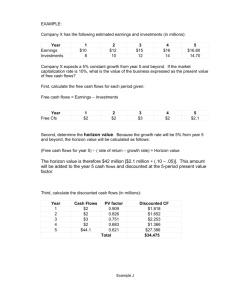

ES INC: Economic and discounted cash flow

advertisement

ES INC: Economic and discounted cash flow techniques: a comparison with respect to the Requirements of the Management Control System Discounted cash flow techniques 1. Completeness: YES The problem: “Corporate staff personnel have observed that the company’s returns to shareholders have not been closely associated with the company’s performance as measured in accounting terms” pag. 474 Dennis Chu….. FORMULA included the perpetuity factor= C/r at t=3, today has a value of C/r(1+r)3 2. Long term orientation: YES, with some practical problems to be solved - but attention: it is too strong the simplification of the perpetuity formula (v. also issue 1) 3. Measurability: NO Hard problems for this point. Consequently it’s very difficult to use these measures for motivating people. In fact: - it can be objectively hard to estimate the future cash flows - it is necessary the commitment of the organisational units with a strong risk of opportunistically behaviour. In particular it can be the temptation of under-evaluate the closer cash flows and over -evaluate the farther to evidence positive variances (this is true particularly with a high management turn-over) Discounted cash flow techniques 4. Timeliness: NO Very low. From these point of view these measures are worse than the accounting measures. In fact: - all information (market share, features of products, competitive position) must be translate in financial terms and this way of proceeding requires time. In addition, it is necessary to estimate future values and this fact requires more and more time respect to the account techniques that use actual values. 5. Identification of specific responsibilities: NO The hard problem of measurability causes problems also for the identification of specific responsibilities: consequently, it is difficult to identify the specific contribution of each unit to the value creation Economic techniques 1. Completeness: NO - the accounting measures ignore risk and the time value of money (r=discount rate, includes real interest rate, free risk, allowance for inflation, and risk factor) - - incomes are “economic” and not financial. Lower significance from the shareholder point of view. 2. Long term orientation: NO Lack because: - only actual information, not expected - Exhibit 5 and 6 of the case show specific examples in which accounting measures can be misleading. Exhibit 5 shows an example of a good investment that does not look good in accounting terms. Such a situation occurs where an expenditure is expensed immediately or depreciated (amortised) more rapidly than the revenues generated from the expenditure or where the payoff (in accounting terms) is toward the end of (or after) the planning horizon. Exhibit 6 shows how a bad investment can look good in accounting terms. This can occur where revenues appear early but significant expenses are required after the end of the planning horizon. This limit is inferior for DCF techniques thanks to the perpetuity factor. Economic technique 3. Measurability: YES - are based on transactions that have already taken place - precise, specific and well defined rules exist to limit the degree of discretion that can be applied to any economic event - some imprecision is present concerning estimates (amortisation and inventory value), but the existing conventions limit the degree of discretion. It is important to maintain the same rules of estimations in all considered periods (that means to have homogeneous information) 4. Timeliness: NO Poor because many steps must be realised: - the recording of physical transactions; - the economic evaluation of physical transactions; - the aggregation of the information to build the balance sheet; - the calculation of the indicators on the base of balance sheet data (ratio analysis). 5. Identification of specific responsibilities: YES/NO - yes at strategic level (top management) - no at operative level where the units are not able to determine at the same time costs, revenues and investments. At this level these economic measures are overly aggregated. Open issues related to the implementation of the discounted cash flow measures 1. Whether the planning horizon should be extended The company’s present practice is to assume that the operating cash flows in the last year of the three year plan will remain constant in perpetuity. This short horizon puts a lot of weight on the third year of the plan, but this procedure may be adequate for some entities, such as those which operate in relatively stable markets (static contexts), which have many sales transactions in a given period, and which have relatively short product development cycles. But a short horizon is not adequate for entities which are expecting significant growth or those which will not derive the bulk of the incoming cash flows from their current investments within the three year time period, perhaps because they are investing in large amounts of fixed assets. It would seem to be necessary that the company extend its planning horizon, perhaps to five or seven years, or at least incorporate an assumption about a growth rate for the cash flows. 2. Whether plans should reflect a single point or some form of probability distribution Even if is theoretically better the second alternative, several senior managers think that single point estimates are necessary for control purposes, so that managers can be held responsible for achieving a specific plan. Open issues related to the implementation of the discounted cash flow measures 3. How to include risk in the discounted cash flow model The options are as follows: - use the same discount rate for all units - estimate a risk factor for each unit based on the stock market betas of the closest competitors. Option 2 is the theoretically correct choice (option 1 is acceptable only if the company is vertically integrated and operates in a single market), but the concept of risk can be difficult to explain to some managers, and competitors do not exists in many situations. The company is probably best advised to start with option 1, even if it causes an under-valuation of less risky entities, and then to experiment with the other options. 4.5. How fast to involve managers in the implementation of the financial measures and whether or not to link such measures to management reward system There is not enough information in the case to say much these issues, but as they would involve quite a substantial change in the way managers think, it is likely that progress would have to be made relatively slowly Conclusions Each technique has advantages and disadvantages in order to achieve the expected Requirements Anyway, a single technique does not allow to satisfy all the requisites of the Management Control System It’s necessary to use a MIX of different techniques but, HOW TO CHOOSE THE RIGHT MEASURES/TECHNIQUES? Conclusions Such a mix should be coherent with: 1. The Objectives of the Management Control System (ex. for supporting decisions it is better to choose measures that satisfy the requirement of completeness and not the measurability) 2. As we will study in the following, we have to consider also the second element of the Management Control System, the STRUCTURE. For each level it is necessary to define the appropriate measures (see the next lesson concerning the levels of cost control)