FTTx Architectures and Why it Matters for the Open Access Debate Carnegie Mellon

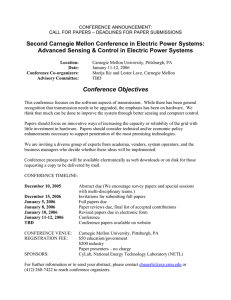

advertisement

Carnegie Mellon FTTx Architectures and Why it Matters for the Open Access Debate Marvin A. Sirbu Department of Engineering and Public Policy Carnegie Mellon University sirbu@cmu.edu http://www.andrew.cmu.edu/user/sirbu/ © 2008 Marvin A. Sirbu 1 Carnegie Mellon FTTP networks have significant economies of scale facilities-based competition is unlikely to be sustainable Service-level competition can exist over shared network infrastructure Conclusions Up Front Sharing possible at different levels Sharing of dark fiber requires attention to fiber layout There is great variety in the models of sharing which can be found today A wholesale-only provider is financially viable It is not necessary to be vertically integrated to be profitable © 2008 Marvin A. Sirbu 2 Carnegie Mellon Outline Models of Competition in FTTP Alternative FTTP architectures: impact on competition Economics of FTTP Economics of a Wholesale/Retail split © 2008 Marvin A. Sirbu 3 Carnegie Mellon Outline Models of Competition in FTTP Alternative FTTP architectures: impact on competition Economics of FTTP Economics of a Wholesale/Retail split © 2008 Marvin A. Sirbu 4 Carnegie Mellon Facilities based competition – each competitor builds FTTP network Central Office s Home 1 Service Provider A Network 1 Home 2 Separate Networks Service Provider B Network 2 Data Link Layer Equipment ATM, Gigabit Ethernet, SONET © 2008 Marvin A. Sirbu 5 Carnegie Mellon UNE (LLU) based Competition in FTTP Dark fiber based – network owner wholesales dark fiber Wavelength based – network owner wholesales wavelengths Central Office Home 1 Service Provider A Network Data Link Layer Equipment Service Provider B Home 2 © 2008 Marvin A. Sirbu 6 Carnegie Open Access based competition – network owner Mellon wholesales transport capacity Central Office Home A Service Provider A Network Home B Common Data Link Layer Equipment © 2008 Marvin A. Sirbu Service Provider B 7 Carnegie Mellon Sharing Network Infrastructure: Summary Layer: Shared Infrastructure… 0 Conduit and collocation facilities. 1 (Physical Layer Unbundling) Dark fiber leasing, or perhaps, Optical Layer unbundling (CWDM or DWDM in PONs) 2 (Data Link Layer Unbundling) Dark fiber and link-layer electronics at each end. For example, Ethernet-based VLAN, or ATM-based PVCs. 3 (Network Layer Unbundling) Basic network service provided. For example, IP Layer 3 service over cable using policy-based routing to multiple ISPs © 2008 Marvin A. Sirbu 8 Carnegie Mellon 0 Open access to ducts 1 Portugal France Dark fiber at layer 1 2 Examples of Sharing at Different Layers Stokab in Stockholm VLAN service at layer 2 UTOPIA Amsterdam Pau © 2008 Marvin A. Sirbu 9 Carnegie Mellon Multiple Layer Separation Amsterdam Source: http://www.citynet.nl/upload/Wholesale-bandwidth-Amsterdam-Citynet.pdf © 2008 Marvin A. Sirbu 10 10 Carnegie Mellon If you build a wholesale network, will there be service providers? Kutztown, PA wanted to do only up to layer 2 and couldn’t find service providers to run over the network Operations finger pointing between wholesaler and retailer Issues and Problems Provo Utah sold its layer 2 wholesale network to a service retailer arguing that integrated operations are cheaper Economies of scale Operating company to light the fiber in multiple cities – Axione – Packet Front © 2008 Marvin A. Sirbu 11 Carnegie Mellon Outline Models of Competition in FTTP Alternative FTTP architectures: impact on competition Economics of FTTP Economics of a Wholesale/Retail split © 2008 Marvin A. Sirbu 12 Carnegie Mellon Home Run Architecture ONU Central Office Infrastructure Implications for Competition Physical layer unbundling possible – wholesaler can sell individual fiber Also supports open access Dedicated fiber to each Home Central Office Equipment OLT Port ONU Optical Network Unit OLT Optical Line Termination