MONEY, BANKING, AND MONETARY POLICY

advertisement

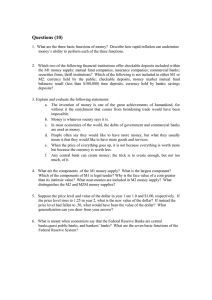

MONEY, BANKING, AND MONETARY POLICY

The focus of this first week is on the basic concepts of the United States’ financial system.

Students will first learn what money is, how banks and the banking systems can influence

and control the supply and disposition of money, and the function of the Federal Reserve.

Lastly, the relationship between money and various economic variables will be discussed.

OBJECTIVES

1. Identify the functions of money and the money supply.

2. Illustrate the creation of money using the money multiplier effect.

3. Delineate the role of the Federal Reserve System in designing and implementing U.S.

Monetary policies.

4. Describe how changes in the money supply impact inflation.

5. Analyze the effect of changes in the reserve requirement, discount rate, and open market

policies.

TOPICS

Please read all the lectures by clicking on the following topics.

FUNCTIONS OF MONEY

MEASURES OF MONEY

BANKS AND MONEY CREATION

FEDERAL RESERVE SYSTEM

MONETARY POLICY

THE MONEY MARKET

EQUATION OF EXCHANGE

Functions of Money

Money is any good that is widely accepted in exchange of goods and services, as well as

payment of debts. Most people will confuse the definition of money with other things,

like income, wealth, and credit. Three functions of money are:

1. Medium of exchange: Money can be used for buying and selling goods and services. If

there were no money, goods would have to be exchanged through the process of barter

(goods would be traded for other goods in transactions arranged on the basis of mutual

need). For example: If I raise chickens and want to buy cows, I would have to find a

person who is willing to sell his cows for my chickens. Such arrangements are often

difficult. But Money eliminates the need of the double coincidence of wants.

2. Unit of account: Money is the common standard for measuring relative worth of

goods and service.

3. Store of value: Money is the most liquid asset (Liquidity measures how easily assets

can be spent to buy goods and services). Money’s value can be retained over time. It is a

convenient way to store wealth.

Measures of Money

In the real world, money supply has different definitions: M1 and M2. Money is categorized according to

its liquidity. The most liquid items are in M1.

M1: includes currency (coins minted by the U.S. Treasury and paper currency issued by the Federal

Reserve), checkable deposits and traveler’s checks (issued by the commercial banks and thrift

institutions).

Currency and checkable deposits belonging to the federal government, Federal Reserve, or other

financial institutions are not included in M1.

M1 = Currency + Checkable deposits + Traveler’s checks

M2: includes all of the components of M1 plus near-moneys which includes items like:

a) Small Time deposits: interest-earning deposits with a value of less than $100,000, and having a

specified maturity.

b) Savings deposits: interest-earning deposits with no specific maturity of maximum value.

c) Money market accounts: savings that invest in short-term financial instruments, pay higher than

savings account interest.

d) Overnight repurchase agreements: agreements by a financial institutions to sell short –term securities

to its customers, accompanied by an agreement to repurchase the securities within 24 hours.

e) Overnight Eurodollar deposits: 24-hour dollar-denominated deposits held in financial institutions

outside the United States.

M2 = M1 + all near moneys (Such as Small time deposits, Savings deposits, Money market accounts,

overnight repurchase agreements, overnight Eurodollar deposits).

Banks and Money Creation

History:

The modern banking system was developed from fractional reserve banking of the early days.

Goldsmiths had safes for gold and precious metals, which they often kept for consumers and merchants

for a fee. They issued receipts for these deposits. Later on, the receipts came to be used as money in

place of gold for their convenience, and goldsmiths became aware that much of the stored gold was

never redeemed. Goldsmiths realized they could loan gold by issuing receipts to borrowers, who agreed

to pay back gold plus interest. The actual gold in the vaults became only a fraction of the receipts held

by borrowers and owners of gold. Fractional reserve banking is significant because banks can create

money by lending more than the original reserves on hand.

Creation of money:

Individual banks are not allowed to print their own money. But, banks may create money by creating

checkable deposits, which are a part of the money supply.

Suppose the Fed prints $100 and decided to deposit it in Bank X. Bank X sets aside a portion of that

$100 that is required reserves (a specific amount that banks must hold as reserves on all deposits), say

10%. The remaining 90%, $90 becomes excess reserves. Bank X can lend that $90 to Customer A, who

deposits into his account in Bank Y. At this step, the original $100 remains in the system, and we can

now add Customer A’s $90. Bank Y sets aside 10%, and lends out the rest. This process continues until

no new excess reserves can be created.

Federal deposit Insurance Corporation (FDIC)

Deposits at banks are insured by the FDIC. Such insurance guarantees deposits in amounts of up to

$100,000 per depositor before the 2008 recession. Since then, the amount is increased to $250,000.

This guarantee gives financial institutions the incentive to make risky loans, and gives depositors

confidence for their funds.

Banks and Money Creation

The money multiplier is the number by which a change in the monetary base is multiplied to

find the resulting change in the quantity of money.

Change in quantity of money = Money multiplier X Change in monetary base.

The money multiplier is determined by the required reserve ratio (r) and by the currency drain

(c). c: an increase in currency held outside the banks, tells us the portion of currency which

people will hold as cash for their expanses after they borrowed from the banks. r is the

required reserve ratio which determined by the Federal Reserve. Banks are required to hold r

portion of their total deposit as their required reserve.

