News and Notes 4/8 • Today: finish up NW economics

advertisement

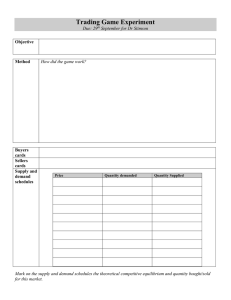

News and Notes 4/8 • HW3 due date delayed to Tuesday 4/13 – will hand out HW4 on 4/13 also • Today: finish up NW economics • Tuesday 4/13 – another mandatory class exercise – topic: evolutionary game theory Market Economies and Networks Networked Life CSE 112 Spring 2004 Prof. Michael Kearns Market Economies • Suppose there are a bunch of different goods – wheat, rice, paper, raccoon pelts, matches, grain alcohol,… – no differences or distinctions within a good: rice is rice • We may all have different initial amounts or endowments – I might have 10 sacks of rice and two raccoon pelts – you might have 6 bushels of wheat, 2 boxes of matches – etc. etc. etc. • Of course, we may want to exchange some of our goods – I can’t eat 10 sacks of rice, and I need matches to light a fire – it’s getting cold and you need raccoon mittens – etc. etc. etc. • How should we engage in exchange? • What should be the rates of exchange? • These are among the oldest questions in economics Cash and Prices • Suppose we introduce an abstract good called cash – no inherent value – simply meant to facilitate trade, encode exchange rates • And now suppose we introduce prices in cash – i.e. rates of exchange between each “real” good and cash • Then if we all believed in cash and the prices… – we might try to sell our initial endowments for cash – then use the cash to buy exactly what we most want • But will there really be: – others who want to buy all of our endowments? (demand) – others who will be selling what we want? (supply) Mathematical Economics • • • • Have k abstract goods or commodities g1, g2, … , gk Have n consumers or players Each player has an initial endowment e = (e1,e2,…,ek) > 0 Each consumer has their own utility function: – – – – assigns a personal valuation or utility to any amounts of the k goods e.g. if k = 4, U(x1,x2,x3,x4) = 0.2*x1 + 0.7*x2 + 0.3*x3 + 0.5*x4 here g2 is my “favorite” good --- but it might be expensive generally assume utility functions are insatiable • always some bundle of goods you’d prefer more – utility functions not necessarily linear, though Market Equilibrium • Suppose we post prices p = (p1,p2,…,pk) for the k goods • Assume consumers are rational: – they will attempt to sell their endowment e at the prices p (supply) – if successful, they will get cash e*p = e1*p1 + e2*p2 + … + ek*pk – with this cash, they will then attempt to purchase x = (x1,x2,…,xk) that maximizes their utility U(x) subject to their budget (demand) – example: • U(x1,x2,x3,x4) = 0.2*x1 + 0.7*x2 + 0.3*x3 + 0.5*x4 • p = (1.0,0.35,0.15,2.0) • look at “bang for the buck” for each good i, wi/pi: – g1: 0.2/1.0 = 0.2; g2: 0.7/0.35 = 2.0; g3: 0.3/0.15 = 2.0; g4: 0.5/2.0 = 0.25 – so we will purchase as much of g2 and/or g3 as we can subject to budget • Say that the prices p are an equilibrium if there are exactly enough goods to accomplish all supply and demand steps • That is, supply exactly balances demand --- market clears The Phone Call from Stockholm • Arrow and Debreu, 1954: – There is always a set of equilibrium prices! – Both won Nobel prizes in Economics • Intuition: suppose p is not an equilibrium – if there is excess demand for some good at p, raise its price – if there is excess supply for some good at p, lower its price – the “invisible hand” of the market • The trickiness: – changing prices can radically alter consumer preferences • not necessarily a gradual process; see “bang for the buck” argument – everyone reacting/adjusting simultaneously – utility functions may be extremely complex • May also have to specify “consumption plans”: – who buys exactly what from whom – example: • A has Fruit Loops and Lucky Charms, but wants granola • B and C have only granola, both want either FL or LC (indifferent) • need to “coordinate” B and C to buy A’s FL and LC Remarks • A&D 1954 a mathematical tour-de-force – resolved and clarified a hundred of years of confusion – proof related to Nash’s; (n+1)-player game with “price player” • Actual markets have been around for millennia – highly structured social systems – it’s the mathematical formalism and understanding that’s new • Model abstracts away details of price adjustment process – – – – modern financial markets pre-currency bartering and trade auctions etc. etc. etc. • Model can be augmented in various way: – labor as a commodity – firms producing goods from raw materials and labor – etc. etc. etc. • “Efficient markets” ~ in