– The Future of TV What’s the Role of P2P?

advertisement

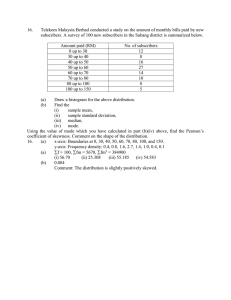

The Future of TV – What’s the Role of P2P? Introduction – Natalie Klym, MIT Community Networking – Marie José Montpetit, Motorola Community PVR – Henry Holtzman, MIT MIT Communications Futures Program Bi-annual meeting, January 22-23, 2008 San Jose, CA Several key trends are disrupting the traditional TV industry • Enhancement & extension of traditional platforms • New delivery platforms • New end-user devices • New content types 2 A larger number of more complex and interconnected value chains now comprise the video landscape Content providers Delivery platforms End user devices Wireless networks Online video producers Cable TV networks Private Internet Cell phone Public Internet PDA PC Cable Licensed spectrum (OTA) Postal service (DVD) DVD player Film studios Linear VOD DVR Big 4 networks STB Satellite TV 3 Services can be broken down into 2 high-level categories Carrier services Wireless networks Online services “Closed” Private Internet “Open” Acquired content (short tail) Guaranteed connection To the TV (lean back) (except wireless) Public Internet Satellite TV Linear Cable TV VOD “Any” content (long-short tail) “Best-effort” connection To the PC (lean forward) (some bridges to TV) Licensed spectrum (OTA) 4 Services both complement and compete with one another • For many users, online video complements carrier services • But for certain users, it is becoming a substitute • For carriers who also function as ISPs, substitution scenario is known as the “over the top” threat 5 Live TV still dominates… how and when will this change? Most people in the U.S. still watch traditional TV Percent of US TV Households 2007 112.3M Total OTA 15% Satellite 27% Cable 58% (56% digital) Worldwide IPTV subscribers 2007 • 8.3M Total • Europe 60% • Asia 26% • USA 5% Satellite Highest growth rate is in 27% Europe US mobile TV subscribers 2007 3.7% of mobile subscribers watched video on their mobile phones = 8M mobile TV viewers (36% carriers’ content, 64% sent by peers) US Broadband subscribers in 2007 • 60M+ broadband subscribers − 32.6M cable − 27.5M DSL • 66% of home BB users consume online video (vs 31% of dial-up users) • (16% is traditional TV content, 25% is YouTube) − − − − 76% of 18-29 year olds 57% of 30-49 year olds 46% of 50-64 year olds 39% of 65 + year olds 6 As video services evolve, the TV experience is being redefined • User behaviors are redefining the video value proposition • It’s what you can do with content once you get it that’s important – Time shifting – Screen shifting – Place shifting – Sharing/redistributing – Enter social networking 7 How does P2P enable social networking in the TV experience? Community Networking: Getting P2P out of Prison Marie José Montpetit Distinguished Member of the Technical Staff Motorola Community PVR Henry Holtzman Research Scientist MIT Media Lab 8