Distribution Loop Feeder Loop © 2008 Marvin A. Sirbu 13 Carnegie Mellon Active Star Architecture ONU Central Office Infrastructure 1 Implications for Competition Physical layer unbundling is difficult Shared Feeder fiber Central Office Equipment OLT N Remote Node with Active Electronics Equipment Distribution Loop Feeder Loop © 2008 Marvin A. Sirbu requires competitors to collocate electronics at remote node Must provide feeder fibers for each competitor Logical layer unbundling possible - supports open access 14 Carnegie Mellon Curb side Passive Star Architecture (PON) ONU Central Office Infrastructure Central Office Equipment OLT 32 Distribution Loop Implications for Competition Physical layer unbundling not possible Logical layer unbundling possible - supports open access Shared Feeder fiber 1 Curbside Passive Splitter – Combiner Separate λ’s may be used for Data and video Feeder Loop © 2008 Marvin A. Sirbu 15 Carnegie Mellon WDM PON ONU Implications for Competition Physical layer unbundling not possible Optical layer unbundling possible – wholesaler can sell wavelengths Also supports open access Central Office Infrastructure 1 Shared Feeder fiber Central Office Equipment OLT 32 Passive Splitter – Combiner Distribution Loop Feeder Loop © 2008 Marvin A. Sirbu 16 Carnegie Mellon Design Considerations in a PON: A Curb-side PON Neighborhood 1 Central Office Infra structure Splitter 1 Central Office OLT Equipment PON1 Central Office OLT Equipment PON2 Splitter 2 Both OLTs needed if only one home in each splitter group subscribes Neighborhood 2 © 2008 Marvin A. Sirbu 17 Design Considerations in a PON: A Fiber Aggregation Point (FAP) PON Carnegie Mellon Neighborhood 1 Central Office Infrastructure Splitter 1 Central Office OLT Equipment Splitter 2 Aggregation Neighborhood 2 Fiber Aggregation Point PON supports all models of competition © 2008 Marvin A. Sirbu 18 Carnegie Mellon How many homes should be aggregated at an Optimal FAP? FTTH Costs for an Urban Deployment NPV of Cost per Home 1600 1500 Home Run 1400 Active Star 1300 PON 1200 Distributed Split PON Home Run PON 1100 1000 900 800 0 200 400 600 800 1,000 Num ber of Hom es Aggregated at OFAP OFAP allows deferring investment in OLTs until penetration requires it © 2008 Marvin A. Sirbu 19 OFAP as a Real Option to Phase-in New Technologies Carnegie Mellon Neighborhood 1 Central Office Infrastructure Splitter 1 GPON GPON CO OLT Equipment BPON CO OLT Equipment Splitter 1 BPON Neighborhood 2 Aggregation © 2008 Marvin A. Sirbu •OFAP also supports flexibility in future split ratios - 10 Gbps GPON, GEPON - WDM PONs 20 Carnegie Mellon OFAP Benefits with an Active Star Architecture Neighborhood 1 Central Office Infrastructure Feeder 1 Central Office OLT Equipment RT & OLT to be deployed as needed Central Office OLT Equipment Feeder 2 Neighborhood 2 •Larger serving area Aggregation point •Higher utilization of RT and OLT ports •Neighboring homes can be served by different technology generations © 2008 Marvin A. Sirbu 21 Carnegie Mellon As video becomes dominated by unicast Video on Demand (VOD) metro aggregation network costs soar In smaller communities, access to regional transport to a Tier 1 ISP is a major barrier to entry Retail service providers sharing an FTTH access network may also need to share at the metro/regional level in order to be economically viable. Sharing in the “Second Mile” NOAAnet There is a tradeoff with distributed video servers Sharing a content delivery network (e.g. Akamai) may be an alternative. – This requires distributed colo space and interconnection See Han, S. et al “IPTV Transport Architecture Alternatives and Economic Considerations,” IEEE Comm Mag, Feb 2008 Lamb L., “The Future of FTTH – Matching Technology to the Market in the Central Office and Metro Network,” NOC 2008. NSP, “A Business Case Comparison of Carrier Ethernet Designs for Triple Play Networks,” © 2008 Marvin A. Sirbu 22 Carnegie Mellon If regulators want to be able to require dark fiber