Econ Geog Economic Geography: study of flow

advertisement

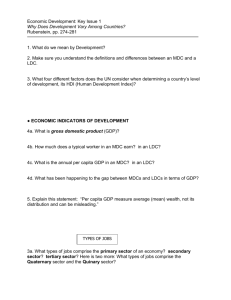

Econ Geog Economic Geography: study of flow of goods and services across space • Look at ways in which people provide for themselves across the globe • Geographic patterns of inequality at different scales • Globalization: is a MAJOR thread throughout econ geog….free trade, intnl trade, international econ alliances, etc. Industrial Revolution Industry: manufacturing goods in a factory Industrial Revolution: • GB – late 1700s – diffused to W. Eur and U.S. • Technology and mechanization led to unprecedented increase in production • Iron and textiles = 1st to industrialize Where is Industry Distributed? For 200 yrs industry was limited to • N. Europe – GB, France, Russia, Germany • E. Asia – Japan • N. America – U.S. • These countries dominated ind production/innovation until mid 20th C Where is Industry Distributed In recent yrs – shift in geography of industrialization • Major corporations have moved factories to LDCs (cheap labor) • Older industrial countries have shifted to service based economies – research and development, marketing, tourism, sales, telecommunications, etc.) • Service jobs are safer, more pay, less pollution, and overall higher satisfaction Where is Industry Distributed? • BUT service jobs require more education/training than factory work • i.e. difficult transition – factory lose jobs as factories outsource, must go back to school or switch careers in mid life • Mill towns/factory towns – ghost towns or reinvent themselves with new econ niche Where is Industry Distributed? Deindustrialization: when industrial factories leave an area and take that region’s econ base with them • Ex: Rust Belt: Great Lakes region was home to all auto manufacturing but GM and other companies have relocated – debilitating for the economy of the region and the workers there • Backwash Effect: when one region’s econ gain is another’s loss The Rust Belt Where are industries distributed and why there? All industries seek to maximize profits by minimizing production costs Critical question: Where is the most profitable place to locate a factory?? Alfred Weber: Least Cost Theory: firms look at the following to decide where to locate…….. Least Cost Theory 1.) Transportation Costs: must move raw materials (inputs) to plant and finished product to market • Market Orientation Firms: if finished product weighs more or is perishable, then locate the plant closer to the market than the raw materials….4 types of market orientation: Least Cost Theory – Market Oriented Firms • A.) Bulk Gaining Industry: product gains volume or weight during production (TV, refrigerator, soft drinks) • B.) Single Market Manufacturer: product sold mainly in one location • C. Perishibility: fresh fruits, milk, bread, newspaper – must be near market • D.Ubiquitious Industry: industry distr is in direct proportion to the distr of the population (i.e. near large metro areas with people = labor and market) i.e. hospitals, big business Least Cost Theory – Material/Resource Orientation Material/Resource Orientation: raw materials (inputs) weigh more (or are perishable) than the finished product so locate plant closer to raw materials than to market. These are called Bulk Reducing Industries: final product weighs less than the inputs (i.e. paper mills, steel, copper – most mining, tomato cannery, etc.) Least Cost Theory – Other transportation variables Footloose firms: industries w/ products that are lightweight and valuable and can locate anywhere (i.e. diamond of computer chips) Spatially fixed cost: cost of product does not change no matter where factory is located Spatially Variable cost: price of product varies depending on where factory is located and where product is produced Least Cost Theory Transportation • Longer distance is cheaper per mile • Ships best for longest distances • Air – most expensive but fastest • Break of Bulk Points: cost of transport for some inputs is cheaper than another type of transport – so you use multiple methods of transport. BBP = transfer point (usually a seaport or airport) Least Cost Theory AGGLOMERATION Agglomeration: when many companies of the same industry cluster together in a small area to draw from the same set of collective resources (i.e. computer companies in Silicon Valley, motion picture industry in LA, fashion in Paris) Least Cost Theory AGGLOMERATION Multiplier Effect: as more firms from same industry locate in an area, more resources become available and cements that region’s specialty even more (ex: CA became known for high tech firms, it attracted more computer experts, which