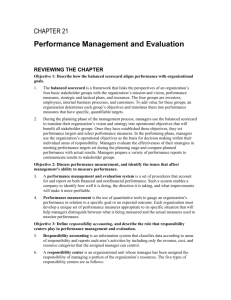

8 Return on Invested Capital CHAPTER

advertisement

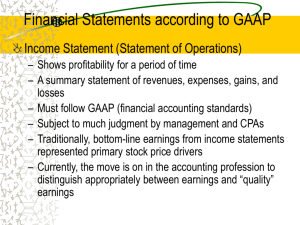

Return on Invested Capital 8 CHAPTER Return on Invested Capital Importance of Joint Analysis • Joint analysis is where one measure is assessed relative to another • Return on invested capital (ROI) is an important joint analysis Return on Invested Capital ROI Relation • ROI relates income, or other performance measure, to a company’s level and source of financing • ROI allows comparisons with alternative investment opportunities, and with same opportunity over time • Riskier investments are expected to yield a higher ROI • ROI impacts a company’s ability to succeed, attract financing, repay creditors,and reward owners Return on Invested Capital Application of ROI ROI is applicable to: (1) evaluating managerial effectiveness (2) assessing profitability (3) earnings forecasting (4) planning and control Return on Invested Capital Evaluating Managerial Effectiveness • Management is responsible for all company activities • ROI is a measure of managerial effectiveness in business activities • ROI depends on the skill, resourcefulness, ingenuity, and motivation of management Return on Invested Capital Measuring Profitability • ROI is an indicator of company profitability • ROI relates key summary measures: profits with financing • ROI conveys return on invested capital from different financing perspectives Return on Invested Capital Assists in Forecasting Earnings • ROI links past, current, and forecasted earnings with invested capital • ROI adds discipline to forecasting • ROI helps identify optimistic or pessimistic forecasts • ROI aids in evaluating prior forecast performance Return on Invested Capital For Planning and Control ROI assists managers with: • • • • • Planning Budgeting Coordinating activities Evaluating opportunities Control Components of ROI Definition Return on invested capital is defined as: Income Invested capital Components of ROI Invested Capital Defined • No universal measure of invested capital exists • Different measures of invested capital reflect different financiers’ perspectives Components of ROI Alternative Measures of Invested Capital Five Common Measures: • Total Assets • Long-Term Debt Plus Equity • Common Equity • Market Value of Invested Capital (debt and equity) • Investor Invested Capital Components of ROI Total Assets • Perspective is that of its total financing base • Called return on assets (ROA) ROA: measures operating efficiency/ performance reflects return from all financing does not distinguish return by financing sources Components of ROI Total Assets Some adjust this invested capital base for: 1. Unproductive Assets (subtracted) 2. Intangible Assets (subtracted) 3. Accumulated Depreciation (not subtracted) Components of ROI Total Assets Unproductive Asset Adjustment • Assumes management not responsible for earning a return on capital not in operations • Excludes inactive plants, facilities under construction, surplus plants, surplus inventories, surplus cash Such adjustment is not valid as it fails to: recognize that management has discretion over all investment assess overall management effectiveness Components of ROI Total Assets Intangible Asset Adjustment Excludes intangible assets from invested capital assuming skepticism about their values Adjustment is not valid as: Lack of information or increased uncertainty does not justify exclusion Components of ROI Total Assets Accumulated Depreciation Adjustment • Assumes plant assets maintained in prime condition • Assumes inappropriate to assess return relative to net assets • Concern with a decreasing invested capital base Adjustment is not valid as: It is inconsistent with computation of income net of depreciation expense Acquisitions of new depreciable assets offset a declining capital base It fails to recognize increased maintenance costs as assets age Components of ROI Long-Term Debt Plus Equity Capital • Perspective is that of the two main suppliers of long-term financing —longterm creditors and equity shareholders • Referred to as “Return on long-term capitalization” • Excludes current liability financing Components of ROI Common Equity Capital • Perspective is that of common equity holders • Captures the effect of leverage (debt) capital on equity holder return (financial leverage) • Excludes all debt financing and preferred equity Components of ROI Market Value of Invested Capital • Assumes certain assets not recognized in financial statements • Uses the market value of invested capital (debt and equity) Components of ROI Investor Invested Capital • Perspective is that of the individual investor • Focus is on individual shareholder, not the company • Uses the purchase price of securities as invested capital Components of ROI Computing Invested Capital • Usually computed using average capital available for the period • Typically add beginning and ending invested capital amounts and divide by 2 • More accurate computation is to average interim amounts — quarterly or monthly Components of ROI Income Defined • Definition of income (return) depends on definition of invested capital • Measures of income in computing return on invested capital must reflect all applicable expenses from the perspective of the capital contributors • Income taxes are valid deductions in computing income for return on invested capital Examples: • Return on total assets capital uses income before interest expense and dividends • Return on long-term debt plus equity capital uses income before interest expense and dividends • Return on common equity capital uses net income after deductions for interest and preferred dividends Components of ROI Adjustments to Invested Capital and Income Numbers Many accounting numbers require analytical adjustment—see prior chapters Some numbers not reported in financial statements need to be included Such adjustments are necessary for effective analysis of return on invested capital Components of ROI Return on Assets -- ROA Net income + Interest expense (1 -Tax rate) + Minority interest income (Beginning total assets + Ending total assets) 2 Components of ROI Return on Long-Term Debt plus Equity Net income +Interest expense (1-Tax rate)+Minority interest in income (Average long-term debt+ Average equity) [Also called return on long-term capitalization] Components of ROI Return on Common Equity -- ROCE Net income - Preferred dividends Total common shareholders’ equity [When ROCE is higher than ROA, it often reflects favorable impacts of leverage] Analyzing Return on Assets--ROA Disaggregating ROA Return on assets = Profit margin x Asset turnover Income Income Sales Assets Sales Assets Profit margin: measures profitability relative to sale (RETURN ON SALES) Asset turnover (utilization): measures effectiveness in generating sales from assets Analyzing Return on Assets--ROA Relation Between Profit Margin and Asset Turnover Profit margin and asset turnover are interdependent Relation between Profit Margin, Asset Turnover, and Return on Assets Asset turnover 3.75 3.5 3.25 3 2.75 2.5 2.25 2 1.75 1.5 1.25 1 0.75 C 0.5 0.25 0 -2 -1 A D Y E B K L F M G N H X O I J P 0 1 2 3 4 5 6 7 8 9 Profit margins % 10 11 12 13 14 15 16 Analyzing Return on Assets--ROA Relation Between Profit Margin and Asset Turnover Profit Margin, Asset Turnonver, and Return on Assets for Selected Industries 6 ROA = 5% 5.5 Food Stores 5 Transportation Service Asset turnover 4.5 Wholesale-Nondurables Auto Dealers Builders Wholesale Trade 4 3.5 3 Building Materials Paper Construction Air Transportation Chemicals Tobacco Petroleum Metals Fisheries Oil & Gas Health Services Hotels 2.5 2 1.5 1 Amusements 0.5 Real Estate Agriculture Museums 0 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 Profit margins % 5.5 6 6.5 7 7.5 8 Analyzing Return on Assets--ROA Asset Turnover Analysis • Asset turnover measures the intensity with which companies utilize assets • Relevant measure is the amount of sales generated Analyzing Return on Assets--ROA Disaggregating Asset turnover Sales to Cash: Reflects trade-off between liquidity and accumulation of low-return funds Sales to Receivables: Reflects trade-off between increased sales and accumulation of funds in receivables Sales to Inventories: Reflects trade-off between funds accumulated in inventory and the potential loss of current and future sales Sales to Fixed Assets: Reflects trade-off between fixed asset