Corporations Chapter 12

advertisement

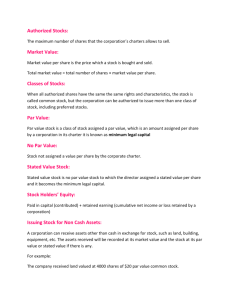

Corporations Chapter 12 Corporation Characteristics Is a legal entity, distinct and separate from the individuals who create and operate it. It may acquire, own and dispose of property in its own name. It may also incur liabilities and enter into contracts It can sell shares of ownership Stock – shares of ownership It gives the corporations the ability to raise large amounts of capital. Corporations Stock – shares of ownership Stockholder – owners of stock Dividends – distribution of income to shareholders Types of Corporations Public Corporations those with shares of stock are traded in public markets such as the NASDAQ or NYSE regulated by the Securities and Exchange Commission. http://www.sec.gov/ Private or Nonpublic Corporations Shares are not traded publicly are usually owned by a small group of investors. Additional Characteristics Additional Characteristics of Corporations Limited liability Board of Directors Elected by the shareholders Meets periodically to establish corporate policies Selects the Chief Executive Officers Dividends A corporation’s creditors usually may not go beyond the assets of the corporation to satisfy their claims. Distribution of income to shareholders Liable for Taxes on the income of the corporation before the distribution of dividends to shareholders may cause double taxation of income Forming a Corporation Application of incorporation Filed with the state authority http://www.sunbiz.org/ Once approved the state grants a Charter or Articles of Incorporation Articles of incorporation Formally create the corporation Organizational Costs Costs may be incurred in organizing a corporation Costs include legal fees, taxes, state incorporation fees, license fees, and promotional costs Example 1 Suppose that $15,000 is spent in the forming of the corporation. Account Organizational costs Cash Debit Credit $15,000 $15,000 Paid-In Capital from Issuing Stock Two main sources of stockholders’ equity Paid in capital Paid in capital comes from the issuance of stock Retained earnings From the earnings of the business not distributed as dividends Stock Authorized – number of shares of stock that a corporation can issue Issued – number sold Outstanding – number in hands of stockholders Stock Authorizing > Issued ≥ Outstanding Stock Par value or stated value – assigned Rights monetary value Right to vote in matters concerning the corporation Right to share in distribution of earnings Right to share in assets at liquidation Rights vary with the class of stock Classes of Stock Common stock Has all the rights listed above Preferred stock The dividend rights of preferred stock are usually stated in monetary terms or as a percent of par $2 preferred stock Has a right to an annual $2 per share dividend 5% preferred stock with par of $100 Has a right to an annual dividend of $5 per share They have the first right to dividends when any dividends are declared. Have greater chance of receiving their dividends Dividends Dividends First paid to preferred stockholders Remainder to common stockholders Dividend Distributions by class Corporation has 4,000 shares of common stock and 1,000 shares outstanding of 8% preferred stock with a par value of $50. The Board declares the following dividends. 2006 $20,000 2007 $50,000 2008 $62,000 Example 2 What are dividends distributed to preferred stock and common stock? Preferred stock gets 8% times par value 8% x $50 = $4 per share There are 1,000 shares outstanding of preferred stock so dividend is: $4 per share x 1,000 shares outstanding = $4,000 Example 2 2006 2007 2008 Dividends $20,000 $55,000 $62,000 Preferred stock $4,000 $4,000 $4,000 Common Stock $16,000 $51,000 $58,000 Note Even though the dividends declared increased each year, preferred stock only received the $4,000 and common stock always receives the remainder which increases as dividends increase. Example 3 Corporation has 5,000 shares of common stock and 2,000 shares outstanding of $10 preferred stock with a par value of $50. The Board declares the following dividends. 2005: $30,000 2006: $55,000 2007: $20,000 What are dividends distributed to preferred stock and common stock? Issuing Stock An account is created for each type of stock. These accounts are classified as equity. They increase with a credit. Stock can be issued at par or above par Issued at par: Amount received is the same amount credited to the stock account. Journal Entry Account Cash Debit Credit Amount received Preferred stock Par value Common stock Par value Example 4 The Corporation issues 10,000 shares of $5 par value common stock and 4,000 shares of $10 par value preferred stock at par. Record the entry. Preferred stock: 4,000 shares x $10 per share = $40,000 Common stock: 10,000 shares x $ 5 per share = $50,000 Total cash received $90,000 Example 4 Account Cash Debit Credit $90,000 Preferred stock $40,000 Common stock $50,000 Premium on sale of stock When stock is issued for a price that is more than its par. Caused by Financial conditions, earnings record, and dividend record of the corporation Investor expectations of the corporation’s potential earning power Premium on sale of stock When stock is issued for a price above its par value, it has sold at a PREMIUM. When stock is issued for a price above its par value, it has sold at a DISCOUNT. Difference between par value and selling price is placed in an equity account called Paid in Capital in Excess of Par. Journal Entry Account Cash Debit Credit Total