International Diversification Chapter 25 McGraw-Hill/Irwin

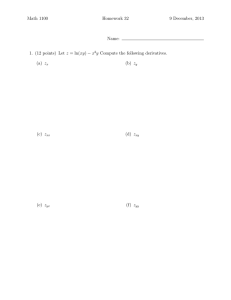

advertisement

International Diversification Chapter 25 McGraw-Hill/Irwin Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved. Background Global market US Market is 40% - 49% of all markets Improved access & technology New instruments Emphasis for our investigation Risk assessment Diversification 25-2 Issues What are the risks involved in investment in foreign securities? How do you measure benchmark returns on foreign investments? Are there benefits to diversification in foreign securities? 25-3 Foreign Exchange Risk Foreign Exchange Risk Variation in return related to changes in the relative value of the domestic and foreign currency. Total return = investment return & return on foreign exchange It’s not possible to completely hedge a foreign investment. 25-4 Returns with Foreign Exchange Return in US is a function of two factors: 1. Return in the foreign market 2. Return on the foreign exchange 25-5 Returns with Foreign Exchange: Example Condition: U.S. Investor invests $10,000 in the British Market Initial Conditions: Initial Investment : $20,000 Initial Exchange: $2.00/ Pound Sterling Initial Investment in Pound Sterling: 10,000 Risk Free Rate in U.K.: 10% Future Value in Pound Sterling: 11,000 25-6 Returns with Foreign Exchange Pound Depreciates to $1.80 11,000 * 1.8 = $19,800 Return in US$ (-200 / 20,000) = -1% Pound Remains at $2.00 11,000 * 2.0 = $22,000 Return in US$ (2,000 / 20,000) = 10% Pound Appreciates to $2.20 11,000 * 2.20 = $24,200 Return in US$ ( 4,200 / 20,000) = 21% 25-7 Returns with Foreign Exchange Movements in foreign exchange can have a major influence From Figure 25.2 New Zealand nearly 50% of return is from foreign exchange Australia virtually all of the return in from foreign exchange Returns from U.K. and Switzerland are mostly from returns in local currency Both factors must be considered in international investing 25-8 Country Specific Risk Political Risk Services Group Ratings Rank countries with respect to political risk, financial risk and economic risk Assign composite rating from very high risk to very low risk based on the above elements of risk 25-9 PSR Risk Variables Political Risk Variables Government stability, corruption etc Financial Risk Variables Foreign debt (%GDP), Exchange rate stability etc Economic Risk Variables GDP per capita, annual inflation etc 25-10 Diversification Benefits Evidence shows international diversification is beneficial. It’s possible to expand the efficient frontier above domestic only frontier. It’s possible to reduce the systematic risk level below the domestic only level. 25-11 Gains From International Diversification Int’l Return ** * * * * * Dom * Risk 25-12 Systematic Risk Level with International Risk Dom Int’l Securities 25-13 International Investment Choices Direct stock purchases American depository receipts Mutual Funds Open-end funds Closed-end funds WEBS 25-14 Measuring Benchmark Returns Indexes EAFE Index Issues in measuring performance Weighting Cross-Holdings Other possibilities Country and Region Funds 25-15 Performance Attribution with International Extension to consider additional factors Currency selection Country selection Stock selection Cash and bond selection 25-16