Ch. 25 Section 2 State and Local Governments

advertisement

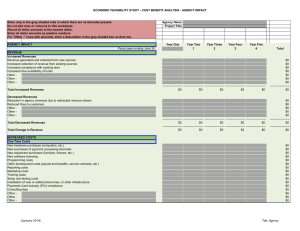

Ch. 25 Section 2 State and Local Governments State Government Revenues ► The largest source of revenue for state governments is intergovernmental revenue – the money that one level of government receives from another level. $.28 of every dollar ► Federal government gives states money for welfare, highways, hospitals, etc. State Government Revenues (cont.) ► Sales tax is the second largest source of state revenue; $.21 of every dollar ► Tax on consumer purchases ► A percentage of the purchase price is added to arrive at the final price the consumer pays. ► The merchant turns over the taxes to a state government agency State Government Revenues (cont.) ►5 states do not have a sales tax; Alaska, Delaware, Montana, New Hampshire, and Oregon. ► Other states however range from 2.9 – 7% ► Internet purchases are not subject to sales tax which cut into state revenue. State Government Revenues (cont.) ► 3rd largest source of state revenue comes from contributions that states and state government workers make to their own retirement plans ► It is invested money until needed to pay for people’s retirement. ► $.17 of every dollar State Government Revenues (cont.) ► State gets revenue from income tax as well. ► Some states charge a single rate to all taxpayers ► Some states tax a percentage of the federal income tax ► Seven states do not charge a income tax Local Government Revenue ► Local governments # 1 source of revenue comes from intergovernmental revenue ► 36% of revenue comes from the federal government and state government Local Government Revenue (cont.) ► Property tax is the 2nd largest source of local revenue ► These are taxes that people pay on the real property or the personal property they own. ► ► Real property includes land and buildings Personal property includes portable objects (jewels, cars, art) ► Local governments anymore only tax real property Local Government Revenue (cont.) ► Water and Utility companies are the 3rd largest source of revenue; $.07 of every dollar ► In some places people are hit with a federal, state, and local income tax State Expenditures ► Largest expenditure for the states are entitlement programs – these programs provide health, nutritional, or income payments to people who meet eligibility requirements ► Higher Education (colleges) is second on the list ► States subsidize or pay part of the costs for people’s college education. ► Without this, people would pay higher tuition and other fees. Local Expenditures (cont.) ► 1/3 of all spending goes to local school districts and the operation of public schools. ► Elementary and Secondary education ► Building new schools; new additions; renovations ► Hiring new teachers ► Raises for veteran teachers Local Expenditures (cont.) ► Police ► Local firms and fire protection community water service/contracting private ► Sewage/garbage disposal