equilibrium (at least at any given moment) Network Economics • All of what we’ve said so far assumes: – – – – that anyone can trade (buy or sell) with anyone else wheat bought from Nick is the same as wheat bought from Kilian equivalently, exchange takes place on a complete network global prices must emerge due to competition • But there are many economic settings in which everyone is not free to trade with everyone else – geography: • perishability: you buy groceries from local markets so it won’t spoil • labor: you purchases services from local residents – legality: • if one were to purchase drugs, it is likely to be from an acquaintance (no centralized market possible) • peer-to-peer music exchange – politics: • there may be trade embargoes between nations – regulations: • on Wall Street, certain transactions (within a firm) may be prohibited Next Up • A model of network economics • Analysis of our experiment • Network economics and preferential attachment A Network Model of Market Economies • Still begin with the same framework: – k goods or commodities – n consumers, each with their own endowments and utility functions • But now assume an undirected network dictating exchange – each vertex is a consumer – edge between i and j means they are free to engage in trade – no edge between i and j: direct exchange is forbidden • Note: can “encode” network in goods and utilities – for each raw good g and consumer i, introduce virtual good (g,i) – think of (g,i) as “good g when sold by consumer i” – consumer j will have • zero utility for (g,i) if no edge between i and j • j’s original utility for g if there is an edge between i and j Network Equilibrium • Now prices are for each (g,i), not for just raw goods – permits the possibility of variation in price for raw goods – prices of (g,i) and (g,j) may differ – what would cause such variation at equilibrium? • Each consumer must still behave rationally – attempt to sell all of initial endowment, but only to NW neighbors – attempt to purchase goods maximizing utility within budget – will only purchase g from those neighbors with minimum price for g • Market equilibrium still always exists! – set of prices (and consumptions plans) such that: • all initial endowments sold (no excess supply) • no consumer has money left over (no excess demand) Our Experimental Network • Four “island economies” --- groups A, B, C, D – can only engage in trade within group and with group E • One economic “superpower” --- group E – can trade with anyone, including internally • • • • • • • Group A: 6 buyers, 3 sellers (excess demand) Group B: 3 buyers, 7 sellers (excess supply) Group C: 5 buyers, 5 sellers (balanced) Group D: 2 buyers, 5 sellers (excess supply) Group E: 3 buyers, 3 sellers (internal balance irrelevant) Overall: 19 buyers, 23 sellers (excess supply) What should happen at equilibrium? The Theory Says… • At equilibrium: – – – – – group E buyers join groups B and D (excess supply) create merged economy of B, D (all parties) and E’s buyers group E sellers join groups A (excess demand) group C remains isolated, only trades internally price computations: • B-D-Ebuyers: cash/goods = 8/12 ~ 0.67 • A-Esellers: cash/goods = 6/6 = 1.0 • C: cash/goods = 5/5 = 1.0 – market incentive for E players to equalize opportunity – but price variation remains sellers in blue buyers in red ignore edge color D B E A C the exchange subgraph at equilibrium 0.67 black: competitive, used yellow: not competitive, unused dashed: competitive, unused 1.00 1.00 What Actually Happened? Esell3 Asell1 Abuy2 Abuy5 CSE112 Perpetrators: • colluded to inflate profits of Esell3 and Abuy5 • $0 for 1, $1 for 0 transactions • agreed to split any prizes • we’ll come back to their fate Some Analysis • Market clearance: – 18.56 dollars spent (out of 19) – 21.34 wheat sold (out of 23) • Group A: 6 buyers, 3 sellers (excess demand) – average buyer price: 1.14; 1.23 excluding perp Abuy5 – average seller price: 0.72; 1.13 excluding perp Asell1 – versus 1.00 equilibrium • Group B: 3 buyers, 7 sellers (excess supply) – average buyer price: 0.5, average seller price: 0.59 – versus 0.67 equilibrium • Group C: 5 buyers, 5 sellers (balanced) – average buyer price: 1.10, average seller price: 1.10 – versus 1.00 equilibrium • Group D: 2 buyers, 5 sellers (excess supply) – average buyer price: 0.65, average seller price: 0.71 – versus 0.67 equilibrium • Group E: 3 buyers, 3 sellers (internal balance irrelevant) – average buyer price: 0.72 (0.67 equilibrium) – average seller price: 1.47; 1.21 