unbundling, they need to require compatible fiber layout Regulatory Implications OFAP PON vs curb-side PON Even larger OFAP for competitive active star – Need for additional feeder fibers for competitors All architectures support logical layer (“bitstream”) unbundling IPTV unbundling possible at bitstream layer If video distributed over a separate wavelength, issues of access to RF multiplex. © 2008 Marvin A. Sirbu 23 Carnegie Mellon Outline Models of Competition in FTTP Alternative FTTP architectures: impact on competition Economics of FTTP Economics of a Wholesale/Retail split © 2008 Marvin A. Sirbu 24 Simple FTTH Economics: FTTH Includes Fixed Plus Variable Costs Carnegie Mellon Cost = Fixed + R * Variable $ e.g. for Verizon YE06 Fixed=$850 Variable=$880 Source: http://investor.verizon.com/news/20060927/200 60927.pdf Fixed costs 0% 100% Take Rate (R = customers / homes passed) Adapted from Friogo, et.al. http://ieeexplore.ieee.org/iel5/35/29269/01321382.pdf © 2008 Marvin A. Sirbu 25 Carnegie Mellon Cost Per Subscriber vs Take Rate Variable Cost Total Cost/Sub 8000 Cost/Subscriber 7000 6000 5000 4000 3000 $1730 2000 1000 0 0% 20% 40% 60% 80% 100% Take Rate © 2008 Marvin A. Sirbu 26 Carnegie Mellon One operator estimates $90/month per subscriber $40 for ongoing services cost $50/month to cover capital costs Assume an average of 10 year lifetime, 5% cost of capital How Much Revenue to Support FTTH? Fiber lasts 40 years Electronics lasts five years $50/month can amortize $4700 What if Average Revenue Per User (ARPU) is less? $30/month can amortize $2800 © 2008 Marvin A. Sirbu 27 Carnegie Mellon Cost Per Subscriber vs Take Rate Variable Cost Total Cost/Sub Capital at $50/mo Capital at $30/mo 8000 Percent take rate needed to break even 7000 Cost/Subscriber 6000 Capital that can be amortized with $50/mo/sub 5000 4000 Capital at $30/mo/sub 3000 2000 1000 0 0 Adapted from Frigo et. al. 0.2 0.4 0.6 Take Rate © 2008 Marvin A. Sirbu 0.8 1 28 Carnegie Mellon Cost Per Subscriber vs Take Rate 8000 Take Rate 7000 Consumers Cost/Subscriber 6000 Capital that can be amortized with $50/mo/sub 5000 4000 3000 2000 Competition 1000 0 0 Adapted from Frigo et. al. 0.2 0.4 © 2008 Marvin A.Take Sirbu 0.6 Rate 0.8 1 29 Carnegie Mellon Economic Implications: If revenue available to amortize plant is only $30/month, must reach penetration of > 45% room for at most 2 facilities-based providers This analysis understates the problem No customer acquisition (marketing/sales) cost included – Customer acquisition drives up Fixed costs pushing breakeven penetration higher Unlikely to see >90% total penetration © 2008 Marvin A. Sirbu 30 Carnegie Mellon Facilities-based competition among fiber network providers is unlikely Economies of scale Regulators should be cautious of waiving open access requirements in return for investment in fiber Regulatory Implications Could lead to remonopolization At best duopoly competition If service competition limited to ISPs which own facilities greatly reduced service level competition Operators will have Significant Market Power (SMP) Reduced service-level competition raises Network Neutrality issue © 2008 Marvin A. Sirbu 31 Carnegie Mellon Net Neutrality Can third parties compete with vertically Integrated ISPs? Central Offices Home 1 Service Provider A Network 1 Home 2 Apps + Content Separate Networks Service Provider B Network 2 Apps + Content Data Link Layer Equipment © 2008 Marvin A. Sirbu 32 Apps + Content Carnegie Mellon Outline Models of Competition in FTTP Alternative FTTP architectures: impact on competition Economics of FTTP Economics of a Wholesale/Retail split © 2008 Marvin A. Sirbu 33 Carnegie Mellon Open Access: Network operator provides wholesale transport to service providers Economic Analysis: Motivating Question Do sustainable prices exist for an infrastructure-only provider? Build a supply/demand model and calculate welfare effects for different industry structure models Central Office Home A Service Provider A