Optimal Investment Strategies for Enhanced Productivity in the Textile Industry

advertisement

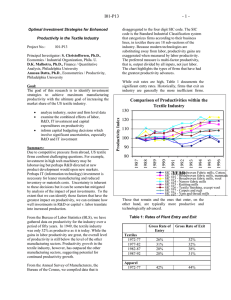

National Textile Center Year 11 Continuing Project Proposal Project No. I01-P13 Competency: Intelligent Systems Optimal Investment Strategies for Enhanced Productivity in the Textile Industry Project Team: Leader: Email: Members: S. Christoffersen, Ph.D., Philadelphia University, Economics / Industrial Organization ChristoffersenS@PhilaU.edu Phone: (215) 951.2821 D.K. Malhotra, Ph.D., Philadelphia U, MalhotraD@PhilaU.edu, Finance/Quantitative Analysis, Anusua Datta, Ph.D., Philadelphia U., DattaA@PhilaU.edu, Econometrics / Productivity Moon Suh, Ph.D., NC State University, Moon_Suh@NCSU.edu, Statistics Objective: The object of this research is to increase the market share of the US textile industry by identifying investment strategies to achieve maximum manufacturing productivity while satisfying dynamic consumer needs. Market share can be gained if textile firms are more competitive, either through product development or improved productivity resulting in lower costs. Identifying optimal investment strategies to achieve these goals is complex, dependent upon foreign industry dynamics, tariff changes, uncertain R&D pay-offs, the type and timing of investment in information technology (IT) and domestic industry dynamics, specifically economies of scale. Progress Statement: Traditionally, labor productivity (output per worker) has been used to measure productivity growth , however, this measure exaggerates productivity gains as the textile industry becomes more high tech and therefore capital intensive: stagnant output and a diminishing labor force would look like a productivity gain. In order to achieve our main objective, we have gathered data on the multi-factor productivity (MFP) of the textile industry, which will be analyzed to assess the impact of R&D investment, IT investment, capital and labor expenditures, and economies of scale. Ultimately, this project will develop a model for deriving the optimal investment strategy, measuring the relative impact of these expenditures on productivity. The study will be conducted at three levels: using overall industry data ( SIC22), three-digit SIC level data and firm level data. For the latter, we will use panel data regression analysis: the time series aspect will allow us to analyze how parameters change over time and cross-section data will show variations across firms. For example, there are learning curve effects associated with R&D and IT, causing pay-offs to increase over time, however there are interactions with other factors of production, and these may vary across firms. This is important for firms commercializing new products and processes as they must divert productive resources towards implementation. Such adjustment costs for R&D related projects are estimated to be seven times the adjustment costs of investment in new plant and equipment. This necessarily changes the way we view R&D (and IT) investment. Analyzing multi-factor productivity will improve how one assesses productivity by including these costs of complexity. Chart 1 presents the growth in MFP for both the textile and apparel industries. The tremendous growth in productivity in textiles is not found in the apparel industry due to the inability of the apparel industry to shift away from labor-intensive production. While the textile industry has demonstrated a greater ability to adopt advanced technology, demand for textiles may be limited by the lagging productivity of the apparel industry. The data is indexed at 100 in 1996; fifty years ago the textile industry was 35% as productive as it was in 1996 and between 1996 and 1999 productivity increased by 8 percent. While this data has been compiled on the two-digit level, it is augmented in the study by data gathered on the three-digit level, as well as plant-level data. Chart 1: Comparision of MFP for SIC 22 and SIC 23 120 INDEXES 100 SIC 22 80 SIC 23 60 40 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 1969 1967 1965 1963 1961 1959 1957 1955 1953 1949 20 TIME Chart 2 shows the productivity trends for the textile industry, broken down to the level of three-digit SIC codes. SIC 221 - Broadwoven Fabric mills, Cotton. SIC 223 - Broadwoven fabric mills, wool SIC 225 - Knitting mills SIC 227 - Carpets and rugs SIC 229 - Miscellaneous textile goods 1996 1995 1994 1993 TIME 1992 1991 1990 1989 1988 1987 INDEXES Chart 2: Comparison: MFP's of SIC-221, 222, 223, 224, 225, 226, 227, 228 229 130 125 120 115 110 105 100 95 90 85 SIC 222 - Broadwoven fabric mills, manmade SIC 224 - Narrow fabric mills SIC 226 - Textile finishing, except wool SIC 228 - Yarn and thread mills This chart indicates which types of firms have had the greatest productivity advances. While these sectors require greater study, the chart highlights the need to disaggregate. Indeed, on the industry level, shrinking employment is discouraging, however plant level data tell a different story: Table 1 shows significant exit and entry in the textile industry. Historically, firms