attracted more high tech firms, etc.) Least Cost Theory AGGLOMERATION Ancillary Activities: agglomeration results in ancillary activities – i.e. the supporting cast. Economic activities that surround/support the primary industry of the region. These can include a range of activities – shipping, food services, etc. Least Cost Theory AGGLOMERATION Agglomeration leads to regionalization: unique specialization from region to region Deglomeration: opposite of agglomeration – when a firm leaves an agglomerated region to start up in a new place Least Cost Theory – Agglomeration Regional Specialization – Silicon valley Least Cost Theory – LABOR Labor intensive industry = one where the cost of labor is a high percentage of production (ex: textiles) Outsourcing: move production abroad for cheap labor. You’re willing to pay more for transportation b/c of cheap labor. Outsourcing usually goes to semiperiphery – cheap labor, decent infrastructure, no environmental regs Least Cost Theory – LABOR Textiles has followed cheap labor – originally in NE b/c of cheap immigrant labor, late 1800s/early 1900s moved to SE to avoid unions, post WW II moved overseas to LDCs in Asia (50s in Hong Kong and Japan, 70’s in China and Korea, today in Indonesia, Bangladesh Least Cost Theory – Other things a firm may consider…… Land: • Factories today usually rural or suburban • Need large tracts of land (1 story – more efficient) • Amenities – climate, cost of living, re opportunities (i.e. Sun Belt) • Communities engage in bidding wars – zoning, tax breaks, environmental conditions, etc. to offer most attractive package (i.e. Dell in NC) Least Cost Theory – Other things a firm may consider…. Capital • Money available to expand or open new factories • May go to area where banks are willing to make high risk loans (i.e. Silicon Valley) Factory Work Fordism: mass production and assembly lines (each worker assigned one specific task to perform repeatedly). Started by Ford in early 20th C Factory Work Post-Fordism: more flexible – work in teams and often master a wide array of tasks Weber’s factors to consider = site and situation factors Site Factors: land, labor, capital Situation Factors: transportation costs – i.e. relative location to inputs/raw materials and to market Summary of Location Principles Access to materials for production Adequate supply of cheap labor Proximity to shipping and market Decrease production costs (cheap land, cheap labor, and favorable govn’t policies) Natural factors, climate Firm’s history and personal inclinations Industrial Problems Over production – global capacity to produce manufactured goods has increased more rapidly than demand • Consumption leveled off since 1970s b/c No population increase Wages have not risen as fast as prices Market Saturation: everyone already has one (TV, cars, microwaves, etc.) Higher quality goods last longer Industrial Problems in MDCs Must protect markets from new competitors Trading Blocs: industrial competition in MDCs is betwn blocs, not countries • NAFTA, EU, ASEAN • Cooperation within bloc, competition betwn • Seek complementary trade within bloc Industrial Problems in MDCs Transnational Corporations – locate aspects of production in various countries. i.e. take advantage or regional diff in wages, tax laws, labor laws, natural resources, etc. • Ex: Nike – HQ in Oregon, but factories span the globe Industrial Problems in MDCs Most transnational corp are conglomerate corporations: firms that consist of many smaller firms that serve different functions (ex: GM – many smaller firms that operate all over the world, and produce a wide variety of goods and services Industrial Problems in LDCs Distance from markets – far from wealthy consumers in MDCs Poor infrastructure (roads, technology, communication, etc.) Cheap labor = best drawing card for industry. Intnl division of labor: low paid, low skilled work done in LDCs, high skilled work in MDCs Industrial Problems in LDCs Export Processing Zones: zones officially designated for manufacturing – have accessible facilities, lax environmental regs, and tax exemptions, cheap labor. Ex: Maquiladoras along US/MX border. Pros – jobs for MX, cheap labor for US. Cons – often plagues w/ high crime, govnt corruption, pollution Industry today….. Outsourcing Export processing zones maquiladoras Tourism All of these exploit LDCs/periphery. Neocolonialism: econ and political controls are exercised by developed states over the economies and societies of independent countries in the developing world DEVELOPMENT Development: process of improving material conditions of people w/ diffusion of knowledge and technology – continuous