Production & Cost in the Firm ECO 2013 Chapter 7

advertisement

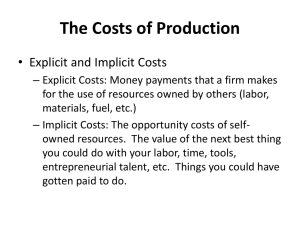

Production & Cost in the Firm ECO 2013 Chapter 7 Created: M. Mari Fall 2007 Economic Costs • Costs exists because resources are scarce and have alternative uses • When society uses a combination of resources to produce a particular product, it foregoes all alternative opportunities to use those resources for other purposes. • The measure of the economic cost or the opportunity cost of any resource used to produce a good is the value or worth the resource would have in its best alternative. Economic Costs • (opportunity costs) are those payments a firm must make or income it must provide to resource suppliers to attract the resources away from alternative production. Costs • Two types of costs – Explicit – Implicit • Total costs = Explicit Costs + Implicit Costs Explicit Costs •are monetary payments to nonowners of the firm for the resources they supply. –Rent –Labor –Materials –Utilities Implicit Costs •costs of self-owned, self-employed resources. –Salary of owner not taken –Capital invested by owners –Foregone rent, interest, wages •Not seen in accounting profit analysis Profits • Accounting profit – A firm’s total revenue minus its explicit costs – Total revenue – explicit costs • Economic profit – A firm’s total revenue minus explicit and implicit costs – Earn more than expected – Normal profit • The accounting profit earned when all resources earn their opportunity costs • What you expect to earn Production in the Short Run • Long run – A period during which all resources under the firm’s control are variable • Short run – A period during at least one of a firm’s resources is fixed Relationships • A firm’s costs of producing a specific output depend not only on the price of needed resources but also on the quantities of resources needed to produce that output. • Resource supply and demand determine the resource prices • The technological aspects of production specifically the relationship between inputs and outputs, determine the quantity of resources needed. Law of Diminishing Marginal Returns • Total product – The total output produced by a firm • Production function – The relationship between the amount of resources employed and a firm’s total product • Marginal product – The change in total product that occurs when the sue of a particular resource increases by one unit Marginal Returns • Law of diminishing marginal returns – As more of a variable resource is added to a given amount of a fixed resource, marginal product eventually declines and could become negative Graphical Total product Total product Workers per day Diminishing but positive M P Increasing Negative marginal returns Costs in the Short run •Fixed costs –Any production cost that is independent of the firm’s rate of output •Depreciation on building •Insurance •Property taxes •Variable costs –An production cost that changes as the rate of output changes –Labor –Materials –utilities Formula Total Costs = Fixed Costs + Variable Cost Variable costs = Variable cost per unit x units At zero output then: Total costs = Fixed costs Formula Average Fixed Costs (AFC) = Total Fixed Costs Output (Q) Average Variable Costs (AVC) = Total Variable Costs Output (Q) Average Total Costs (ATC) = Total Costs Output (Q) Marginal Costs = Change in total cost Change in quantity Chart Tons per day Fixed Costs Workers per day Variable costs Total Costs Marginal Costs 0 $200 0 0 $200 - 2 $200 1 $100 $300 $50 5 $200 2 $200 $400 $33.33 9 $200 3 $300 $500 $25 12 $200 4 $400 $600 $33.33 14 $200 5 $500 $700 $50 15 $200 6 $600 $800 $100 Curves Total cost Variable costs $200 0 Fixed Costs Tons per day Curves Marginal cost Costs in the Long Run • No fixed costs exists • Can increase facility size • Long run Average cost curve – A curve that indicates the lowest average cost of production at each rate of output when the size or scale of the firm varies Economies of Scale • Explain the downward sloping part of the long run ATC curve • Economies of mass production • Capital intensive firms • As plant size increases, a number of factors will for a time lead to lower average costs of production • Labor specialization • Managerial specialization • Efficient capital Diseconomies of Scale • Caused by the difficulty of efficiently controlling and coordinating a firm’s operations, as it becomes a largescale producer. • Alienation of workers Constant Returns to Scale • Long-run average costs do not change as output changes. • Example: textbooks