that exit an industry are generally the more inefficient firms. Those that remain and the ones that enter, on the other hand, are typically more productive and technologically advanced. Table 1: Rates of Plant Entry and Exit Year Gross Rate of Entry Gross Rate of Exit Textiles Gross Rate of Entry Gross Rate of Exit Apparel 1972-77 26% 32% 42% 44% 1977-82 31% 32% 48% 43% 1982-87 20% 38% 25% 55% 1987-92 28% 31% 49% 46% An important aspect is foreign competition, which has intensified due to increased openness in trade, especially from the newly industrializing countries (NICs), while also increasing outsourcing possibilities for U.S. firms. Chart 3, presents the trends in textile exports and imports. Beginning around 1983 imports began a steady increase outstripping exports by a sizeable margin. Imports in textiles came from both developing and developed countries, although the share of the former is increasing. Exports declined for a while between 1982-85, and although they increased thereafter, exports continued to fall short of imports. Clearly, 807A imports play an import role, rising precipitously since NAFTA, but declining after 1998. Imports ($millions) 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 Exports ($millions) 1972 $ MILLIONS Chart 3: Comparison of Imports and Exports in $millions 12,000 10,000 8,000 6,000 4,000 2,000 0 TIME The Annual Report presents more details on the data compiled to-date. Next Year’s Goals: Currently we are working on the consistency of the data. While data collection at the industry level SIC 22 is complete, inconsistencies in three-digit SIC data exist due to changes in SIC definitions over time. Additionally, nominal figures have to be deflated by consistent yet specific inflation indices: imports use a different deflator than domestic output but the underlying inflation estimates must be the same. In the coming year we will use regression analysis to analyze the data in stages. First we will analyze factors that enhance productivity. Next we will assess the contribution of enhanced productivity to market share. The Approach section, following, details the analyses. Approach: Panel data will be used to econometrically estimate the Cobb-Douglas production function for textile firms:1 Qit = A CLK M. The results will shed light on the impact and interactions of factors of production. K represents knowledge and quantifies the contribution of R&D and IT as measured by a distributed lag effect of past R&D/IT investment; the residual indicates productivity (MFP). The parameters and represent the elasticities of output relative to capital, labor and knowledge. For example, the elasticity of capital indicates the percentage increase in production to expect from increased investment in new plant and equipment. Comparison of these measures reveals the relative importance of various investments such as the impact on production of R&D relative to capital investment (. Time series allows one to analyze how these parameters change over time. Once production functions are estimated, contribution of other factors can be assessed, such as firm size, nature of the product (availability of close substitutes), ownership characteristics, sources of financing, and offshore plants. MFP = f(R&D, IT, Scale, Import Competition, Policy etc.) To understand the factors that contribute to higher productivity, we will estimate the above model. Changes in MFP will be regressed on changes in R&D and IT to determine the effectiveness of these investments, as well as a proxy for size, to assess economies of scale versus customization. Understanding the sources of productivity growth will then contribute to an analysis of market share: Sales = f( MFP, X-M, apparel sales, K/Q, tariffs, etc.) The market share will be analyzed as a function of productivity, foreign markets, apparel dynamics, tariff rates, capital deepening and scale. Initial estimates will require adjustments for inflation, depreciation of both the capital stock and R&D, the latter being very different from the depreciation of plant and equipment investment. Previous studies pertain to pharmaceuticals and aeronautics where the importance of R&D is recognized, yet the potential to enhance productivity remains great in the textile industry. Outreach to Industry: Burlington, UNIFI, and Cannon-Fldcrst were visited, with interviews of financial officers and product development guys. Our research results, based upon rigorous research, will address decisions they face. Presentations at academic conferences and publication in scholarly journals will be augmented with industry pieces on our findings. New Resources Required: None 1 Q is the output of firm i at time t, as measured by sales deflated by the relevant price index. Gross plant, adjusted for inflation, is the measure of capital stock, C, and L is the total number of employees and M is materials; the value of purchases. A is the rate of disembodied technical change while is the perturbation or error term. K= Ri (t-), where R is a deflated measure of R&D, and the subscripts t,tand i stand for current year, lagged year and firm.