Chapter 16-1

advertisement

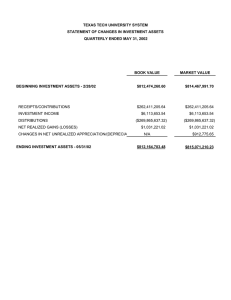

Chapter 16-1 CHAPTER 16 INVESTMENTS Accounting Principles, Eighth Edition Chapter 16-2 Study Objectives 1. Discuss why corporations invest in debt and stock securities. 2. Explain the accounting for debt investments. 3. Explain the accounting for stock investments. 4. Describe the use of consolidated financial statements. 5. Indicate how debt and stock investments are reported in financial statements. 6. Distinguish between short-term and long-term investments. Chapter 16-3 Long-Term Liabilities Why Corporations Invest Accounting for Debt Investments Accounting for Stock Investments Valuing and Reporting Investments Cash management Recording acquisition of bonds Recording bond interest Recording sale of bonds Holdings of less than 20% Categories of securities Holdings between 20% and 50% Holdings of more than 50% Balance sheet presentation Realized and unrealized gain or loss Investment income Strategic reasons Classified balance sheet Chapter 16-4 Why Corporations Invest Corporations generally invest in debt or stock securities for one of three reasons. 1. Corporation may have excess cash. 2. To generate earnings from investment income. 3. For strategic reasons. Illustration 16-1 Temporary investments and the operating cycle Chapter 16-5 LO 1 Discuss why corporations invest in debt and stock securities. Why Corporations Invest Question Pension funds and banks regularly invest in debt and stock securities to: a. house excess cash until needed. b. generate earnings. c. meet strategic goals. d. avoid a takeover by disgruntled investors. Chapter 16-6 LO 1 Discuss why corporations invest in debt and stock securities. Accounting for Debt Instruments Recording Acquisition of Bonds Cost includes all expenditures necessary to acquire these investments, such as the price paid plus brokerage fees (commissions), if any. Recording Bond Interest Calculate and record interest revenue based upon the carrying value of the bond times the interest rate times the portion of the year the bond is outstanding. Chapter 16-7 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Sale of Bonds Credit the investment account for the cost of the bonds and record as a gain or loss any difference between the net proceeds from the sale (sales price less brokerage fees) and the cost of the bonds. Chapter 16-8 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Exercise: Issel Corporation had the following transactions pertaining to debt investments. Jan. 1 Purchased 60, 8%, $1,000 Hollis Co. bonds for $60,000 cash plus brokerage fees of $900. Interest is payable semiannually on July 1 and January 1. July 1 Received semiannual interest on Hollis Co. bonds. July 1 Sold 30 Hollis Co. bonds for $34,000 less $500 brokerage fees. Instructions (a) Journalize the transactions. (b) Prepare the adjusting entry for the accrual of interest at December 31. Chapter 16-9 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Exercise: Jan. 1 Purchased 60, 8%, $1,000 Hollis Co. bonds for $60,000 cash plus brokerage fees of $900. Interest is payable semiannually on July 1 and January 1. Jan 1 Debt investment Cash 60,900 * 60,900 * ($60,000 + $900 = $60,900) Chapter 16-10 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Exercise: July 1 Received semiannual interest on Hollis Co. bonds. Sold 30 Hollis Co. bonds for $34,000 less $500 brokerage fees. July 1 Cash Interest revenue Cash Debt investments Gain on sale * ($60,000 x 8% x ½ = $2,400) ** ($34,000 - $500 = $33,500) Chapter 16-11 2,400 * 2,400 33,500 ** 30,450 *** 3,050 *** ($60,900 x ½ = $30,450) LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Exercise: (b) Prepare the adjusting entry for the accrual of interest at December 31. Dec 31 Interest receivable Interest revenue 1,200 * 1,200 * ($30,000 x 8% x ½ = $1,200) Chapter 16-12 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Question An event related to an investment in debt securities that does not require a journal entry is: a. acquisition of the debt investment. b. receipt of interest revenue from the debt investment. c. a change in the name of the firm issuing the debt securities. d. sale of the debt investment. Chapter 16-13 LO 2 Explain the accounting for debt investments. Accounting for Debt Instruments Question When bonds are sold, the gain or loss on sale is the difference between the: a. sales price and the cost of the bonds. b. net proceeds and the cost of the bonds. c. sales price and the market value of the bonds. d. net proceeds and the market value of the bonds. Chapter 16-14 LO 2 Explain the accounting for debt investments. Accounting for Stock Investments Ownership Percentages 0 --------------20% ------------ 50% -------------- 100% No significant influence usually exists Significant influence usually exists Investment valued using Cost Method Investment valued using Equity Method Control usually exists Investment valued on parent’s books using Cost Method or Equity Method (investment eliminated in Consolidation) The accounting depends on the extent of the investor’s influence over