management • Reaction of Company Management: Their Concerns and Our Responses • Future Model Enhancements • Conclusions DynaMo: The Public-Access DFA Model • Developed by Miller, Rapp, Herbers & Terry, Inc. (with Academic Assistance) • Freely Available -- Encourages Industry Input • www.mrht.com • Excel and @Risk • Stochastic Simulation – Specify Inputs – Select Outputs DynaMo Catastrophe Generator U/W Inputs U/W Generator Payment Patterns U/W Cycle U/W Cashflows Tax Interest Rate Generator Investment & Economic Inputs Investment Generator Investment Cashflows Outputs & Simulation Results Risks Modeled Underwriting • Pricing – Claim Frequency and Severity (Non-Cat.) • Inflation • Aging Phenomenon – Jurisdictional – Underwriting Cycle • New Business Penalty • Loss Reserve Development • Catastrophes Risks Modeled Financial • Interest Rates – Cox-Ingersoll-Ross • dr = a(b-r)dt + sr0.5dz – Mean-Reverting; Rate-Sensitive Volatility • Inflation – General (CPI): Function of Simulated Interest Rate – Line of Business: Function of Simulated CPI • Equity Market Performance Outputs Available • • • • • • 5-year Projections Balance Sheets Income Statements Loss Ratio Reports IRIS Tests Others as Needed – Select Any Cell of Spreadsheet – Graphs and Histograms Model Uses Internal • • • • • Strategic Planning Ratemaking Reinsurance Valuation / M&A Market Simulation and Competitive Analysis • Asset / Liability Management External • External Ratings • Communication with Financial Markets • Regulatory / Risk-Based Capital • Capital Planning / Securitization Description of Case Company We applied DynaMo to an actual insurance company having the following attributes: • • • • Mid-size Property-Liability Insurer Writes Nationally In Business for More than Twenty Years Multi-line Lines of Business • • • • • • Private Passenger Auto Homeowners Commercial Auto Commercial Multiple Peril Workers Compensation Others Reinsurance Contracts • Excess-of-Loss • Quota Share • Catastrophe • Aggregate Stop Loss Data Requested From Company • Annual Statements • Expense Data – IEE – Future Plans • Historical Loss Data – Actuarial Analysis – Direct, Ceded, and Net • Historical Premium Data – By Renewal Category Where Possible • Reinsurance Program Data Requested From Company • Underwriting Data -- by Line of Business – – – – – New and Renewal Exposures Written Renewal Ratios Projected Growth Rates Exposure Distribution Policy Limit Profile • Asset data – Statutory and Market Values, by Asset Type – Coupon and Dividend Rates – Equity Betas The DFA Process • Review Company • Gather Data • Modify Base Model to Best Reflect ABC’s Structure – – – – Group and Ungroup Lines of Business Unique Reinsurance? Unique Assets? Other The DFA Process (cont.) • Enter Data • Run Model – How Many Simulations? • Review Results – Graphs – Exhibits The DFA Process (cont.) • Check for Reasonableness – – – – – – Premiums Losses Asset Values Compare Modeled Latest Two Years to Actual Loss Ratios ... The DFA Process (cont.) • Re-parameterize Model – – – – Frequencies Severities Interest Rates Other • Accept or Reject – What Criteria? The DFA Process (Cont.) • Modify and Rerun Model • Sensitivity Test By Changing Parameters • Determine Plan of Attack A Second Look at Parameters • New Business Penalty – Frequencies – Severities • Interest Rates – Long Term Mean – Volatility • Underwriting Cycle – Trends in WC and HMP Results Initial Findings - Areas to Review • Dispersion of Results • Probability of Undesirable Results • Maximum and Minimum Initial Findings • Surplus Steadily Decreased Over the 5 Year Period • Great Variability in Year 2002 Results • Probability of Negative Surplus Year 2002 Surplus Distribution Original Assumptions 0.25 0.15 0.1 0.05 Millions 9. 2 30 5. 0 27 0. 8 24 6. 6 20 2. 4 17 8. 2 13 3. 