investments having high break-even points and investments in more efficient, productive assets with high sales potential Sales to Other Assets: Reflects trade-off between assets held for current and future sales and accumulation of funds in higher risk assets Sales to Current Liabilities: Reflects a relation between sales and current trade liabilities Analyzing Return on Common Equity--ROCE Role in Equity Valuation V BV + t t NI - (k BV ) NI - (k BV ) NI - (k BV ) t + t +2 t+1 t+1 + . . . + t+n t+n-1 + . . . (1+ k) (1+ k)n (1+ k)2 This can be restated in terms of future ROCE: V BV + t t (ROCE - k)BV (ROCE - k)BV (ROCE - k)BV t + t+n t+1 t +2 t+1 + . . . + t+n-1 + . . . n (1+ k) (1+ k) (1+ k)2 where ROCE is equal to net income available to common shareholders (after prefered diviends) divided by the beginning-of-period common equity Analyzing Return on Common Equity--ROCE Disaggregating ROCE ROCE = Adjusted profit margin × Asset turnover × Leverage Average Net income Net income Preferred dividends Preferred dividends assets Sales Sales Average Average Average assets common equity common equity • Adjusted profit margin: portion of each sales dollar remaining for common shareholders after providing for all costs and claims (including preferred dividends) • Asset turnover (utilization): measures effectiveness in generating sales from assets • Leverage*: measures the proportion of assets financed by common shareholders *Also called financial leverage and common leverage. Analyzing Return on Common Equity--ROCE Further Disaggregation of Adjusted Profit Margin Adjusted profit margin = Pre-tax adjusted profit margin x Retention rate Pre-tax earningsNet incomeNet incomePreferred dividends Preferred dividends Preferred dividends Sales Sales Pre-tax earningsPreferred dividends Pre-tax adjusted profit margin: measure of operating effectiveness Retention rate: measure of tax-management effectiveness Analyzing Return on Common Equity--ROCE Further Disaggregation of ROCE ROCE = [(EBIT profit margin × Asset turnover) – Interest burden] × Leverage × Retention rate • EBIT is earnings (income) before interest and taxes (and before any preferred dividends) • EBIT profit margin is EBIT divided by sales • Interest burden is interest expense divided by average assets This disaggregation highlights effects of both interest and taxes on ROCE Analyzing Return on Common Equity--ROCE Assessing Equity Growth Equity growth rate = Net income - Preferred dividends - Dividend payout Average common stockholders’ equity • Assumes earnings retention and a constant dividend payout • Assesses common equity growth rate through earnings retention Analyzing Return on Common Equity--ROCE Assessing Equity Growth Sustainable equity growth rate = ROCE (1-Payout rate) Assumes internal growth depends on both earnings retention and return earned on the earnings retained Analyzing Return on Common Equity--ROA Leverage and ROCE • Leverage refers to the extent of invested capital from other than common shareholders • If suppliers of capital (other than common shareholders) receive less than ROA, then common shareholders benefit; the reverse occurs when suppliers of capital receive more than ROA • The larger the difference in returns between common equity and other capital suppliers, the more successful (or unsuccessful) is the trading on the equity Analyzing Return on Common Equity--ROCE Analyzing Leverage on Common Equity Financing Source Current liabilities Analyzing Leverage on Common Equity ($ thousands) Average Funds Earnings on Funds Payment to Accruing to (Detracting Supplied Supplied at 5.677% Financiers from) Return on Common Equity (a) $ 176,677 $ 10,030 $ 412 $ 9,618 Long-term debt 353,985 20,096 Deferred taxes 93,962 5,334 Preferred stock 41,538 11,817(b) 8,279 none 5,334 (c) 2,358 2,908 Earnings in excess of return to financiers Add: Common equity Totals (550) $ 22,681 — 686,640 38,980 $ 1,352,802 $ 76,798 Total return to shareholders 38,980 $ 15,137 $ 61,661 Return on assets 5.677% Leverage advantage accruing to common equity 3.303 Return on common equity 8.980% Analyzing Return on Common Equity--ROCE Return on Shareholders’ Investment--ROSI Dividends + Market val ue of earnings reinvested ROSI Share price (cost)