Document 17603501

advertisement

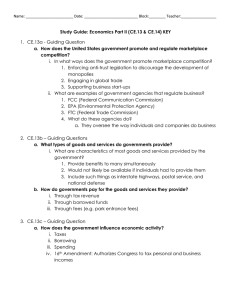

Name: _______________________ Date: __________________________ Block:________ Teacher:_________________ Study Guide: Economics Part II (CE.13 & CE.14) KEY 1. CE.13a - Guiding Question a. How does the United States government promote and regulate marketplace competition? i. In what ways does the government promote marketplace competition? 1. Enforcing _______________________ legislation to discourage the development of _______________________ 2. Engaging in _______________________ trade 3. Supporting _______________________ start-ups ii. What are examples of government agencies that regulate business? 1. _______________________ (Federal Communication Commission) 2. EPA (_______________________) 3. _______________________ (Federal Trade Commission) 4. What do these agencies do? a. They oversee the way individuals and _______________________ do business 2. CE.13b – Guiding Questions a. What types of goods and services do governments provide? i. What are characteristics of most goods and services provided by the government? 1. Provide _______________________ to many simultaneously 2. Would not likely be available if individuals had to provide them 3. Include such things as interstate _______________________, postal service, and national _______________________ b. How do governments pay for the goods and services they provide? i. Through _______________________ revenue ii. Through borrowed _______________________ iii. Through _______________________ (e.g. park entrance fees) 3. CE.13c – Guiding Question a. How does the government influence economic activity? i. Taxes ii. Borrowing iii. Spending iv. _______________________ Amendment: Authorizes Congress to tax personal and business incomes Name: _______________________ Date: __________________________ Block:________ Teacher:_________________ 4. CE.13d – Guiding Question a. What is the role of the Federal Reserve System? i. As the _______________________ of the United States, the Federal Reserve System… 1. Has a duty to maintain the _______________________ of national currency (dollar) 2. Regulates banks to ensure the soundness of the banking system and the safety of _______________________ 3. Manages the amount of money in the economy to try to keep _______________________ low and stable 4. Acts as the federal governments bank 5. CE.13e – Guiding Question a. What is the role of the U.S. government in protection consumer rights and property rights? i. Individuals have the right of _______________________ ownership, which is protected by negotiated _______________________ that are enforceable by law. ii. Government agencies establish guidelines that protect public _______________________ and safety. iii. Consumers may take _______________________ action against violation of consumer rights. 6. CE.13f – Guiding Questions a. Why does the government issue currency and coins? i. When the United States government issues coins and currency, people accept it in exchange for goods and services because they have _______________________ in the government. ii. Government issues money to _______________________ this exchange. b. Which government agencies are responsible for creating money? i. The three types of money generally used in the United States are: 1. Coins 2. _______________________ notes (currency) 3. _______________________ in bank accounts that can be accessed by checks and _______________________ cards. Name: _______________________ Date: __________________________ Block:________ Teacher:_________________ 7. CE.14 – Guiding Questions a. What is the role of self-assessment in career planning? i. Career planning _______________________ with self-assessment. b. What is the role of work ethic in determining career success? i. Employers seek employees who demonstrate the attitudes and behaviors of a strong _______________________. c. What is the relationship among skills, education, and income? i. Higher skill and/or education levels generally lead to higher _______________________. ii. Supply and _______________________ also influence job income. iii. Employers seek individuals who have kept pace with _______________________ changes by updating their skills. d. What influence do advances in technology have on the workplace? i. Technology and information flows permit people to work across _______________________ borders. 1. This creates competition from _______________________ workers for United States jobs but also may create opportunities for United States workers to work for companies based in other _______________________. ii. Being fiscally responsible includes making careful spending decisions, _______________________ and investing for the future, having _______________________, keeping to a _______________________, using _______________________ wisely, as well as understanding how contracts, warranties, and guarantees can protect the individual. 8. Further Clarification: a. How do debit cards work? i. Charging your debit card = money pulled directly from your _______________________ account. b. How do credit cards work? i. When you charge your credit card, the credit card _______________________ pays the bill, and you promise to pay them back. If you don’t pay them back on schedule, there are extra fees. c. What is inflation? i. A general increase in _______________________ for goods and services, and an accompanying fall in the purchasing _______________________ of money Name: _______________________ Date: __________________________ Block:________ Teacher:_________________ d. Consider this scenario: i. The Federal Reserve wants to stimulate the economy by encouraging consumers to borrow to that they can spend. What will it do to the interest rates for borrowers? Answer: It will lower them to make it “cheaper to borrow money.” 9. Circular Flow (Suggestion: Draw a picture to help you understand.) a. Businesses pay _______________________ as wages/paychecks to households. b. Households use the income to purchase goods and services from _______________________. c. Both households and businesses pay _______________________ to the U.S government. d. Banks issue _______________________ for the U.S. government. e. Banks make _______________________to both businesses and households. f. _______________________ spending on public goods and services benefits both households and businesses. g. Government pays U.S. bond _______________________ to both households and businesses. h. Households deposit _______________________ in banks.