RR: Required Reserve = Total deposit x r

ER: Excess Reserve = Actual reserve - Required Reserve

Maximum new loan amount of the banks is equal to the excess reserve held by the banks.

Money multiplier = 1/ {1- (1-r)(1-c)}

Maximum change in checkable deposits = Money multiplier X Change in reserves from the initial injection

For example, A deposits $1000 in Bank X. The current required reserve ratio (r) is 10%, c is 25%

Money multiplier = 1 / {1- (1-10%)(1-25%)} = 3

Maximum change in checkable deposits = 3 X $1000 = $3000

When c=0, Money multiplier = 1/r, this is the simple money multiplier.

Federal Reserve System

The Federal Reserve System, established by Congress in 1913, regulates the money supply and banking

system in the U.S. Its principal components are the following:

1. Board of Governors: controls and coordinates the activities of the Federal Reserve System. The seven

governors are appointed by the president and confirmed by the Senate to staggered 14-year nonrenewable terms. The president designates one member of the board as the chair for a four year,

renewable term.

2. Federal Open Market Committee (FOMC): is made up of the seven governors plus five presidents of

Federal Reserve District Banks (the president of the New York district has a permanent seat; the other

four places rotate among the remaining 11 district banks). FOMC has the authority to conduct open

market operations, which is the buying and selling of government securities for the purposes of

manipulating the money supply.

3. Federal Reserve District Banks: assist the Board of Governors in overseeing the banking system and

controlling the money supply, the system was divided into 12 geographic districts and each district is

overseen by a Federal Reserve District Bank.

Functions of the Federal Reserve Systems are: 1. Control the money supply

2. Supply the economy with paper money

3. Provide check-clearing services

4. Hold depository institution’s Reserves

5. Supervise member banks

6. Serve as the Government’s banker

7. Serve as a lender of last resort

8. Serve as a Fiscal Agent for the Treasury.

Monetary Policy

Monetary Policy tools:

The Fed can use the following tools to influence the money supply.

1. Open Market Operation: The Fed can affect the money supply by buying or selling U.S. government

securities, using open market operations. When the Fed purchases a government security from the

public, it does so with money that did not exist in the system. Thus, bank reserves will rise, increasing

the money supply.

2. The Required-Reserve Ratio (r): The Fed can influence money supply by changing this ratio. This ratio

specified the amount banks must hold as reserves on all deposits and limits the amount that banks

may lend out. If the Fed increases the reserve ratio, the deposit and money multiplier will be smaller,

thereby further limiting the amount by which banks may expand the money supply.

3. Discount Rate: Banks will borrow funds when needed. When the banks borrow from the Fed, they

pay an interest rate called the Discount rate. When the discount rate is raised, banks will have less

incentive to borrow, thus lowering the money supply in the system.

When the economy is in inflationary gap, the Fed will adopt contractionary monetary policy to

decrease the money supply in the market by selling securities, raising the reserve rate, and/or

increasing the discount rate. These actions will lower the AD and close the GDP gap.

When the economy is in recessionary gap, the Fed will adopt expansionary monetary policy to increase

money supply in the market by buying securities, lowering the required reserve rate, and/or decreasing

the discount/federal funds rate. These actions will increase the AD and close the GDP gap.

However, these policy tools may not be effective due to issues like time lags, liquidity trap, or interestinsensitive investments.

Money Market

The demand for money has two components: transactional demand and asset demand.

Transactional demand (Dt) is money kept for purchases and will vary directly with GDP.

Asset demand (Da) is money kept as a store of value for later use. . Asset demand varies inversely with the interest rate,

since that is the price of holding idle money.

Total demand for money will equal quantities of money demanded for assets plus that for transactions. The demand

curve for money illustrates the inverse relationship between the quantity demanded of money and the interest rate.

The supply of money is a vertical line, suggesting the

quantity of money is fixed at a level largely determined by

the Fed.

Equilibrium in the money market exists when the quantity

demanded of money equals the quantity supplied. In the

above graph, it shows an equilibrium of the money market

at interest rate of 6%, and quantity of money at 600 billions.

The vertical curve indicates the money supply decided by

the Federal Reserve.

At any interest rate above the equilibrium rate, there is an

excess supply of money. At any interest rate below the

equilibrium rate, there is an excess demand of money.

Fed can influence the market interest rate by adjusting the money supply. If the money supply

increases (moving the vertical curve in the above graph towards the right), the interception point

will demonstrate a lower interest rate in the market. If the money supply decreases (moving the

vertical curve in the above graph towards the left), the interception point will demonstrate a

higher interest rate. Therefore, market's interest rate is closely related to the monetary policy of

the Fed.

Equation of Exchange

The Equation of Exchange addresses the relationship between money and price level, and

between money and nominal GDP.

The equation simply states: M x V = P x Y

Where M = the money supply, usually the M1

V = the velocity of money

P = the price level

Y = real output, or real GDP.

Velocity is the number of times the average dollar is spent to buy final goods and services

in a given year. Velocity can be calculated by using V = (P x Y ) / M

The equation tells us that total spending (M x V) is equal to total sales revenue (P x Y). Since

(P x Y) is equal to the nominal GDP, then M x V = nominal GDP.

Velocity (V) and Real GDP (Y) are effectively constant in the short run, therefore any

changes in money supply (M), will cause a proportional change in the price level (P).

Re-writing the equation, we get: P = ( M x V ) / Y

This equation demonstrated a direct relationship between price and money supply. If V and

Y are constant, a certain percentage change in money supply will cause a same amount of

change in the price level.