Network Home B Common Data Link Layer Equipment © 2008 Marvin A. Sirbu Service Provider B 34 Carnegie Mellon Structural separation interferes with the ability to price discriminate Vertically integrated entity ‡ Can sell 7 bundles: Voice, Data, Video, Voice-Data, Voice-Video, DataVideo, Voice-Video-Data ‡ Can set 7 prices Does this make a wholesaler less likely to recover costs vis-à-vis a vertically integrated entity? Dark fiber wholesaler ‡ Can sell only dark fiber access ‡ Can set only one price © 2008 Marvin A. Sirbu 35 Carnegie Mellon Wholesale Prices and Arbitrage A dark fiber wholesaler can set only one price A lit fiber wholesaler can set a price for data or video bandwidth but cannot set a separate price for the bundle Video bandwidth is sufficient to offer both video and data services to customers, so Wholesale price of “bundle” bandwidth and “video” bandwidth must be the same © 2008 Marvin A. Sirbu 36 Carnegie Mellon We have studied 3 models Assumptions FTTP Single Service Provider 2-service network only network serving market Voice services are provided over a separate network FTTP network used to provide only data and video services FTTP Single Service provider 3-service network only network serving market FTTP network used to provide voice, video and data service Market Duopoly 2-service already served by (cable) incumbent when FTTP provider enters FTTP and incumbent network used to provide only data and video services © 2008 Marvin A. Sirbu 37 Carnegie Mellon Two-service model for the Wholesale-Retail Split Demand Model Consumers have different willingness to pay for voice, video and data services: Willingness to pay for a particular service can be modeled by a statistical distribution for a particular market There is correlation between the willingness to pay for voice, video and data for one particular consumer: One can imagine a 3-space where the coordinates of each point give her willingness to pay for voice, video and data services For simplicity, here we assume everyone wants voice – so our demand model is 2-space, where the coordinates of each point give the willingness to pay for data and video © 2008 Marvin A. Sirbu 38 Demand Model.. Carnegie Mellon X1=Homes taking service1 (data) at price P1 (Area BDP1P3) X2=Homes taking service2 (video) at price P2 (Area ACP2P3) X3=Homes taking service3 (video and data) at price P3 (Area ACDBZ) Willingness to Pay A 160 Z 140 120 Video P3 100 80 P2 60 C 40 B D 20 0 0 20 40 P1 60 80 Data © 2008 Marvin A. Sirbu P 1003 120 140 39 Carnegie Mellon Supply Model Annualized Fixed cost for wiring up the entire market consisting of X homes = F Annualized Fixed Cost of installing CPE and drop loop = C0 Annual incremental cost of providing data service (Service 1) per home = C1 Annual incremental cost of providing video service (Service 2) per home = C2 Observation: Marginal Cost of Bundle (C0 +C1+C2) is less than the sum of Marginal Cost of Data (C0 +C1) and Marginal Cost of Video(C0 +C2) If X1 homes take data service, X2 homes take video service and X3 take both, annual cost of providing service = F + C0(X1+X2+X3) + C1X1 + C2X2 + (C1 +C2)X3 © 2008 Marvin A. Sirbu 40 Carnegie Mellon Vertically Integrated entity (Network owner provides retail service) Possible Industry Structures ‘Verizon’ Model (Profit Maximizing) ‘Bristol’ Model (Welfare Maximizing) Structurally Separated entities (Network owner, either by regulation or choice, is only a wholesaler. The retail market is assumed to be competitive/contestable) ‘Grant County Profit (GCP)’ (Profit Maximizing layer 2 service wholesaler) ‘Grant County Welfare (GCW)’ (Welfare Maximizing layer 2 service wholesaler) ‘Stockholm Profit (SP)’ Model (Profit Maximizing dark fiber wholesaler) ‘Stockholm Welfare (SW)’ Model (Welfare Maximizing dark fiber wholesaler) © 2008 Marvin A. Sirbu 41 Carnegie Mellon Model Results Not surprisingly, if network owner optimizes Social Welfare (e.g. Bristol) consumers are much better off than if network owner