the operating and financial affairs of the issuing corporation. Chapter 16-15 LO 3 Explain the accounting for stock investments. Holdings of Less than 20% Companies use the cost method. Under the cost method, companies record the investment at cost, and recognize revenue only when cash dividends are received. Cost includes all expenditures necessary to acquire these investments, such as the price paid plus any brokerage fees (commissions). Chapter 16-16 LO 3 Explain the accounting for stock investments. Holdings of Less than 20% Exercise: Dossett Company had the following transactions pertaining to stock investments. Feb. 1 Purchased 800 shares of Hippo common stock (2%) for $8,000 cash, plus brokerage fees of $200. July 1 Received cash dividends of $1 per share on Hippo common stock. Sept. 1 Sold 300 shares of Hippo common stock for $4,400, less brokerage fees of $100. Instructions Journalize the transactions. Chapter 16-17 LO 3 Explain the accounting for stock investments. Holdings of Less than 20% Exercise: Feb. 1 Purchased 800 shares of Hippo common stock (2%) for $8,000 cash, plus brokerage fees of $200. July 1 Received cash dividends of $1 per share on Hippo common stock. Feb. 1 Stock investments 8,200 * Cash July 1 8,200 Cash Dividend revenue 800 ** 800 * ($8,000 + $200 = $8,200) ** (800 x $1 = $800) Chapter 16-18 LO 3 Explain the accounting for stock investments. Holdings of Less than 20% Exercise: Sept. 1 Sold 300 shares of Hippo common stock for $4,400, less brokerage fees of $100. Sept. 1 Cash Stock investments Gain on sale 4,300 * 3,075 ** 1,225 * ($4,400 - $100 = $4,300) ** ($8,200 x 3/8 = $3,075) Chapter 16-19 LO 3 Explain the accounting for stock investments. Holdings Between 20% and 50% Equity Method Record the investment at cost and subsequently adjust the amount each period for the investor’s proportionate share of the earnings (losses) and dividends received by the investor. If investor’s share of investee’s losses exceeds the carrying amount of the investment, the investor ordinarily should discontinue applying the equity method. Chapter 16-20 LO 3 Explain the accounting for stock investments. Holdings Between 20% and 50% Question Under the equity method, the investor records dividends received by crediting: a. Dividend Revenue. b. Investment Income. c. Revenue from Investment. d. Stock Investments. Chapter 16-21 LO 3 Explain the accounting for stock investments. Holdings Between 20% and 50% Exercise: (Equity Method) On January 1, 2008, Pennington Corporation purchased 30% of the common shares of Edwards Company for $180,000. During the year, Edwards earned net income of $80,000 and paid dividends of $20,000. Instructions Prepare the entries for Pennington to record the purchase and any additional entries related to this investment in Edwards Company in 2008. Chapter 16-22 LO 3 Explain the accounting for stock investments. Holdings Between 20% and 50% Exercise: Pennington purchased 30% of the common shares of Edwards for $180,000. Edwards earned net income of $80,000 and paid dividends of $20,000. Stock investments 180,000 Cash 180,000 Stock investments 24,000 Investment revenue Cash 6,000 Stock investments Chapter 16-23 24,000 ($80,000 x 30%) ($20,000 x 30%) 6,000 LO 3 Explain the accounting for stock investments. Holdings Between 20% and 50% Exercise: Pennington purchased 30% of the common shares of Edwards for $180,000. Edwards earned net income of $80,000 and paid dividends of $20,000. After Pennington posts the transactions for the year, its investment and revenue accounts will show the following. Stock Investments Investment Revenue Debit Debit 180,000 24,000 Credit Credit 24,000 6,000 198,000 Chapter 16-24 LO 3 Explain the accounting for stock investments. Holdings of More Than 50% Controlling Interest - When one corporation acquires a voting interest of more than 50 percent in another corporation Investor is referred to as the parent. Investee is referred to as the subsidiary. Investment in the subsidiary is reported on the parent’s books as a long-term investment. Parent generally prepares consolidated financial statements. Chapter 16-25 LO 4 Describe the use of consolidated financial statements. Valuing and Reporting Investments Categories of Securities Companies classify debt and stock investments into three categories: Trading securities Available-for-sale securities Held-to-maturity securities These guidelines apply to all debt securities and all stock investments in which the holdings are less than 20%. Chapter 16-26 LO 5 Indicate how debt and stock investments are reported in financial statements. Valuing and Reporting Investments Trading Securities Companies hold trading securities with the intention of selling them in a short period. Trading means frequent buying and selling. Companies report trading securities at fair value, and report changes from cost as part of net income. Chapter 16-27 LO 5 Indicate how debt and stock investments are reported in financial statements. Valuing and Reporting Investments Available-for-Sale Securities Companies hold available-for-sale securities with the intent of