9 10 .7 69 .5 35 1.3 .9 0 -32 Probability 0.2 Initial Findings - Possible Reasons Large Growth Objectives Surplus Drain Renewal Ratio New Business Penalty Initial Findings - Additional Complications Growth Objectives Unacceptable Surplus Drain Loss Ratio Deterioration Devaluation of Assets Adverse Reserve Development Unusual Catastrophes What Now? • Leave As Is • Make Adjustments and Rerun – Critical Variables – Parameters Critical Variables • Exposure Changes • Expense Provisions • Frequencies and Severities – Initial Selections – New Business Penalty • Growth Rates • Interest Rates – Current – Long-Run Critical Variables (cont.) • Parameter Adjustments – – – – • • • • Inflation U/W Cycle (Probability of Turning) U/W Cycle (Supply and Demand Curves) Jurisdictional Risk Renewal Ratios Reinvestment Allocations Stock Betas U/W Cycle (Current Position) Critical Variables (cont.) • Reinsurance Arrangements – – – – – – – – Q/S XOL CAT Stop Loss Retention Cost Commission Ceding % Presentation of Initial Findings • Initial Report to Management – Information about DynaMo and DFA – Results/Simulations for 2 Initial Scenarios • Meeting With ABC and Authors – – – – Actuarial Investments Reinsurance CFO • Interactive Session – Q&A – Laptops for Training and Variation Suggested Changes • Our Original Suggestion – Temper Growth Rate • ABC’s Suggestion – – – – Adjusting Growth Unsatisfactory Renewal Ratio New Business Penalty (Tighten U/W) Exposure Distributions • Our Additional Recommendation – Changing Reinsurance Provisions Other Changes • Change Long Term Interest Rate – Tendency of Interest Rates Climbing (Mean Reverting Property of C-I-R Model) – Higher Investment Return – Lower Future Value of Current Bonds – Higher General Inflation – Higher Claims Inflation – Greater Than Expected Losses Year 2002 Surplus Distribution Constrained Growth Assumptions 0.25 0.15 0.1 0.05 Millions 4.8 33 8.1 30 1.4 28 4.7 25 8.0 22 1.3 20 4.6 17 7.8 14 1.1 12 94 .4 0 67 .7 Probability 0.2 Year 2002 Surplus Distribution Different Reinsurance Assumptions Increased Stop Loss Max Ceding Amount 0.3 0.2 0.15 0.1 0.05 Millions 0.4 28 2.3 24 4.3 20 6.2 16 8.1 12 90 .1 52 .0 13 .9 -62 .2 -24 .2 0.3 0 -10 Probability 0.25 Year 2002 Surplus Distribution Different Reinsurance Assumptions Lowered Stop Loss Attachment Point 0.3 0.2 0.15 0.1 0.05 Millions 8.7 30 2.0 27 5.3 23 8.7 19 2.0 16 5.3 12 88 .6 51 .9 15 .2 .5 -21 .2 0 -58 Probability 0.25 Year 2002 Surplus Distribution Slightly Constrained Growth, Tightened Underwriting, and Increased New Business Retention 0.25 0.15 0.1 0.05 Millions 6.2 35 6.2 32 6.2 29 6.2 26 6.3 23 6.3 20 6.3 17 6.3 14 6.4 11 86 .4 0 56 .4 Probability 0.2 ABC’s First Impressions • Excel/@Risk Platform • Understandability • Ability to Modify ABC’s View on Using the Model • • • • • Strategic Planning Capital Allocation Reinsurance Contract Negotiations Internal Communications External Communications – Regulators – Rating Agencies – Investment Community • Other Company Assessment ABC’s Concerns • Usability With Other Software – Catastrophe Models – Fixed Income Security Software • Presenting Results to Senior Management • Comparing Expected vs. Actual – Project Last Year and Look at Differences • Enhanced Assets – Callable Bonds – CMO’s Future Enhancements • Expand Enterprise-Wide Modeling Capabilities • Enhancements to Assets – – – – – Callable Bonds Other Options Embedded in Bonds CMO’s Foreign Currency Risk More Sophisticated Reinvestment Abilities • Add State and/or Regional Detail in U/W Module Future Enhancements (cont.) • Enhancement of U/W Cycle Module – Supply/Demand Curves – Impact on Retention Rates – Impact on Jurisdictional Risk • Additional Correlations Between LoB’s • Add Tax Carry-Forwards and Carry-Backs • Additional Outputs – RBC – BCAR – Others Summary and Conclusions • The MRH&T Public-Access Model – Publicly Available – Use Encouraged; Comments Welcome – Evolving • Application of DFA Model to Companies – Model Flexibility is Important – Test the Results; Make Adjustments if Necessary – Listen to the Company