optimizes profit If network owner optimizes profit, THERE IS VIRTUALLY NO DIFFERENCE in profit for a vertically integrated firm or a wholesaler. The fact that vertically integrated firm has more flexibility to price discriminate is not important since most households subscribe to the bundle, and wholesaler can extract the same rent. If there is a large fraction of the population with no interest in broadband data, then vertically integrated firm can do 25% better than a dark fiber wholesaler, but still no better than a lit fiber wholesaler. © 2008 Marvin A. Sirbu 42 Carnegie Mellon 3 services model shows less than 5% difference Stockholm and Verizon profits F=5x104 C0=8 C1=20 C2=30 C3=5 1= 35 σ1= 10 2 = 45 σ2 = 10 3= 25 σ3= 10 © 2008 Marvin A. Sirbu 43 Carnegie Mellon Similar profits are attained in spite of a different distribution of subscribers © 2008 Marvin A. Sirbu 44 Carnegie Mellon If services are identical, classic case of natural monopoly Firm with higher penetration has lower costs Ruinous competition What if There Are Competing FTTP Operators? Having sunk cost in fixed plant, each competitor is willing to price at marginal cost negative profits Stable competition can exist only if there are Differentiated services appealing to heterogeneous customer tastes; or High switching costs © 2008 Marvin A. Sirbu 45 Carnegie Mellon Duopoly Model Results We assume two operators with similar cost structures, one an incumbent, one a new entrant Assuming video and data services are sufficiently differentiated between competitors, both can survive in the marketplace If the new entrant is a wholesaler only, or vertically integrated makes no difference in its profit An incumbent competing against a dark fiber wholesaler is modestly worse off than when competing against a vertically integrated competitor Wholesaler’s inability to price discriminate forces competitor to reduce price discrimination and lose profit. © 2008 Marvin A. Sirbu 46 Carnegie Mellon Model assumptions and caveats Retail industry assumed to be perfectly competitive and no entry barriers; retailers make zero economic profit Revenues derived entirely from end customers, not from application service providers No economies of scope at retail assumed Incremental costs, Ci , are the same in both vertically integrated and competitive retail cases Competition should drive down incremental costs of services Layer 2 costs, C0, are the same whether supplied competitively or by wholesaler See above © 2008 Marvin A. Sirbu 47 Carnegie Mellon Regulatory Policy Implications Operators, municipalities or communities that build out FTTP and choose to be wholesalers: ‡ (i) can realize sustainable prices, ‡ (ii) are likely to create greater welfare (due to innovation spurred by retail competition) and ‡ (iii) are just as likely to recover costs (vis-à-vis vertically integrated entities) Model results contradict claims by operators that vertical integration is necessary to support investment in FTTP infrastructure regulatory holiday for FTTP investment is unwarranted. © 2008 Marvin A. Sirbu 48 Carnegie Mellon What are the different models of competition in FTTP? OFAP supports fiber unbundling even for PONs More feeder fibers required for competition FTTP networks have significant economies of scale Facilities based Service level (over shared network infrastructure) Fiber layout affects options for competition Conclusion Unlikely to support multiple facilities-based providers “Second Mile” sharing also important A Wholesale Operator can earn profits similar to those available to vertically integrated competitors It is not necessary to be vertically integrated in order to “earn enough” to pay for the infrastructure © 2008 Marvin A. Sirbu 49 Carnegie Mellon For Further Information http://www.andrew.cmu.edu/user/sirbu/pubs/Banerjee_Sirbu. pdf http://web.si.umich.edu/tprc/papers/2006/648/Banerjee_Sirbu%20TP RC_2006.pdf http://cfp.mit.edu/groups/broadband/muni_bb_pp.html © 2008 Marvin A. Sirbu 50