excluding perp Esell3 (1.00 equilibrium) • Qualitative agreement with equilibrium; higher prices overall Prizes: $10 Each • Must have cleared (unloaded all of endowment) • Lowest avg prices for a buyer compared to equilibrium – Bbuy1 (Eric Pierce): 0.38, vs 0.67 equilibrium (0.29 differential) – Abuy5 (Chenxi Jiao): 0.50, vs. 1.00 equilibrium (0.50 differential) • Highest avg prices for a seller compared to equilibrium – Esell2 (Sarah Dong): 1.35, vs. 1.00 equilibrium (0.35 differential) – Esell3 (Scott Brown): 2.00, vs. 1.00 equilibrium (1.00 differential) • Congratulations! • The SEC may be contacting some of you. Markets on Natural Networks • NW for class experiment highly artificial – very regular and simple structure – facilitated an easy experiment • What happens on the NW types from SNT? – – – – e.g. Erdos-Renyi, a model, preferential attachment,… we’ll take a quick look at preferential attachment will have only buyers ($1) and sellers (1 wheat) introduce a bipartite version of pref. att. • Some personal comments on: – serving up only the freshest fare – the research-teaching-research cycle – MK talk tomorrow at CMU; (optional) paper on web site A Preferential Attachment Model for Buyer-Seller Networks • • • • Probabilistically generates a bipartite graph Buyers and sellers added in pairs at each time step All edges between buyers and sellers Each new party will have n > 1 links back to extant graph – note: n = 1 generates bipartite trees – larger n generates cyclical graphs • Distribution of new buyer’s links: – with prob. 1 – a: extant seller chosen w.r.t. preferential attachment – with prob. a: extant seller chosen uniformly at random – a = 0 is pure pref. att.; a = 1 is “like” Erdos-Renyi model • So (a,n) characterizes distribution of generative model A Sample Network and Equilibrium • Solid edges: – exchange at equilibrium • Dashed edges: – competitive but unused • Dotted edges: – non-competitive prices • Note price variation – 0.33 to 2.00 • Degree alone does not determine price! – e.g. B2 vs. B11 – e.g. S5 vs. S14 Basic Theory Statistics of the Network • Can generate standard range of degree distributions • Define b = (1-a)n/(1+n) – varies from (1-a)/2 to 1-a • Theorem: in the (a,n) model, for x = o(n^(1/b)), the fraction of sellers at time n with degree > x is Q(x^(-1/b)). – closely follows standard techniques – (a = 0, n = 1) yields cumulative distribution Q(x^(-2)) – as a 1, tails become lighter; exponential decay at a = 1 Economics of the Network • Now not just interested in structural properties of NW • Examine the properties of global (equilibrium) computation • A useful monotonicity lemma: – take a subgraph with a buyer (respectively, seller) frontier – let p be the global equilibrium price of some good in this subgraph – let p’ be its equilibrium price when computed just on the subgraph – then p’ > p (respectively, p’ < p) • For example, seller degree is an upper bound on seller wealth • This lemma has algorithmic applications – compute controlled, local approximations to global equilibrium prices – how well will this work? Economics of the Network • Theorem (Wealth Distribution): For w = o(n^(1/b)), the fraction of sellers with wealth > w is O(w^(-1/b)). – no corresponding lower bound yet – power laws seen empirically – not explained by degree distribution! • Theorem (Price Variation): If (e.g.) a = 0 (pure pref. att.), then (max price)/(min price) = W(n^(2/(1 + n))) – = W(n) for n = 1 – = W(n^(2/3)) for n = 1 – variation generally scaling as a root of population size Simulation Studies Degree and Wealth Distributions degree wealth Model: (a = 0.4, n = 1) n = 250 average of 25 trials Power law wealth distribution at (rational) economic equilibrium Degree and Wealth Distribution versus n Model: (a = 0, n = 2) n = 250 average of 25 trials Increased n lightens wealth tail, separates wealth and degree Price Variation vs. NW Size & n Model: (a = 0, n varying) average of 25 trials Power of network size (matches theory); decreasing with n Price Variation vs. a and n n=1 n = 250, scatter plot n=2 Exponential decrease with a; rapid decrease with n Quality of Local Approximations Model: (a = 0, n = 1) n = 50 to 250 (five plots) each plot averages 5 trials Very good approximations in small neighborhoods Error decays exponentially with k Quality of Local Approximation II Model: (a = 0, n = 1) n = 50 to 250 (five plots) each plot averages 5 trials Very mild dependence on n (Chung & Lu on loglog(n) core) k = 5 gives exact solution; k = 3 is 60% faster (n = 250)