process of trying to improve health, living conditions, and prosperity Wallerstein’s World Systems Model • N/S Divide (see handout) Development Varies Across Space Dev can be broken into econ, social, or demographic factors Human Development Index (HDI): created by UN to look at all 3 • Life exp, educ (literacy rate and amnt of ed), income (GDP) • Highest possible – 1.0 (100%) • Norway – highest - .944 • U.S. never first, but always high • Lowest - sub Sahara Africa (Sierra Leone .275) Economic Factors of Development GNP and GDP (omits investments abroad) Per capita (divide by population) Annual per capita GDP more than $20,000 in MDCs and @ $1,000 in LDCs – this gap is widening Economic Factors of Development Types of jobs…. • Primary activities: w/ land – fishing, farming • Secondary: manufacturing, industry • Tertiary: service Quaternary: research and development – generating/exchanging knowledge (teaching, banking, law, accounting, etc.) Quinary: high tech scientific research Types of Jobs/Econ Activities Economic Factors of Development All countries have all types of econ activities. The higher up you go, the more educ required and the better pay. MDC’s mostly in tertiary or higher. LDC’s mostly in primary. Semi-periphery mostly in secondary. Human Res and productivity increase in MDCs (workers produce more w/ less effort)….higher educ, skilled, machinery and technology Economic Factors of Development Energy Consumption per capita – correlates w/ technology and dev. • MDCs =10X more per capita than LDCs • MDCs consume sign more energy than they produce • MDCs use coal, natural gas, hydropower • LDCs use firewood, dung, peat, and domestic fuels to cook and keep warm • Wood – 60% of fuel use in LDCs and 90% in poorest countries Social Indicators of Development MDCs use money for schools, hospitals, that provide better educ and healthier longer lives – this is cyclical b/c better educated and healthier pop can be more productive and make more money Social Indicators of Development Education: MDC’s have greater quantity and quality of educ • Student – teacher ratio (2X as many students to 1 teacher in LDC) • Literacy Rate (over 95% in MDCs, less than 35% in LDCs) • Avg student attends school 10 yrs in MDC and a few yrs in LDCs (varies) Social Indicators of Development Health • MDCs – better ratio of people to hospitals, doctors, and nurses • MDC consume greater calorie consumption. In LDCs many get less than daily recommended allowance • Different problems……MDCs – problems w/ obesity, elderly population, etc. Demographic Indicators of Development Life Expectancy: avg # if yrs a newborn can expect to live (early 40s in LDCs, 70s in MDCs) Infant Mortality: die b/f 1st b-day (less than 1% in MDCs, 10% in LDCs) CBR – higher in LDCs but dropping Maternal Mortality Rate – sign higher in LDCs Gender Issues in Development Gender inequality exists in every country Two composite measures to look at…… GDI Gender Related Development Index GDI: looks at same measure as HDI but to highlight disparity betwn men and women • Complete equality is 1.0 • Penalized for greater diff betwn men and women • Highest GDIs in Europe and N. America; lowest in Sub Sahara Africa • Even in MDCs women’s average income is less than men’s GDI • In LDC’s women less likely to attend school and have lower literacy rates (99/100 women to men in MDC high school; 60/100 in LDC high schools) (remember this affect on pop growth) • Globally women outlive men, but outlive men much longer in MDCs than in LDCs (mostly b/c of maternal mortality rate) Gender Empowerment Measure (GEM) Measures econ and political power 4 factors…. • Income • Professional jobs • Managerial jobs • Elected positions (no country has a natnl Congress w/ majority women…highest in Eur w/ @ 30%....U.S. has @ 15%) Every nation has a higher GDI and lower GEM i.e. means women possess a greater share of a nation’s resources than power over allocation of those resources Even in MDCs women’s average income is less than men’s…WHY? LDCs Obstacles to Development While LDCs have improved, gap betwn MDC and LDC has increased. WHY? Circular/cumulative causation: process where tendency for econ growth are self-reinforcing….i.e. it takes money and development to foster money and development Solution? LDCs must dev at a faster rate, but how? Two prominent options…. Self Sufficiency/Balanced Growth Approach – China and India Country should invest = across all sectors of the economy and all regions Limit imports (tariffs) Internal businesses encouraged to produce for own people; not export Problems w/ Self-Sufficiency Model Protects inefficient businesses in own country (protect from international competition, but has little incentive to improve quality or lower price) HUGE govnt bureaucracy to manage econ – leads to abuse and corruption – Govn’t red tape Option Two – International Trade Model Develop through international trade (look outward). Look outward. Identify a unique econ asset and export globally. Use funds and profit to finance other development Done in Arabian peninsula and E/SE Asia W.W. Rostow – Dev Model Rostow advocated intnl trade approach with a 5 step model towards development. He created the model in the 1950s and based it on the pathway the U.S. and Eur followed: • Stage 1: Traditional Society: country dominated by primary econ activities – low prod, low tech, low per capita income Rostow – Intnl Trade Stage 2: Preconditions to Takeoff: preconditions to econ dev are commercialization of AG and exploitation of raw materials Stage 3: Takeoff: foreign investment jump starts econ. Rapid growth in a limited number of sectors; other sectors still dominated by tradntl methods. Country uses profits to pour into infrastructure (roads, canals, etc.) Rostow – Intnl Trade Stage 4: Drive to Maturity: Dev and modern tech diffuse to wider variety of the econ. Workers become more skilled and specialized Stage 5: high levels of mass consumption and per capita income. Shift from heavy industry to services and producing consumer goods. Criticisms of Rostow Not all countries will pass through stages consecutively Model doesn’t account for…. • • • • • • • Global politics Colonialism Physical geog War Culture Ethnic conflict All of these may affect progression and cause different pathway Example of INtnl Trade Model 4 Asian Tigers/Dragons: S. Korea, Singapore, Taiwan, Hong Kong • all poor in natural resources • Promoted dev by focusing on a handful of econ goods (esp clothing and electronics). i.e. find comparative advantage – produce item for which you have the greatest advantages in comparison to other countries • Low labor allowed them to sell products cheaply in MDCs Map – Asia India – China – initially self/sufficiency and balanced growth model 4 Asian Tigers – International Trade Model 4 ASIAN TIGERS South Korea Taiwan Hong Kong Singapore Problems w/ Intnl Trade Model May hinder other LDC’s from following this path…. • 1.) Uneven resource distr: many country's niche faced lower price on world market (ex: Zambia and copper – world prices for copper have been dropping) • 2.) Market stagnation: market for consumer goods slowing down in general Problems w/ Intnl Trade Model 3.) Increased dependence on MDCs: takeoff industries force LDCs to decrease production of food, clothing, or other necessities for own people Conclusion….intntl trade model is widely accepted alternative to selfsufficiency model Statistics…… World Bank – since 1990 per capita GDP has increased more than 4% annually in countries w/ intnl trade model and less than 1% in countries w/ self-sufficiency model Statistics….. 1960-1990….. • India’s GDP increased by 4%/year on self sufficiency model • Thailand’s by 8%/year (intnl trade) • Taiwan’s by 8%/year (intnl trade) • S. Korea’s by 9% /year (intnl trade) • Since 1990s India switched to intnl trade and GDP has increased by 6%/year WTO – World Trade Organization Est in 1995 – promotes intnl trade model. Works to decrease barriers to intnl trade by…. • Eliminating restriction on trade (no tariffs, no quotas on imports, no subsidies on exports) • Enforcing trade agreements (rules on arguments and accusations) WTO Liberal critics – say WTO is antidemocratic and promotes interests of large, wealthy, transnational corp Conservative critics – says WTO compromises gov of countries b/c it can order changes in subsidies, taxes, etc. ALWAYS protestors outside WTO mtgs WTO $$$$$ for Development?? 1.) Loans – usually from World Bank or International Monetary Fund (both controlled by MDCs) • Together loan @ 50 billion/year • Idea – borrow $$ to improve infrastructure to attract businesses/investment • Many infrastructure projects fail – don’t work, don’t pay off, or businesses still do not come $$$$ for Development? (Loans) • Debt is greater than annual income in 30 countries • Many LDCs cannot even pay interest on loans, much less the principal • Result….many MDC’s becoming more hesitant to grant loans $$$$ for Development?? 2.) Foreign Direct Investment – Transnational Corporations: flow of money and investment from one country to another through private corporations (increasing trend in late 20th C) • BUT only ¼ of foreign investment went from MDC to LDC (most goes from MDC to MDC) • Of all money from MDC to LDC, ½ of that goes to Brazil, China, MX