cash received Preferred stock Par value Paid in capital in excess of par Cash - par Example 5 The Corporation issues 4,000 shares of $10 par value preferred stock for $15 per share. Record the entry. Preferred stock: Selling price: $15 per share x 4,000 shares = Par value: $10 per share x 4,000 shares = Paid in capital EXCESS $60,000 $40,000 $20,000 Journal Entry Account Cash Debit Credit $60,000 Preferred stock $40,000 Paid in capital in excess of par $20,000 Example 6 The Corporation issues 7,000 shares of $4 par value common stock and 3,000 shares of $20 par value preferred stock. The common stock is issued at $7 per share and the preferred stock at $24 per share. Record the entry. Rule Companies will never declare a gain or loss on transactions with its own stock. Always the difference will go to paid in capital in excess of par. No Par Stock Stock may be issued without par value Entire proceeds from the sale are credited to the stock account No paid in capital in excess of par account will exist Accounting for Dividends Cash dividends A cash distribution of earnings by a corporation to its shareholders. These are the most common though other assets may be distributed. Three conditions for dividends to be paid: Sufficient retained earnings Sufficient cash Formal action by the board of directors. Though they are not legally required to do so. Three important dates with dividends: Example 6: On May 10, 2007, the ABC Corporation’s Board of Directors declared a cash dividend of $.25 per common stock share to stockholder’s of record on May 31, 2007 payable on June 10th. There are 10,000 shares outstanding. Date 1: Declaration Date Declaration date The date that Board of Directors approves the dividend. A liability is incurred by the corporation. Entry: Cash dividends DR Dividends payable CR Example 6 Date May 10, 2007 Account Cash dividends Dividends Payable DR CR $2500.00 $2500.00 Date 2: Date of Record This date determines which shareholders will get the dividend. No entry Shares sold after May 31 are called exdividend stock. The sales price includes a share of the dividend Example 6 May 31 is the date of record. Shareholders at the close of business on this day will receive the dividend check. Date 3: Payment Date This is the date that the dividend checks are mailed out Entry: Dividends payable DR Cash CR Example 6 Date Account June 10, Dividends payable 2007 Cash DR CR $2500.00 $2500.00 Stock Dividends A distribution of shares of stock to stockholders. These distributions are in common stock Issued to holders of common stock only The effect of the stock dividend on the stockholders’ equity of the issuing corporation is to transfer retained earnings to paid in capital. Therefore no assets are affective The amount transferred from retained earnings to paid in capital is normally the fair market value of the shares issued in the stock dividend. Example 7 Suppose that on June 10, 2007, Morton Company declares a 2% stock dividend on shares outstanding on June 30, 2007. The stock dividend is payable on July15, 2007. The stockholder’s equity account looks like this: Example 7 Common stock, ($15 par value with 100,000 shares issued) $1,500,000 Paid in Capital Retained Earnings $ 700,000 $7,000,000 Fair market value of stock on declaration date is $20 per share. Example 7: Declaration Date Date Account June Stock Dividends 10, 2007 Stock Dividends Distributable Paid in capital in excess of par DR CR $40,000 $30,000 $10,000 Example 7: Payment Date Date Account June 10, Stock Dividends 2007 DR CR $40,000 Stock Dividends Distributable $30,000 Paid in capital in excess of par $10,000 Note It does not change the assets, liabilities or total stockholder’s equity of a company Treasury Stock Companies may buy its own stock to provide shares: for resale to employees for reissuing as a bonus to employees for supporting the market price of the stock Cost method A commonly used method of accounting for the purchase and resale of treasury stock. Treasury Stock Transactions for Treasury Stock Repurchase – when a company buys back its stock create a new equity account called: Treasury Stock it is a contra equity account increases with a debit recorded at the purchase price called COST Treasury Stock Sale Recorded at original buy back cost Difference between SELLING PRICE and cost Recorded in PAID IN CAPITAL Example 9: A corporation has common stock with a par value of $25. The company repurchases 2,000 shares at $45 per share. Record the buy back. Date Account Cash Treasury Stock DR CR $90,000 $90,000 Example 9 The company sells 700 shares at $60 per share. Record the entry. Selling price: 700 x $60 = Cost: 700 x$45 = Excess paid in capital $42,000 $31,500 10,500 Example 9 Account Cash Debit Credit $42,000 Treasury Stock $31,500 Paid in capital in excess of par $10,500 Example 9 The company sells 200 shares at $40 per share. Record the entry. Selling price: 200 x $40 = Cost: 200 x$45 = Excess paid in capital $8,000 $9,000 (1,000) Example 9 Account Debit Cash $8,000 Paid in capital in excess of par $1,000 Treasury Stock Credit $9,000 Example 10 A corporation has common stock with a par value of $10. The company repurchases 1,000 shares at $20 per share. Record the buy back. The company sells 500 shares at $30 per share. Record the entry. The company sells 200 shares at $15 per share. Record the entry. Why Paid in Capital and not a gain or loss? Companies will never declare a gain or loss on transactions with its own stock. Always the difference will go to paid in capital in excess of par.