selling these investments sometime in the future. These securities can be classified as current assets or as long-term assets, depending on the intent of management. Companies report securities at fair value, and report changes from cost as a component of the stockholders’ equity section. Chapter 16-28 LO 5 Indicate how debt and stock investments are reported in financial statements. Valuing and Reporting Investments Question Marketable securities bought and held primarily for sale in the near term are classified as: a. available-for-sale securities. b. held-to-maturity securities. c. stock securities. d. trading securities Chapter 16-29 LO 5 Indicate how debt and stock investments are reported in financial statements. Trading Securities Problem: Loxley Company has the following portfolio of securities at September 30, 2008, its last reporting date. Trading Securities Dan Fogelberg, Inc. common (5,000 shares) Petra, Inc. preferred (3,500 shares) Tim Weisberg Corp. common (1,000 shares) Cost $ 225,000 133,000 180,000 Fair Value $ 200,000 140,000 179,000 On Oct. 10, 2008, the Fogelberg shares were sold at a price of $54 per share. In addition, 3,000 shares of Los Tigres common stock were acquired at $59.50 per share on Nov. 2, 2008. The Dec. 31, 2008, fair values were: Petra $96,000, Los Tigres $132,000, and the Weisberg common $193,000. Chapter 16-30 LO 5 Indicate how debt and stock investments are reported in financial statements. Trading Securities Problem: Prepare the journal entries to record the sale, purchase, and adjusting entries related to the trading securities in the last quarter of 2008. Portfolio at September 30, 2008 Trading Securities Dan Fogelberg, Inc. common (5,000 shares) Petra, Inc. preferred (3,500 shares) Tim Weisberg Corp. common (1,000 shares) Cost $ 225,000 133,000 180,000 $ 538,000 Market Adjustment – Trading (account balance) Chapter 16-31 Fair Value $ 200,000 140,000 179,000 $ 519,000 ($19,000) LO 5 Indicate how debt and stock investments are reported in financial statements. Trading Securities Problem: On Oct. 10, the Fogelberg shares were sold at a $54 per share. In addition, 3,000 shares of Los Tigres common stock were acquired at $59.50 per share on Nov. 2. October 10, 2008 (Fogelberg): Cash (5,000 x $54) 270,000 Trading securities 225,000 Gain on sale 45,000 November 2, 2008 (Los Tigres): Trading securities (3,000 x $59.50) Cash Chapter 16-32 178,500 178,500 LO 5 Indicate how debt and stock investments are reported in financial statements. Trading Securities Problem: Portfolio at December 31, 2008 Trading Securities Petra, Inc. preferred Tim Weisberg Corp. common Los Tigres common $ $ Cost 133,000 180,000 178,500 491,500 Prior market adjustment balance Market fair value adjustment Fair Value $ 96,000 193,000 132,000 $ 421,000 Unrealized Gain (Loss) $ (37,000) 13,000 (46,500) (70,500) $ (19,000) (51,500) December 31, 2008: Unrealized loss - Income Market adjustment - Trading Chapter 16-33 51,500 51,500 LO 5 Indicate how debt and stock investments are reported in financial statements. Available-for-Sale Securities Problem: How would the entries change if the securities were classified as available-for-sale? The entries would be the same except that the Unrealized Gain or Loss—Equity account is used instead of Unrealized Gain or Loss—Income. The unrealized loss would be deducted from the stockholders’ equity section rather than charged to the income statement. Chapter 16-34 LO 5 Indicate how debt and stock investments are reported in financial statements. Available-for-Sale Securities Question An unrealized loss on available-for-sale securities is: a. reported under Other Expenses and Losses in the income statement. b. closed-out at the end of the accounting period. c. reported as a separate component of stockholders' equity. d. deducted from the cost of the investment. Chapter 16-35 LO 5 Indicate how debt and stock investments are reported in financial statements. Balance Sheet Presentation Short-Term Investments Also called marketable securities, are securities held by a company that are (1) readily marketable and (2) intended to be converted into cash within the next year or operating cycle, whichever is longer. Investments that do not meet both criteria are classified as long-term investments. Chapter 16-36 LO 6 Distinguish between short-term and long-term investments. Balance Sheet Presentation Presentation of Realized and Unrealized Gain or Loss Nonoperating items related to investments Chapter 16-37 Illustration 16-10 LO 6 Distinguish between short-term and long-term investments. Balance Sheet Presentation Realized and Unrealized Gain or Loss Unrealized gain or loss on available-for-sale securities are reported as a separate component of Illustration 16-11 stockholders’ equity. Chapter 16-38 LO 6 Distinguish between short-term and long-term investments. Balance Sheet Presentation Classified Balance Sheet (partial) Chapter 16-39 Illustration 16-12 LO 6 Distinguish between short-term and long-term investments. Copyright “Copyright © 2008 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.” Chapter 16-40